Real-time Number Plate Recognition System Market Overview and Analysis

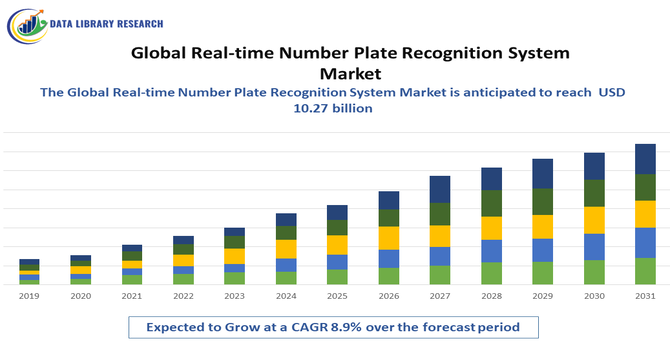

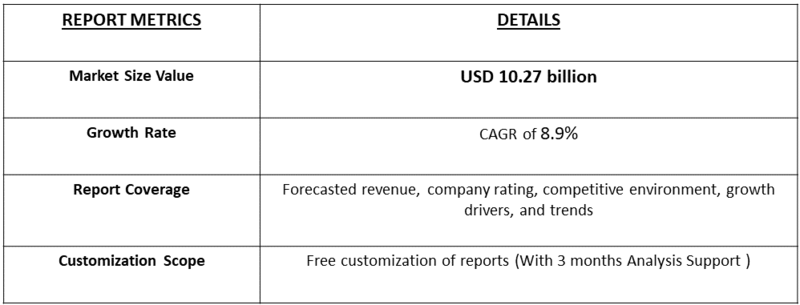

- The Global Real-Time Number Plate Recognition (NPR) System Market is valued at USD 4.98 billion in 2025 and is expected to reach USD 10.27 billion by 2032 growing with a CAGR of 8.9% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Real-Time Number Plate Recognition (NPR) System Market is experiencing robust growth, primarily driven by the increasing need for advanced traffic management, law enforcement automation, and enhanced public safety measures. The surge in vehicle ownership, coupled with rising concerns over security and traffic violations, has accelerated the adoption of NPR systems across smart city and transportation infrastructure projects. Additionally, advancements in artificial intelligence, machine learning, and high-resolution imaging technologies are improving recognition accuracy and operational efficiency, further propelling market expansion. Growing government initiatives to implement intelligent transportation systems (ITS) and the integration of NPR with surveillance and tolling systems are also key factors contributing to the market’s growth trajectory.

Real-time Number Plate Recognition System Market Latest Trends

Rapid advances in AI and machine learning are improving accuracy of plate recognition even under challenging conditions like low-light, high speed, distortion, and varied plate fonts. Edge-computing ANPR devices are becoming more common, reducing latency and enabling real-time processing without depending solely on cloud infrastructure. Integration with smart city and intelligent traffic management systems is growing strongly — real-time number plate systems are being tied to traffic enforcement, tolling, parking management, and security surveillance networks. Also, there is increasing deployment in emerging markets, driven by urbanization and rising regulatory and enforcement demand.

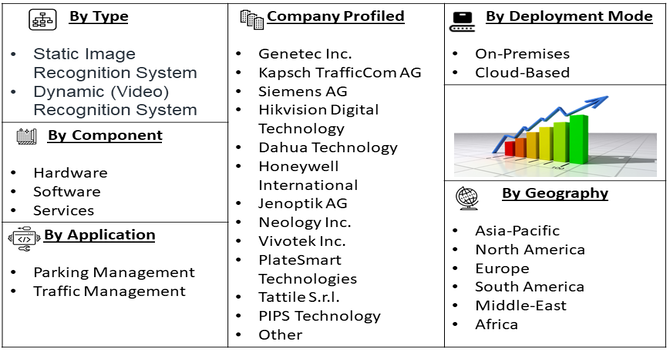

Segmentation: Global Real-time Number Plate Recognition System Market is segmented by Type (Static Image Recognition System, Dynamic (Video) Recognition System), Application (Parking Management, Traffic Management), Component (Hardware, Software, Services), Deployment Mode (On-Premises, Cloud-Based), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Demand for Advanced Traffic Management and Law Enforcement Systems

One of the key factors driving the growth of the Global Real-Time Number Plate Recognition (RT-NPR) System Market is the increasing need for efficient traffic management and law enforcement solutions. With rising urbanization and vehicle ownership worldwide, governments and municipalities are investing heavily in intelligent transportation systems (ITS) to reduce congestion, improve traffic flow, and enhance road safety. Real-time number plate recognition systems play a crucial role in monitoring traffic violations, identifying stolen or unregistered vehicles, and enforcing toll collection and parking regulations. Additionally, the integration of RT-NPR systems with surveillance cameras and IoT-based infrastructure is enabling authorities to achieve seamless monitoring and data-driven decision-making, thereby fueling market expansion.

