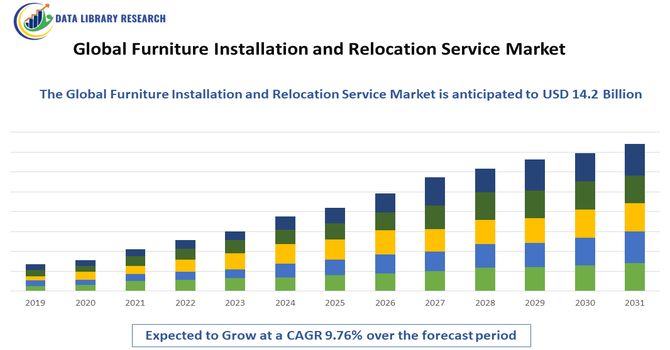

Furniture Installation and Relocation Service Market Overview and Analysis:

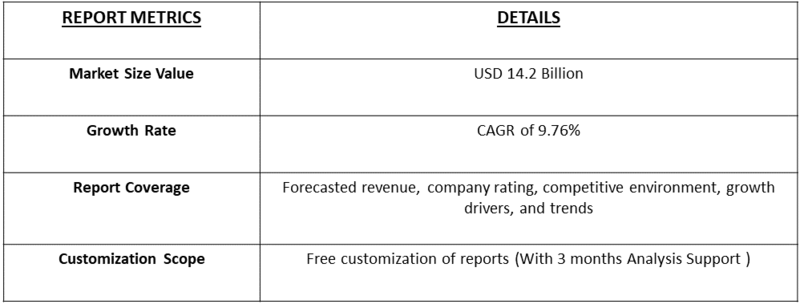

- The Furniture Assembly Services segment alone was valued at approximately USD 8.5 Billion in 2025 and is projected to reach around USD 14.2 Billion by 2032, growing with a CAGR of 9.76% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Furniture Installation and Relocation Service Market is experiencing steady expansion as corporate real estate transitions, workspace modernization, rising commercial construction activity, and increased demand for professional moving services continue to grow worldwide. The market includes a wide scope of services such as furniture assembly, dismantling, workspace planning, employee relocation, logistics coordination, and specialized handling for commercial, institutional, and residential environments.

Furniture Installation and Relocation Service Market Latest Trends:

The Global Furniture Installation and Relocation Service Market is witnessing several emerging trends driven by evolving workplace dynamics, digitalization, and sustainability priorities. One of the strongest trends is the integration of advanced technologies—including real-time asset tracking, route optimization software, cloud-based inventory systems, and 3D or AR-enabled space planning—allowing service providers to deliver more precise, efficient, and transparent relocation and installation processes.

Segmentation: Global Furniture Installation and Relocation Service Market is segmented By Service Type (Furniture Installation, Furniture Relocation and Moving, Furniture Assembly and Disassembly, Project Management & Space Planning), Application (Residential Relocation, Commercial and Office Relocation, Industrial and Warehouse Furniture Installation), End-User Industry (Corporate Offices and Co-Working Spaces, Education Institutions, Healthcare and Medical Facilities, Retail and Showrooms), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Commercial Real Estate Expansion and Hybrid Workplace Transformation

The primary drivers accelerating the growth of the Global Furniture Installation and Relocation Service Market is the increasing activity within the commercial real estate sector coupled with the global shift toward hybrid and flexible workplace models.

Corporate sectors such as IT, finance, co-working facilities, and large enterprises are investing in new workspace strategies that prioritize ergonomic, modular, and smart furniture solutions to enhance operational efficiency and employee experience. For instance, in Febaruary 2024, Xerox Holdings Corporation launched new solutions and services to enhance digital transformation, productivity, and security in hybrid workplaces. This innovation positively impacted the Growing Commercial Real Estate Expansion and Hybrid Workplace Transformation, as well as the Global Furniture Installation and Relocation Service Market, by increasing demand for efficient office setups, secure technology integration, and optimized work environments. Companies relied on these offerings to support smooth transitions, improve operational efficiency, and facilitate professional furniture installation and relocation services in expanding and hybrid office spaces.

- Rising E-Commerce Furniture Sales and Demand for Professional Delivery & Assembly Services

Another significant growth driver is the rapid expansion of the online furniture retail ecosystem, which includes direct-to-consumer brands, marketplace platforms, and omnichannel furniture suppliers.

