Maritime Telemedical Assistance Service Market Overview and Analysis

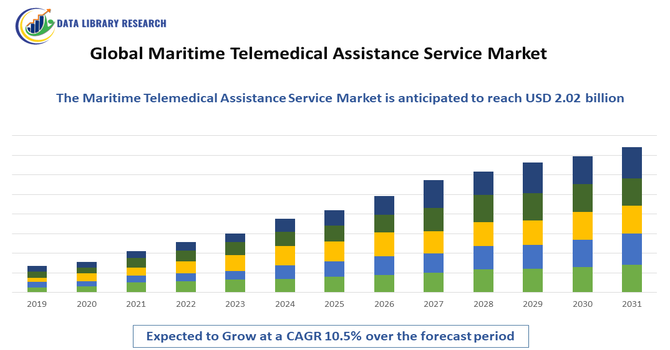

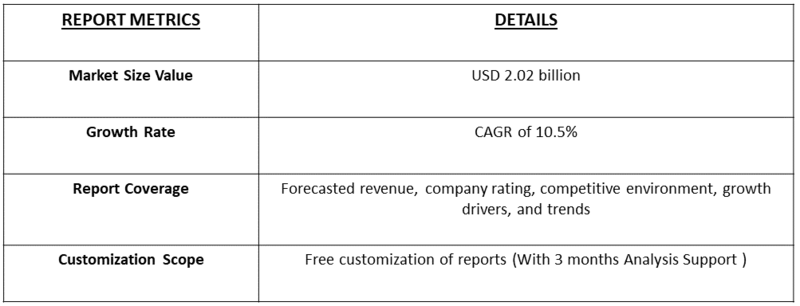

- The Maritime Telemedical Assistance Service Market size was valued at USD 2.02 billion in 2025 and is forecasted to grow at a CAGR of 10.5% from 2025 to 2032, reaching USD 8.6 billion in the year 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Maritime Telemedical Assistance Service (TMAS) Market refers to the worldwide industry providing remote medical support and consultation to seafarers and maritime personnel. Leveraging telecommunication technologies, TMAS delivers real-time diagnosis, emergency guidance, and health management services onboard ships. Market growth is driven by increasing maritime operations, stringent safety regulations, and the need for timely medical interventions at sea.

The growth of the Global Maritime Telemedical Assistance Service (TMAS) Market is driven by the increasing volume of international shipping and offshore operations, which heighten the need for onboard medical support. Strict maritime safety and health regulations compel shipping companies to ensure timely medical assistance. Advances in telecommunication, satellite connectivity, and digital health technologies enable real-time consultations, emergency response, and health monitoring at sea.

Maritime Telemedical Assistance Service Market Latest Trends

The global TMAS market is undergoing rapid transformation due to the convergence of telemedicine, IoT, artificial intelligence and mobile health technologies that support real time medical consultation, wearable health monitoring, and remote diagnostics onboard vessels. With increasing satellite connectivity and digital health platforms, ship owners are shifting from basic tele aid to integrated health ecosystems. The rise of mental health services, chronic disease surveillance for seafarers, and regulatory mandates on crew welfare further reinforce these trends, making telemedical assistance a core operational requirement rather than a luxury for maritime operations.

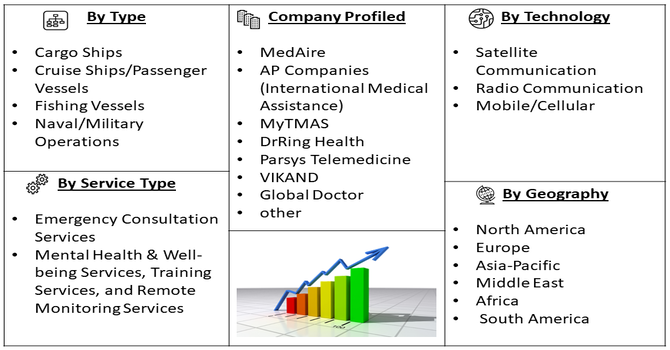

Segmentation: The Global Maritime Telemedical Assistance Service Market is segmented by Vessel Type (Cargo Ships, Cruise Ships/Passenger Vessels, Fishing Vessels, and Naval/Military Operations), Service Type (Emergency Consultation Services, Mental Health & Well-being Services, Training Services, and Remote Monitoring Services), Technology (Satellite Communication, Radio Communication and Mobile/Cellular), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers

