X-ray Inspection Systems for Food Foreign Object Detection Market Overview and Analysis

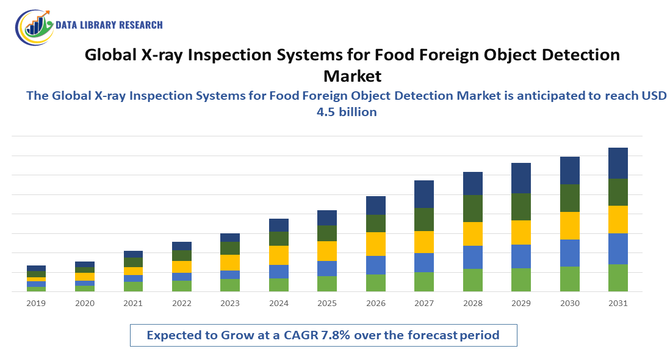

- The Global X-ray Inspection Systems for Food Foreign Object Detection Market is projected to exhibit a strong Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2032. This growth is driven by stringent food safety regulations and the rising global demand for processed, contamination-free food products, with the market expected to reach around USD 4.5 billion by 2032, from USD 1.8 billion in 2025.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global X-ray Inspection Systems for Food Foreign Object Detection Market is witnessing strong growth, driven primarily by the rising emphasis on food safety compliance and the increasing number of contamination-related product recalls worldwide. As governments and regulatory bodies enforce stricter quality standards, food manufacturers are adopting advanced X-ray systems to detect a wider range of contaminants—including metal, glass, stone, bone, and dense plastics—more accurately than traditional technologies.

X-ray Inspection Systems for Food Foreign Object Detection Market Latest Trends

X-ray inspection for food foreign-object detection is rapidly moving from standalone hardware to intelligent inspection ecosystems — systems now combine higher-resolution and multi-energy imaging (dual/multi-energy detectors) with AI/ML algorithms to improve contaminant discrimination and dramatically cut false rejects. Vendors are integrating X-ray units with other QA functions (checkweighers, vision systems, and metal detectors) and offering cloud-connected analytics and IoT monitoring for real-time performance tracking and traceability. There’s also growing use of advanced complementary technologies — e.g., hyperspectral and deep-learning-based vision models — for hard-to-detect, low-density contaminants and fresh-produce inspection.

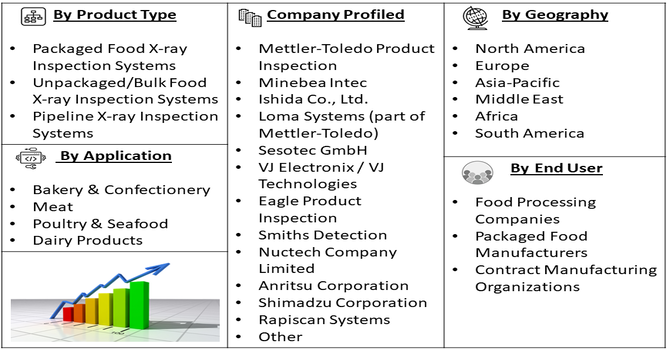

Segmentation: Global X-ray Inspection Systems for Food Foreign Object Detection Market is segmented By Product Type (Packaged Food X-ray Inspection Systems, Unpackaged/Bulk Food X-ray Inspection Systems, Pipeline X-ray Inspection Systems), Technology (High-resolution X-ray Imaging, Multi-energy X-ray Detection, AI/ML-based X-ray Inspection), Application (Bakery & Confectionery, Meat, Poultry & Seafood, Dairy Products), End User (Food Processing Companies, Packaged Food Manufacturers, Contract Manufacturing Organizations), Distribution Channel (Direct Sales, Authorized Distributors, Online Industrial Equipment Platforms), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Stringency of Global Food Safety Regulations

One of the strongest drivers of market growth is the tightening of food safety regulations worldwide. Regulatory bodies such as the FDA (FSMA in the U.S.), EFSA (Europe), and various Asia-Pacific authorities are enforcing strict compliance for contaminant detection, traceability, and prevention of foreign-object contamination. These rules require food manufacturers to adopt more advanced inspection technologies capable of detecting metal, glass, bone, stone, and dense plastics that traditional metal detectors may miss. Retailers—especially large supermarket chains—have also introduced their own stringent quality standards, making X-ray inspection systems indispensable. This regulatory pressure is pushing even small and mid-sized manufacturers to invest in X-ray solutions to avoid costly recalls, legal liabilities, and reputational damage.

