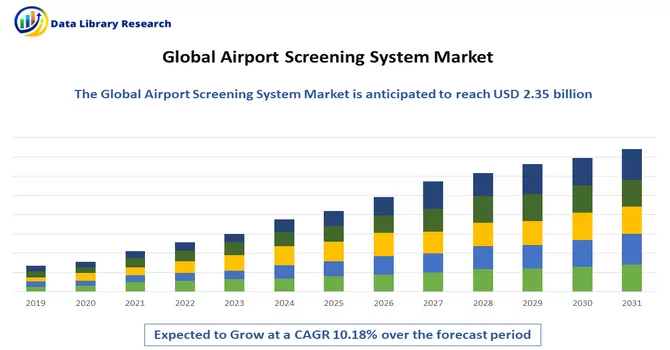

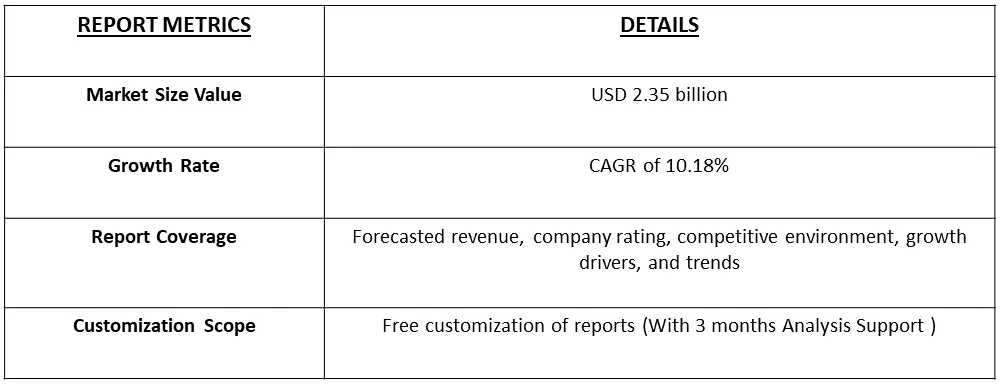

The airport passenger screening systems market was worth USD 2.35 billion in 2022. During the forecast period, 2023-2030, it is expected to register a CAGR of 10.18%.

Get Complete Analysis Of The Report - Download Free Sample PDF

Airport passenger screening systems refer to a comprehensive set of technologies and procedures implemented at airports to ensure the security and safety of passengers, their belongings, and aviation assets. These systems are designed to identify and mitigate potential threats by screening individuals and their luggage before they board flights. Key components of airport passenger screening systems include various imaging technologies such as X-rays, millimeter-wave scanners, and advanced imaging technology (AIT). Additionally, biometric screening, metal detectors, explosive trace detection, and other technologies may be employed to enhance security measures. The primary objectives of these systems are to detect prohibited items, including weapons and explosives, and to verify the identity of passengers while maintaining a balance between ensuring security and facilitating the smooth flow of passengers through airport.

The escalating frequency of terrorist attacks and various acts of violence globally has led to heightened vigilance and stricter customs and border security measures in every nation. Consequently, airport security has emerged as a significant concern, prompting the implementation of robust airport passenger screening systems. Prior to the onset of the pandemic, there was a rapid surge in the number of individuals opting for air travel. This substantial increase in air travelers posed a significant challenge for airports, as they grappled with the management of such large passenger volumes. The surge in passenger numbers necessitated the establishment of enhanced security measures to address the growing demand and ensure the safety of all travelers.

The global pandemic has accelerated the adoption of contactless screening solutions. Technologies that minimize physical contact, such as touchless biometrics and remote screening options, have gained traction to address health and safety concerns. Stringent regulatory requirements continue to shape the market. Airport operators and screening system manufacturers are aligning their solutions with international standards to ensure compliance and interoperability across different regions.

