Rescue and Medical Training Services Market Overview and Analysis

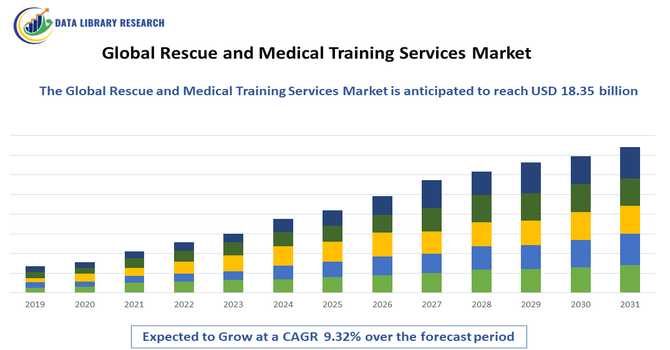

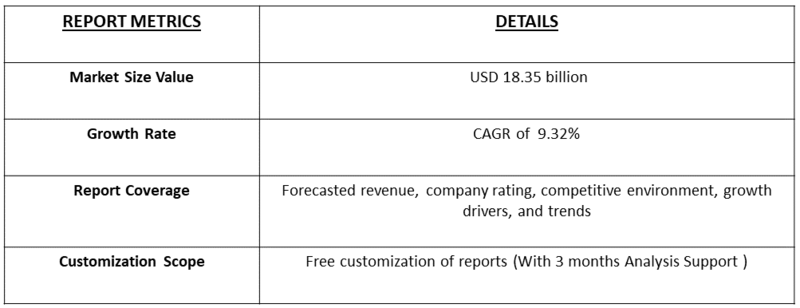

- The global Healthcare Professionals Training Market, which encompasses medical training services, was valued at approximately USD 10.14 billion in 2025, forecasted to grow to USD 18.35 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 9.32% over the forecast period, 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

Growth in the Global Rescue and Medical Training Services Market is primarily driven by the increasing emphasis on emergency preparedness, occupational safety, and healthcare workforce skill development across both public and private sectors. Rising incidences of natural disasters, industrial accidents, and medical emergencies have heightened the demand for trained professionals capable of providing timely and effective rescue and medical interventions. The integration of advanced simulation technologies, e-learning platforms, and scenario-based training further fuels market expansion by improving accessibility and effectiveness of training programs worldwide.

Rescue and Medical Training Services Market Latest Trends

Key recent trends in the Global Rescue and Medical Training Services Market reflect rapid transformation driven by technology integration, digital learning, and immersive simulation tools. Training providers are increasingly incorporating virtual reality (VR), augmented reality (AR), and simulation based platforms into curricula to create realistic, risk-free environments that enhance skill retention and emergency preparedness for both medical professionals and first responders. VR/AR adoption not only improves experiential learning but also supports remote or hybrid training models, expanding accessibility and flexibility. There is also a strong shift toward customized and industry-specific training solutions, catering to sectors like healthcare, aviation, and industrial safety with tailored modules.

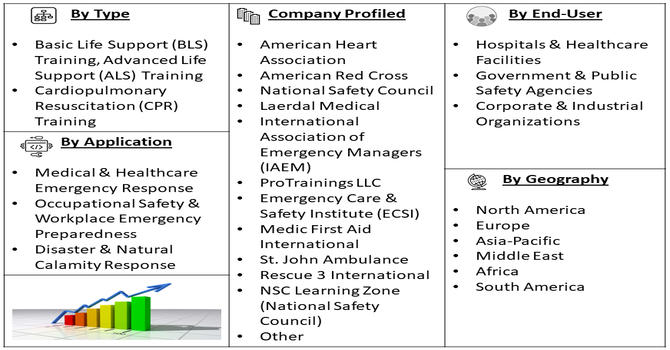

Segmentation: Global Rescue and Medical Training Services Market is segmented By Training Type (Basic Life Support (BLS) Training, Advanced Life Support (ALS) Training, Cardiopulmonary Resuscitation (CPR) Training), Delivery Mode (Instructor-Led Classroom Training, E-Learning / Online Training, Simulation-Based / Virtual Reality (VR) Training), End-User (Hospitals & Healthcare Facilities, Government & Public Safety Agencies, Corporate & Industrial Organizations), Application (Medical & Healthcare Emergency Response, Occupational Safety & Workplace Emergency Preparedness, Disaster & Natural Calamity Response, and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Incidence of Emergencies and Disasters

The increasing frequency of natural disasters, industrial accidents, terrorist attacks, and medical emergencies is a primary driver for the market. Organizations, governments, and healthcare facilities are recognizing the critical need for trained personnel who can respond quickly and effectively in life-threatening situations. From hospitals managing sudden patient surges to industrial plants handling chemical or fire accidents, well-trained responders can significantly reduce casualties and damage. This heightened awareness has prompted investments in structured rescue and medical training programs, scenario-based exercises, and disaster preparedness initiatives, boosting demand across sectors worldwide.

