Grapeseed Oil Market Overview and Analysis:

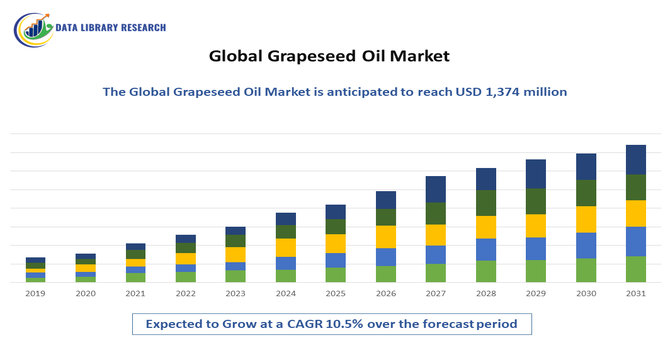

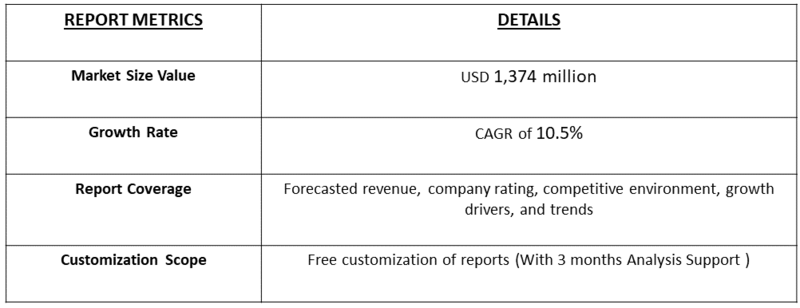

- The global grapeseed oil market size was estimated at USD 683 million in 2025 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.5% and anticipated reach at USD 1,374 million in 2032.

Get Complete Analysis Of The Report - Download Free Sample PDF

Grapeseed oil is a light, nutrient-rich oil extracted from the seeds of grapes, often as a byproduct of winemaking. Known for its high vitamin E content, antioxidants, and healthy fatty acids, it is widely used in cooking, skincare, cosmetics, and even supplements. Its mild taste and high smoke point make it ideal for frying, baking, and salad dressings, while its moisturizing and anti-inflammatory properties support skin and hair health. The market for grapeseed oil is growing steadily, driven by increasing consumer preference for natural, plant-based products and the rising demand for healthier cooking oils and clean-label personal care solutions.

Grapeseed Oil Market Latest Trends:

The growth of the global grapeseed oil market is driven by rising consumer preference for natural, plant-based, and nutrient-rich products across food, cosmetics, and personal care industries. Its high vitamin E and antioxidant content make it a popular choice in skincare and haircare, while its light flavor and high smoke point support its adoption in healthy cooking. Beyond nutrition, grapeseed oil is valued for its therapeutic uses, such as body massage and relief from muscular aches post-workout, as well as in the treatment of conditions like psoriasis, eczema, and rosacea due to its anti-inflammatory properties. With consumers increasingly leaning toward health-conscious, vegan, and clean-label products, demand is set to rise further in the coming years. The market remains highly fragmented, with both global and regional players competing on production capacity, product innovation, and geographic reach, making product differentiation and innovation key strategies for maintaining competitiveness.

Segmentation:

