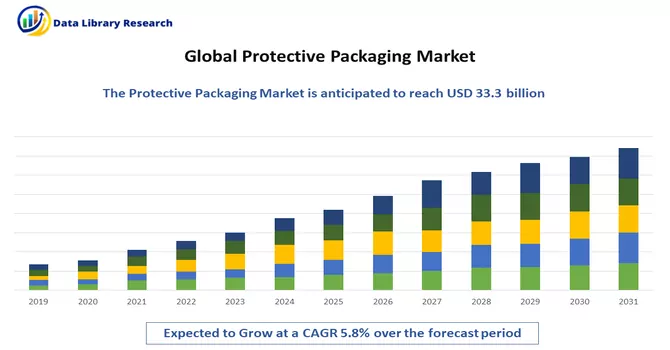

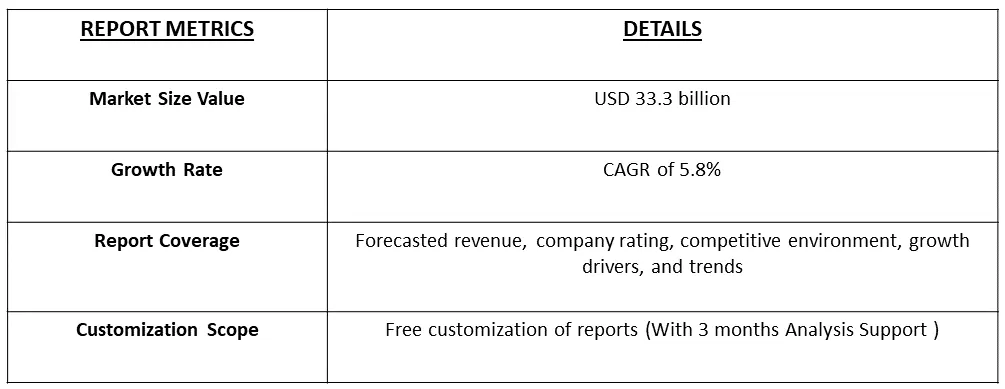

In 2022, the global protective packaging market reached a substantial valuation of USD 33.3 billion, and projections indicate a robust growth trajectory with a Compound Annual Growth Rate (CAGR) of 5.8% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Protective packaging plays a pivotal role in safeguarding products throughout their journey, encompassing transportation, storage, and handling phases. The fundamental objective of protective packaging is to mitigate the risks of damage, breakage, or contamination, thereby ensuring that goods reach their destination in optimal condition.

Diverse materials and solutions contribute to the realm of protective packaging, including but not limited to bubble wrap, foam, air pillows, corrugated cardboard, and other cushioning materials. Additionally, specialized packaging designs have emerged to effectively absorb shocks, vibrations, and external impacts that may compromise the integrity of the packaged items.

A key driving force behind the escalating demand for protective packaging is the exponential growth of e-commerce. As the direct shipment of goods to consumers becomes increasingly prevalent, there is a heightened susceptibility to damage during transit. Protective packaging serves as a crucial line of defense against these potential hazards, guaranteeing that products arrive intact. Beyond the mere preservation of physical goods, this also contributes to an enhanced overall customer experience by reducing instances of damaged or compromised products. Consequently, the strategic adoption of protective packaging not only fortifies the integrity of shipped items but also plays a pivotal role in diminishing the likelihood of returns, thereby bolstering the efficiency and satisfaction levels of the entire supply chain.

There is a discernible shift towards prioritizing sustainable and environmentally friendly packaging solutions within the protective packaging sector. Both manufacturers and consumers are growing more conscious of the ecological repercussions associated with packaging materials. Consequently, a notable trend has emerged, steering the protective packaging market towards the adoption of recycled and recyclable materials. Moreover, there is a concerted effort in developing packaging solutions that leave a minimal environmental footprint. A noteworthy development within the industry is the increasing integration of smart technologies into packaging. This involves incorporating features such as sensors, RFID tags, or QR codes, which serve various functions such as real-time tracking, temperature monitoring, and other capabilities. The implementation of these technologies has gained significant traction as they contribute to heightened supply chain visibility and enhanced product safety.

The utilization of smart packaging solutions goes beyond traditional protective measures, introducing a new dimension of functionality and efficiency. These technological advancements not only address environmental concerns but also elevate the overall performance of protective packaging by providing valuable insights and control throughout the entire supply chain. This dual focus on sustainability and innovation is reshaping the protective packaging landscape, aligning it with the evolving demands of a conscientious market and fostering a more responsible and tech-savvy approach to packaging solutions.