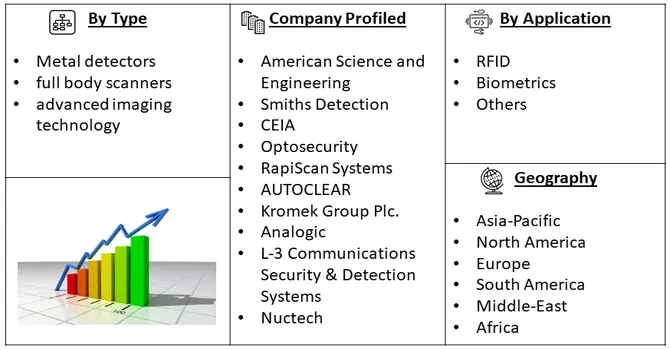

Market Segmentation: The Airport Passenger Screening Systems Market is segmented by type (metal detectors, full body scanners, and advanced imaging technology) and geography (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa). The Market Size and Forecasts Are Provided in Terms of Value (USD Million) for All the Above Segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Driver :

Increasing Connectivity Of Screening Systems

The rising interconnectivity of screening systems within the airport security landscape has brought forth a critical imperative for an intensified focus on cybersecurity. This increased connectivity, while fostering efficiency and information sharing, concurrently amplifies the vulnerability to potential cyber threats. As technology evolves, the aviation industry recognizes the necessity of safeguarding screening technologies against unauthorized access, data breaches, and cyber intrusions. Heightened awareness of the ever-growing spectrum of cyber threats has become a driving force behind substantial investments in fortifying the cybersecurity framework surrounding screening systems. Airport authorities, regulatory bodies, and technology providers are acutely attuned to the potential risks associated with cyber attacks, which could compromise the integrity of sensitive data and disrupt the seamless functioning of security systems. Thus, such factors are expected to witness significant growth over the forecast period

Increasing Government Initiatives and Investments

Government initiatives aimed at enhancing national security frequently entail substantial investments in airport infrastructure and screening systems. This strategic commitment recognizes the pivotal role that secure and robust aviation facilities play in safeguarding a nation against various threats, including terrorism and illegal activities. The collaborative efforts between the public sector and private entities, facilitated through public-private partnerships (PPPs), are instrumental in achieving these objectives. Governments allocate significant funds to upgrade and modernize airport infrastructure, emphasizing the integration of advanced technologies and state-of-the-art screening systems. This investment ensures that airports are equipped with cutting-edge facilities capable of addressing evolving security challenges. Thus, such factors are expected to witness significant growth over the forecast period.

Market Restraints :

Hight Initial Cost of Implementation

The deployment of advanced airport screening systems often involves significant upfront costs for airports and aviation authorities. The acquisition and installation of cutting-edge technologies, such as advanced imaging systems and biometric solutions, can be capital-intensive. This financial barrier may limit the adoption of the latest security technologies, particularly for smaller airports or those operating under budget constraints. Integrating new screening systems into existing airport operations can lead to operational disruptions. Implementation processes may require downtime, impacting the normal flow of passenger traffic and potentially causing delays. Airports must carefully plan and execute the installation of new systems to minimize disruptions and maintain operational efficiency. Thus, such afctors are expected to slow down the growth of the studied market.

The COVID-19 pandemic has significantly impacted the global airport screening system market, reshaping priorities and accelerating certain trends within the industry. The unprecedented decline in air travel demand during the pandemic resulted in reduced passenger traffic at airports globally. This decline directly affected the demand for airport screening systems, leading to delays or cancellations of planned system installations or upgrades. The need for social distancing and reducing physical contact accelerated the adoption of remote screening solutions. Technologies allowing certain screening processes to be conducted off-site gained traction, providing flexibility in managing security operations. Thus, the COVID-19 pandemic has reshaped the global airport screening system market, influencing priorities, accelerating specific trends, and emphasizing the need for adaptability in the face of unforeseen challenges. As the industry navigates the post-pandemic landscape, a balance between security, health, and operational efficiency will continue to shape the evolution of airport screening systems.

Segmental Analysis:

Advanced Imaging Technology Segment is Expected to Witness Significant Growth Over the Forecast Period

During the forecast period, the advanced imaging technology segment is poised to experience substantial growth, primarily attributed to heightened investments by airport authorities in imaging technology-based passenger screening systems. This strategic shift is geared towards achieving efficient and contactless screening. The advanced imaging technology (AIT) system emerges as a pivotal player, facilitating the screening of passengers for both metallic and non-metallic threats without any physical contact, employing cutting-edge imaging technologies such as X-rays and computed tomography (CT).