As consumers increasingly purchase flat-packed, modular, or customized furniture online, the need for specialized last-mile delivery, assembly, and installation services has grown substantially. For instance, in April 2025, RentoMojo’s rental plans for premium furniture in Delhi and other cities boosted the e-commerce furniture market and the Global Furniture Installation and Relocation Service Market by driving demand for professional delivery, assembly, and relocation services, as consumers increasingly favored flexible, cost-effective access over ownership.

Market Restraints:

- High Operational Cost Associated with Skilled Labor

The key challenges is the high operational cost associated with skilled labor, transportation, insurance, warehousing, and specialized handling equipment. Since furniture relocation requires trained professionals and sometimes involves high-value or custom-built furniture, service providers must maintain quality standards, which increases cost and reduces profitability, especially in price-sensitive markets. Additionally, fluctuating fuel prices, supply chain disruptions, and rising logistics expenses create uncertainty and operational bottlenecks, affecting service efficiency and pricing strategies.

Socio Economic Impact on Furniture Installation and Relocation Service Market

The Global Furniture Installation and Relocation Service Market has a notable socioeconomic impact worldwide. It creates numerous job opportunities, from skilled installers to logistics and support staff, boosting local economies. These services support businesses and households by ensuring smooth office setups and home relocations, reducing downtime and stress. Additionally, the market encourages the growth of related industries like transportation and warehousing. By making moving and installation easier, it improves quality of life, supports business continuity, and fosters economic activity. This market helps communities adapt to changing work and living environments, contributing to overall social and economic development.

Segmental Analysis:

- Furniture Installation segment is expected to witness highest growth over the forecast period

Furniture installation represents a key segment in the service offering, driven by the increasing adoption of modular and ergonomic furniture across residential, office, and institutional environments. As modern spaces require precise assembly, consistent configuration, and specialized tools, professional installation services ensure safety, aesthetic alignment, and compliance with ergonomic and space utilization standards. This segment is increasingly supported by commercial real estate expansion and hybrid workspace trends.

- Commercial and Office Relocation segment is expected to witness highest growth over the forecast period

Commercial and office relocation continues to dominate the market as organizations restructure work environments, relocate to new facilities, or adopt flexible seating and co-working models. The complexity of relocating large office furniture, IT-integrated workstations, and high-value ergonomic setups makes professional support essential. The rise of corporate expansions, mergers, and workforce mobility further strengthens demand in this segment.

- Corporate Offices and Co-Working Spaces segment is expected to witness highest growth over the forecast period

Corporate offices and co-working spaces form one of the fastest-growing end-user segments, as companies increasingly prioritize space optimization, employee comfort, and operational efficiency.

Frequent reconfiguration of workstations, adoption of modular and smart furniture systems, and new office setups after renovation or expansion are driving continuous needs for installation, relocation, and workspace management services. For instance, in 2025, Ofis Square launched a 30,000-square-foot premium co-working space in Gurugram, strategically near MG Road Metro and IGI Airport. This development impacted the Global Furniture Installation and Relocation Service Market by driving increased demand for professional furniture setup, relocation, and installation services to equip modern workspaces efficiently for enterprises and professionals.

- North America segment is expected to witness highest growth over the forecast period

North America holds a significant share of the market due to mature commercial infrastructure, high demand for specialized moving services, and strong penetration of professional installation companies.

The region benefits from a large base of businesses adopting hybrid workplace models, frequent real estate transitions, and a well-established e-commerce furniture ecosystem, all of which contribute to sustained growth in relocation and installation demand. For instance, in 2021, Cozey, the Montreal-based furniture start-up, raised USD 2M from private investors to expand its team and infrastructure. This funding strengthened North America’s Global Furniture Installation and Relocation Service Market by boosting e-commerce furniture demand, increasing the need for professional delivery, assembly, and relocation services, and supporting the company’s expansion into modular, customer-focused home furniture offerings.

Similarly, in October 2024, WeWork launched its Coworking Partner Network, partnering with Vast Coworking Group to expand access to third-party workspaces. This initiative impacted this region’s Furniture Installation and Relocation Service Market by increasing demand for professional furniture setup, relocation, and installation services to support flexible and hybrid workspaces across both suburban and metropolitan locations.

Additionally, North America’s market growth was supported by technological advancements in logistics and tracking, which improved service efficiency and reliability. Rising consumer expectations for timely, professional delivery and assembly further fueled demand. The presence of experienced workforce and standardized industry practices enabled seamless handling of complex commercial and residential moves, reinforcing the region’s leadership in the Global Furniture Installation and Relocation Service Market and driving consistent revenue growth.

