Online Pharmacy Tests Drone Delivery Market Overview and Analysis

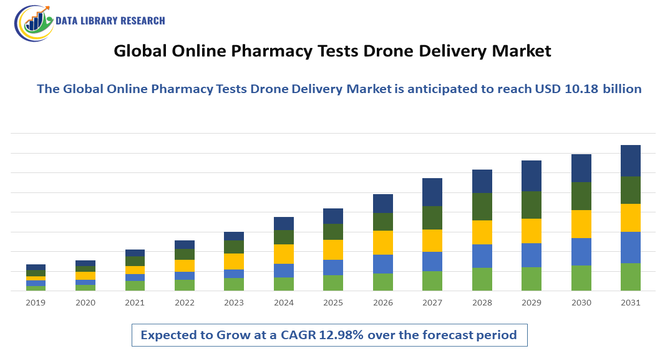

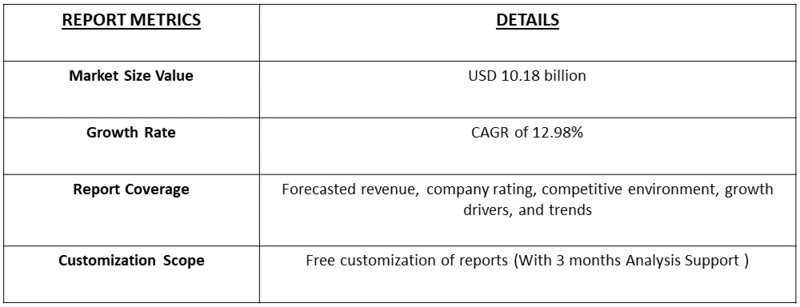

- The Global Online Pharmacy Tests Drone Delivery Market was valued at approximately USD 1.95 billion, and it is projected to reach USD 10.18 billion by 2032, growing with a CAGR of 12.98% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Online Pharmacy Tests Drone Delivery Market involves using drones to deliver pharmaceutical products, medical tests, and healthcare supplies ordered online.

The growth of the global online pharmacy drone delivery market is driven by increasing demand for fast, contactless, and reliable delivery of medicines and diagnostic tests, especially in remote or underserved areas. Rising e-pharmacy adoption, advancements in drone technology, supportive regulations, and growing healthcare digitization further accelerate market expansion, enabling cost-effective and timely healthcare distribution.

Online Pharmacy Tests Drone Delivery Market Latest Trends

The online pharmacy drone delivery market is growing rapidly as people and healthcare providers seek faster, safer, and contactless ways to get medicines and medical tests. Drones can quickly reach remote or hard-to-access areas where traditional delivery takes hours or days. Improvements in drone technology — like longer battery life, better navigation, and temperature-controlled storage make deliveries more reliable. At the same time, the rise of e-pharmacies, telemedicine, and home healthcare is encouraging pharmacies and hospitals to adopt drones as part of their supply chain, pushing global adoption forward.

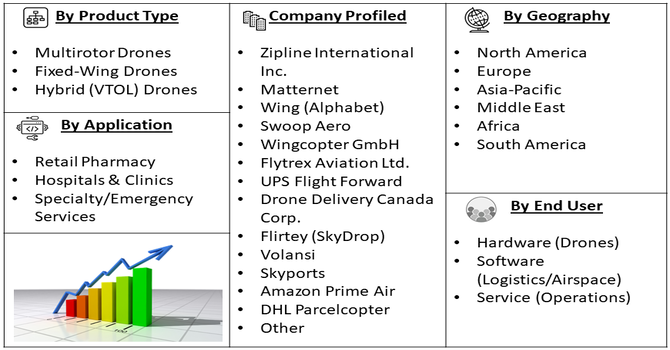

Segmentation: The Global Online Pharmacy Tests Drone Delivery Market is Segmented by Drone Type (Multirotor Drones, Fixed-Wing Drones, and Hybrid (VTOL) Drones), Application (Retail Pharmacy, Hospitals & Clinics, and Specialty/Emergency Services), Operational Range (Short Range and Long Range), Component (Hardware (Drones), Software (Logistics/Airspace) and Service (Operations)), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Fast and Contactless Healthcare Delivery

The global online pharmacy drone delivery market is being driven by growing demand for fast, reliable, and contactless delivery of medicines, vaccines, and diagnostic kits. Consumers and healthcare providers increasingly seek timely access to essential medications, especially in emergencies or remote areas where traditional delivery can take hours or days. Drone delivery significantly reduces delivery time, minimizes human contact, and ensures medicines reach patients safely. The rise of e-pharmacies, telemedicine services, and home-based healthcare solutions further fuels adoption. These factors collectively accelerate investment and innovation in drone-based pharmacy delivery systems worldwide.