- Rising Adoption Across Commercial and Security Applications

The increasing deployment of real-time number plate recognition systems in commercial spaces such as shopping malls, corporate campuses, residential complexes, and toll plazas is another major growth driver. These systems enhance operational efficiency by automating entry and exit management, improving vehicle tracking, and ensuring better security control. Furthermore, the growing concerns regarding crime prevention and border security are encouraging government and private organizations to invest in real-time recognition technologies. The rise of smart cities and the growing integration of RT-NPR systems with cloud-based analytics, artificial intelligence, and edge computing further accelerate adoption, supporting the market’s strong growth trajectory over the forecast period.

Market Restraints:

- Privacy, Legal and Regulatory Concerns

Real-time number plate recognition (NPR/ANPR) systems capture and store potentially sensitive personal data (vehicle numbers, timestamps, locations), which raises privacy issues. Various jurisdictions have strict laws governing how surveillance data can be collected, stored, processed, and shared. Compliance with data protection regulations—such as GDPR in Europe—often requires anonymization, secure storage, heavy oversight, and sometimes even limits on usage. Legal challenges or public opposition in some regions can slow deployment of NPR systems or force costly modifications to ensure compliance, reducing market momentum.

Socio Economic Impact on Real-time Number Plate Recognition System Market

The socioeconomic impact on the Global Real-time Number Plate Recognition (ANPR) System Market has been significant, driven by urbanization, rising vehicle ownership, and increasing traffic congestion. Governments and municipalities are investing in ANPR technologies to enhance traffic management, reduce congestion, and improve road safety, creating public-sector employment opportunities and boosting local economies. For businesses, ANPR systems facilitate efficient parking management, toll collection, and law enforcement, lowering operational costs and increasing revenue streams. Socially, these systems enhance citizen safety, reduce manual labor, and improve transportation convenience. The growing integration of ANPR with IoT and smart city initiatives has also stimulated technological innovation, research, and development, further contributing to economic growth and the expansion of advanced intelligent transportation infrastructure globally.

Segmental Analysis:

- Dynamic (Video) Recognition System segment is expected to witness highest growth over the forecast period

The Dynamic (Video) Recognition System segment is expected to dominate the market, driven by its ability to continuously capture moving vehicles in real time and process video feeds for instant identification. This type offers higher accuracy and efficiency compared to static systems, making it ideal for traffic monitoring, highway tolling, and law enforcement applications. The integration of AI and machine learning algorithms in dynamic systems further enhances detection accuracy under varying conditions such as low light and high-speed movement.

- Traffic Management segment is expected to witness highest growth over the forecast period

The Traffic Management segment holds a major share due to increasing global efforts to reduce congestion, enforce traffic rules, and improve road safety. Real-time number plate recognition systems are widely deployed by municipalities and transportation departments to detect violations, monitor vehicle flow, and automate fine collection. With smart city initiatives on the rise, the integration of ANPR systems into intelligent traffic control frameworks is becoming a key trend driving this segment’s growth.

- Software segment is expected to witness highest growth over the forecast period

The Software segment is witnessing significant growth as advanced algorithms and AI-based analytics play a crucial role in enhancing recognition accuracy and data processing speed. Modern software solutions enable features such as multi-lane tracking, data storage, and real-time analytics, providing actionable insights for traffic management and law enforcement agencies. Continuous software upgrades and the emergence of cloud-based analytics are further boosting this segment.

- Cloud-Based segment is expected to witness highest growth over the forecast period

The Cloud-Based deployment mode is expected to experience the fastest growth over the forecast period, owing to its scalability, remote accessibility, and cost-efficiency. Cloud-based solutions facilitate centralized data management, seamless integration with IoT platforms, and real-time updates without the need for extensive on-site infrastructure. The increasing preference for SaaS-based ANPR solutions among governments and private organizations is accelerating this shift.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period in the Global Real-Time Number Plate Recognition System Market. This growth is driven by increasing government investments in smart city initiatives, intelligent traffic management, and law enforcement automation. The rising number of vehicles and growing concerns over road safety, congestion, and crime prevention are prompting widespread adoption of advanced ANPR systems.

Additionally, the region benefits from advanced technological infrastructure, early adoption of AI- and cloud-based solutions, and strong presence of key system providers, which collectively support rapid deployment and expansion of real-time number plate recognition systems across urban and highway networks. In January 2024, Vaxtor Technologies and VIVOTEK, a leading IP surveillance solutions provider, entered a strategic collaboration. The partnership integrated Vaxtor’s license plate recognition (LPR) software with VIVOTEK’s advanced surveillance technology, showcased in their latest LPR camera series. This collaboration strengthened the adoption of high-precision LPR solutions in North America, enhancing traffic monitoring, law enforcement, and smart city initiatives. By combining advanced software and hardware, it boosted market competitiveness, accelerated deployment of real-time vehicle identification systems, and stimulated growth in the regional ANPR market for both public and private sector applications. Thus, such development are fuelling growth of above market in this region.