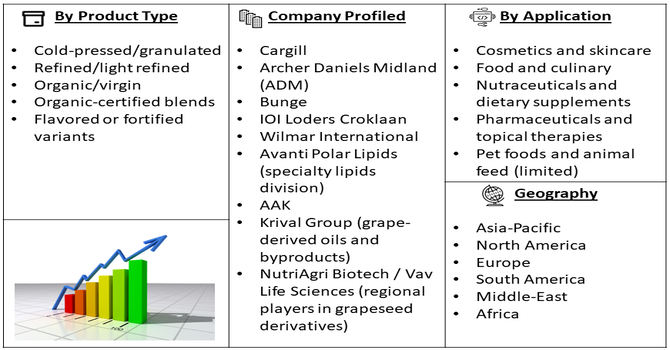

The Grapeseed Oil Market can be segmented by Product Type (Cold-pressed/granulated, Refined/light refined, Organic/virgin, Organic-certified blends, and Flavored or fortified variants), Application (Cosmetics and skincare, Food and culinary, Nutraceuticals and dietary supplements, Pharmaceuticals and topical therapies, and Pet foods and animal feed (limited)), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Drivers:

- Growing Health and Wellness Consciousness

The primary growth driver for the grapeseed oil market is the global surge in health and wellness consciousness among consumers. As individuals become more informed about nutrition, they are actively seeking to replace saturated fats and heavily processed cooking oils with healthier alternatives. Grapeseed oil is perfectly positioned to capture this demand due to its favorable nutritional profile; it is rich in polyunsaturated fats (like linoleic acid) and Vitamin E, a powerful antioxidant, and is often marketed as a heart-healthy option that can help manage cholesterol. This trend extends beyond the kitchen into the personal care sector, where the same health-conscious consumers are driving the "clean beauty" movement. They demand natural, plant-based ingredients in their skincare and haircare products, valuing grapeseed oil for its lightweight, non-comedogenic properties and high antioxidant content, which are believed to combat signs of aging and improve skin health.

- Expansion of the Food Service and Cosmetic Industries

The robust expansion of the global food service and cosmetic industries acts as a significant secondary driver for grapeseed oil demand. Within the culinary world, professional chefs and restaurants prize grapeseed oil for its high smoke point, which makes it exceptionally versatile for frying, sautéing, and other high-heat cooking methods without burning or imparting a strong flavor. Its neutral taste also ensures it doesn't overpower other ingredients in dressings and marinades. Concurrently, the booming cosmetics industry, particularly the natural and organic segments, is incorporating grapeseed oil as a fundamental base or active ingredient in a multitude of products, from moisturizers and serums to hair treatments. Its efficacy, natural origin, and consumer appeal make it a staple for formulators, thereby creating substantial and sustained industrial demand beyond retail consumer purchases.

Market Restraints:

- High Production Cost and Supply Volatility

A major restraint hindering the grapeseed oil market's growth is its inherently high production cost and associated supply chain volatility. Unlike primary commodity oils, grapeseed oil is a by-product of winemaking; its availability is entirely dependent on the volume of grapes crushed for wine, making its supply seasonal and geographically concentrated in wine-producing regions. This secondary sourcing creates a complex and often inefficient extraction process. Furthermore, to produce a high-quality, food-grade oil, particularly cold-pressed or organic variants, requires sophisticated and expensive machinery and processing techniques. These factors collectively result in a final product that is significantly more costly than common vegetable oils like sunflower or canola. This price premium limits its mass-market adoption and makes it vulnerable to supply fluctuations based on annual wine harvest yields, creating pricing instability that can deter consistent large-scale use.

Social Economic Impact On Grapeseed Oil Market

The grapeseed oil market has created notable socioeconomic impact by supporting agriculture, food, cosmetics, and wellness industries. Farmers and processors benefit from value addition to winemaking byproducts, generating additional income streams and reducing agricultural waste. Its applications in skincare, personal care, and nutraceuticals have fostered new business opportunities, job creation, and rural development. Small-scale producers and startups have also entered the market, encouraged by the growing demand for natural, plant-based, and clean-label products.

Before COVID-19, the market experienced steady growth fueled by rising health and wellness awareness. During the pandemic, supply chain disruptions and reduced restaurant demand temporarily slowed expansion. Post-COVID, however, the market rebounded strongly as consumers became more health-conscious, prioritizing immune support, natural remedies, and clean beauty, significantly boosting demand for antioxidant-rich oils like grapeseed oil. This shift has accelerated innovation, strengthened exports, and positioned the market as a contributor to sustainable economic development globally.