Market Segmentation: The Protective Packaging Market is segmented by Material Type (Plastic, Paper and Paperboard), Product (Rigid, Flexible, and Foam), End-user Vertical (Food and Beverage, Industrial, Pharmaceutical, Consumer Electronics, Beauty and Home Care), and Geography.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

E-commerce Growth

The relentless growth of e-commerce stands out as a major catalyst propelling the protective packaging market forward. The surge in online retail activities has generated a heightened demand for packaging solutions that can effectively navigate the intricacies of the e-commerce supply chain. This includes addressing challenges related to handling, transportation, and potential impacts encountered during the crucial last-mile delivery phase. Within this dynamic landscape, protective packaging emerges as a pivotal component, serving an indispensable role in guaranteeing that products ordered through online platforms reach customers in pristine condition.

The imperative for protective packaging in the realm of e-commerce extends beyond the conventional functions of safeguarding against wear and tear. It becomes a linchpin in mitigating the risks associated with the various stages of the digital retail journey, from distribution centers to the ultimate doorstep delivery. The overarching objective is to reduce the vulnerability of products to damage, ensuring they arrive at the customer's doorstep in optimal condition. In doing so, protective packaging not only minimizes the potential for losses due to damaged goods but also significantly contributes to elevating the overall customer experience. As e-commerce continues its expansion, the role of protective packaging becomes increasingly pivotal in meeting the evolving challenges and expectations of a dynamic online retail landscape.

Growing awareness and concerns about environmental sustainability

The burgeoning awareness and heightened concerns surrounding environmental sustainability have emerged as pivotal catalysts within the protective packaging market. There is a palpable shift in consumer preferences and regulatory expectations, both advocating for the widespread adoption of packaging solutions that are not only protective but also eco-friendly. This collective consciousness has spurred a notable transformation, prompting the development and embrace of protective packaging materials characterized by recyclability, biodegradability, or composition from recycled content. The integration of recyclable and biodegradable materials, as well as the utilization of recycled content, marks a paradigm shift in the protective packaging landscape. This shift is not merely a response to market trends but a proactive commitment to environmental stewardship. In essence, sustainability has become a driving force shaping the trajectory of the protective packaging market, influencing a responsible and forward-thinking approach that resonates with the growing global emphasis on preserving and safeguarding our planet.

Market Restraints

Cost Concerns and Environmental Challenges of Packaging Materials:

The financial implications associated with the implementation of protective packaging solutions pose a significant hurdle for businesses. The costs involved in acquiring high-quality protective materials, especially those tailored for specific purposes such as safeguarding temperature-sensitive or fragile products, can be notably elevated. Striking a balance between the imperative for effective protection and the budgetary constraints of packaging becomes a challenge, particularly in industries where profit margins are tightly managed. Consequently, the pursuit of both effective product protection and environmentally friendly packaging solutions becomes a delicate equilibrium for companies. The inherent challenge lies in identifying materials and strategies that not only meet stringent protective standards but also align with the growing emphasis on sustainability. This intricate balancing act underscores the evolving landscape where businesses must navigate the trade-offs between protective efficacy, cost considerations, and environmental responsibility.

The pandemic, marked by lockdowns and restrictions on in-person shopping, triggered a notable surge in online shopping activities. This heightened reliance on digital retail channels significantly increased the demand for protective packaging to guarantee the secure and safe delivery of goods purchased online. E-commerce packaging, specifically crafted to shield products during the transit phase, experienced an unprecedented uptick in demand.

During the pandemic, there was an evident spike in the requirement for essential goods, spanning categories such as food, healthcare products, and personal care items. The escalated production and distribution of these essential items necessitated the implementation of appropriate protective packaging to ensure product safety and hygiene standards were met. In this context, packaging materials designed to provide protection against contamination and preserve the freshness of perishable items assumed paramount importance. As lockdown measures compelled consumers to turn to online platforms for their shopping needs, the role of protective packaging became instrumental in not only safeguarding products during the delivery process but also in upholding the integrity and quality of essential items. The increased demand for e-commerce packaging, coupled with the specific requirements of essential goods, underscored the critical nature of protective packaging in maintaining the safety, hygiene, and overall quality of products amid the unique challenges posed by the global health crisis.

Segmental Analysis:

Food and Beverage is Expected to Witness Significant Growth Over the Forecast Period

Ensuring the safety and hygiene of food and beverage products is paramount. Protective packaging is designed to prevent contamination, maintain product integrity, and comply with regulatory standards. Packaging materials and designs must be chosen to safeguard products from external factors, including physical damage, moisture, and microorganisms. Protective packaging helps extend the shelf life of perishable food and beverage items. Packaging solutions with barrier properties, such as those that protect against oxygen and light exposure, contribute to preserving the freshness and quality of products. This is particularly important for items with shorter shelf lives or those sensitive to environmental factors. Thus, owing to such benefits the segment is expected to witness significant growth over the forecast period.