- Increasing global maritime operations and regulatory compliance

The expansion of international shipping, offshore oil and gas operations, and cruise industries has amplified the demand for onboard medical support. Seafarers often operate in remote locations with limited access to healthcare, making telemedical assistance vital. Additionally, maritime authorities and international organizations, including the International Maritime Organization (IMO), mandate access to medical guidance for vessels at sea, driving adoption of TMAS solutions.

In October 2025, The Union Minister of Ports, Shipping & Waterways, Sarbananda Sonowal, announced that India Maritime Week 2025 secured over INR 12 lakh crore in investments with more than 600 MoUs signed. This 41% increase from 2023 highlighted India’s growing leadership in sustainable port development and boosted global maritime activities, thereby driving demand and expansion in the Global Maritime Telemedical Assistance Service (TMAS) Market. Compliance with safety regulations, occupational health standards, and insurance requirements compels ship-owners to implement telemedical services. The combination of growing maritime traffic and strict regulatory oversight ensures that TMAS becomes an essential service, underpinning safer operations and continuous monitoring of crew health globally.

- Technological advancements in telemedicine and connectivity

Rapid improvements in satellite communications, mobile health platforms, wearable devices, and AI-powered diagnostic tools have enhanced the effectiveness of TMAS services. Ships can now access real-time medical consultation, remote monitoring, and diagnostic support even in the most isolated ocean regions. The integration of IoT and cloud-based platforms allows continuous tracking of crew health parameters, predictive analytics for chronic conditions, and immediate guidance during emergencies.

In April 2024, Universal Marine Medical Supply International, launched comprehensive telemedicine capabilities, enhancing its technology-driven maritime medical platform. This development improved remote healthcare delivery onboard vessels, strengthened TMAS service offerings, and contributed to increased adoption and growth in the global maritime telemedical assistance service market. These technological innovations improve response times, reduce medical evacuation costs, and increase crew confidence in onboard healthcare. Consequently, shipping companies are increasingly investing in advanced telemedical solutions to ensure operational efficiency, reduce risks, and improve overall seafarer welfare.

Market Restraint:

- High implementation costs and infrastructure dependency

Despite their benefits, TMAS services face adoption challenges due to significant upfront investment and dependency on reliable communication infrastructure. Installing satellite-based telemedicine systems, integrating software platforms, and training crew members incur substantial costs, which can be prohibitive for smaller shipping companies. Additionally, performance relies heavily on uninterrupted connectivity; remote or extreme-weather regions may experience signal disruptions, limiting service reliability. Concerns over data security, compliance with international health and privacy regulations, and ongoing maintenance add complexity. These financial and operational constraints can delay adoption, particularly in price-sensitive markets or among operators with older vessels, restraining broader growth of the global maritime telemedical assistance service market.

Socio Economic Impact on Maritime Telemedical Assistance Service Market

Maritime telemedical assistance services significantly improve seafarer health and safety by providing access to expert medical care in remote marine environments, thereby reducing evacuation costs and operational disruptions for shipping companies. Enhanced onboard health support promotes crew welfare, retention, and productivity which benefits global trade operations. At the societal level, the availability of remote diagnostics and preventive medical monitoring contributes to improved occupational health outcomes and lowers overall maritime healthcare burdens—especially in regions with limited on shore access—thus supporting more inclusive and resilient maritime logistics infrastructure.