Segmental Analysis

- Organic/virgin segment is expected to witness highest growth over the forecast period

The Organic/Virgin segment of the grapeseed oil market is poised for substantial growth, driven by increasing consumer demand for natural, minimally processed products. Consumers are actively seeking alternatives perceived as healthier and more sustainable, and organic and virgin grapeseed oils fit this profile perfectly. These oils retain more of their natural nutrients, antioxidants (like Vitamin E), and inherent flavor, appealing to health-conscious buyers. The growing transparency in food labeling and a desire to avoid synthetic additives further propel the adoption of organic and virgin variants. This segment directly caters to the wellness trend and premiumization in the food and cosmetic industries.

- Food and culinary Application segment is expected to witness highest growth over the forecast period

The Food and Culinary application segment is anticipated to experience the highest growth in the grapeseed oil market. Its popularity stems from its desirable culinary properties, including a high smoke point, neutral flavor, and low saturated fat content, making it an excellent all-purpose cooking oil. Consumers are increasingly opting for healthier cooking alternatives, and grapeseed oil's nutritional profile aligns well with these preferences. Its versatility in salad dressings, marinades, sautés, and baking further enhances its appeal. As global diets evolve and the demand for lighter, healthier cooking oils rises, particularly in emerging economies, the food and culinary segment is set to dominate market expansion.

- North America region is expected to witness highest growth over the forecast period

The European region is projected to witness substantial growth in the grapeseed oil market, driven by a confluence of consumer trends and industrial demand. European consumers are increasingly health-conscious and environmentally aware, showing a strong preference for organic, natural, and sustainably sourced products. Grapeseed oil, with its perceived health benefits, low saturated fat content, and status as a byproduct of the wine industry, aligns perfectly with these consumer values. Furthermore, the region's robust wine production provides a consistent and ample supply of grape pomace, the raw material for grapeseed oil extraction, making it a key production and consumption hub. The strong culinary tradition in many European countries also bolsters demand for high-quality cooking oils, while a well-developed cosmetics industry further fuels its application in personal care products, solidifying Europe's position as a significant growth market.

To Learn More About This Report - Request a Free Sample Copy

Grapeseed Oil Market Competitive Landscape:

The global grapeseed oil market is highly competitive and fragmented, with the presence of both international and regional players competing across food, cosmetics, and personal care segments. Leading companies focus on expanding production capacity, diversifying product portfolios, and strengthening distribution networks to capture growing demand. Many players emphasize clean-label, organic, and sustainable offerings to align with consumer preferences for natural and vegan products. Strategic initiatives such as mergers, acquisitions, partnerships, and new product launches are common, enabling companies to expand their global footprint. Innovation in applications across pharmaceuticals, nutraceuticals, and specialty skincare further intensifies competition in the market.

Here are 10 major companies active in the Grapeseed Oil market:

- Cargill

- Archer Daniels Midland (ADM)

- Bunge

- IOI Loders Croklaan

- Wilmar International

- Avanti Polar Lipids (specialty lipids division)

- AAK

- Krival Group (grape-derived oils and byproducts)

- NutriAgri Biotech / Vav Life Sciences (regional players in grapeseed derivatives)

- Flamenco Foods.

Recent Developments:

- In April 2025, the Cortopassi family—owners of Corto Olive Co. and Stanislaus Foods—launched the Corto x Stanislaus Chef’s Essentials Kit, priced at USD 85 and available through Corto’s website and Amazon. The kit brings consumers closer to restaurant-quality cooking by offering fresh, farm-to-table ingredients trusted by professional chefs. This development is set to support market growth by bridging the gap between professional and home kitchens, driving demand for premium, high-quality cooking oils and ingredients. By making chef-preferred products more accessible, the launch taps into the growing consumer trend toward gourmet home cooking and health-focused culinary experiences.

