Quad Camera for Self-driving Cars Market Overview and Analysis

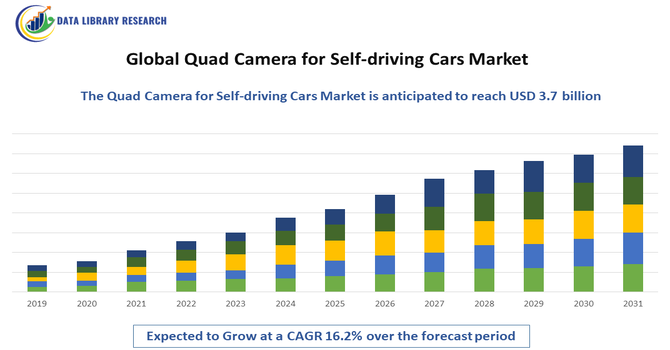

- The Global Quad Camera for Self-driving Cars Market indicates a robust and rapidly expanding sector, with a current value of USD 3.7 billion in the year 2025.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Quad Camera for Self-driving Cars Market refers to the sector dedicated to developing and deploying vehicle vision systems consisting of four integrated cameras that provide comprehensive, 360° situational awareness for autonomous or semi autonomous vehicles. These systems enhance object detection, depth perception, and lane keeping in complex driving environments, thereby supporting advanced driver assistance systems (ADAS) and higher levels of vehicle autonomy.

The growth of the global quad camera for self-driving cars market is primarily driven by increasing demand for advanced driver assistance systems (ADAS) and higher levels of vehicle autonomy, which rely on precise, 360° environmental perception. Rising safety concerns and the need to reduce road accidents encourage automakers to integrate multi-camera vision systems for enhanced object detection, lane-keeping, and pedestrian recognition.

Quad Camera for Self-driving Cars Market Latest Trends

The global quad camera for self driving cars market is evolving rapidly, with rising integration of multi-camera systems to provide full 360° situational awareness in autonomous vehicles. Advances such as higher resolution sensors, multi spectral imaging (including infrared or thermal), and artificial intelligence (AI) for real time image processing are key trends. Cost reduction and miniaturization of camera modules are enabling deployment beyond luxury vehicles into mass market models, while regulatory pressure and integration with vehicle to everything (V2X) systems are also accelerating adoption.

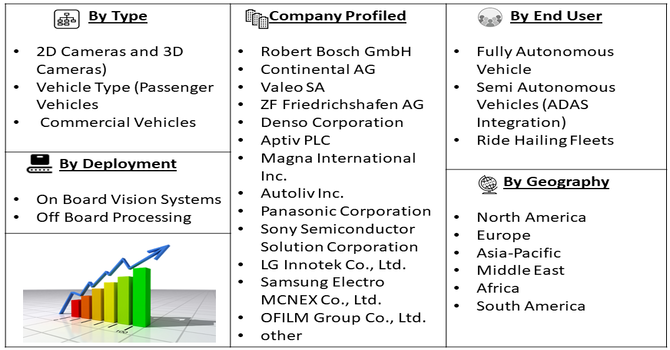

Segmentation: The segmentation of the Global Quad Camera for Self driving Cars Market can be outlined by Type (2D Cameras and 3D Cameras), Vehicle Type (Passenger Vehicles and Commercial Vehicles), Deployment/Technology (On Board Vision Systems and Off Board Processing), End User/Application (Fully Autonomous Vehicles, Semi Autonomous Vehicles (ADAS Integration), and Ride Hailing Fleets), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Adoption of Autonomous Vehicles and Advanced Driver Assistance Systems

The increasing adoption of autonomous and semi-autonomous vehicles is a primary driver for the global quad camera market. Quad camera systems provide 360° vision, enabling advanced driver assistance systems (ADAS) such as lane departure warning, collision avoidance, adaptive cruise control, and pedestrian detection. As automotive manufacturers strive to meet rising safety expectations and regulatory standards, integrating high-resolution quad cameras has become essential for real-time environmental perception and decision-making. The shift toward Level 3 and Level 4 autonomous driving necessitates comprehensive sensing solutions, further fueling demand.

