Hepatitis C Virus (HCV) Treatment Market Overview and Analysis

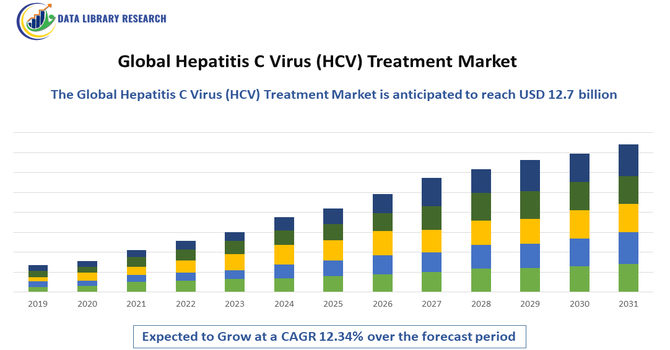

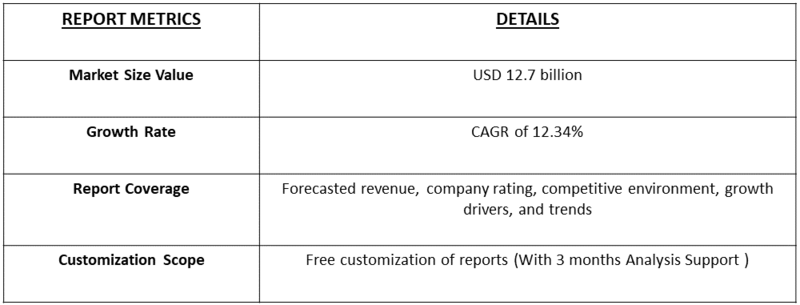

- The Global Hepatitis C Virus (HCV) Treatment Market size is likely to be valued at USD 9.8 billion in 2026 and is expected to reach USD 12.7 billion by 2032, growing with a CAGR of 12.34% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Hepatitis C Virus (HCV) Treatment Market encompasses the development, production, and commercialization of therapies for managing HCV infection, a leading cause of liver disease worldwide. This market includes direct-acting antivirals (DAAs), interferons, and combination therapies aimed at achieving sustained virologic response and preventing liver complications. Growth is driven by rising HCV prevalence, increased screening programs, advances in antiviral therapies, and supportive government initiatives promoting treatment access.

Hepatitis C Virus (HCV) Treatment Market Latest Trends

The Global Hepatitis C Virus (HCV) Treatment Market is evolving rapidly with the adoption of direct-acting antivirals (DAAs), which offer higher cure rates, shorter treatment durations, and improved tolerability compared to traditional interferon-based therapies. There is a growing emphasis on personalized treatment regimens, considering viral genotype and patient comorbidities. Expansion of screening programs and government-led awareness initiatives has increased early diagnosis, driving demand for effective therapies.

Segmentation: The Global Hepatitis C Virus (HCV) Treatment Market is segmented by Therapy Type (Direct-Acting Antivirals (DAAs) (NS3/4A Protease Inhibitors, NS5A Inhibitors and NS5B Polymerase Inhibitors), Interferons, Ribavirin and Combination Therapies), Disease Type (Chronic HCV Infection and Acute HCV Infection), Route of Administration (Oral and Injectable), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Prevalence and Awareness

The increasing global prevalence of Hepatitis C Virus (HCV) infections is a major driver of market growth. Rising awareness about HCV transmission, symptoms, and long-term complications has encouraged more individuals to undergo screening and seek treatment. For instance, in 2025, WHO reported that globally, an estimated 50 million people have chronic hepatitis C virus infection, with about 1.0 million new infections occurring per year.

Government and non-governmental health initiatives, along with public health campaigns, have enhanced early diagnosis and detection rates. For instance, NGO reported that G.B. Pant Hospital in Delhi ran out of key Hepatitis C medicines, including Sofosbuvir, Daclatasvir, and Ribavirin, affecting 20–30 patients daily. The stock-outs highlighted challenges in drug supply and the need for government support. While global advances and initiatives promoting screening, early diagnosis, and reimbursement facilitated access to direct-acting antivirals, inconsistent medicine availability hindered treatment uptake and emphasized the need for stronger logistics and policy enforcement in the HCV treatment market. As a result, the demand for effective antiviral therapies, including direct-acting antivirals (DAAs) and combination regimens, has surged, contributing significantly to the expansion of the global HCV treatment market.