Paperboard Segment is Expected to Witness Significant Growth Over the Forecast Period

Paperboard is a versatile and sustainable packaging material widely used in various industries for packaging and labeling purposes. It is a thick and rigid type of paper that provides durability and strength, making it suitable for protecting and presenting a wide range of products. Paperboard finds applications in diverse industries, including food and beverage, pharmaceuticals, cosmetics, electronics, and more. It is used for packaging boxes, cartons, sleeves, and other containers. Paperboard offers excellent printability, allowing for vibrant and high-quality graphics. This makes it an ideal choice for branding and marketing purposes. Thus, owing to such benefits the segment is expected to witness significant growth over the forecast period.

Flexible Segment is Expected to Witness Significant Growth Over the Forecast Period

The flexible packaging segment is poised for substantial growth over the forecast period, driven by a confluence of factors that underscore its increasing popularity and market demand. Consumers are increasingly drawn to the convenience offered by flexible packaging, which often includes features like resealable closures, easy-to-open seals, and portion control. This aligns with evolving consumer lifestyles and preferences. Flexible packaging is inherently lightweight, which translates to reduced material consumption during production and transportation. This not only contributes to cost savings but also aligns with sustainability goals by minimizing resource use. In conclusion, the flexible packaging segment is primed for significant growth, driven by its adaptability, convenience, sustainability considerations, preservation capabilities, innovations in design and functionality, and responsiveness to evolving market dynamics. The forecasted expansion of this segment underscores its central role in meeting the dynamic demands of diverse industries in the packaging landscape.

North America is Expected to Witness Significant Growth Over the Forecast Period

The North American region is expected to experience rapid growth in terms of Compound Annual Growth Rate (CAGR) throughout the forecast period. This surge can be attributed to the heightened prevalence of online shopping through popular e-commerce platforms like Amazon, Shein, and Grubhub in the region. These prominent companies offer comprehensive packaging guidelines and recommendations to sellers, underscoring the significance of employing suitable protective packaging solutions. The focus of these guidelines is to ensure that products are shielded from various risks encountered during the shipping process. Manufacturers stand to benefit significantly from the adoption of protective packaging solutions as it enables them to deliver products in optimal condition. This, in turn, not only enhances customer satisfaction but also acts as a driving force for market growth within the North America.

The U.S. protective packaging sector is propelled by the expansion of e-commerce platforms, a trend attributed to the busy lifestyles of consumers. Numerous pivotal companies are consistently innovating, introducing novel materials, designs, and technologies to cater to the dynamic requirements of e-commerce enterprises. Examples of these advancements include inflatable air cushions, environmentally sustainable protective packaging, and molded foam inserts. Sealed Air, as an illustration, has introduced a specialized on-demand protective foam packaging solution named Instapak Quick RT, specifically designed to cater to the unique needs of e-commerce businesses across the country. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The protective packaging market features a moderately fragmented competitive landscape with diverse vendors offering a range of products and solutions. Within this landscape, market players are strategically prioritizing merger and acquisition activities as part of their initiatives to secure and expand their market share.

Some prominent players in the global protective packaging industry include:

Recent Development:

1) In June 2019, Warburg Pincus, a global private equity firm, entered into an agreement to acquire Pregis LLC, a manufacturer specializing in protective packaging materials and automated systems. The acquisition was facilitated from Olympus Partners, with headquarters in Stamford, Connecticut. This strategic move signaled a significant development in the protective packaging sector, with Warburg Pincus positioning itself to strengthen its presence and influence in the industry through the acquisition of Pregis LLC.

2) In February 2023, Smurfit Kappa introduced the Vitop Uni taps as a new addition to its bag-in-box product lineup. This innovation is designed to offer enhanced security measures, guarding against tampering with the packaging throughout its entire distribution process.

Q1. What was the Protective Packaging Market size in 2022?

As per Data Library Research the global protective packaging market reached a valuation of USD 33.3 billion in 2022.

Q2. At what CAGR is the protective packaging market projected to grow within the forecast period?

The Protective Packaging Market is Expected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% over he forecast period.

Q3. What are the factors driving the protective packaging market?

Key factors that are driving the growth include the E-commerce Growth and Growing awareness and concerns about environmental sustainability.

Q4. What segments are covered in the Protective Packaging Market Report?

By Material Type, By Product, End-User and Geography these are the segments covered in the Protective Packaging Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model