Telemedicine Technologies and Services Market Overview and Analysis

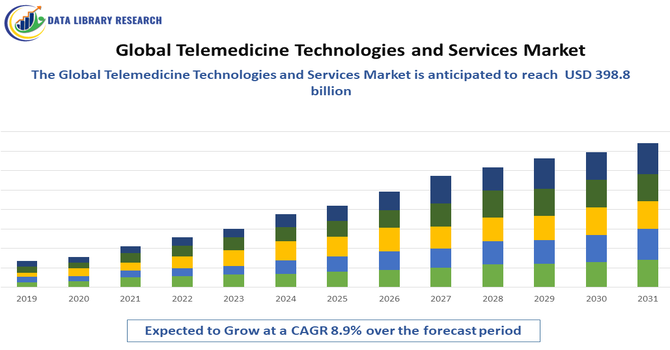

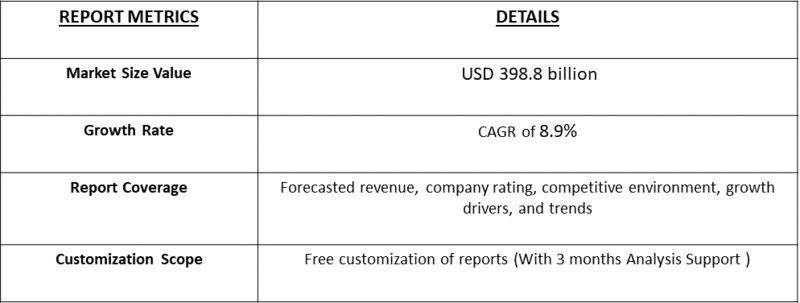

- The Global Telemedicine Technologies and Services Market is experiencing rapid growth, with a 2024 valuation around USD 118.8 billion and projected to reach USD 398.8 by 2032, growing a CAGR 8.9% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Telemedicine Technologies and Services Market is experiencing strong growth, primarily driven by rising demand for remote healthcare access, increased digitalization of medical services, and expanding government support for telehealth infrastructure. Growing pressure on healthcare systems, especially in rural and underserved regions, is accelerating adoption of virtual consultations, remote diagnostics, and AI-enabled monitoring tools. Additionally, increasing prevalence of chronic diseases, aging populations, rising healthcare costs, and the need for continuous patient engagement are fueling demand for telemedicine platforms.

Telemedicine Technologies and Services Market Latest Trends

The Global Telemedicine Technologies and Services Market is witnessing rapid transformation driven by several key trends. The acceleration of remote care solutions during and after the COVID-19 pandemic has led to mainstream adoption of virtual doctor visits, remote patient monitoring, and asynchronous teleconsultations, reshaping care delivery models. The integration of AI and machine learning algorithms into telemedicine platforms is enhancing diagnostic accuracy, personalized treatment plans, and predictive health analytics. Wearable health technologies and IoT devices are increasingly connected to telehealth services, enabling continuous monitoring of chronic diseases and immediate clinician intervention.

Segmentation: Global Telemedicine Technologies and Services Market is segmented By Component (Medical Devices & IoT Monitoring Devices, Video Conferencing Systems, EHR/EMR-Integrated Telemedicine Platforms, Remote Patient Monitoring Software), Application (Teleradiology, Telepathology, Teledermatology Telepsychiatry & Mental Health), End User (Hospitals & Clinics, Home Healthcare Providers, Diagnostic Centers), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers

- Rising Chronic Disease Burden and Aging Population

The global increase in chronic diseases such as diabetes, cardiovascular disorders, cancer, and respiratory illnesses, along with a rapidly aging population, is significantly accelerating the adoption of telemedicine. For instance, in February 2024, CDC reported that in the United States, an estimated 129 million people had at least one major chronic disease such as heart disease, cancer, diabetes, obesity, or hypertension. Nearly 42% of Americans lived with two or more chronic conditions, and 12% had five or more, reflecting a steadily increasing prevalence over the past two decades. Thus, high chronic diseases patients highlights more number of patients require continuous monitoring and frequent consultations, and telemedicine provides a convenient, cost-effective, and efficient way to manage long-term care. Additionally, elderly individuals benefit from remote care solutions that reduce the need for travel and improve access to specialists, further fueling market growth.

- Increasing Digital Healthcare Infrastructure and Internet Penetration

Expanding broadband and mobile internet connectivity, coupled with advancements in digital healthcare infrastructure such as electronic health records (EHRs), AI-powered diagnostics, and remote patient monitoring devices, is driving telemedicine utilization worldwide. The proliferation of smartphones, wearable devices, and digital health apps is improving accessibility to virtual healthcare services. Governments and healthcare providers are investing heavily in digital health platforms and telehealth reimbursement policies, strengthening telemedicine’s role in mainstream medical practice.