- Advancements in Direct-Acting Antivirals

Technological advancements in direct-acting antivirals (DAAs) have significantly driven the growth of the global HCV treatment market. DAAs offer high cure rates, shorter treatment durations, and improved tolerability compared to traditional interferon-based therapies. For instance, in 2024, A research team led by DZIF scientist Prof. Thomas Krey at Universität zu Lübeck, in collaboration with international partners, achieved a breakthrough in hepatitis C vaccine development. Using “epitope-focused immunogens,” they induced broadly neutralizing antibodies in laboratory models for the first time. The promising findings, addressing the virus’s high genetic diversity, were published in Science Advances.

The development of pan-genotypic DAAs has simplified treatment regimens and reduced the need for genotype-specific therapy, enabling broader patient coverage. Continuous research and clinical trials have led to combination therapies that target multiple viral proteins, enhancing efficacy and reducing relapse rates. These innovations have not only improved patient adherence but also increased clinician confidence, fostering adoption and supporting sustained growth in the global HCV therapeutic market.

Market Restraints

- High Treatment Costs and Limited Access

High treatment costs and limited access to advanced HCV therapies remain a significant restraint for the global market. Many direct-acting antivirals and combination therapies are expensive, posing financial challenges for patients, especially in low- and middle-income countries. Limited insurance coverage, inadequate government reimbursement, and insufficient healthcare infrastructure further restrict access to effective treatment. Additionally, disparities in healthcare awareness and diagnostic availability contribute to delayed therapy initiation. These barriers reduce market penetration and limit adoption of high-efficacy therapies. Addressing affordability, expanding insurance and reimbursement programs, and improving access to healthcare facilities are essential to overcome these challenges and sustain global HCV market growth.

Socioeconomic Impact on Hepatitis C Virus (HCV) Treatment Market

HCV imposes a significant socioeconomic burden, including healthcare costs, loss of productivity, and long-term complications like liver cirrhosis and hepatocellular carcinoma. Untreated HCV can lead to hospitalization and the need for liver transplants, increasing financial strain on healthcare systems. Access to effective antiviral therapies reduces disease progression, improves patient quality of life, and lowers long-term healthcare expenditures. However, high drug costs and limited insurance coverage in low- and middle-income countries hinder treatment accessibility. Public health initiatives, early diagnosis, and affordable therapy distribution are essential to mitigate socioeconomic challenges, reduce disease-related disability, and promote overall population health.

Segmental Analysis:

- NS5A Inhibitors segment is expected to witness highest growth over the forecast period

The NS5A inhibitors segment is expected to witness the highest growth over the forecast period due to their high efficacy in suppressing Hepatitis C Virus replication and achieving sustained virologic response. These inhibitors are a key component of modern direct-acting antiviral (DAA) regimens and are often used in combination therapies for all major HCV genotypes. Their improved tolerability, shorter treatment duration, and pan-genotypic coverage have increased patient adherence and clinical adoption. Continuous R&D efforts and approvals of next-generation NS5A inhibitors with enhanced potency are further driving market demand, making this segment the fastest-growing within the global HCV treatment market.

- Chronic HCV Infection segment is expected to witness highest growth over the forecast period

The chronic HCV infection segment is projected to witness the highest growth over the forecast period, driven by the large patient population with long-term viral persistence and risk of severe liver complications. Increasing awareness, improved screening programs, and early diagnosis of chronic cases have expanded the eligible patient pool for therapy. Chronic infections require effective long-term treatment strategies, creating demand for advanced DAAs and combination regimens. Government initiatives and public health campaigns targeting chronic HCV management are also supporting market expansion. The growing focus on preventing progression to cirrhosis and hepatocellular carcinoma further reinforces growth in this segment.

- Oral segment is expected to witness highest growth over the forecast period

The oral segment is expected to witness the highest growth over the forecast period due to patient preference for convenient, non-invasive treatment options. Oral direct-acting antivirals (DAAs) offer simplified dosing regimens, shorter treatment durations, and fewer side effects compared to injectable therapies, enhancing adherence and treatment outcomes. Pan-genotypic oral therapies enable broader coverage across HCV genotypes, eliminating the need for extensive genotype testing. The increasing availability of combination oral therapies, along with strong physician preference and regulatory approvals, has driven widespread adoption. These factors position the oral segment as the fastest-growing route of administration in the global HCV therapeutic market.