The surge in market growth is further propelled by the escalating air traffic volumes and an increased emphasis on security concerns at airports. Post the pandemic, airports worldwide have incorporated new imaging technology to champion contactless screening protocols. Notably, U.S. airports took the lead in adopting AIT passenger screening systems, driven by initiatives from the Transportation Security Administration (TSA). Presently, the TSA is intensifying efforts to expand the integration of technology across U.S. airports. A case in point is Analogic Corporation's announcement in March 2022, revealing the deployment of the ConneCT computed tomography (CT) checkpoint security screening system at a TSA checkpoint in Plattsburgh International Airport (PBG), U.S. The integration of this new CT system aligns with the TSA's Checkpoint Property Screening Systems (CPSS) program, wherein Analogic aims to install over 300 mid-size CPSS systems across airport security checkpoints nationwide. Similar proactive initiatives by airport operators in various regions are anticipated to drive significant growth within the advanced imaging technology segment throughout the forecast period.

Asia-Pacific Region is Expected to Witness Significant growth Over the Forecast Period

Over the forecast period, the Asia-Pacific region is set to experience the most significant growth, and several factors contribute to this optimistic outlook. A key driver is the ongoing construction of new airports and the modernization efforts of existing facilities. This trend is particularly prominent in countries like India, China, Vietnam, and Thailand, where efforts are underway to increase the passenger-handling capacities of airports.

For example, the Indian government announced plans in January 2022 to build 16 new airports across five states. This initiative is part of the PM Gati Shakti-National Master Plan, which aims to improve multi-level connectivity across the country. Such government-led initiatives are expected to create a demand surge for advanced passenger screening systems. Noteworthy is the case of Incheon International Airport Corporation (IIAC), which, in September 2021, selected Smiths Detection to supply HI-SCAN 10080 XCT for hold baggage screening at Terminal 2 of Incheon International Airport (ICN) as part of its Phase 4 Expansion Construction Project.

Additionally, airport authorities are proactively replacing outdated passenger screening systems to enhance efficiency and speed. For instance, the Perth Airport initiated the "Passenger Screening Reform (CT Upgrade)" project in January 2022. This project involves upgrading screening infrastructure across all terminals, introducing new body scanners, explosive trace detection systems, walkthrough metal detectors, x-ray machines, and secondary viewing stations with explosive trace detectors. Such forward-thinking procurement strategies are expected to significantly boost market growth in the Asia-Pacific region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The current landscape of passenger screening systems is undergoing a notable phase of consolidation. Companies within the industry are strategically positioning their products and services to excel in specific niches or opting to transform into comprehensive manufacturers and providers of security and detection products. This strategic evolution reflects a dynamic effort to optimize offerings, whether by specializing in particular types of products to achieve excellence in a specific area or by adopting a holistic approach to deliver a complete suite of security and detection solutions. This trend underscores a deliberate and forward-thinking adaptation within the market, as businesses seek to streamline their operations and cater effectively to the evolving needs of the passenger screening systems sector.

Recent Developments:

1) March 2023: The Central Industrial Security Force (CISF) in India commenced the deployment of cutting-edge full-body scanners in airports nationwide, marking a significant step towards enhancing security systems and passenger convenience throughout the country's airports.

2) February 2023: London Luton Airport (LLA) in the United Kingdom unveiled a strategic partnership with Leidos to usher in technological advancements in passenger screening systems across all security checkpoints within the airport premises. Leidos assumes the role of the primary contractor for the airport's security systems, taking charge of overseeing all subcontractors and consultants involved in the comprehensive project.

Q1. What was the Airport Screening System Market size in 2022?

As per Data Library Research the airport passenger screening systems market was worth USD 2.35 billion in 2022.

Q2. What is the Growth Rate of the Airport Screening System Market?

Airport Screening System Market is expected to register a CAGR of 10.18% over the forecast period.

Q3. What Impact did COVID-19 have on the Airport Screening System Market?

The COVID-19 pandemic has significantly impacted the global airport screening system market, reshaping priorities and accelerating certain trends within the industry. For more insights request a sample here.

Q4. What are the Growth Drivers of the Airport Screening System Market?

Increasing Connectivity Of Screening Systems and Increasing Government Initiatives and Investments are the Growth Drivers of the Airport Screening System Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model