- Technological Advancements in Camera Systems and AI Integration

Technological innovations in camera sensors, imaging software, and artificial intelligence (AI) are significantly propelling the global quad camera market. High-resolution CMOS sensors, wider dynamic range, and improved low-light performance enhance object recognition, depth perception, and situational awareness for self-driving vehicles.

In February 2025, Netradyne, an industry-leading SaaS provider of AI, edge computing, and full-service video telematics for commercial fleet safety and driver coaching, partnered with cash-in-transit (CIT) leader Loomis to enhance the safety of its armored trucks. Loomis implemented 3,000 units of Netradyne’s Driver i D-430 video safety devices, equipped with quad cameras, across its U.S., Canada, and Puerto Rico fleets. The D-430 provided high-definition, real-time visibility to monitor driver behavior, mitigate risk, and improve safety. This partnership highlighted the growing adoption of multi-camera systems in fleet operations, indirectly supporting innovation and expansion in the global quad-camera/self-driving car market. AI and machine learning algorithms enable real-time image processing, predictive analysis, and decision-making, increasing vehicle safety and navigation efficiency. The miniaturization of camera modules and integration with vehicle-to-everything (V2X) communication systems further improve system reliability and scalability.

Market Restraint:

- High Cost and Integration Challenges

Despite the growing demand, high costs and integration challenges pose a significant restraint to the global quad camera market. Advanced quad camera systems involve expensive high-resolution sensors, sophisticated computing units, and AI-based software, which increase the overall cost of autonomous vehicle production. Additionally, integrating multiple cameras with other vehicle sensors, such as LiDAR, radar, and ultrasonic sensors, requires complex calibration, testing, and system optimization. Smaller automotive manufacturers and emerging markets may find these costs prohibitive, limiting widespread adoption.

Socio Economic Impact on Quad Camera for Self-driving Cars Market

The expansion of the global quad camera systems market for self driving cars is poised to generate notable socioeconomic impacts: enhanced vehicle safety and reduced traffic related injuries will lower healthcare and insurance costs, while greater mobility access offered by advanced autonomous systems can benefit the elderly and disabled. Improved commuting efficiency may free up time for work or leisure, boosting productivity. However, job displacement in driving dependent sectors, unequal access to autonomous vehicle technologies, and infrastructure demands could exacerbate social and economic inequalities if not managed with inclusive policies.

Segmental Analysis:

- 3D Cameras Segment is Expected to Witness Significant Growth Over the Forecast Period

The 3D cameras segment within the global quad camera for self driving cars market is poised for strong expansion because 3D systems deliver enhanced depth perception and spatial awareness crucial for advanced driver assistance and autonomous navigation. Rising demand for automated parking, 360° surround view and obstacle detection functionalities is pushing the adoption of 3D camera modules. According to research, the 3D view type is anticipated to grow at a significant CAGR from 2024 to 2030 across automotive multi camera systems.

- Commercial Vehicles Segment is Expected to Witness Significant Growth Over the Forecast Period

The commercial vehicles segment is expected to see elevated growth in the quad camera systems market as logistics, trucking and bus fleets increasingly adopt advanced camera suites for enhanced safety and driver visibility. Multi camera systems help reduce blind spots, improve manoeuvrability and meet stricter regulatory mandates for commercial fleets. Forecasts for the commercial vehicle multi camera market show a projected CAGR in the range of ~9–11% through the forecast period.

- On Board Vision Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

The on board vision systems segment—comprising factory integrated camera arrays in vehicles—is forecast to expand rapidly as OEMs replace stand alone sensors with integrated quad camera vision architectures. These systems provide continuous real time data for ADAS and autonomy, replace traditional mirrors, and integrate with in vehicle processing units. With more manufacturers embedding full surround vision modules in their platforms, the on board vision systems segment is becoming a cornerstone of the multi camera solution adoption trend.

