Medical Component Electrical Discharge Machining (EDM) Services Market Overview and Analysis

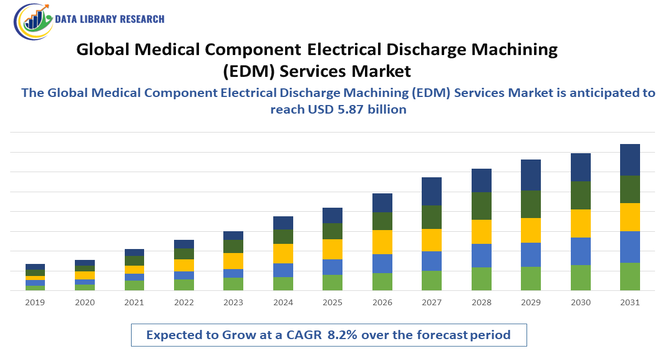

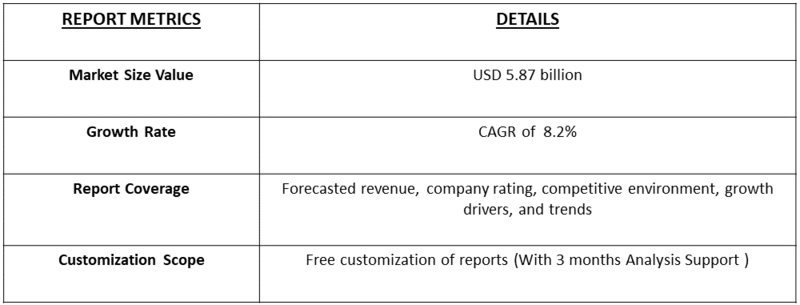

- The Global Medical Component Electrical Discharge Machining (EDM) Services Market is projected to reach approximately USD 5.87 billion by 2030, from USD 1.89 billion in 2025 with a CAGR around 8.2%, 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

Rapid growth in the Global Medical Component Electrical Discharge Machining (EDM) Services market is being driven primarily by the escalating need for ultra-precise, complex and miniaturized medical components that conventional machining cannot reliably produce — especially for implantables and instruments made from hard, biocompatible alloys (titanium, cobalt-chromium, nitinol). Rising global healthcare expenditure, an ageing population, and expanding volumes of surgical procedures (orthopedics, cardiovascular, dental and minimally invasive devices) are increasing demand for high-tolerance parts and bespoke, small-batch production, which favors specialized EDM providers.

Medical Component Electrical Discharge Machining (EDM) Services Market Latest Trends

Key recent trends in the Global Medical Component EDM services market include rapid uptake of micro-EDM and micromachining as manufacturers chase ever-smaller, tighter-tolerance implants and minimally invasive device parts; the medical micromachining segment is growing strongly as minimally invasive procedures and complex microfeatures drive demand. Hybrid workflows—where EDM (especially wire-EDM and micro-EDM) is combined with additive manufacturing or other subtractive processes for post-processing and feature finishing—are becoming common to produce complex geometries and reduce lead times. Industry-4.0 adoption and automation (CNC/robotic loading, process monitoring, and shop-floor data integration) are being implemented to raise throughput, repeatability and traceability for regulated medical production.

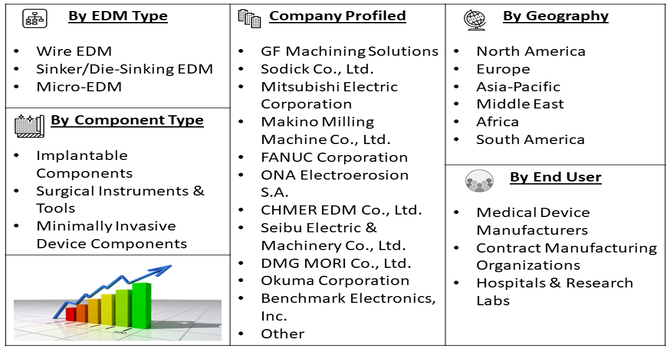

Segmentation: Global Medical Component Electrical Discharge Machining (EDM) Services Market is segmented By EDM Type (Wire EDM, Sinker/Die-Sinking EDM, Micro-EDM), Component Type (Implantable Components, Surgical Instruments & Tools, Minimally Invasive Device Components), Material Type (Titanium & Titanium Alloys, Stainless Steel & Medical-Grade Steel, Cobalt-Chromium (Co-Cr) Alloys), Service Type (Precision Machining Services, Micro-Machining Services, Prototyping & Low-Volume Production), End-User (Medical Device Manufacturers, Contract Manufacturing Organizations, Hospitals & Research Labs), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for High-Precision and Miniaturized Medical Components

The increasing complexity of modern medical devices is one of the strongest forces driving the EDM services market. As healthcare shifts toward minimally invasive surgery, implantable microdevices, and advanced diagnostic tools, manufacturers require components with micron-level accuracy, intricate geometries, and superior surface finishes—capabilities that conventional machining cannot consistently achieve. Medical implants such as orthopedic screws, dental abutments, stents, cardiovascular components, and spinal fixation parts are increasingly designed using ultra-hard biocompatible alloys like titanium, cobalt-chromium, and nitinol, all of which are ideal for EDM machining due to their difficulty in processing using traditional cutting tools. Additionally, the surge in micro-EDM for producing microholes, fine features, and extremely tight tolerances for catheter components and micro-surgical instruments further accelerates demand.

