Personalized Holiday Stockings Market Overview and Analysis:

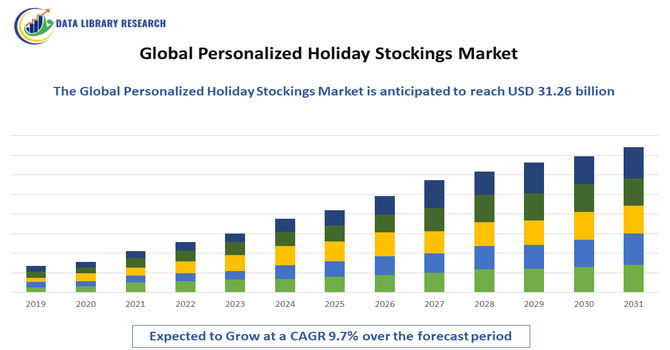

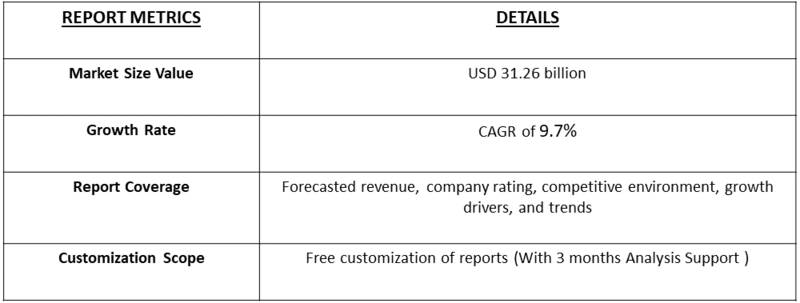

- The global personalized holiday stockings market is currently valued at USD 5.6 billion and expected to reach USD 31.26 billion in 2032, the market is projected to grow at a CAGR of 7.5% to 9.7% during the forecast period of 2025–2033.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Personalized Holiday Stockings Market is experiencing significant growth, driven by rising consumer demand for customized and meaningful holiday décor that adds a personal touch to festive celebrations. Increasing disposable incomes and the expanding middle-class population in key regions are encouraging consumers to invest in unique, high-quality holiday products that reflect individual tastes and family traditions.

Personalized Holiday Stockings Market Latest Trends:

The Global Personalized Holiday Stockings Market is witnessing several notable trends that are redefining how consumers celebrate the festive season. A key trend is the rise of customization and personalization, with shoppers increasingly opting for stockings featuring embroidered names, unique motifs, and bespoke color palettes that reflect personal style or family themes. Eco-friendly and sustainable materials—such as organic cotton, recycled fabrics, and biodegradable decorations—are gaining popularity as consumers become more environmentally conscious. Digital innovation is also reshaping the market, with online design tools and augmented reality previews enabling customers to visualize and customize stockings before purchase.

Segmentation: Global Personalized Holiday Stockings Market is segmented By Product Type (Embroidered Name Stockings, Printed & Customized Design Stockings, Handcrafted & Luxury Personalized Stockings), Material Type (Fabric Stockings, Sustainable & Eco-Friendly Materials, Mixed Material Stockings), Personalization Type (Name & Initial Personalization, Family & Themed Customization, Photo & Graphic Personalization), Price Range (Mass-Market Personalized Stockings, Premium & Luxury Personalized Stockings), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Consumer Preference for Personalized and Meaningful Festive Products

A key driver of the Global Personalized Holiday Stockings Market is the increasing consumer preference for personalized holiday décor that adds emotional value and uniqueness to festive celebrations. Personalized stockings featuring names, initials, family titles, or custom themes allow consumers to express individuality and strengthen family traditions, making them more appealing than mass-produced alternatives. This trend is particularly strong among younger consumers and families who prioritize experiential and emotionally resonant purchases. The cultural shift toward customized gifting, supported by social media inspiration and holiday storytelling, is encouraging higher spending on personalized stockings, thereby driving sustained market growth during peak festive seasons.

- Expansion of E-commerce and Direct-to-Consumer Sales Channels

The rapid growth of e-commerce and direct-to-consumer platforms is significantly driving the Global Personalized Holiday Stockings Market. Online platforms enable consumers to easily design, preview, and order customized stockings with flexible personalization options and fast delivery. Digital printing and embroidery technologies have reduced production lead times and costs, allowing brands and small artisans to efficiently scale personalized offerings. Additionally, global online marketplaces provide access to a wide variety of styles, materials, and price points, increasing product visibility and consumer reach. Seasonal online promotions and targeted digital marketing further stimulate demand, strengthening overall market expansion.