- Semi Autonomous Vehicles (ADAS Integration) Segment is Expected to Witness Significant Growth Over the Forecast Period

The semi autonomous vehicles segment—covering ADAS enabled vehicles leveraging quad camera vision systems—will continue to drive demand. As vehicles equipped with Level 2 and Level 3 autonomy functions proliferate, the need for robust four camera vision architectures to support lane keeping, collision avoidance, and surround view becomes critical. Studies indicate that the 3D multi camera systems and surrounding view solutions are being adopted increasingly in ADAS applications, signalling strong growth for this integration segment.

- Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia Pacific region is forecast to experience significant growth in the quad camera for self driving cars market, driven by rapid automotive production, strong ADAS penetration and rising demand for advanced safety systems in emerging markets like China and India.

For instance, Quest Global, a Bengaluru-based engineering firm, unveiled its QUAD prototype, an advanced driver assistance system (ADAS) designed for the complexities of Indian roads. Demonstrated on August 22, 2025, the system combined 11 cameras with 4D radar to detect lanes and boundaries more accurately than existing technologies. This innovation marked a step toward functional self-driving cars in India, boosting the Asia-Pacific quad-camera market by showcasing high-demand, region-specific ADAS solutions, and driving local adoption, technological advancement, and investment in India’s autonomous vehicle ecosystem.

Similarly, Honda Motor Co., Ltd. began leasing the Honda Legend EX equipped with Honda SENSING Elite in Japan on March 5, 2021. Building on its global safety initiative, “Safety for Everyone,” Honda advanced its research in driver-assistive technologies. The Legend featured SENSING Elite, including the Traffic Jam Pilot function, which enabled Level 3 conditional automated driving in congested traffic. This launch highlighted the adoption of advanced multi-camera and sensor systems in Asia-Pacific vehicles, boosting the region’s quad-camera market and accelerating investment in autonomous driving technologies.

To Learn More About This Report - Request a Free Sample Copy

Quad Camera for Self-driving Cars Market Competitive Analysis

The competitive landscape of the global quad camera for self-driving cars market is highly dynamic and features a mix of established automotive suppliers and emerging technology entrants. Companies like Robert Bosch GmbH, Continental AG and Magna International Inc. dominate with deep OEM relationships and broad sensor portfolios, while agile firms specialise in 3D imaging, software-defined vision systems and AI analytics. Firms are competing via strategic partnerships, mergers, geographic expansion and rapid innovation in camera modules, compute platforms and perception algorithms. As camera solutions become central to ADAS and autonomous vehicle stacks, differentiation through cost efficiency, reliability and software integration is crucial for market leadership.

The 20 major players for above market are:

- Robert Bosch GmbH

- Continental AG

- Valeo SA

- ZF Friedrichshafen AG

- Denso Corporation

- Aptiv PLC

- Magna International Inc.

- Autoliv Inc.

- Panasonic Corporation

- Sony Semiconductor Solution Corporation

- LG Innotek Co., Ltd.

- Samsung Electro Mechanics Co., Ltd.

- Sunny Optical Technology (Group) Co., Ltd.

- MCNEX Co., Ltd.

- OFILM Group Co., Ltd.

- Foresight Autonomous Holdings Ltd.

- Gentex Corporation

- OmniVision Technologies, Inc.

- Veoneer Inc.

- Partron Co., Ltd.

Recent Development

- In October 2025, Redtiger unveiled the F17 Plus, a four-channel dash cam providing full interior and exterior coverage with front and rear cabin cameras plus standard forward and rear-facing exterior cameras. Targeted at rideshare drivers, safety-conscious families, and large SUV owners, it showcased the rising demand for multi-camera systems, indirectly boosting innovation and adoption in the global quad-camera market, including self-driving and advanced driver-assistance vehicle applications.