- Expansion of Outsourcing by Medical Device Manufacturers to Specialized EDM Service Providers

Medical device OEMs are increasingly outsourcing machining tasks to specialized EDM service providers to enhance production efficiency, reduce costs, and maintain regulatory compliance. EDM machining requires highly specialized equipment, skilled operators, cleanroom-compatible workflows, and advanced inspection systems, all of which demand substantial capital investment. For instance, in May 2023, GF Machining Solutions launched the Cut F Series of wire EDMs, debuting the Cut F 600 model. Equipped with Uniqua control, the Intelligent Spark Protection System (ISPS), and the iWire function, the machine automatically adjusts wire speed according to erosion height, offering enhanced flexibility, ease of use, and reliable precision for diverse manufacturing applications.

Market Restraints:

- High Capital Investment and Operational Costs Associated with Advanced EDM Technologies

The significant restraints for market growth is the substantial capital expenditure required to acquire and maintain advanced EDM machines—especially micro-EDM, multi-axis wire EDM, and automation-enabled EDM systems. These machines often involve high procurement costs, stringent climate-control requirements, expensive consumables, and the need for precision fixtures, tooling, and dielectric fluids. Additionally, EDM processes are relatively slower than conventional machining, resulting in higher per-part production costs for certain geometries. The need for highly skilled operators, continuous maintenance, and investment in metrology equipment such as CMMs, optical scanners, and surface-finish analyzers further increases operational overhead.

Socioeconomic Impact on Medical Component Electrical Discharge Machining (EDM) Services Market

The Global Medical Component Electrical Discharge Machining (EDM) Services Market is experiencing significant growth driven by the increasing demand for precision-engineered medical components. EDM technology enables the manufacture of complex, high-precision parts used in medical devices such as implants, surgical instruments, and diagnostic equipment. Rising investments in healthcare infrastructure, the expansion of the medical device industry, and stringent quality standards are fueling market growth. Additionally, the ability of EDM to work with hard-to-machine materials like titanium and stainless steel makes it indispensable in producing durable and reliable medical components. Technological advancements, coupled with growing adoption of minimally invasive surgeries, further boost the demand for EDM services. As healthcare continues to advance globally, the market is poised for steady expansion driven by innovation and precision manufacturing needs.

Segmental Analysis:

- Wire EDM segment is expected to witness the highest growth over the forecast period

Wire EDM holds a dominant share in the market due to its ability to produce highly precise and intricate geometries essential for medical implants and surgical tools. Its capability to cut hard biocompatible materials with exceptional dimensional accuracy and minimal thermal distortion makes it indispensable in manufacturing orthopedic screws, dental implants, and precision surgical components. The demand for Wire EDM is growing as OEMs increasingly require complex contours, fine tolerances, and burr-free surfaces for advanced medical devices.

- Implantable Components segment is expected to witness the highest growth over the forecast period

Implantable components represent a major segment due to the rising global demand for orthopedic, cardiovascular, and dental implants. These products require extremely high precision, biocompatible materials, and tight tolerances—attributes ideally suited to EDM processing. As implant designs become more intricate and patient-specific, Wire EDM and Micro-EDM are increasingly used to machine complex shapes, internal channels, and micro-features. Growth in aging populations and surgical volumes further drives this segment.

- Titanium & Titanium Alloys segment is expected to witness the highest growth over the forecast period

Titanium and its alloys are widely used in medical implants and instruments owing to their strength, corrosion resistance, and biocompatibility. However, these materials are difficult to machine using conventional techniques, making EDM an essential manufacturing method. EDM allows precise shaping of titanium components without tool wear or mechanical stress. The increasing usage of titanium in orthopedic implants, spinal devices, and dental fixtures significantly boosts demand for EDM services.

- Precision Machining Services segment is expected to witness the highest growth over the forecast period

Precision machining services dominate the market as medical device manufacturers require highly accurate and repeatable processes to meet stringent regulatory standards. These services support the production of intricate components with micro-level tolerances and high-quality surface finishes. The growth of personalized medicine and minimally invasive surgery has increased the need for precision-engineered parts, making high-accuracy EDM machining a crucial service for OEMs and CMOs.

- Medical Device Manufacturers segment is expected to witness the highest growth over the forecast period

Medical device manufacturers are the largest consumers of EDM services due to their need for complex, high-performance components for implants, surgical instruments, and diagnostic devices. The growing trend toward outsourcing precision machining tasks allows OEMs to reduce production costs, accelerate prototyping timelines, and meet strict regulatory compliance. Continuous innovation in medical device design further strengthens this segment's reliance on EDM services.