- Technological Advancements in Drones and Airspace Management

Advancements in drone technology, including longer battery life, higher payload capacity, autonomous navigation, obstacle avoidance, and temperature-controlled storage, are driving the growth of the online pharmacy drone delivery market. Coupled with software solutions for logistics, airspace coordination, and UAS Traffic Management (UTM), drones can safely deliver medicines across urban and rural areas. These technological improvements reduce operational risks, improve reliability, and enable scalable delivery networks. As healthcare providers adopt more sophisticated drone systems, the efficiency and speed of pharmaceutical logistics improve, fostering market expansion and creating opportunities for new entrants and innovative service models globally.

Market Restraints:

- Regulatory and Safety Challenges

Regulatory hurdles and safety concerns pose significant restraints on the growth of the online pharmacy drone delivery market. Stringent aviation rules, airspace restrictions, and differing regulations across countries slow the deployment of large-scale drone networks. Safety issues, including potential mid-air collisions, payload security, and risks to civilians, require robust risk management and compliance, increasing operational costs. Additionally, drones carrying temperature-sensitive medicines must maintain precise conditions, adding complexity to logistics. These regulatory and safety challenges limit the speed of adoption, especially in densely populated or highly regulated regions, restraining overall market growth despite rising demand and technological advancements.

Socioeconomic Impact on Online Pharmacy Tests Drone Delivery Market

The Global Online Pharmacy Tests Drone Delivery Market for medicines and medical tests are making healthcare more accessible, especially in remote or underserved areas. They reduce delivery times from hours to sometimes under 30 minutes, ensuring critical treatments, vaccines, or lab samples reach patients and hospitals quickly. This can save lives, improve public health, and reduce the strain on traditional delivery systems. Economically, drones lower logistics costs, create jobs in operations and maintenance, and make healthcare supply chains more efficient and reliable. Overall, drone delivery is helping bridge healthcare gaps while supporting safer, faster, and more equitable medical access.

Segmental Analysis:

- Fixed-Wing Drones segment is expected to witness highest growth over the forecast period

The fixed-wing drones segment is expected to witness the highest growth over the forecast period due to their longer flight range, higher payload capacity, and superior energy efficiency compared to rotary drones. These drones are ideal for delivering medicines, vaccines, and diagnostic kits to remote or rural areas where infrastructure is limited. Healthcare providers and e-pharmacies are increasingly adopting fixed-wing drones for large-scale, long-distance operations, ensuring faster and more reliable delivery. Technological advancements, improved battery life, and autonomous navigation systems further enhance operational efficiency, making fixed-wing drones a preferred solution for scaling global online pharmacy and medical drone delivery services.

- Retail Pharmacy segment is expected to witness highest growth over the forecast period

The retail pharmacy segment is projected to grow significantly as e-pharmacies and brick-and-mortar pharmacies increasingly integrate drone delivery to improve customer convenience. Rising consumer demand for home delivery of prescription medicines, over-the-counter drugs, and diagnostic kits has encouraged pharmacies to adopt drone logistics. Retailers benefit from reduced delivery times, lower labor costs, and improved operational efficiency. Additionally, regulatory support for drone-based medical deliveries and growing awareness of contactless healthcare services accelerate adoption. As pharmacies expand their digital and delivery capabilities, the integration of drones is expected to become a standard solution, driving strong growth in the retail pharmacy segment.

- Software (Logistics/Airspace) segment is expected to witness highest growth over the forecast period

The software segment, including logistics management and airspace coordination systems, is expected to witness rapid growth due to the increasing complexity of drone delivery operations. Efficient software ensures safe route planning, real-time tracking, air traffic management, and regulatory compliance. As drone networks scale to cover multiple pharmacies, hospitals, and remote regions, advanced software becomes critical to prevent collisions, optimize delivery efficiency, and maintain temperature-sensitive payloads. Investments in AI-driven logistics platforms, autonomous flight management, and decentralized UAS Traffic Management (UTM) systems are accelerating market adoption. Consequently, software solutions are becoming central to the growth and sustainability of the global medical drone delivery market.