- In October 2025, Netradyne, launched unveiled the Driver I D-810. Designed to maximize safety and efficiency in fleet operations, the D-810 became the first platform to combine 360° AI capabilities with edge intelligence across up to eight cameras. Expanding Netradyne’s leadership in fleet safety, the D-810 provided fleets with enhanced visibility into driver behavior and vehicle activity, enabling smarter decision-making, proactive risk management, and highlighting the growing demand for multi-camera systems, indirectly driving innovation in the global quad-camera/self-driving car market.

Frequently Asked Questions (FAQ) :

Q1. What the main growth driving factors for this market?

The main growth factor is the global push toward higher levels of driving autonomy (Level 3 and above), where a 360-degree view of the environment is non-negotiable for safety. Quad camera systems provide essential data for Advanced Driver Assistance Systems (ADAS) like lane-keeping and collision avoidance. Furthermore, strict government safety regulations, particularly in North America and Europe, mandating advanced safety features, along with the increasing integration of AI and computer vision for real-time object recognition, are fueling this market's rapid expansion.

Q2. What are the main restraining factors for this market?

A significant restraining factor is the technical challenge of ensuring robust performance in all real-world conditions. Cameras struggle with poor visibility due to heavy rain, snow, fog, or extreme low-light scenarios, which necessitates the costly addition of complementary sensors like LiDAR and radar. Moreover, the massive amount of high-resolution video data generated by four cameras requires extremely powerful and expensive processors and complex AI algorithms, which increases the overall system cost and complexity for vehicle manufacturers.

Q3. Which segment is expected to witness high growth?

The segment expected to witness the highest growth is the one associated with Level 3 (Conditional Automation) and Level 4 (High Automation) vehicles. Achieving these levels of autonomy requires the multi-camera redundancy and comprehensive, real-time environmental mapping that quad camera systems provide. As major automakers continue to launch and refine semi-autonomous and fully driverless features in premium and mainstream vehicle models, the demand for these multi-camera architectures will accelerate rapidly.

Q4. Who are the top major players for this market?

The market is led by major Tier 1 automotive suppliers and specialized technology companies. Top players include Mobileye (an Intel subsidiary), known for its leading computer vision and ADAS chip solutions that rely heavily on multi-camera input, Continental AG, and Robert Bosch GmbH, who supply integrated sensor and control units to major OEMs. Companies like NVIDIA also play a crucial role by providing the high-performance computing platforms necessary to process the quad camera data in real-time.

Q5. Which country is the largest player?

China is emerging as the largest and most dynamic country player, particularly in terms of sheer market scale and rapid technological deployment. This is driven by strong central government support and massive investment in autonomous vehicle technology, a thriving ecosystem of robotaxi services (like Baidu's Apollo Go), and high vehicle production rates. While North America (led by the U.S.) remains a leader in innovation and revenue for high-end systems, China's aggressive regulatory environment and industrial policy are making it the dominant market for mass adoption.

List of Figures

Figure 1: Global Quad Camera for Self-driving Cars Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Quad Camera for Self-driving Cars Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Quad Camera for Self-driving Cars Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Quad Camera for Self-driving Cars Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Quad Camera for Self-driving Cars Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Quad Camera for Self-driving Cars Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Quad Camera for Self-driving Cars Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Quad Camera for Self-driving Cars Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Quad Camera for Self-driving Cars Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Quad Camera for Self-driving Cars Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Quad Camera for Self-driving Cars Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Quad Camera for Self-driving Cars Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Quad Camera for Self-driving Cars Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Quad Camera for Self-driving Cars Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Quad Camera for Self-driving Cars Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Quad Camera for Self-driving Cars Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Quad Camera for Self-driving Cars Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Quad Camera for Self-driving Cars Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Quad Camera for Self-driving Cars Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Quad Camera for Self-driving Cars Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Quad Camera for Self-driving Cars Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Quad Camera for Self-driving Cars Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model