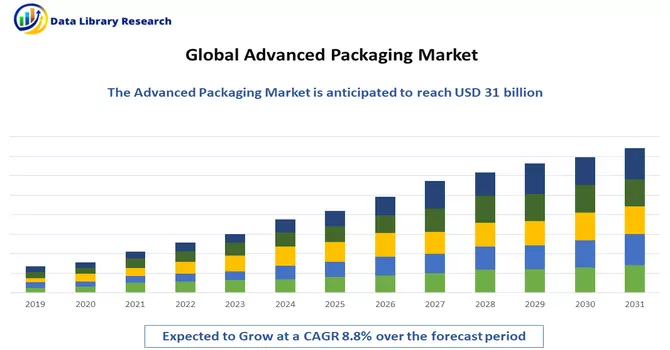

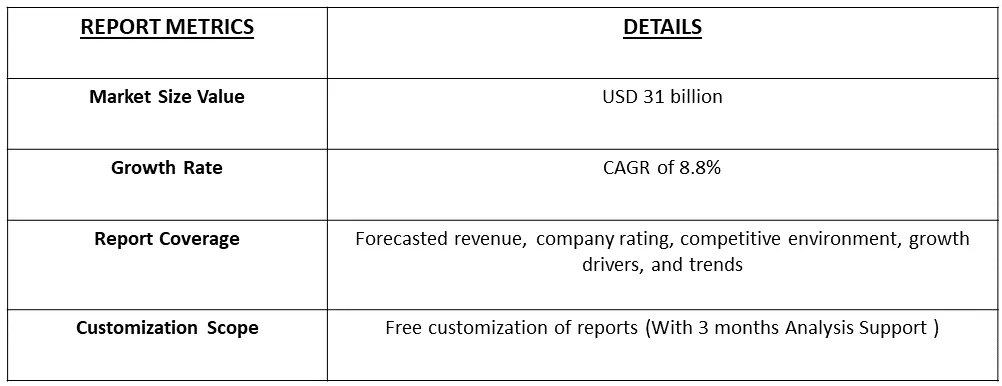

As of 2022, the global market size for advanced packaging is estimated to be USD 31 billion and is poised for substantial growth with an impressive Compound Annual Growth Rate (CAGR) of 8.8% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The advanced packaging market represents a pivotal segment within the semiconductor industry, focusing on the development of innovative and sophisticated packaging solutions for integrated circuits (ICs) or chips. In contrast to conventional packaging methods, advanced packaging employs cutting-edge techniques aimed at enhancing the performance, reliability, and form factor of semiconductor devices. This encompasses a spectrum of packaging technologies tailored to meet the evolving demands of modern electronics, spanning mobile devices, automotive systems, high-performance computing, and the Internet of Things (IoT).

A key catalyst driving the advanced packaging market is the burgeoning demand for smaller and more integrated electronic devices. The escalating expectations of consumers for compact and lightweight gadgets have created a necessity for packaging solutions that facilitate the miniaturization and integration of semiconductor components. Advanced packaging technologies, including 3D packaging and system-in-package (SiP), play a pivotal role in addressing this demand. These technologies enable the integration of multiple functions or chips into a single package, contributing to improvements in overall device performance and space efficiency.

In summary, the advanced packaging market is experiencing substantial growth, fueled by the imperative for sophisticated packaging solutions in the semiconductor industry. The adoption of cutting-edge technologies not only enhances the capabilities of semiconductor devices but also aligns with the evolving needs of the electronics industry, catering to trends such as miniaturization, integration, and the quest for more efficient and high-performance electronic gadgets.

Heterogeneous integration is the practice of amalgamating various semiconductor technologies and materials within a singular package. This emerging trend has garnered increased traction due to its capacity to seamlessly integrate diverse functionalities, encompassing analog, digital, and RF components, all within a unified chip package. The adoption of advanced packaging technologies is pivotal in propelling this shift towards system-level integration, ushering in a new era where semiconductor devices can be designed with heightened power, versatility, and consolidated functionality.