- Rising Incidence of Product Recalls and Demand for Greater Consumer Safety

The growing number of contamination-related product recalls globally is significantly driving demand for advanced X-ray inspection systems. As consumer awareness of food safety increases and recall incidents become more widely publicized, manufacturers are under intense pressure to prevent foreign-object contamination before products reach shelves. X-ray systems offer superior detection accuracy, even for non-metallic foreign bodies, and can identify tiny contaminants without damaging or opening packages. Brands are investing in X-ray inspection to safeguard consumer trust, minimize financial losses, reduce wastage, and maintain competitive advantage. The need for consistent quality assurance across high-speed production lines further boosts adoption of advanced X-ray technologies integrated with AI, machine learning, and multi-energy imaging.

Market Restraints:

- High Initial Investment and Maintenance Costs

One of the primary restraints is the significant capital expenditure required for advanced X-ray inspection systems. These machines are more expensive than traditional metal detectors, making it difficult for small and mid-sized food manufacturers to adopt them. Additionally, ongoing maintenance, calibration, radiation compliance checks, and software upgrades further increase operational costs. This financial burden slows adoption, especially in developing regions where price sensitivity is high.

Socioeconomic Impact on X-ray Inspection Systems for Food Foreign Object Detection Market

The global X-ray inspection systems market for food foreign object detection has significant socioeconomic impact by ensuring food safety and protecting public health. These systems reduce the risk of contamination from metal, glass, stones, and other foreign objects, preventing foodborne illnesses and costly product recalls. Enhanced food safety increases consumer confidence, supports regulatory compliance, and strengthens brand reputation, contributing to stable economic growth in the food industry. Additionally, widespread adoption of X-ray inspection technology drives employment in manufacturing, installation, and maintenance sectors. By minimizing health risks and economic losses, these systems play a critical role in global food security and societal well-being.

Segmental Analysis:

- Packaged Food X-ray Inspection Systems segment is expected to witness highest growth over the forecast period

Packaged food X-ray inspection systems hold a major share of the market as they are widely used to detect contaminants in sealed products such as ready-to-eat meals, snacks, bakery items, and dairy goods. Their ability to inspect products without damaging the packaging, along with rising global preference for packaged foods, drives strong demand in this segment. Enhanced capabilities such as detection of metal, glass, bone, and dense plastics further support its growth.

- Multi-energy X-ray Detection segment is expected to witness highest growth over the forecast period

Multi-energy X-ray detection technology is gaining rapid adoption due to its superior ability to differentiate between materials of varying densities. This improves detection of low-density contaminants, making it highly effective for complex and composite food products. The technology also reduces false rejection rates and enhances overall accuracy, positioning it as a preferred choice for advanced quality control environments.

- Meat, Poultry & Seafood segment is expected to witness highest growth over the forecast period

The meat, poultry, and seafood segment relies heavily on X-ray inspection due to the higher risk of contamination from bones, metal fragments, and processing equipment. Ensuring product integrity is critical in this category, and X-ray systems provide precise detection even in products with variable density. Growing consumption of animal protein and strict regulatory standards further strengthen the adoption of X-ray systems in this application.

- Food Processing Companies segment is expected to witness the highest growth over the forecast period

Food processing companies represent the largest end-user segment as they operate high-volume production lines requiring consistent and reliable contaminant detection. These companies prioritize automation, traceability, and advanced inspection technologies to meet retailer requirements and global food safety certifications. Adoption of X-ray systems helps them minimize recalls, reduce wastage, and maintain brand reputation.

- Direct Sales segment is expected to witness the highest growth over the forecast period

Direct sales dominate the distribution channel as large food manufacturers prefer purchasing X-ray systems directly from OEMs for better customization, installation support, and after-sales service. Direct engagement ensures tailored solutions, faster troubleshooting, and the integration of equipment into complex production lines, making it the most trusted channel for high-value industrial equipment.

- North America region is expected to witness the highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period, driven by the strong presence of advanced food processing industries, stringent regulatory frameworks such as FSMA that mandate rigorous contamination detection, and the rapid adoption of automation and high-precision inspection technologies.