Market Restraints:

- Lack of Universal Regulatory Frameworks and Standardization

One key challenge is the lack of universal regulatory frameworks and standardization across regions, which creates inconsistencies in telehealth practices, reimbursement policies, cross-border medical licensing, and data privacy compliance. This limits seamless service delivery and interoperability between telemedicine platforms. Additionally, data security and privacy concerns remain a major barrier, as telemedicine involves the exchange of sensitive patient health information, making systems vulnerable to cyberattacks, breaches, and misuse. Furthermore, limited digital literacy and unequal internet access, particularly in rural and low-income regions, restrict patient adoption and hinder widespread telemedicine deployment.

Socio Economic Impact on Telemedicine Technologies and Services Market

The Global Telemedicine Technologies and Services Market has had a profound socioeconomic impact by transforming healthcare access, affordability, and delivery. Telemedicine bridges geographic barriers, providing remote consultations, diagnostics, and monitoring to underserved and rural populations, thereby reducing travel costs and lost wages associated with in-person visits. It enhances healthcare efficiency, lowering operational expenses for providers while enabling faster diagnosis and treatment, which improves patient outcomes and productivity. Economically, telemedicine stimulates growth in technology infrastructure, software development, and healthcare services, creating jobs and investment opportunities. Socially, it promotes health equity, patient empowerment, and continuity of care, particularly for chronic disease management and elderly populations. Thus, telemedicine contributes to cost-effective, inclusive, and technologically advanced healthcare systems globally.

Segmental Analysis

- EHR/EMR-Integrated Telemedicine Platforms segment is expected to witness highest growth over the forecast period

EHR/EMR-integrated telemedicine platforms are expected to dominate the component segment as healthcare providers focus on seamless patient data access, coordinated care, and streamlined documentation. Integration with electronic health records enables real-time sharing of patient histories, prescriptions, and diagnostic data, improving clinical accuracy and treatment outcomes. Hospitals and clinics are increasingly adopting these systems to support virtual consultations, remote diagnostics, and automated medical workflows, driven by the need for interoperability, regulatory compliance, and enhanced patient experience.

- Teleradiology segment is expected to witness highest growth over the forecast period

Teleradiology is emerging as the largest application segment, fueled by a growing global shortage of radiologists and rising demand for rapid diagnostic imaging reviews. Hospitals and diagnostic centers are increasingly outsourcing radiology reporting to remote specialists to accelerate turnaround times and improve diagnostic accuracy. Technological advancements, such as AI-enabled imaging interpretation and cloud-based image sharing, further support adoption. The segment benefits from high utilization in emergency care, trauma cases, and rural healthcare delivery.

- Hospitals & Clinics segment is expected to witness highest growth over the forecast period

Hospitals and clinics represent the leading end-user segment due to rapid digitalization and increasing investment in telehealth infrastructure. These facilities are expanding teleconsultation services, virtual outpatient departments, and remote patient monitoring systems to reduce operational costs, enhance patient convenience, and manage rising patient loads. Telemedicine adoption in hospitals is also supported by government initiatives and payer reimbursement policies that encourage digital health integration, particularly for chronic disease management and post-treatment follow-up.

- North America is expected to witness highest growth over the forecast period

North America leads the market geographically, driven by advanced healthcare infrastructure, strong adoption of digital health technologies, and favorable reimbursement frameworks. The region has witnessed rapid integration of telemedicine in primary care, specialty consultation, behavioral health, and chronic disease management.

High internet penetration, technology-savvy population, and the presence of major telehealth solution providers also support growth. Continued investment in AI-based diagnostics, remote monitoring, and virtual care ecosystems ensures sustained market expansion. For instance, in 2022, The Ministry of Health, with support from UNICEF and USAID, implemented a telemedicine pilot initiative after receiving fifty remote health monitoring devices to enable doctors to perform virtual physical examinations. These devices were distributed to vulnerable families and used by trained physicians to deliver remote care when in-person visits were unnecessary or impractical. The program advanced equitable healthcare access and positively influenced the U.S. Global Telemedicine Technologies and Services Market by demonstrating scalable telehealth solutions that enhance accessibility, efficiency, and digital health adoption worldwide.

Thus, such factors are driving the growth of above market in the above region.