Segmental Analysis

- Naval/Military Operations Segment is Expected to Witness Significant Growth Over the Forecast Period

The Naval/Military Operations segment is projected for significant growth due to the critical need for secure, immediate, and continuous medical support for personnel deployed in remote, high-risk operational environments where traditional healthcare is unavailable. Military forces are heavily investing in telemedicine and integrated digital health solutions to ensure readiness and reduce costly, risky aeromedical evacuations. The adoption of AI-powered triage and specialized tele-behavioral health services is accelerating, driven by government focus on service member well-being and the need for resilient communication infrastructure (often satellite-based) to maintain operational continuity even during defense missions.

- Emergency Consultation Services Segment is Expected to Witness Significant Growth Over the Forecast Period

The Emergency Consultation Services segment will witness substantial growth as it is the foundational and most critical component of the entire market. This service provides 24/7 real-time medical advice via radio, phone, or video to ships with often minimally trained staff, enabling prompt remote diagnosis and guidance for emergency treatment. The growth is fueled by international maritime law (MLC, IMO) which mandates this level of care, the need to avoid catastrophic delays in critical situations, and the drive to reduce expensive vessel diversions or unnecessary medical evacuations by managing treatable emergencies effectively onboard.

- Satellite Communication Segment is Expected to Witness Significant Growth Over the Forecast Period

The Satellite Communication segment is expected to see significant growth, as it is the primary enabler of high-quality maritime telemedicine. The rising demand for real-time video consultations, large data transfers (like X-rays or full patient histories), and reliable connectivity far from shore drives the adoption of advanced services like VSAT (Very Small Aperture Terminal) and High-Throughput Satellites (HTS). Ongoing technological advancements are minimizing the size and increasing the capacity of shipboard antennas, making high-speed broadband more cost-effective and dependable for crew welfare and remote diagnostic applications, thus overcoming previous bandwidth constraints.

- North America Region is Expected to Witness Significant Growth Over the Forecast Period

The North America Region is expected to witness significant growth, leveraging its highly mature and technology-driven healthcare and telecommunications sectors. Growth is fueled by the strong presence of major telemedicine technology providers (driving innovation), robust regulatory frameworks that support remote care, and high adoption rates of digital health solutions across all industries. While its primary focus remains on high-value commercial vessels and advanced naval fleets, the region's continuous investment in maritime satellite infrastructure and its dominant role in the global health and safety services market ensures it remains a high-revenue, high-growth hub for sophisticated telemedical assistance.

To Learn More About This Report - Request a Free Sample Copy

Maritime Telemedical Assistance Service Market Competitive Analysis

Competition in the TMAS market is intensifying as established players partner with technology firms and maritime service providers to expand global reach and capabilities. Companies are differentiating through advanced platforms, AI driven analytics, multilingual remote consultation services and satellite communication infrastructure. Strategic collaborations, mergers and acquisitions are common as firms seek to capture growth in emerging shipping markets and offshore energy segments. Smaller specialist entrants are pushing innovation, forcing incumbents to continuously upgrade offerings, streamline operations and reinforce their regulatory compliance credentials to maintain market leadership.

The major players for above market are:

- MedAire

- AP Companies (International Medical Assistance)

- MyTMAS

- DrRing Health

- Parsys Telemedicine

- VIKAND

- Global Doctor

- InterHealth Canada

- Radio Medical

- GVA

- SphereMD

- SeaMed24

- Marine Medical Service Ltd.

- The First Call • MaritimeHealth

- Patronus Medical

- Bethesda Medical

- Larkin Health

- Maritime Medical Solutions

- Discovery Health MD

Recent Development

- In October 2025, The Indian Coast Guard (ICG) successfully conducted a long-range medical evacuation of a critically injured Iranian fisherman from the dhow Al-Owais, located about 1500 km west of Kochi in the Arabian Sea. The Maritime Rescue Coordination Centre (MRCC) in Mumbai acted promptly after receiving emergency information from MRCC Chabahar, Iran. The fisherman had severe eye injuries and deep lacerations from an onboard explosion during fuel transfer. This operation demonstrated the critical role of TMAS in coordinating timely medical assistance at sea, enhancing the demand and trust in global maritime telemedical services for emergency response and crew safety.