- In July 2023, ICAR–NRC Grapes introduced a grapeseed oil derived from Manjari Medika, a unique, India-bred grape variety, noted for its high nutraceutical properties. This development is expected to significantly contribute to the growth of the global grapeseed oil market by showcasing India’s capability in developing value-added, health-focused products. With rising consumer demand for nutraceutical-rich, natural, and functional oils, innovations like Manjari Medika-based grapeseed oil will not only strengthen domestic production but also enhance India’s competitiveness in international markets, fueling both adoption and market expansion.

Frequently Asked Questions (FAQ) :

Q1. What the main growth driving factors for this market?

The increasing consumer preference for natural and healthy cooking oils, rising awareness of grapeseed oil's antioxidants and low saturated fat content, and its diverse applications in cosmetics and personal care are key growth drivers. Growing demand for culinary versatility also contributes.

Q2. What are the main restraining factors for this market?

The primary restraints include the relatively high cost of grapeseed oil compared to other vegetable oils, potential supply chain volatility linked to grape harvests, and competition from established, lower-priced alternatives. Brand perception can also be a factor.

Q3. Which segment is expected to witness high growth?

The cosmetics and personal care segment is projected for high growth. Grapeseed oil's emollient properties, antioxidants like Vitamin E, and non-greasy feel make it ideal for skincare, haircare, and massage oils, aligning with the trend for natural beauty products.

Q4. Who are the top major players for this market?

Key players in the grapeseed oil market include companies like Olio Extra Vergine di Oliva, Spectrum Organic Products, La Tourangelle, ConAgra Brands (part of their portfolio), and numerous smaller regional producers and ingredient suppliers focused on specialty oils.

Q5. Which country is the largest player?

Italy is a dominant player, renowned as both a major producer and consumer. Its strong winemaking industry provides abundant raw materials (grapeseeds), and the country has a well-established tradition of producing high-quality grapeseed oil for culinary and cosmetic uses.

List of Figures

Figure 1: Global Grapeseed Oil Market Revenue Breakdown (USD Billion, %) by Region, 2023 & 2030

Figure 2: Global Grapeseed Oil Market Value Share (%), By Segment 1, 2023 & 2030

Figure 3: Global Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 4: Global Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 5: Global Grapeseed Oil Market Value Share (%), By Segment 2, 2023 & 2030

Figure 6: Global Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 7: Global Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 8: Global Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 9: Global Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 10: Global Grapeseed Oil Market Value Share (%), By Segment 3, 2023 & 2030

Figure 11: Global Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 12: Global Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 13: Global Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 14: Global Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 15: Global Grapeseed Oil Market Value (USD Billion), by Region, 2023 & 2030

Figure 16: North America Grapeseed Oil Market Value Share (%), By Segment 1, 2023 & 2030

Figure 17: North America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 18: North America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 19: North America Grapeseed Oil Market Value Share (%), By Segment 2, 2023 & 2030

Figure 20: North America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 21: North America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 22: North America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 23: North America Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 24: North America Grapeseed Oil Market Value Share (%), By Segment 3, 2023 & 2030

Figure 25: North America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 26: North America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 27: North America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 28: North America Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 29: North America Grapeseed Oil Market Forecast (USD Billion), by U.S., 2018-2030

Figure 30: North America Grapeseed Oil Market Forecast (USD Billion), by Canada, 2018-2030

Figure 31: Latin America Grapeseed Oil Market Value Share (%), By Segment 1, 2023 & 2030

Figure 32: Latin America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 33: Latin America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 34: Latin America Grapeseed Oil Market Value Share (%), By Segment 2, 2023 & 2030

Figure 35: Latin America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 36: Latin America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 37: Latin America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 38: Latin America Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 39: Latin America Grapeseed Oil Market Value Share (%), By Segment 3, 2023 & 2030