To Learn More About This Report - Request a Free Sample Copy

Real-time Number Plate Recognition System Market Competitive Landscape

The global real-time number plate recognition (ANPR) system market is highly competitive, characterized by the presence of both established multinational corporations and specialized technology providers. These companies offer a range of solutions encompassing hardware, software, and integrated systems tailored for applications such as traffic management, law enforcement, electronic toll collection, and parking management.

Key Players:

- Axis Communications

- Bosch Security Systems

- Genetec Inc.

- Kapsch TrafficCom AG

- Siemens AG

- Hikvision Digital Technology

- Dahua Technology

- Honeywell International

- Jenoptik AG

- Neology Inc.

- Vivotek Inc.

- PlateSmart Technologies

- Digital Recognition Systems Ltd.

- Tattile S.r.l.

- PIPS Technology

- Leonardo S.p.A. (SELEX ES)

- Q-Free ASA

- NDI Recognition Systems

- Vaxor Technologies

- Rekor Systems

Recent Development:

- In February 2025, an article published by the journal, Measurement: Sensors reported that urban parking issues by developing a Smart Parking Management System (SPMS) using Automatic Number Plate Recognition (ANPR) and IoT sensors. It automated vehicle registration, monitored real-time slot availability, enabled flexible billing, and enhanced parking efficiency, thereby reducing manual effort and improving user convenience in urban environments.

- In March 2025, an article published by International Journal of Intelligent Transportation Systems Research a Smart Parking Management System (SPMS) integrating ANPR and IoT sensors within Intelligent Transportation Systems (ITS), automating vehicle registration, monitoring real-time slot availability, and recognizing license plates under adverse conditions like fog, rain, dust, or damaged plates. It enhanced parking efficiency, traffic surveillance, flow monitoring, and user convenience, reducing manual effort and enabling flexible billing. This advancement boosted demand for robust ANPR solutions, driving global market growth in real-time vehicle identification, smart parking, and advanced traffic management applications.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is strongly driven by the accelerating demand for enhanced public security and sophisticated traffic management solutions globally. Real-time Number Plate Recognition (NPR) is integral to smart city initiatives, providing critical data for effective traffic flow, congestion control, and automated tolling systems. Furthermore, the increasing integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) is significantly improving system accuracy and reliability, boosting governmental and commercial adoption for surveillance and law enforcement.

Q2. What are the main restraining factors for this market?

The primary restraining factors revolve around significant concerns regarding data privacy and security. Since NPR systems collect and process sensitive personal information (vehicle location and travel history), public and regulatory scrutiny, particularly from laws like GDPR, can slow deployment. Additionally, challenges related to system accuracy under adverse conditions—such as poor lighting, severe weather, or high vehicle speed—and the substantial initial cost and ongoing maintenance requirements can also impede market growth.

Q3. Which segment is expected to witness high growth?

The Software segment, encompassing the AI and ML algorithms that drive recognition, is projected to witness the fastest growth rate. This is due to the increasing focus on improving recognition accuracy and integrating NPR data with other intelligent traffic and surveillance systems for real-time analytics. By end-user, the Commercial segment, driven by applications in parking management and access control for corporate and residential facilities, is also expected to show high growth.

Q4. Who are the top major players for this market?

The global market is highly competitive, featuring players that offer comprehensive hardware and software solutions. While specific rankings fluctuate, key major players include Kapsch TrafficCom, Genetec Inc., Neology, Q-Free ASA, and Vigilant Solutions (now part of Motorola Solutions). These companies focus on continuous innovation in AI-powered analytics and cloud-based solutions to secure large government contracts for traffic and security infrastructure.

Q5. Which country is the largest player?

North America, particularly the United States, is projected to hold the largest market share by revenue. This dominance stems from its well-established technology infrastructure, high investment in public safety and surveillance systems by government agencies, and the widespread use of Automatic Number Plate Recognition (ANPR) for applications like electronic toll collection and law enforcement activities across major cities and state borders.

List of Figures

Figure 1: Global Real-time Number Plate Recognition System Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Real-time Number Plate Recognition System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Real-time Number Plate Recognition System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Real-time Number Plate Recognition System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Real-time Number Plate Recognition System Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Real-time Number Plate Recognition System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Real-time Number Plate Recognition System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Real-time Number Plate Recognition System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Real-time Number Plate Recognition System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Real-time Number Plate Recognition System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Real-time Number Plate Recognition System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Real-time Number Plate Recognition System Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Real-time Number Plate Recognition System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Real-time Number Plate Recognition System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Real-time Number Plate Recognition System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Real-time Number Plate Recognition System Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Real-time Number Plate Recognition System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Real-time Number Plate Recognition System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Real-time Number Plate Recognition System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Real-time Number Plate Recognition System Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Real-time Number Plate Recognition System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Real-time Number Plate Recognition System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Real-time Number Plate Recognition System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Real-time Number Plate Recognition System Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Real-time Number Plate Recognition System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model