Semiconductor Assembly Testing Services (SATS) Market Overview

Semiconductor assembly & testing services (SATS) can be referred to as a cloud service that needs less management and an easier application development platform. It allows end-users to conduct programming and all alternative tasks while not having to manage any server. With the rising adoption of cloud services, the adoption of semiconductor assembly & testing services (SATS) is increasing. The electrification and automation of automobiles are resulting in the increasing would like for semiconductor assemblies and testing. This issue is projected to drive the worldwide SATS market over the forecast amount.

The Semiconductor Assembly and Testing Services Market are anticipated to achieve momentum over the forecast period. Because electronics equipment requires smarter solutions with low value, measurability, design, and others. This semiconductor testing ensures the long performance of the system. The tests wafers are driving the semiconductor market to the large extent. The semiconductor checking will improve in test times, maintain mensuration, and offer high performance. Higher prices related to larger wafer fabrication are a major challenge for the semiconductor assembly & testing services market.

| Report Metric | Details |

| Market size available for years | 2023–2030 |

| Base year considered | 2023 |

| Forecast period | 2024–2030 |

| Forecast unit | Value (USD Million) |

| Segments covered | Services Type, Solution, Application and Region |

| Regions covered | North America (the U.S. and Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South East Asia, Rest of Asia Pacific), Latin America and the Middle East and Africa (Brazil, Saudi Arabia, UAE, Rest of LAMEA) |

| Companies covered | ASE Group, Inc., Amkor Technology, Inc., Siliconware Precision Industries Co., Ltd, Powertech Technology, Inc., United Test and Assembly Center Ltd., JCET Group Co Ltd, Chipbond Technology Corporation., Global Foundries Inc., CORWIL Technology Corp. |

The covid-19 Impact on Semiconductor Assembly Testing Services (SATS) Market:

Like several different industries, COVID-19 badly knocked the electronic and semiconductor trade. This new event has compact nearly 230 countries in exactly a couple of weeks, leading to the forced conclusion of producing and transportation activities at intervals and across the countries. This has directly affected the expansion of the sector. It's calculable that COVID-19 to depart over USD thirty billion impacts on the physics and semiconductor trade. The arena is majorly affected thanks to transport restrictions on major physics and semiconductor staple suppliers. However, the rising want for semiconductors in many industries can supply fast market recovery over the longer-term amount.

Semiconductor Assembly Testing Services (SATS) Market Segment Overview

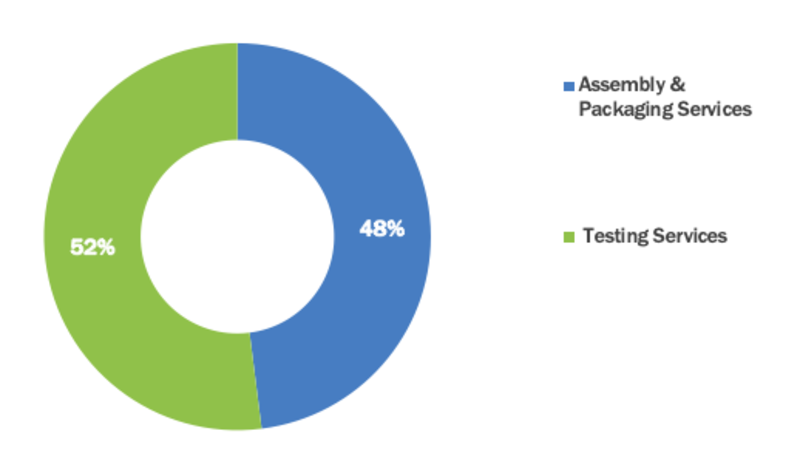

By Services Type, Testing services segment is accounted huge share in forecast period .Mainly, these semiconductor testing ensures long-term performance of the system. The tests wafers are driving the semiconductor market to the big extent. The semiconductor take a look like will improve in test times, maintaining activity, and give high performance.