- North America Region is expected to witness highest growth over the forecast period

North America is expected to witness the highest growth over the forecast period due to a combination of high HCV prevalence, well-established healthcare infrastructure, and widespread access to advanced antiviral therapies.

Government initiatives promoting screening, early diagnosis, and treatment reimbursement have facilitated patient access to direct-acting antivirals. For instance, in 2025, The U.S. Department of Health and Human Services (HHS) launched a USD 100 million pilot program to prevent, test, treat, and cure HCV among individuals with substance use disorder or serious mental illness, particularly in homeless communities. The initiative improved patient identification, treatment completion, and cure rates, increased adoption of direct-acting antivirals, and, through government-led screening and reimbursement efforts, strengthened North America’s HCV treatment market while reducing disease burden.

Strong investment in research and development, coupled with regulatory approvals, along with the presence of key market players, has accelerated the launch of innovative therapies. For instance, in 2025, Cepheid announced that Health Canada issued a medical device license for its Xpert HCV VL Fingerstick test, which detects and quantifies HCV RNA from a single drop of blood. Performed on the GeneXpert system, the test simplified diagnostics, accelerated patient linkage to care, and facilitated monitoring of sustained virological response. Patient awareness and support programs have further enhanced treatment adoption. Thus, these factors position North America as the leading growth region in the global HCV treatment market, particularly for high-efficacy therapies.

To Learn More About This Report - Request a Free Sample Copy

Hepatitis C Virus (HCV) Treatment Market Competitive Landscape

The Global HCV Treatment Market is highly competitive, dominated by pharmaceutical giants and innovative biotech companies focusing on high-efficacy antiviral therapies. Key players prioritize research and development of DAAs, pan-genotypic drugs, and combination therapies to improve cure rates and reduce treatment duration. Strategic partnerships, mergers, and licensing agreements are common to expand global reach and market penetration. Companies differentiate through patient support programs, pricing strategies, and real-world outcome data. The competitive environment is also shaped by patent expirations and the introduction of generic formulations, which increase accessibility but intensify price competition, pushing companies to prioritize innovation and value-based healthcare solutions.

The major players for this market are:

- Gilead Sciences, Inc.

- AbbVie Inc.

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Johnson & Johnson (Janssen Pharmaceuticals)

- Roche Holding AG

- Novartis AG

- Hetero Drugs Limited

- Mylan N.V. (Viatris)

- Zydus Cadila

- Aurobindo Pharma Limited

- Natco Pharma Limited

- Sun Pharmaceutical Industries Ltd.

- Cipla Limited

- Lupin Limited

- BioPharma Solutions (Generic/Contract Manufacturing)

- Pharmstandard PLC

- Shionogi & Co., Ltd.

- Taigene Pharmaceutical Co., Ltd.

- Emcure Pharmaceuticals Ltd.

Recent Development

- In June 2025, Enanta Pharmaceuticals, Inc. announced FDA approval of a label expansion for MAVYRET (glecaprevir/pibrentasvir), establishing it as the only eight-week treatment for adults and pediatric patients aged three and above with HCV. The approval strengthened market position, expanded patient access, accelerated adoption of oral pan-genotypic therapies, and supported growth in the global HCV treatment market by improving treatment convenience, adherence, and clinician confidence.

- In 2025, Atea Pharmaceuticals dosed the first patient in its C-BEYOND Phase 3 trial in the U.S. and Canada, evaluating bemnifosbuvir and ruzasvir versus sofosbuvir and velpatasvir for chronic HCV. The milestone advanced next-generation therapies, potentially expanded treatment options, increased clinician confidence, and stimulated market investment, contributing to global HCV treatment growth through enhanced therapy diversity and adoption of high-efficacy, patient-friendly antivirals.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing because of a rising global awareness of silent liver infections and improved screening programs. The development of "Direct-Acting Antivirals" (DAAs) has revolutionized care, offering cure rates over 95% with short treatment cycles. Additionally, government-led initiatives to eliminate hepatitis by 2030 are increasing patient access to medicine.

Q2. What are the main restraining factors for this market?

Growth is limited by the high cost of breakthrough antiviral drugs, which remains a barrier in low-income regions. Because these modern treatments actually cure the disease, the total number of infected patients decreases over time, eventually shrinking the long-term customer base. Asymptomatic cases also lead to many patients remaining undiagnosed.