- Asia-Pacific segment is expected to witness the highest growth over the forecast period

The Asia-Pacific segment is expected to witness the highest growth in the Global Medical Component Electrical Discharge Machining (EDM) Services Market over the forecast period. Rapid advancements in healthcare infrastructure, increasing investments in medical device manufacturing, and a growing patient population drive demand for precision-engineered medical components in this region.

Countries like China, India, Japan, and South Korea are emerging as key hubs for medical device production, benefiting from cost-effective manufacturing and skilled labor. For instance, in March 2024, AccuteX introduced the AZ-600, a state-of-the-art wire-cutting machine designed for Industry 4.0 trends and energy-efficient operations. Featuring advanced mechanical design and next-generation controllers, the AZ-600 provides superior precision, operational stability, and processing efficiency, aligning with global demands for intelligent, high-performance, and energy-saving manufacturing solutions.

Additionally, government initiatives supporting healthcare innovation and technological adoption further fuel market growth. The rising prevalence of chronic diseases and increasing adoption of minimally invasive surgeries also contribute to higher demand for EDM services, making Asia-Pacific a critical growth region for the medical component EDM market.

To Learn More About This Report - Request a Free Sample Copy

Medical Component Electrical Discharge Machining (EDM) Services Market Competitive Landscape

The competitive landscape for the Global Medical Component Electrical Discharge Machining (EDM) Services market is characterized by a mix of global machine manufacturers, specialized EDM job-shops, and larger contract manufacturers (CMOs) that offer end-to-end medical device production. Competition centers on technological capability (micro-EDM, wire-EDM, automation), regulatory certifications (ISO 13485, FDA-compliant processes), quality and metrology strength, geographic proximity to medical OEM clusters, and the ability to deliver validated, traceable production for low- to mid-volume precision parts. Strategic differentiation often comes from investments in Industry 4.0 connectivity, hybrid manufacturing workflows, high-performance consumables, and deep industry partnerships that shorten qualification cycles and support product customization.

Key Players:

- GF Machining Solutions

- Sodick Co., Ltd.

- Mitsubishi Electric Corporation

- Makino Milling Machine Co., Ltd.

- FANUC Corporation

- ONA Electroerosion S.A.

- CHMER EDM Co., Ltd.

- Seibu Electric & Machinery Co., Ltd.

- DMG MORI Co., Ltd.

- Okuma Corporation

- Jabil Inc.

- Benchmark Electronics, Inc.

- Sanmina Corporation

- Flex Ltd.

- TE Connectivity Ltd.

- Precitech (Ultra Precision Machine Company)

- AgieCharmilles (GF group brand)

- Nakamura-Tome Precision Industry Co., Ltd.

- Hurco Companies, Inc.

- Tornos Holdings S.A.

Recent News

- In January 2025, CHMER unveiled its G43S Wire Cutting Machine at IMTEX 2025. Incorporating 48 patents, the G43S delivers exceptional precision, energy efficiency, and eco-friendly operation. The machine is ideally suited for sectors such as 3C, IT, automotive, medical, aerospace, and mold manufacturing, offering advanced performance and sustainable benefits for high-demand industrial applications.

- In April 2024, Sodick launched its latest wire cut EDM machine featuring I-Groove technology in India. The system retains Sodick’s core wire-cut EDM and Die Sinker EDM technologies, including linear motors, linear scales for improved surface finish, and ceramic components to enhance thermal stability. These features ensure consistent accuracy and reliable performance over extended operational periods.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The core driver is the surge in demand for complex, high-precision medical devices, such as intricate surgical instruments and orthopedic implants. EDM services are essential as they can accurately machine hard, biocompatible materials like titanium without generating mechanical stress or thermal distortion, meeting the stringent tolerance requirements of the healthcare sector.

Q2. What are the main restraining factors for this market?

The primary restraint is the significant cost associated with acquiring, installing, and maintaining advanced EDM machinery. Furthermore, the specialized nature of EDM requires a highly skilled technical workforce, which presents a challenge due to the ongoing skill gap in precision manufacturing and the need for complex operational knowledge.

Q3. Which segment is expected to witness high growth?

The fastest-growing segment is the application of EDM in the manufacturing of miniaturized and complex medical implants and instruments. Specifically, Wire EDM technology is seeing high growth due to its ability to cut intricate contours and micro-features in hard materials, critical for advanced devices and minimally invasive surgical tools.

Q4. Who are the top major players for this market?

The leading players are major manufacturers of high-precision EDM equipment who supply the medical sector, including GF Machining Solutions, Mitsubishi Electric Corporation, Sodick Co., Ltd., and Makino. These companies focus on technological integration, offering high-accuracy systems and automation features essential for meeting the strict quality standards of medical components.

Q5. Which country is the largest player?

The Asia Pacific region, particularly China and Japan, dominates the overall EDM market due to robust industrialization and high-volume manufacturing capabilities. However, North America, led by the U.S., remains a key market leader in advanced EDM services and high-value applications, driven by its large and innovative aerospace and medical device industries.

List of Figures

Figure 1: Global Medical Component Electrical Discharge Machining (EDM) Services Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Medical Component Electrical Discharge Machining (EDM) Services Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Medical Component Electrical Discharge Machining (EDM) Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model