The global intravenous (IV) solutions market is expected to grow at a CAGR of 7.6% from 2022 to 2029. The market is driven by the increasing demand for IV solutions, the growing number of hospital admissions, and the rising number of surgical procedures. The market is segmented by product type, application, end-user, and geography. By product type, the market is classified into saline solutions, dextrose solutions, amino acid solutions, lipid emulsions, and other IV solutions. By application, the market is divided into hydration therapy, parenteral nutrition, chemotherapy, and others. By end-user, the market is categorized into hospitals and clinics, home healthcare, and ambulatory surgical centers. The increase in the number of surgeries and hospitalizations, the rise in the geriatric population, and the growth in the home care setting are some of the major factors driving the growth of this market.

Market Drivers

The growth of the market is primarily driven by the increasing prevalence of chronic diseases, technological advancements in delivery systems, and the growing preference for home healthcare among patients.

According to the World Health Organization (WHO), chronic diseases are responsible for an estimated 38 million deaths globally each year, which is equivalent to nearly one-third of all deaths annually. Cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes are some of the leading causes of death due to chronic diseases. The increasing incidence of these chronic diseases is one of the major factors driving the growth of the IV solutions market.

Technological advancements in delivery systems have resulted in the development of new and improved IV solutions that are easier to administer and have fewer complications. For instance, needle-free connectors eliminate the need for needles and catheters, thus reducing the risk of needle-stick injuries and infections. Similarly, pre-filled syringes reduce preparation time and minimize errors associated with conventional syringes. These advances are expected to fuel market growth over the forecast period.

The preference for home healthcare is growing among patients worldwide owing to its cost-effectiveness and convenience.

Market Restraints

1. Market Restraints:

The global intravenous (IV) solutions market is currently facing a number of restraints that are hampering its growth. Some of the key restraints include stringent regulations, the high cost of products, and the lack of skilled personnel.

Stringent Regulations:

One of the major restraints for the global IV solutions market is the stringent regulations that are in place for the manufacturing and marketing of these products. The regulatory landscape for IV solutions is quite complex and ever-changing, which makes it difficult for companies to keep up with the latest requirements. This often leads to delays in product launches and higher costs associated with compliance.

High Cost of Products:

Another key restraint for the IV solutions market is the high cost of these products. IV solutions are generally used for critical applications where there is no room for error, which drives up the prices. In addition, many IV solution products are only available through specialty pharmacies or distributors, further adding to the costs. Lack of Skilled Personnel:

A final restraint that is impacting the IV solutions market is the lack of skilled personnel necessary to properly administer these products. Many hospitals and other healthcare facilities do not have staff with the proper training to safely use IV solutions, which can lead to errors and serious complications.

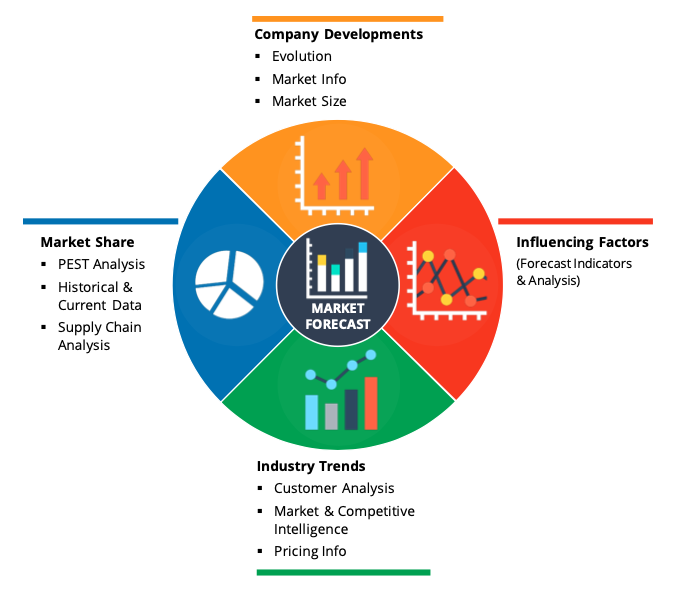

Report Includes

An overview of the global IV Solutions market, and related technologies and developments. Analyses of global market trends, with historical data from 2018, 2019, and 2020 estimates and projections of CAGRs through 2029. It also includes breakdowns of the overall IV Solutions market along with various segments, and by geographic region. Analysis of the stakeholder value chain in the IV Solutions market and comprehensive profiles of leading companies in the industry

Report Scope

The report forecasts the size of the IV Solutions market for components from 2022 through 2029

The Executive Summary provides a snapshot of the key findings of the report. The introduction chapter includes the research scope, market segmentation, research methodology, and definitions and assumptions. It involves extremely rigorous scientific methods, tools, and techniques to estimate the market size. Exhaustive secondary research is being carried out to collect information related to the market, the parent market, and the peer market. Primary research is undertaken to validate the assumptions, findings, and sizing with industry experts and professionals across the value chain of the market. Both top-down and bottom-up approaches are employed to estimate the complete market size.