Figure 40: Latin America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 41: Latin America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 42: Latin America Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 43: Latin America Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 44: Latin America Grapeseed Oil Market Forecast (USD Billion), by Brazil, 2018-2030

Figure 45: Latin America Grapeseed Oil Market Forecast (USD Billion), by Mexico, 2018-2030

Figure 46: Latin America Grapeseed Oil Market Forecast (USD Billion), by Rest of Latin America, 2018-2030

Figure 47: Europe Grapeseed Oil Market Value Share (%), By Segment 1, 2023 & 2030

Figure 48: Europe Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 49: Europe Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 50: Europe Grapeseed Oil Market Value Share (%), By Segment 2, 2023 & 2030

Figure 51: Europe Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 52: Europe Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 53: Europe Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 54: Europe Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 55: Europe Grapeseed Oil Market Value Share (%), By Segment 3, 2023 & 2030

Figure 56: Europe Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 57: Europe Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 58: Europe Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 59: Europe Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 60: Europe Grapeseed Oil Market Forecast (USD Billion), by U.K., 2018-2030

Figure 61: Europe Grapeseed Oil Market Forecast (USD Billion), by Germany, 2018-2030

Figure 62: Europe Grapeseed Oil Market Forecast (USD Billion), by France, 2018-2030

Figure 63: Europe Grapeseed Oil Market Forecast (USD Billion), by Italy, 2018-2030

Figure 64: Europe Grapeseed Oil Market Forecast (USD Billion), by Spain, 2018-2030

Figure 65: Europe Grapeseed Oil Market Forecast (USD Billion), by Russia, 2018-2030

Figure 66: Europe Grapeseed Oil Market Forecast (USD Billion), by Rest of Europe, 2018-2030

Figure 67: Asia Pacific Grapeseed Oil Market Value Share (%), By Segment 1, 2023 & 2030

Figure 68: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 69: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 70: Asia Pacific Grapeseed Oil Market Value Share (%), By Segment 2, 2023 & 2030

Figure 71: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 72: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 73: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 74: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 75: Asia Pacific Grapeseed Oil Market Value Share (%), By Segment 3, 2023 & 2030

Figure 76: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 77: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 78: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 79: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 80: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by China, 2018-2030

Figure 81: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by India, 2018-2030

Figure 82: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Japan, 2018-2030

Figure 83: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Australia, 2018-2030

Figure 84: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Southeast Asia, 2018-2030

Figure 85: Asia Pacific Grapeseed Oil Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2030

Figure 86: Middle East & Africa Grapeseed Oil Market Value Share (%), By Segment 1, 2023 & 2030

Figure 87: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 88: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 89: Middle East & Africa Grapeseed Oil Market Value Share (%), By Segment 2, 2023 & 2030

Figure 90: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 91: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 92: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 93: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 94: Middle East & Africa Grapeseed Oil Market Value Share (%), By Segment 3, 2023 & 2030

Figure 95: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 96: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 97: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 98: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Others, 2018-2030

Figure 99: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by GCC, 2018-2030

Figure 100: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by South Africa, 2018-2030

Figure 101: Middle East & Africa Grapeseed Oil Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2030

List of Tables

Table 1: Global Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 2: Global Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 3: Global Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 4: Global Grapeseed Oil Market Revenue (USD Billion) Forecast, by Region, 2018-2030

Table 5: North America Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 6: North America Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 7: North America Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 8: North America Grapeseed Oil Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 9: Europe Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 10: Europe Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 11: Europe Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 12: Europe Grapeseed Oil Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 13: Latin America Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 14: Latin America Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 15: Latin America Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 16: Latin America Grapeseed Oil Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 17: Asia Pacific Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 18: Asia Pacific Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 19: Asia Pacific Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 20: Asia Pacific Grapeseed Oil Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 21: Middle East & Africa Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 22: Middle East & Africa Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 23: Middle East & Africa Grapeseed Oil Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 24: Middle East & Africa Grapeseed Oil Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model