Q3. Which segment is expected to witness high growth?

The Combination Therapy segment is expected to see the highest growth. Doctors prefer using a mix of different antiviral drugs in one pill to prevent the virus from becoming resistant. These "all-oral" regimens are highly effective across different strains of the virus, making them the standard of care globally.

Q4. Who are the top major players for this market?

The market is dominated by global pharmaceutical leaders with strong portfolios in infectious diseases. Key players include Gilead Sciences, AbbVie, Bristol-Myers Squibb, Merck & Co., and Johnson & Johnson. These companies lead by producing the most effective DAAs and forming partnerships to provide low-cost versions in developing nations.

Q5. Which country is the largest player?

The United States is the largest player in the Hepatitis C treatment market. This is due to its high healthcare spending, advanced diagnostic network, and early adoption of premium curative therapies. A strong emphasis on veteran health and public screening programs ensures a high volume of patients receive advanced medical care.

List of Figures

Figure 1: Global Hepatitis C Virus (HCV) Treatment Market Revenue Breakdown (USD Billion, %) by Region, 2019 & 2027

Figure 2: Global Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 1, 2019 & 2027

Figure 3: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 4: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 5: Global Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 2, 2019 & 2027

Figure 6: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 7: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 8: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 9: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 10: Global Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 3, 2019 & 2027

Figure 11: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 12: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 13: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 14: Global Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 15: Global Hepatitis C Virus (HCV) Treatment Market Value (USD Billion), by Region, 2019 & 2027

Figure 16: North America Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 1, 2019 & 2027

Figure 17: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 18: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 19: North America Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 2, 2019 & 2027

Figure 20: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 21: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 22: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 23: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 24: North America Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 3, 2019 & 2027

Figure 25: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 26: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 27: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 28: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 29: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by U.S., 2016-2027

Figure 30: North America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Canada, 2016-2027

Figure 31: Latin America Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 1, 2019 & 2027

Figure 32: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 33: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 34: Latin America Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 2, 2019 & 2027

Figure 35: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 36: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 37: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 38: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 39: Latin America Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 3, 2019 & 2027

Figure 40: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 41: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 42: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 43: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 44: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Brazil, 2016-2027

Figure 45: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Mexico, 2016-2027

Figure 46: Latin America Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Rest of Latin America, 2016-2027

Figure 47: Europe Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 1, 2019 & 2027

Figure 48: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 49: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 50: Europe Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 2, 2019 & 2027

Figure 51: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 52: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 53: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 54: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 55: Europe Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 3, 2019 & 2027

Figure 56: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 57: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 58: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 59: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 60: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by U.K., 2016-2027

Figure 61: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Germany, 2016-2027

Figure 62: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by France, 2016-2027

Figure 63: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Italy, 2016-2027

Figure 64: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Spain, 2016-2027

Figure 65: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Russia, 2016-2027

Figure 66: Europe Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Rest of Europe, 2016-2027

Figure 67: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 1, 2019 & 2027

Figure 68: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 69: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 70: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 2, 2019 & 2027

Figure 71: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 72: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 73: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 74: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 75: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 3, 2019 & 2027

Figure 76: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 77: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 78: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 79: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 80: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by China, 2016-2027

Figure 81: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by India, 2016-2027

Figure 82: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Japan, 2016-2027

Figure 83: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Australia, 2016-2027

Figure 84: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Southeast Asia, 2016-2027

Figure 85: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Rest of Asia Pacific, 2016-2027

Figure 86: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 1, 2019 & 2027

Figure 87: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 88: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 89: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 2, 2019 & 2027

Figure 90: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 91: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 92: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 93: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 94: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Value Share (%), By Segment 3, 2019 & 2027

Figure 95: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 96: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 97: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 98: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Others, 2016-2027

Figure 99: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by GCC, 2016-2027

Figure 100: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by South Africa, 2016-2027

Figure 101: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Forecast (USD Billion), by Rest of Middle East & Africa, 2016-2027

List of Tables

Table 1: Global Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 2: Global Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 3: Global Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 4: Global Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Region, 2016-2027

Table 5: North America Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 6: North America Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 7: North America Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 8: North America Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 9: Europe Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 10: Europe Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 11: Europe Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 12: Europe Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 13: Latin America Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 14: Latin America Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 15: Latin America Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 16: Latin America Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 17: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 18: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 19: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 20: Asia Pacific Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 21: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 22: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 23: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 24: Middle East & Africa Hepatitis C Virus (HCV) Treatment Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model