The chapter on market dynamics includes market drivers, restraints, and opportunities which helps familiarise with market potential and upcoming opportunities. The chapter on key insights includes emerging trends from major countries, the latest technological advancement, regulatory landscape, SWOT analysis, and Porter's five forces analysis. This chapter provides detailed insights into the market, which derives the market trends, changing phase of investments, and scope of profit potential, and helps to take appropriate business decisions. The chapter on competitive analysis includes the profiling of leading companies in the global market to map the leading companies and their focus of interest in the market.

After deriving the market size from the market size estimation process, the total market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures is being used. The data triangulation is carried out by studying various factors and trends from demand and supply perspectives.

Segmentation Analysis:

There are numerous ways to segment the global intravenous (IV) solutions market. Some common methods include product type, end-user, geography, and by distribution channel.

By Product Type:

The global IV solutions market can be segmented into isotonic solutions, hypotonic solutions, and hypertonic solutions. Isotonic solutions are the most commonly used type of IV solution and are available in a variety of concentrations. Hypotonic solutions have a lower concentration of solutes than isotonic solutions and are used when a patient needs hydration without electrolytes. Hypertonic solutions have a higher concentration of solutes than isotonic solutions and are used when a patient needs electrolytes without hydration.

By End User:

The global IV solutions market can be segmented into hospitals, ambulatory surgical centers, clinics, and homecare settings. Hospitals are the largest users of IV solutions due to the high volume of patients that require them for treatment. Ambulatory surgical centers also use large quantities of IV solutions for surgery patients who need fluids before or after their procedure. Clinics use IV solutions for patients who need hydration or electrolytes but do not require hospitalization. Homecare settings use IV solutions for patients who need short-term hydration or electrolyte replacement therapy.

By Geography:

The global IV solutions market can be segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Global IV Solutions Market Competitive Analysis:

Key players in the Global IV Solutions market are Baxter (US), Fresenius Kabi AG (Germany), B. Braun Melsungen AG (Germany), ICU Medical, Inc. (US), Grifols, SA (Spain), Terumo Corporation (Japan), and Amanta Healthcare (India) among other players.

*All our reports are customizable as per customer requirements

This study forecasts revenue and volume growth at global, regional, and country levels from 2018 to 2029. Global IV Solutions market is distributed on the basis of the below-mentioned segments:

Global IV Solutions Market, By Type:

- Peripheral Parenteral Nutrition

- Total Parenteral Nutrition

- Others

- Hospital & Clinics

- Ambulatory

- Home Care

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- GCC

- South Africa

- Rest of Middle East and Africa

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global IV Solutions Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Segment 1

- 5.2.1. Sub-Segment 1

- 5.2.2. Sub-Segment 2

- 5.3. Market Analysis, Insights and Forecast – By Segment 2

- 5.3.1. Sub-Segment 1

- 5.3.2. Sub-Segment 2

- 5.3.3. Sub-Segment 3

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast – By Segment 3

- 5.4.1. Sub-Segment 1

- 5.4.2. Sub-Segment 2

- 5.4.3. Sub-Segment 3

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast – By Region

- 5.5.1. North America

- 5.5.2. Latin America

- 5.5.3. Europe

- 5.5.4. Asia Pacific

- 5.5.5. Middle East and Africa

6. North America IV Solutions Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Segment 1

- 6.2.1. Sub-Segment 1

- 6.2.2. Sub-Segment 2

- 6.3. Market Analysis, Insights and Forecast – By Segment 2

- 6.3.1. Sub-Segment 1

- 6.3.2. Sub-Segment 2

- 6.3.3. Sub-Segment 3

- 6.3.4. Others

- 6.4. Market Analysis, Insights and Forecast – By Segment 3

- 6.4.1. Sub-Segment 1

- 6.4.2. Sub-Segment 2

- 6.4.3. Sub-Segment 3

- 6.4.4. Others

- 6.5. Market Analysis, Insights and Forecast – By Country

- 6.5.1. U.S.