By Solution, Wafer level packaging segment accounted huge growth in forecast period, the development of latest semiconductor assembly and testing technologies like wafer-level packaging (WLP) interconnecting technology and organic-substrate-interposer technology, etc. These technologies notice application in varied 3D packages, 3D integrated circuits, and image sensors owing to their attributes such as low value, improved check times, and quantifiability.

By Application, The consumer electronics segment is anticipated to guide the worldwide market with a high market valuation throughout the forecast period, because of many factors like growing penetration of smartphones and solid-state drives (SSDs), and increasing adoption of semiconductor assembly & testing services to fulfil customer expectations.

Market Analysis, Insights and Forecast – By Services Type

· Assembly & Packaging Services

· Testing Services

Market Analysis, Insights and Forecast – By Solution

· Copper Wire and Gold Wire Bonding

· Copper Clip

· Flip Chip

· Wafer Level Packaging

· TSV

Market Analysis, Insights and Forecast – By Application

· Communications

· Computing & Networking

· Consumer Electronics

· Industrial

· Automotive Electronics

Semiconductor Assembly Testing Services (SATS) Market Regional Overview

Region-wise, in terms of regions, the semiconductor assembly and testing services market is witnessing rising within the Asia Pacific region because of the increasing adoption of tablets and wearable devices. Semiconductor assembly and testing services market providers try to expand their operations in China, South Korea, and India to unlock new growth avenues, owing to the growing demand for consumer electronics and also the vast growth of electronic industries in these countries.

Semiconductor Assembly Testing Services (SATS) Market, By Geography

· North America (US & Canada)

· Europe (UK, Germany, France, Italy, Spain, & Rest of Europe)

· Asia-Pacific (Japan, China, India, Australia, & South Korea, & Rest of Asia-Pacific)

· LAMEA (Brazil, Saudi Arabia, UAE & Rest of LAMEA)

Semiconductor Assembly Testing Services (SATS) Market Competitor overview

Some key developments and strategies adopted by manufacturers in the Semiconductor Assembly Testing Services (SATS) are highlighted below.

· In 2020, ASE announced that received GSMA SAS-UP accreditation thus resulting 5G technology characterized by its fast connectivity, low latency and high bandwidth, has enabled the rise of the internet of everything and transformed the way we communicate.

Semiconductor Assembly Testing Services (SATS) Market, Key Players

· ASE Group, Inc.

· Amkor Technology, Inc.

· Siliconware Precision Industries Co., Ltd

· Powertech Technology, Inc.

· United Test and Assembly Center Ltd.

· JCET Group Co Ltd

· Chipbond Technology Corporation.

· Global Foundries Inc.

· CORWIL Technology Corp.

Q1. What is the total CAGR expected to be recorded for the Semiconductor Assembly Testing Services (SATS) market during the forecast period?

Semiconductor Assembly Testing Services (SATS) market is expected to record a CAGR of ~6.5% during the forecast period.

Q2. Which segment is projected to hold the largest share in the Semiconductor Assembly Testing Services (SATS) Market?

Wafer Level Packaging segment is projected to hold the largest share in the Semiconductor Assembly Testing Services (SATS) Market.

Q3. What are the driving factors for the Semiconductor Assembly Testing Services (SATS) market?

Adaptation of cloud services, electrification and automation of automobiles are resulting in the increasing would like for semiconductor assembly testing services (SATS) market in forecast period.

Q4. Which Segments are covered in the Semiconductor Assembly Testing Services (SATS) market report?

Services Type, Solution, Application and Region, these segments are covered in the Semiconductor Assembly Testing Services (SATS) market report.

Q5. Which are the prominent players offering Semiconductor Assembly Testing Services (SATS)?

ASE Group, Inc., Amkor Technology, Inc., Siliconware Precision Industries Co., Ltd, Powertech Technology, Inc., United Test and Assembly Center Ltd., JCET Group Co Ltd, Chipbond Technology Corporation., Global Foundries Inc., CORWIL Technology Corp.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model