- Stringent Regulatory Standards and Compliance Requirements

Regulatory frameworks and compliance mandates in healthcare, workplace safety, aviation, and public safety sectors are accelerating demand for certified training services. Organizations must ensure their staff are compliant with standards such as OSHA, NFPA, JCI, ISO, and local healthcare regulations to avoid legal liabilities and ensure safety. Regular training in CPR, first aid, trauma response, fire safety, and emergency evacuation is increasingly required for both certification and operational readiness. This regulatory pressure, coupled with the growing emphasis on patient safety, occupational health, and emergency preparedness, drives sustained adoption of professional rescue and medical training services.

Market Restraints:

- High Costs of Advanced Training Programs and Technology

One of the key restraints limiting market growth is the high cost associated with specialized training programs, particularly those incorporating simulation-based learning, virtual reality (VR), and augmented reality (AR). Setting up advanced training facilities with mannequins, high-fidelity simulators, and scenario-based modules requires significant capital investment. Additionally, recurring costs for equipment maintenance, software updates, instructor certification, and course material development can be prohibitive for smaller institutions, NGOs, or companies in developing regions. These high expenses can limit adoption, especially in price-sensitive markets, slowing the overall expansion of the market.

Segmental Analysis:

- Advanced Life Support (ALS) Training segment is expected to witness the highest growth over the forecast period

Advanced Life Support (ALS) training is a critical segment due to its focus on equipping healthcare professionals with the skills needed to manage severe and life-threatening medical emergencies, such as cardiac arrest and trauma cases. ALS courses cover advanced airway management, drug administration, and patient monitoring techniques, which are essential for hospitals, emergency medical services, and intensive care units. The growing prevalence of cardiovascular diseases and critical care cases globally is driving the demand for certified ALS training programs.

- Simulation-Based / Virtual Reality (VR) Training segment is expected to witness the highest growth over the forecast period

Simulation-based and VR training is gaining popularity for its ability to replicate realistic emergency scenarios in a safe, controlled environment. This method allows trainees to practice decision-making, procedural skills, and team coordination without risk to real patients. The increasing integration of VR, AR, and high-fidelity mannequins enhances the effectiveness of training programs, particularly for complex rescue and medical procedures. Simulation-based training also enables remote or hybrid learning, expanding access to quality training in geographically diverse regions.

- Hospitals & Healthcare Facilities segment is expected to witness the highest growth over the forecast period

Hospitals and healthcare facilities are the largest end-users as they require well-trained staff for emergency response, critical care, and patient safety. With rising patient volumes, expanding ICU capacity, and stricter regulatory compliance standards, these institutions increasingly invest in professional training programs such as BLS, ALS, and CPR. Properly trained staff reduce medical errors, improve survival rates during emergencies, and ensure compliance with accreditation requirements, driving strong demand from this segment.

- Disaster & Natural Calamity Response segment is expected to witness the highest growth over the forecast period

Disaster and natural calamity response training is becoming increasingly vital due to the rising frequency of earthquakes, floods, hurricanes, and industrial accidents. This application segment emphasizes preparing first responders, healthcare personnel, and emergency management teams to provide timely and efficient rescue operations. Scenario-based and simulation-enhanced training programs help participants manage mass casualties, coordinate logistics, and implement safety protocols, creating a strong growth trajectory for training services in this field.

- North America segment is expected to witness the highest growth over the forecast period

North America dominates the market due to its advanced healthcare infrastructure, high awareness of emergency preparedness, and strong regulatory enforcement for safety and certification. The U.S. and Canada have a large number of hospitals, public safety agencies, and corporate organizations that invest heavily in certified training programs. For instance, in November 2025, The American Red Cross launched its Resuscitation Suite mobile app, powered by Redivus Health, enhancing Basic, Advanced, Pediatric, and Neonatal Life Support training. By providing instant access to protocols, timers, and real-time documentation, the app improved training efficiency and simulation accuracy. This innovation strengthened North America’s Rescue and Medical Training Services Market by boosting adoption of digital tools and supporting more effective emergency preparedness and response across healthcare and corporate sectors.

Adoption of VR-based and simulation training technologies, coupled with stringent standards for healthcare and workplace safety, further drives the growth of the market in this region. For instance, in September 2025, The Cardiothoracic Intensive Care Unit 3 South Practice Council launched the first Surgical Cardiac Advanced Life Support certification program at Brooke Army Medical Center in August 2025. By training nurses and frontline clinicians in specialized post-operative cardiac care, the initiative enhanced clinical skills and protocol adherence, strengthening North America’s Rescue and Medical Training Services Market through increased adoption of advanced, high-acuity medical training programs.