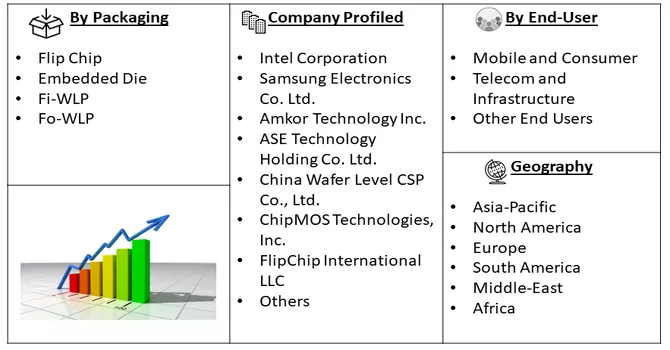

Market Segmentation: The Advanced Packaging Technologies Market is Segmented by Packaging Platform (Flip Chip, Embedded Die, Fi-WLP, Fo-WLP), By End-User (Mobile and Consumer, Telecom and Infrastructure, Other End Users), and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The report also covers market sizes and forecasts of different geographical regions.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Rising Demand for Miniaturization and Integration

One of the key drivers for the advanced packaging market is the increasing demand for miniaturization and integration of electronic components. As consumer electronics, automotive systems, and various IoT devices become more sophisticated, there is a growing need to pack more functionality into smaller spaces. Advanced packaging technologies, such as 3D packaging, system-in-package (SiP), and wafer-level packaging, enable the compact integration of chips, improving overall device performance and efficiency. For example, on May 10, 2021, Veeco Instruments Inc. disclosed the reception of an order for its AP300 Lithography System, a crucial component in the production acceleration of advanced packaging chips. These advanced packaging devices are intended to address the rising need for 5G system-on-a-chip, graphic processors (GPUs), and high-performance computing applications. The selection of AP300 systems stems from their industry-leading uptime, superior performance, and cost-effectiveness. This order serves as a clear indicator of the growing market demand for Veeco's lithography systems.

Furthermore, the technological developments are expected witness significant growth over the forecast period. For instance, in May 2020 - Synapse Electronique, a Canadian equipment electronics manufacturer and EMS provider, integrated two Universal Instruments Fuzion Platform production lines in its Shawinigan, Quebec facility. Each line includes a Fuzion2-60 and FuzionXC2-37 Platform, providing the performance to meet Synapse's long-term OEM throughput requirements and the flexibility to support stringent contract-manufacturing demands. Thus, such factors are expected to witness significant growth over the forecast period.

Increasing Complexity and Performance Requirements in Electronic Devices:

The evolving landscape of electronic devices, including smartphones, tablets, wearables, and high-performance computing systems, is characterized by a demand for enhanced functionality and performance. Advanced packaging solutions cater to this demand by providing efficient thermal management, improved signal integrity, and reduced power consumption. These packaging technologies help meet the increasing complexity and performance requirements of modern electronic devices, thereby driving the adoption of advanced packaging solutions.

Also, in August 2020 - Samsung Electronics announced the availability of its silicon-proven 3D IC packaging technology, eXtended-Cube (X-Cube), for most advanced process nodes. X-Cube enables significant leaps in speed and power efficiency to help address the rigorous performance demands of advanced applications, including 5G, artificial intelligence, high-performance computing, mobiles, and wearables. Thus, such factors are expected to witness significant growth over the forecast period.

Market Restraints:

High Initial Costs and Technological Complexity and Skill Requirements:

Implementing advanced packaging technologies often involves higher initial costs compared to traditional packaging methods. The costs associated with research and development, equipment, and materials for advanced packaging solutions can be significant. This can be a barrier, especially for smaller manufacturers or those operating on tight budgets. The high upfront investment may limit the widespread adoption of advanced packaging technologies, particularly in industries with cost-sensitive considerations. Advanced packaging technologies are often more complex than traditional packaging methods, requiring specialized skills and expertise for design, implementation, and maintenance. The need for highly skilled professionals may pose a challenge for companies looking to adopt advanced packaging solutions, especially if there is a shortage of talent with the necessary expertise. The learning curve associated with mastering these sophisticated technologies can slow down the adoption rate and may deter some companies from transitioning to advanced packaging methods.

The global pandemic triggered significant disturbances in supply chains worldwide, particularly impacting the manufacturing and distribution of electronic components essential for advanced packaging. Measures such as lockdowns, movement restrictions, and workforce challenges disrupted the entire supply chain, leading to delays and shortages in critical materials and components. The pandemic-induced changes in consumer behavior further influenced the demand landscape for various electronic devices. Notably, there was a surge in demand for products like laptops, tablets, and home electronics, while the demand for devices associated with travel and entertainment experienced a decline. These shifts in consumer preferences had direct repercussions on the types of semiconductor devices and packaging solutions in demand.

Segmental Analysis

Flip Chips Segment is Expected to Witness Significant Growth Over the Forecast Period

Flip chip packaging, also known as controlled-collapse chip connection (C4), is an advanced packaging technology used in the semiconductor industry. In flip chip packaging, the semiconductor die is flipped upside down, and its active side (with the integrated circuits) is bonded directly to the substrate or carrier, rather than being wire-bonded. The electrical connections (usually solder bumps) are on the face of the die, allowing for a shorter and more direct path for signals, leading to improved performance and thermal characteristics. Thus, due to such benefits offered, the segment is expected to witness significant growth over the forecast period.