Market Restraints:

- Seasonal Demand Concentration and Limited Year-Round Sales

The primary restraints in the Global Personalized Holiday Stockings Market is the highly seasonal nature of demand. Sales are heavily concentrated around the year-end holiday season, particularly during a short window leading up to Christmas. This creates challenges for manufacturers and retailers in maintaining steady revenue streams throughout the year. Inventory planning, workforce management, and production scheduling become complex, especially for personalized products that require shorter turnaround times. Outside the festive season, consumer demand drops significantly, limiting opportunities for continuous sales growth and making it difficult for businesses to optimize capacity utilization and profitability.

Socioeconomic Impact on Personalized Holiday Stockings Market

The Global Personalized Holiday Stockings Market generated notable socioeconomic impacts by supporting small businesses, artisans, and digital print entrepreneurs, particularly in seasonal and home-based economies. Customization trends encouraged local craftsmanship, on-demand manufacturing, and e-commerce participation, creating flexible employment opportunities. Rising consumer interest in personalized gifting strengthened emotional value over mass production, benefiting niche sellers and family-run enterprises. However, demand remained concentrated in higher-income households, reflecting disposable income disparities. The market also promoted sustainable production through made-to-order models, reducing waste. Overall, its growth fostered micro-entrepreneurship, digital inclusion, and creative expression while reinforcing the role of personalization in modern celebratory consumption patterns worldwide.

Segmental Analysis:

- Embroidered Name Stockings segment is expected to witness the highest growth over the forecast period

Embroidered Name Stockings represent a prominent segment in the Global Personalized Holiday Stockings Market, driven by their classic appeal and long-lasting aesthetic value. Consumers widely prefer embroidered personalization due to its premium finish, durability, and traditional association with holiday décor. These stockings are often reused across multiple festive seasons, enhancing perceived value and justifying higher spending. The segment benefits from advancements in embroidery technology that allow faster turnaround times and precise customization at scale. Rising demand from families seeking cohesive, name-based holiday décor and increasing gifting preferences further support segment growth. As personalization remains central to holiday celebrations, embroidered name stockings continue to command a strong share in overall market revenue.

- Fabric Stockings segment is expected to witness the highest growth over the forecast period

Fabric Stockings dominate the material type segment owing to their versatility, affordability, and wide availability in various textures and finishes such as cotton, felt, velvet, and wool. These materials offer comfort, flexibility, and ease of customization, making them ideal for embroidery and printed designs. Fabric stockings appeal to a broad consumer base, ranging from mass-market buyers to premium customers seeking soft, high-quality finishes. Additionally, fabric materials allow manufacturers to introduce diverse color palettes and seasonal themes, enhancing consumer choice. The durability and reusable nature of fabric stockings further increase their popularity, contributing significantly to the overall value generation of the personalized holiday stockings market.

- Name & Initial Personalization segment is expected to witness the highest growth over the forecast period

Name and Initial Personalization is the most widely adopted personalization type, as it offers simplicity, emotional connection, and broad appeal. Consumers favor this option for family-oriented holiday traditions, as personalized names enhance a sense of belonging and festive identity. This personalization type is also cost-effective compared to complex graphic or photo-based designs, making it accessible across multiple price segments. Its compatibility with various materials and product types further strengthens its market presence. Additionally, name-based customization is highly popular for gifting purposes, as it adds a thoughtful and personal touch. These factors collectively drive strong demand and revenue contribution within this segment.

- Premium & Luxury Personalized Stockings segment is expected to witness the highest growth over the forecast period

Premium and Luxury Personalized Stockings are witnessing steady growth, driven by increasing consumer willingness to spend on high-quality, aesthetically refined holiday décor. This segment includes stockings made from superior materials, intricate embroidery, handcrafted detailing, and designer-inspired themes. Affluent consumers and luxury-focused households value exclusivity, craftsmanship, and long-term usability, which supports higher price points. Social media influence and aspirational décor trends further elevate demand for luxury personalized stockings. Additionally, corporate buyers seeking upscale festive gifts contribute to segment expansion. As holiday décor increasingly reflects lifestyle branding and personal expression, the premium and luxury segment continues to enhance overall market value.

- North America segment is expected to witness the highest growth over the forecast period

North America holds a leading position in the Global Personalized Holiday Stockings Market, supported by strong holiday traditions, high consumer spending on seasonal décor, and widespread adoption of personalized products. The region benefits from a mature e-commerce ecosystem, enabling easy access to customization tools and fast delivery services. Consumers in the U.S. and Canada show a strong preference for name-based and themed personalized stockings, particularly for family and gifting purposes. Additionally, the presence of established décor brands and small artisan sellers strengthens product variety and availability. High disposable incomes and a culture of festive home decoration continue to drive significant market value in North America.