In November 2025, Micro-X Limited launched its updated Rover mobile X-ray system at RSNA in Chicago, introducing a next-generation platform with enhanced workflow, imaging performance, and usability. This innovation strengthened opportunities in the U.S. X-ray food inspection market, boosting efficiency and contaminant detection capabilities. The introduction of Micro-X’s Rover mobile X-ray system further positioned the U.S. market for advanced food inspection technologies as a hub for innovation. By improving accuracy and operational efficiency, it encouraged broader adoption among food manufacturers, enhancing safety standards and driving market growth in food foreign object detection.

Growing consumer demand for safe, high-quality packaged foods and increasing investments in modernizing production lines further accelerate the uptake of X-ray inspection systems. Additionally, the region’s emphasis on reducing product recalls, improving traceability, and integrating smart inspection solutions contributes significantly to North America’s leading market growth trajectory.

To Learn More About This Report - Request a Free Sample Copy

X-ray Inspection Systems for Food Foreign Object Detection Market Competitive Landscape:

The competitive landscape for the Global X-ray Inspection Systems for Food Foreign Object Detection market is highly competitive and technology-driven, dominated by suppliers that combine robust hardware (high-resolution detectors, multi-energy sources) with advanced software (AI/ML analytics, pattern recognition) and strong service networks. Vendors compete on detection accuracy, false-reject reduction, ease of integration into existing lines, modular add-ons (checkweighers, vision systems), and flexible financing or as-a-service options that lower adoption barriers. Differentiation also comes from food-specific tuning, fast on-site support, regional distribution strength, and partnerships with packaging and automation integrators. As processors seek turnkey solutions that minimize recalls and waste while maximizing throughput, suppliers that deliver proven performance, regulatory compliance support, and effective after-sales service capture the largest customers and drive consolidation in the market.

Key Players:

- Mettler-Toledo Product Inspection

- Minebea Intec

- Ishida Co., Ltd.

- Loma Systems (part of Mettler-Toledo)

- Sesotec GmbH

- VJ Electronix / VJ Technologies

- Eagle Product Inspection

- Smiths Detection

- Nuctech Company Limited

- Keyence Corporation

- CEIA S.p.A.

- Anritsu Corporation

- Shimadzu Corporation

- Rapiscan Systems

- Thermo Fisher Scientific

- Marel

- GEA Group

- Heat and Control

- Omron Corporation

- Rockwell Automation

Recent Development

- In July 2025, Loma Systems launched the X5DE Dual Energy X-ray Inspection System in North America. Designed for optimal contaminant detection in rigorous food production settings, the X5DE enhances food safety, improves line efficiency, and sets a new benchmark for quality assurance.

- In November 2024, Mettler-Toledo unveiled the next-generation X6 Series X-ray system to improve food safety compliance and productivity. The system provided enhanced protection for medium to large packaged products and multi-lane applications, strengthening quality assurance in food production processes.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary drivers are increasingly strict global food safety regulations imposed by governments worldwide and heightened consumer awareness regarding product quality. The growing demand for highly processed and packaged foods also necessitates advanced, automated inspection technology to reliably detect contaminants like metal and glass.

Q2. What are the main restraining factors for this market?

The high initial investment cost required for purchasing and installing advanced X-ray inspection systems is a significant restraint, especially for smaller food manufacturers. Additionally, the ongoing operational expenses, maintenance requirements, and the need for specialized training also challenge broader market adoption.

Q3. Which segment is expected to witness high growth?

The segment for the Detection of Foreign Materials in Packaged Products is expected to witness high growth. As consumer demand shifts toward convenience and packaged goods, manufacturers prioritize these systems to ensure product integrity, detect contaminants within various packaging types, and comply with retailer safety standards.

Q4. Who are the top major players for this market?

Key players dominating the market include Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., Anritsu Corporation, and Loma Systems. These companies focus heavily on research and development to introduce innovative systems featuring advanced imaging and artificial intelligence capabilities.

Q5. Which country is the largest player?

The United States holds the largest market share, driven by stringent regulatory frameworks (like the FDA’s rules) and high levels of automation across the food and beverage industry. However, the Asia-Pacific region is also showing rapid growth due to increasing industrialization and rising health consciousness.

List of Figures

Figure 1: Global X-ray Inspection Systems for Food Foreign Object Detection Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global X-ray Inspection Systems for Food Foreign Object Detection Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa X-ray Inspection Systems for Food Foreign Object Detection Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model