Mobile and Consumer Segment is Expected to Witness Significant Growth Over the Forecast Period

Mobile devices and consumer electronics often require smaller form factors and lightweight designs. Advanced packaging technologies, such as flip chip packaging, System-in-Package (SiP), and Fan-Out Wafer-Level Packaging (FOWLP), enable the miniaturization of semiconductor components. This is essential for producing slim and compact devices while maintaining or enhancing functionality. Thus, due to such benefits offered, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia Pacific region exerts a dominant influence on the advanced packaging market, contributing to a market share and is anticipated to sustain robust growth with a projected Compound Annual Growth Rate (CAGR) of 8.3% throughout the forecast period. This dominance can be attributed to several key factors.

Firstly, the presence of major market players in the Asia Pacific region plays a pivotal role in steering its leadership position in the advanced packaging market. The region has emerged as a hub for semiconductor-related activities, attracting significant investments and fostering a conducive ecosystem for technological advancements.

Secondly, the rapid surge in demand for semiconductors across diverse industry verticals is a driving force behind the market's growth in Asia Pacific. Industries such as automotive, consumer electronics, aerospace, defense, and more are fueling the need for advanced packaging solutions. This escalating demand is propelled by technological advancements, the proliferation of electronic devices, and the integration of semiconductors into various applications.

Moreover, governments in the Asia Pacific region, especially in developing countries such as India, China, and South Korea, have made substantial investments in establishing semiconductor manufacturing plants. This strategic initiative aims to bolster the region's capabilities in semiconductor production, fostering technological self-sufficiency and economic growth. A noteworthy example illustrating this trend is Taiwan Semiconductor Manufacturing Co (TSMC), which, on September 29, 2021, announced plans for the development of new advanced packaging facilities in northern Taiwan. This advanced packaging fab located in Chunan is set to focus on the development of System on Integrated Chips (SoIC) technology, showcasing the region's commitment to staying at the forefront of semiconductor innovation.

Thus, the Asia Pacific's dominance in the advanced packaging market is underpinned by the convergence of major market players, burgeoning demand across diverse industries, and substantial government investments in semiconductor infrastructure. These factors collectively contribute to the region's pivotal role in driving the growth trajectory of the advanced packaging market in the foreseeable future.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market is significantly driven by end-user revenue because of the demand for the latest technology and high-speed gadgets. The companies have a sustainable competitive advantage through innovations in this market, owing to the growing need for differentiated products for various applications. The constant evolution of technological developments in smartphones, tablets, wireless communications, etc., will positively impact this industry. The Advanced Packaging Market is witnessing dominance by ten to fifteen significant players like

Feb 2021 - Siemens Digital Industries Software announced that its collaboration with Advanced Semiconductor Engineering, Inc. (ASE) generated two new enablement solutions engineered to help mutual customers create and evaluate multiple complex integrated circuit (IC) package assemblies and interconnect scenarios in a data-robust graphical environment prior to and during physical design implementation.

Recent Development:

1) In July 2020, Amkor Technology outlined its endeavors and accomplishments in the development and validation of wire bond and flip-chip packaging. These efforts were specifically targeted at devices manufactured using the advanced low-k process technologies of Taiwan Semiconductor Manufacturing Company (TSMC). Amkor collaborated with various customers on the qualification of low-k products and anticipates a significant increase in the production volume for low-k packages.

2) In March 2021, Deca, a leading pure-play technology provider in advanced semiconductor packaging, introduced its innovative APDK (Adaptive Patterning® Design Kit) methodology. This groundbreaking solution is a result of Deca's collaboration with Advanced Semiconductor Engineering Inc. (ASE) and Siemens Digital Industries Software.

Q1. What was the Advanced Packaging Market size in 2022?

As per Data Library Research the global market size for advanced packaging is estimated to be USD 31 billion in 2022.

Q2. What is the Growth Rate of the Advanced Packaging Market?

Advanced Packaging Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.8% over the forecast period.

Q3. Which region has the largest share of the Advanced Packaging Market? What are the largest region's market size and growth rate?

Asia-Pacific has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Q4. What are the Growth Drivers of the Advanced Packaging Market?

Rising Demand for Miniaturization and Integration and Increasing Complexity and Performance Requirements in Electronic Devices are the Growth Drivers of the Advanced Packaging Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model