- North America Region segment is expected to witness highest growth over the forecast period

North America is expected to witness the highest growth in the online pharmacy drone delivery market, driven by advanced healthcare infrastructure, widespread e-pharmacy adoption, and supportive regulatory frameworks. The U.S. and Canada have significant investments in drone technology, including pilot programs for medicine and vaccine deliveries.

Rising consumer demand for faster, contactless healthcare solutions, coupled with technological innovation in autonomous flight, battery life, and cold-chain payload management, is fueling market expansion. Additionally, the region’s strong logistics networks, healthcare digitization, and growing collaborations between drone operators and pharmacies position North America as the leading hub for scaling drone-based pharmaceutical delivery services over the forecast period.

To Learn More About This Report - Request a Free Sample Copy

Online Pharmacy Tests Drone Delivery Market Competitive Landscape

The market features a mix of specialized drone companies, logistics providers, and e-pharmacy platforms. Leaders like Zipline already run global networks delivering medicines and vaccines, while companies like UPS Flight Forward and innovative startups compete by developing faster, safer, and more reliable drones. Companies stand out through delivery speed, secure packaging, regulatory compliance, and integration with pharmacies and hospitals. As more players enter and technology improves, competition is intensifying, driving innovation, lowering costs, and expanding access to drone delivery services worldwide. This makes the market dynamic and rapidly evolving.

The major players for this market are:

- Zipline International Inc.

- Matternet

- Wing (Alphabet)

- Swoop Aero

- Wingcopter GmbH

- Flytrex Aviation Ltd.

- UPS Flight Forward

- Drone Delivery Canada Corp.

- Flirtey (SkyDrop)

- Volansi

- Skyports

- Amazon Prime Air

- DHL Parcelcopter

- DroneUp

- Manna Drone Delivery

- EHang

- Antwork (PuduTech)

- JD Logistics (JD.com)

- Airspace Link

- Dronamics

Recent Development

- In October 2023, Amazon’s Prime Air drone service, limited to two locations after a decade of development, began delivering medicines purchased through Amazon Pharmacy, marking the first operational deployment of its drone-based prescription delivery program.

- In November 2021, Several Japanese technology firms, including BIRD INITIATIVE, ANAHD, AIN HD, and NEC, partnered with Hokkaido’s METI to pilot drone deliveries of pharmaceutical supplies in Wakkanai City. The tests evaluated remote-area delivery and safe airport operations using decentralized UAS Traffic Management, fully complying with Japanese drone regulations and guidelines.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The biggest drivers are the urgent need for rapid, contactless delivery of medical supplies, especially in remote areas or during emergencies. Technological advancements in drone navigation and battery life, coupled with increased consumer reliance on online healthcare and retail pharmacy services, accelerate market adoption significantly.

Q2. What are the main restraining factors for this market

?

Strict government regulations and airspace restrictions are the primary constraints, limiting where and how drones can fly, particularly in crowded urban areas. Public safety concerns regarding drone accidents and potential privacy issues related to camera usage also pose significant hurdles to widespread commercial deployment.

Q3. Which segment is expected to witness high growth?

The software segment, covering logistics and airspace management, is expected to grow rapidly due to increasing drone delivery operations. Advanced route planning, real-time tracking, and UAS Traffic Management ensure safe, efficient, and scalable delivery of medicines and healthcare supplies globally.

Q4. Who are the top major players for this market?

The market leaders are typically specialized drone logistics companies and major tech giants. Top players include Zipline, which pioneered medical drone delivery in Africa, as well as Wing (backed by Alphabet) and Matternet, who focus on integrating drone services into established healthcare and retail systems.

Q5. Which country is the largest player?

The United States is the largest market player, driven by high technology investments, extensive e-commerce infrastructure, and large-scale testing programs led by major retailers and specialized drone companies. North America overall leads in market spending and the development of new drone technologies.

List of Figures

Figure 1: Global Online Pharmacy Tests Drone Delivery Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Online Pharmacy Tests Drone Delivery Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Online Pharmacy Tests Drone Delivery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model