To Learn More About This Report - Request a Free Sample Copy

Furniture Installation and Relocation Service Market Competitive Landscape:

The competitive landscape is fragmented with a mix of large global relocation networks, specialised office-move providers, national household movers, and regional niche players — all competing on service breadth (end-to-end relocation, installation, storage, sustainability services), technology adoption (asset tracking, 3D/AR space planning, route optimisation) and integrated partnerships with furniture manufacturers and e-commerce platforms. Consolidation and strategic alliances are common as firms scale geographically and expand offerings into workplace solutions, subscription maintenance, and circular-economy services to capture recurring revenue.

The major players for this market are:

- Cartus

- Graebel

- Atlas Van Lines

- Allied Van Lines

- North American Van Lines

- United Van Lines

- Crown Relocations

- Suddath

- JK Moving & Storage

- International Van Lines

- AGS Worldwide Movers

- Arpin Van Lines

- Altair Global

- Aires

- Weichert Workforce Mobility

- XONEX Relocation Systems & Logistics

- Globe Moving

- Agarwal Packers & Movers

- Royal Cargo

Recent Development

- In November 2025, Reef Movers, launched a comprehensive relocation support program. This initiative aimed to simplify the moving process, lessen client stress, and elevate service quality. Its rollout positively impacted the Global Furniture Installation and Relocation Service Market by setting higher industry standards, influencing competitors to improve offerings, and better meeting evolving customer expectations, ultimately driving market growth and enhancing overall customer satisfaction worldwide.

- In October 2025, expanded its sustainable furniture offerings and rental services to meet growing business demand. Its circular economy model, saving around 1,000 tons of CO2 annually, influenced the Global Furniture Installation and Relocation Service Market by increasing demand for eco-friendly installation and relocation services. By combining immediate availability with sustainable practices, the company encouraged service providers to adopt greener methods, supporting faster office setups while promoting environmental responsibility across the global market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

Key drivers include the rapid growth of e-commerce for furniture, which increases the need for professional, "last-mile" delivery and assembly services. Increasing urbanization globally leads to smaller living spaces, boosting demand for ready-to-assemble and modular furniture, which often requires expert installation. High rates of corporate office relocations and residential moves also consistently fuel this service market.

Q2. What are the main restraining factors for this market?

The market faces restraints primarily due to high logistics and transportation costs, which can negatively impact service provider profitability, especially for long-distance relocations. Furthermore, a reliance on skilled labor for complex assembly tasks and regional variations in service quality pose challenges. Economic downturns affecting construction and real estate can also temporarily curb demand.

Q3. Which segment is expected to witness high growth?

The Commercial Furniture segment is projected to witness the highest growth rate. This is largely driven by companies adapting to new hybrid work models, which necessitates frequent restructuring, relocation, and installation of modular office systems and ergonomic furniture. The ongoing development of commercial infrastructure and office spaces also significantly contributes to this high demand.

Q4. Who are the top major players for this market?

Major players are often hybrid logistics companies, specialized assembly service providers, and large furniture retailers offering installation as an added value. Notable companies include global logistics firms, and platform-based service providers like TaskRabbit and Handy (though these are often for assembly). Also, large furniture brands like IKEA are key players due to their dedicated assembly and delivery ecosystems.

Q5. Which country is the largest player?

North America, particularly the United States, is the largest regional market player, followed closely by the Asia-Pacific region. North America's dominance is sustained by a mature and active real estate market, a high volume of e-commerce furniture sales, and a strong trend of home renovation and office modernization, all demanding professional installation and relocation services

List of Figures

Figure 1: Global Furniture Installation and Relocation Service Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Furniture Installation and Relocation Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Furniture Installation and Relocation Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Furniture Installation and Relocation Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Furniture Installation and Relocation Service Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Furniture Installation and Relocation Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Furniture Installation and Relocation Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Furniture Installation and Relocation Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Furniture Installation and Relocation Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Furniture Installation and Relocation Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Furniture Installation and Relocation Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Furniture Installation and Relocation Service Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Furniture Installation and Relocation Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Furniture Installation and Relocation Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Furniture Installation and Relocation Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Furniture Installation and Relocation Service Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Furniture Installation and Relocation Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Furniture Installation and Relocation Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Furniture Installation and Relocation Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Furniture Installation and Relocation Service Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Furniture Installation and Relocation Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Furniture Installation and Relocation Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Furniture Installation and Relocation Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Furniture Installation and Relocation Service Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Furniture Installation and Relocation Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029