To Learn More About This Report - Request a Free Sample Copy

Personalized Holiday Stockings Market Competitive Landscape

The competitive landscape of the Global Personalized Holiday Stockings Market is characterized by a diverse mix of established seasonal décor brands, niche artisans, and digitally native e-commerce businesses offering customization across styles, materials, and personalization options. Market players compete on product quality, design versatility, turnaround time for custom orders, and seamless online ordering experiences. Many companies leverage direct-to-consumer channels, social media marketing, and partnerships with lifestyle platforms to expand reach and engage holiday shoppers early in the season. Innovation in materials—such as sustainable fabrics—and personalization technologies further differentiates offerings. Seasonal promotions and limited-edition collections help brands capture consumer interest during peak buying periods. As demand for unique holiday décor grows worldwide, companies that combine creative design, efficient customization, and strong digital presence are positioned to thrive in this competitive market.

Key Players:

- Hallmark

- Pottery Barn

- West Elm

- Anthropologie

- Etsy Sellers (Various)

- Personalization Mall

- Shutterfly

- Target

- Walmart

- Christmas Central

- Frontgate

- Pottery Barn Kids

- Jane

- Minted

- Zazzle

- Lands’ End

- Bearington Collection

- Kurt Adler

- Bronner’s CHRISTmas Wonderland

- Red Envelope

Recent Development

- In December 2025, Insights shared by shopping expert Claudia Lombana positively influenced the Global Personalized Holiday Stockings Market by encouraging confident last-minute purchasing. Her guidance highlighted opportunities for savings and quality finds, driving demand even late in the season. This reassured consumers about personalization timelines, boosted impulse and digital orders, and helped sellers extend sales momentum during peak holiday shopping periods worldwide.

- In December 2025, McCoy Outdoor Co.’s introduction of outdoor-themed stocking stuffers influenced the Global Personalized Holiday Stockings Market by reinforcing the shift toward practical, interest-based gifting. By aligning holiday offerings with regional outdoor lifestyles, the initiative expanded personalization beyond traditional décor items. It encouraged niche customization, supported experiential gifting trends, and demonstrated how lifestyle-focused products could reshape consumer expectations within seasonal and personalized holiday markets.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing because consumers increasingly value "experience-based" holidays and unique home decor that reflects their family identity. The rise of social media platforms like Instagram and Pinterest encourages people to create "picture-perfect" holiday mantels. Additionally, advancements in digital embroidery and heat-transfer technology make custom naming faster and more affordable.

Q2. What are the main restraining factors for this market?

Growth is limited by the highly seasonal nature of the business, as most sales occur within a single two-month window. This creates significant inventory and labor challenges for manufacturers. Rising shipping costs for bulky items and competition from cheap, mass-produced generic stockings in big-box retail stores also put pressure on profit margins.

Q3. Which segment is expected to witness high growth?

The Eco-Friendly and Sustainable Materials segment is expected to see the highest growth. Modern parents are moving away from cheap felt and plastic-based fabrics toward high-quality linen, organic cotton, and recycled wool. These "heirloom" stockings are designed to last for decades, appealing to environmentally conscious shoppers who want timeless holiday decor.

Q4. Who are the top major players for this market?

The market is led by major home decor brands and large-scale personalization platforms. Key players include Pottery Barn (Williams-Sonoma), Personalization Mall (1-800-Flowers), Lands' End, Etsy (via top independent creators), and L.L.Bean. These companies dominate by offering a wide variety of fonts, styles, and character themes that appeal to all ages.

Q5. Which country is the largest player?

The United States is the largest player in the personalized holiday stockings market. This is due to the deeply rooted American tradition of hanging stockings on Christmas Eve and a high level of consumer spending on seasonal decorations. The presence of major e-commerce platforms specializing in custom gifts further solidifies its lead.

List of Figures

Figure 1: Global Personalized Holiday Stockings Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Personalized Holiday Stockings Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Personalized Holiday Stockings Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Personalized Holiday Stockings Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Personalized Holiday Stockings Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Personalized Holiday Stockings Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Personalized Holiday Stockings Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Personalized Holiday Stockings Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Personalized Holiday Stockings Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Personalized Holiday Stockings Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Personalized Holiday Stockings Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Personalized Holiday Stockings Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Personalized Holiday Stockings Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Personalized Holiday Stockings Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Personalized Holiday Stockings Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Personalized Holiday Stockings Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Personalized Holiday Stockings Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Personalized Holiday Stockings Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Personalized Holiday Stockings Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Personalized Holiday Stockings Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Personalized Holiday Stockings Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Personalized Holiday Stockings Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Personalized Holiday Stockings Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Personalized Holiday Stockings Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Personalized Holiday Stockings Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Personalized Holiday Stockings Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Personalized Holiday Stockings Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model