- In April 2025, Ideagen, a global player in regulatory compliance software, partnered with Maritime and Healthcare Group (MHG), a well-known provider of healthcare staffing and maritime services. This collaboration aimed to enhance maritime operations and safety significantly. The partnership accelerated the integration of compliance and healthcare solutions, boosting the efficiency and reliability of TMAS, thereby driving growth and innovation in the global maritime telemedical assistance market.

Frequently Asked Questions (FAQ) :

Q1. What the main growth driving factors for this market?

The primary growth driver is the escalating regulatory pressure from bodies like the IMO and ILO, emphasizing crew welfare and mandatory health protection for seafarers. This compels shipping operators to adopt advanced medical support systems. Secondly, rapid advancements in satellite communication technology and onboard digital devices (wearables, portable diagnostic kits) enable reliable, real-time virtual consultations and remote diagnostics even in international waters. This improves medical response times and helps avoid costly and risky medical evacuations or vessel diversions, providing a strong economic incentive.

Q2. What are the main restraining factors for this market?

One significant restraining factor is the issue of connectivity and bandwidth limitations in remote ocean regions. High-quality video consultations and the transmission of large diagnostic files (like real-time vital signs) require stable, high-speed satellite links, which can be expensive and prone to disruption in adverse weather. Another challenge is the low medical training level of most onboard staff (often laypersons), who are the ones executing the remote doctor's orders. This reliance on untrained personnel introduces a risk of miscommunication or improper procedure execution, limiting the scope of care.

Q3. Which segment is expected to witness high growth?

The Offshore/Cargo Ships segment is expected to witness high growth. Unlike cruise ships, these vessels often have limited medical staff and undertake long voyages far from land, making immediate medical assistance critical. The segment is increasingly driven by regulatory requirements and the desire of shipping companies to minimize disruptions caused by crew illness. The integration of AI-powered triage tools and continuous remote monitoring is accelerating in this segment to ensure early intervention and reduce the costly necessity of diverting large cargo vessels.

Q4. Who are the top major players for this market?

The market is led by specialized global medical management and assistance service providers. Top major players include MedAire (part of International SOS), which offers integrated telemedicine and medical assistance platforms leveraging AI-driven triage, and VIKAND, known for comprehensive medical management for the cruise and commercial sectors. Other significant contributors include Global Doctor and established national or state-run Telemedical Maritime Assistance Service (TMAS) centers like Medico Cuxhaven (Germany) and CIRM (Italy), which offer vital radio medical advice.

Q5. Which country is the largest player?

While the service itself is inherently global, the largest players in terms of service provision and technological innovation are concentrated in North America and Europe. The United States, due to its leadership in general telemedicine regulations and the presence of major service providers like International SOS, is a major revenue generator. However, the Asia-Pacific (APAC) region, with countries like China and the Philippines contributing the largest number of seafarers and hosting massive ports, is the fastest-growing market, creating immense demand for health services across global shipping lanes.

List of Figures

Figure 1: Global Maritime Telemedical Assistance Service Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Maritime Telemedical Assistance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Maritime Telemedical Assistance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Maritime Telemedical Assistance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Maritime Telemedical Assistance Service Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Maritime Telemedical Assistance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Maritime Telemedical Assistance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Maritime Telemedical Assistance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Maritime Telemedical Assistance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Maritime Telemedical Assistance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Maritime Telemedical Assistance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Maritime Telemedical Assistance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Maritime Telemedical Assistance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Maritime Telemedical Assistance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Maritime Telemedical Assistance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Maritime Telemedical Assistance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Maritime Telemedical Assistance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Maritime Telemedical Assistance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Maritime Telemedical Assistance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Maritime Telemedical Assistance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Maritime Telemedical Assistance Service Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Maritime Telemedical Assistance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model