To Learn More About This Report - Request a Free Sample Copy

Telemedicine Technologies and Services Market Competitive Landscape

The competitive landscape is diverse and dynamic, led by pure-play telehealth platforms, large healthcare IT vendors, digital health startups, and major healthcare chains expanding virtual care. Competition centers on platform scalability, EHR integration, remote monitoring capabilities, regulatory compliance, reimbursement models, and partnerships with payers and provider networks. Strategic alliances, M&A, and vertical integration (telemedicine + RPM + analytics) are common as firms seek to offer end-to-end virtual care solutions.

Key Player

- Teladoc Health

- Amwell

- Doctor On Demand

- Babylon Health

- Ping An Good Doctor

- Practo

- Zocdoc

- MDLive

- Maven Clinic

- Lemonaid Health

- Doctor Anywhere

- HealthTap

- Heal

- Walgreens Boots Alliance

- CVS Health

- Philips Healthcare

- Epic Systems

- Cerner (Oracle Cerner)

- Google Health

- Microsoft (Healthcare/Teams)

Recent Development

- In April 2025, Hydreight Technologies Inc, a rapidly expanding mobile clinical network providing at-home medical services across all 50 U.S. states, announced the expansion of its VSDHOne platform with the launch of Liraglutide. This strategic addition broadened Hydreight’s GLP-1 weight management and wellness portfolio, enhancing its national telehealth offerings. The move reinforced the company’s commitment to delivering accessible, innovative, and patient-centered healthcare solutions, leveraging its mobile and digital platform to support scalable, flexible, and effective wellness services nationwide.

- In November 2024, VSee Health, Inc. (Nasdaq: VSEE), Health Tech Without Borders (HTWB), and iDocta expanded the Project VITAL Africa telehealth pilots, originally announced at the Clinton Global Initiative 2023. The initiative strengthened Cameroon’s health systems by providing sustainable training, telehealth services, and innovative digital health technologies. This collaboration enhanced healthcare access, promoted equity, and supported scalable, secure telehealth workflows, reinforcing the commitment of public-private partnerships to improve health outcomes in underserved and humanitarian settings across the region.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth driving factors for this market?

The market is primarily driven by the increasing prevalence of chronic diseases and the need for continuous, convenient patient monitoring, especially for the growing geriatric population. Favorable government initiatives globally, which include supportive reimbursement policies and increased funding for digital health startups, accelerate adoption. Furthermore, the limited availability of healthcare professionals in remote or rural areas makes telemedicine a crucial solution for expanding access to care.

Q2. What are the main restraining factors for this market?

Key restraining factors include persistent concerns over data security and patient privacy, which require providers to meet complex regulatory standards like HIPAA. Challenges integrating new telemedicine platforms with older existing hospital IT systems are also a hurdle. Additionally, the lack of reliable high-speed digital infrastructure (broadband internet) and a significant digital literacy gap in low-income or rural regions limit its widespread adoption.

Q3. Which segment is expected to witness high growth?

The Remote Patient Monitoring (RPM) and Teleconsultation Services segments are expected to witness the highest growth. RPM is surging due to the increased use of wearable devices and IoT technology for managing chronic conditions from home, leading to better outcomes. Teleconsultation services, especially real-time video visits, are growing rapidly as they offer cost-effective and immediate access to primary and specialty care.

Q4. Who are the top major players for this market?

The market features a mix of established medical device giants and dedicated virtual care providers. Top major players include Teladoc Health, Inc., a leader in virtual care services, Koninklijke Philips N.V. and Medtronic, focusing on remote monitoring hardware and solutions, and large IT companies like Cisco Systems Inc. and American Well (Amwell), which provide integrated telehealth platforms for health systems.

Q5. Which country is the largest player?

The United States, within the North America region, is the largest market player by revenue share. This dominance is due to early and aggressive adoption of telehealth, favorable and evolving regulatory frameworks, high per capita healthcare expenditure, and the presence of major key market players. However, the Asia Pacific region is forecast to be the fastest-growing market, driven by rapid digitalization and large underserved populations.

List of Figures

Figure 1: Global Telemedicine Technologies and Services Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Telemedicine Technologies and Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Telemedicine Technologies and Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Telemedicine Technologies and Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Telemedicine Technologies and Services Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Telemedicine Technologies and Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Telemedicine Technologies and Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Telemedicine Technologies and Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Telemedicine Technologies and Services Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Telemedicine Technologies and Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Telemedicine Technologies and Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Telemedicine Technologies and Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Telemedicine Technologies and Services Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Telemedicine Technologies and Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Telemedicine Technologies and Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Telemedicine Technologies and Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Telemedicine Technologies and Services Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Telemedicine Technologies and Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Telemedicine Technologies and Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Telemedicine Technologies and Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Telemedicine Technologies and Services Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Telemedicine Technologies and Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Telemedicine Technologies and Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Telemedicine Technologies and Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Telemedicine Technologies and Services Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Telemedicine Technologies and Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model