- 6.5.2. Canada

7. Latin America IV Solutions Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Segment 1

- 7.2.1. Sub-Segment 1

- 7.2.2. Sub-Segment 2

- 7.3. Market Analysis, Insights and Forecast – By Segment 2

- 7.3.1. Sub-Segment 1

- 7.3.2. Sub-Segment 2

- 7.3.3. Sub-Segment 3

- 7.3.4. Others

- 7.4. Market Analysis, Insights and Forecast – By Segment 3

- 7.4.1. Sub-Segment 1

- 7.4.2. Sub-Segment 2

- 7.4.3. Sub-Segment 3

- 7.4.4. Others

- 7.5. Insights and Forecast – By Country

- 7.5.1. Brazil

- 7.5.2. Mexico

- 7.5.3. Rest of Latin America

8. Europe IV Solutions Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Segment 1

- 8.2.1. Sub-Segment 1

- 8.2.2. Sub-Segment 2

- 8.3. Market Analysis, Insights and Forecast – By Segment 2

- 8.3.1. Sub-Segment 1

- 8.3.2. Sub-Segment 2

- 8.3.3. Sub-Segment 3

- 8.3.4. Others

- 8.4. Market Analysis, Insights and Forecast – By Segment 3

- 8.4.1. Sub-Segment 1

- 8.4.2. Sub-Segment 2

- 8.4.3. Sub-Segment 3

- 8.4.4. Others

- 8.5. Market Analysis, Insights and Forecast – By Country

- 8.5.1. UK

- 8.5.2. Germany

- 8.5.3. France

- 8.5.4. Italy

- 8.5.5. Spain

- 8.5.6. Russia

- 8.5.7. Rest of Europe

9. Asia Pacific IV Solutions Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Segment 1

- 9.2.1. Sub-Segment 1

- 9.2.2. Sub-Segment 2

- 9.3. Market Analysis, Insights and Forecast – By Segment 2

- 9.3.1. Sub-Segment 1

- 9.3.2. Sub-Segment 2

- 9.3.3. Sub-Segment 3

- 9.3.4. Others

- 9.4. Market Analysis, Insights and Forecast – By Segment 3

- 9.4.1. Sub-Segment 1

- 9.4.2. Sub-Segment 2

- 9.4.3. Sub-Segment 3

- 9.4.4. Others

- 9.5. Market Analysis, Insights and Forecast – By Country

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. Australia

- 9.5.5. South East Asia

- 9.5.6. Rest of Asia Pacific

10. Middle East & Africa IV Solutions Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 10.1. Key Findings / Summary

- 10.2. Market Analysis, Insights and Forecast – By Segment 1

- 10.2.1. Sub-Segment 1

- 10.2.2. Sub-Segment 2

- 10.3. Market Analysis, Insights and Forecast – By Segment 2

- 10.3.1. Sub-Segment 1

- 10.3.2. Sub-Segment 2

- 10.3.3. Sub-Segment 3

- 10.3.4. Others

- 10.4. Market Analysis, Insights and Forecast – By Segment 3

- 10.4.1. Sub-Segment 1

- 10.4.2. Sub-Segment 2

- 10.4.3. Sub-Segment 3

- 10.4.4. Others

- 10.5. Market Analysis, Insights and Forecast – By Country

- 10.5.1. GCC

- 10.5.2. South Africa

- 10.5.3. Rest of Middle East & Africa

11. Competitive Analysis

- 11.1. Company Market Share Analysis, 2018

- 11.2. Key Industry Developments

- 11.3. Company Profile

- 11.3.1. Company 1

- 11.3.1.1. Business Overview

- 11.3.1.2. Segment 1 & Service Offering

- 11.3.1.3. Overall Revenue

- 11.3.1.4. Geographic Presence

- 11.3.1.5. Recent Development

- 11.3.2. Company 2

- 11.3.3. Company 3

- 11.3.4. Company 4

- 11.3.5. Company 5

- 11.3.6. Company 6

- 11.3.7. Company 7

- 11.3.8. Company 8

- 11.3.9. Company 9

- 11.3.10. Company 10

- 11.3.11. Company 11

- 11.3.12. Company 12

- 11.3.1. Company 1

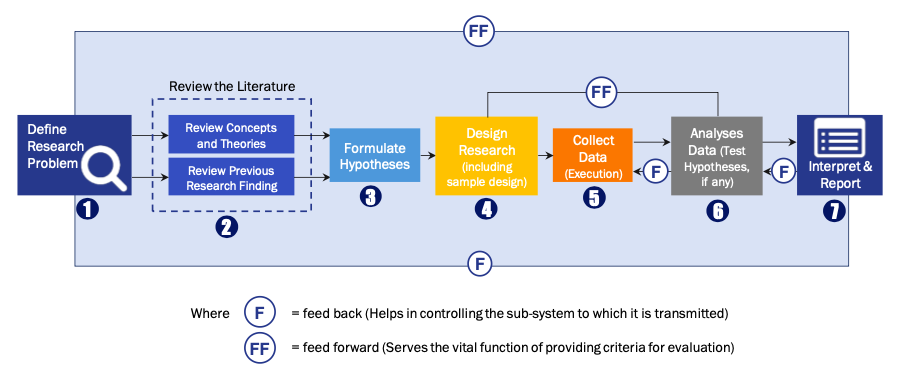

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model