Thus, such factors together are driving this market’s growth in this region.

To Learn More About This Report - Request a Free Sample Copy

Rescue and Medical Training Services Market Competitive Landscape

The competitive landscape of the Global Rescue and Medical Training Services Market is shaped by a diverse mix of specialized training providers, healthcare education companies, professional certification bodies, emergency response institutions, and technology driven simulation firms. Market players compete based on the breadth and accreditation of training programs (BLS, ALS, CPR, disaster response), delivery technologies (live instruction, e learning, VR/simulation), geographic reach, partnerships with healthcare facilities and public agencies, and compliance with global safety standards. Increasing emphasis on integrated training solutions that combine classroom instruction with immersive simulation, standardized curriculum content, and digital learning platforms is intensifying competition. Companies that can deliver certified, scalable, and technology enhanced training are better positioned to capture expanding demand across healthcare, corporate safety, and public safety sectors.

Key Players:

- American Heart Association

- American Red Cross

- National Safety Council

- Laerdal Medical

- International Association of Emergency Managers (IAEM)

- ProTrainings LLC

- Emergency Care & Safety Institute (ECSI)

- Medic First Aid International

- St. John Ambulance

- Rescue 3 International

- NSC Learning Zone (National Safety Council)

- Health & Safety Institute (HSI)

- Occupational Safety and Health Training (OSHT)

- SafetySkills, Inc.

- Red Cross Australia

- Canadian Red Cross

- British Heart Foundation Training

- VR Simulations Ltd.

- Simulaids Inc.

- National Fire Protection Association (NFPA) Training Programs

Recent News

- In November 2025, Quantum’s national launch of its Doctor911 Advanced Life Support (ALS) ambulance network in India, starting with a pilot at Oberoi Mall, demonstrates rapid-response emergency healthcare with under 10-minute turnaround. This initiative highlights growing demand for advanced emergency services and training, driving adoption and expansion in the Global Rescue and Medical Training Services Market.

- In August 2024, The Indian Council of Medical Research (ICMR) launched the National Health Research Priority Project to develop advanced, patient-centric emergency care systems across five districts, including Puri, Odisha. By enhancing ambulance services, training first responders, and integrating IT and AI tools, the initiative strengthened emergency preparedness. This project highlighted the growing demand for skilled rescue and medical training, positively impacting the Global Rescue and Medical Training Services Market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The Global Rescue and Medical Training Services Market is driven by increasing awareness of workplace safety, rising demand for emergency preparedness, and growing adoption of advanced training programs. Expanding industrial, corporate, and healthcare sectors, along with government regulations on safety standards, further boost market growth worldwide.

Q2. What are the main restraining factors for this market?

High costs of specialized rescue equipment and certified training programs, along with limited access in rural or developing regions, restrict market expansion. Additionally, a shortage of qualified trainers and inconsistent regulatory frameworks in some countries slow adoption, posing challenges to the growth of rescue and medical training services globally.

Q3. Which segment is expected to witness high growth?

The Emergency Medical Training segment is expected to witness high growth due to increasing demand for skilled personnel capable of responding to workplace accidents, natural disasters, and medical emergencies. Corporates, healthcare facilities, and educational institutions are investing heavily in certification and simulation-based training programs, driving expansion in this segment.

Q4. Who are the top major players for this market?

Leading companies in the market include Red Cross, Quantum, Drägerwerk AG, MedAire, SOS International, International SOS, AHA (American Heart Association), Fire & Safety Services, Rescue Training International, and Laerdal Medical. These organizations offer a range of emergency response, rescue, and medical training solutions globally.

Q5. Which country is the largest player?

The United States is the largest player in the Global Rescue and Medical Training Services Market, driven by advanced healthcare infrastructure, stringent safety regulations, and widespread adoption of emergency training programs across industries. Strong government support and a high focus on occupational safety further strengthen its market dominance.

List of Figures

Figure 1: Global Rescue and Medical Training Services Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Rescue and Medical Training Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Rescue and Medical Training Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Rescue and Medical Training Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Rescue and Medical Training Services Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Rescue and Medical Training Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Rescue and Medical Training Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Rescue and Medical Training Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Rescue and Medical Training Services Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Rescue and Medical Training Services Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Rescue and Medical Training Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Rescue and Medical Training Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Rescue and Medical Training Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Rescue and Medical Training Services Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Rescue and Medical Training Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Rescue and Medical Training Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Rescue and Medical Training Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Rescue and Medical Training Services Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Rescue and Medical Training Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Rescue and Medical Training Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Rescue and Medical Training Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Rescue and Medical Training Services Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Rescue and Medical Training Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Rescue and Medical Training Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Rescue and Medical Training Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Rescue and Medical Training Services Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Rescue and Medical Training Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model