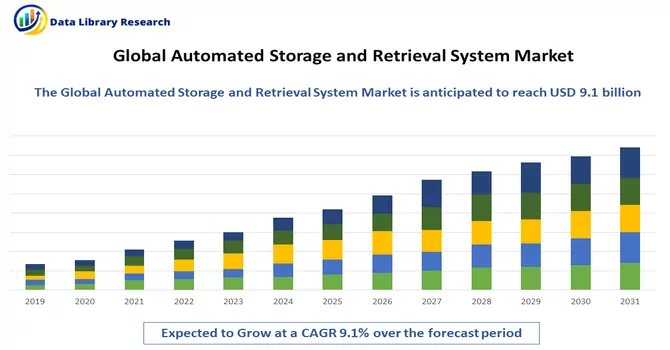

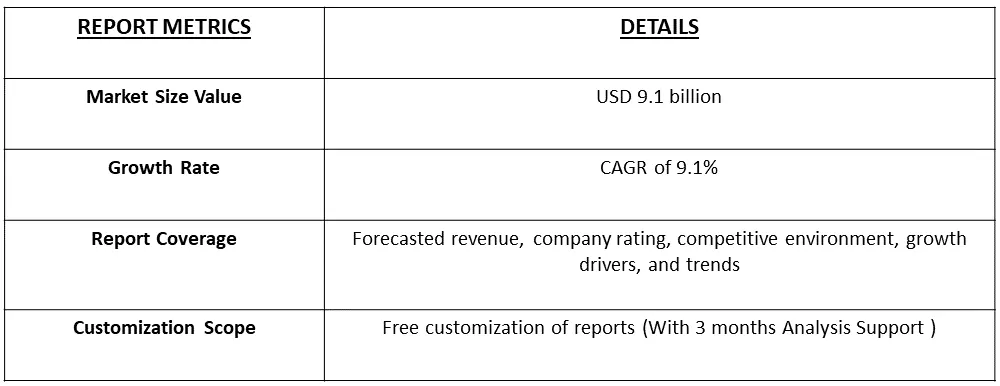

The global Automated Storage and Retrieval System Market in terms of revenue was estimated to be worth USD 9.1 billion in 2023 and is expected to register a CAGR of 9.1% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Automated Storage and Retrieval System (AS/RS) is a sophisticated warehouse technology designed to automate and streamline the storage and retrieval of goods in a warehouse or distribution center. This system utilizes a combination of computer-controlled hardware, such as robotic arms, conveyors, and stacker cranes, along with warehouse management software to efficiently manage inventory. AS/RS optimizes storage space by maximizing vertical storage and minimizing the need for manual intervention in material handling processes. It is widely used in industries with high-volume storage and retrieval needs, such as manufacturing, e-commerce, and logistics, to enhance efficiency, accuracy, and overall warehouse management.

The surge in e-commerce, evolving consumer preferences, and a worldwide shortage of labor are prompting a demand for adaptable automated solutions to expedite and enhance order fulfillment and distribution processes. Automated Storage and Retrieval System (ASRS) technology is becoming increasingly essential in manufacturing facilities, warehouses, and distribution centers, playing a crucial role in materials transport and inventory management. These systems find widespread application in diverse industries, including cold storage, automotive, pharmaceutical manufacturing, food and beverage, and e-commerce. The flexibility and efficiency offered by ASRS technology address the dynamic challenges posed by the contemporary landscape of commerce, where rapid order processing and streamlined inventory management are paramount.

The Automated Storage and Retrieval System (ASRS) technology market is marked by several significant trends. The surge in e-commerce is a key driver, propelling the adoption of ASRS solutions to streamline order fulfillment and meet the demands of last-mile delivery. A notable shift towards flexible and scalable systems is observed, with businesses seeking modular solutions adaptable to changing operational needs. Integration with robotics and artificial intelligence is enhancing precision and speed in material handling, while the emergence of micro-fulfillment centers in urban areas is reshaping warehouse strategies. Additionally, there is increased application in cold storage, a focus on sustainability, and a heightened emphasis on safety features and collaborative robots, reflecting the evolving dynamics of industrial automation and logistics optimization.

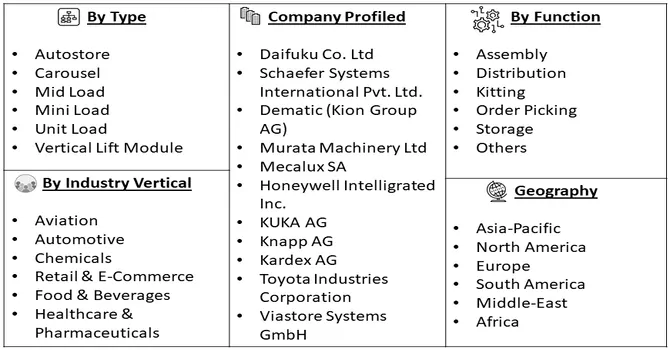

Market Segmentation: The Automated Storage and Retrieval System Market is segmented by Product Type (Fixed Aisle System, Carousel (Horizontal Carousel + Vertical Carousel), Vertical Lift Module), and Geography (North America, Asia-Pacific, Europe, South America, Middle-East and Africa). The report offers market size and forecasts in value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increased Emphasis on Workplace Safety

The Automated Storage and Retrieval System (ASRS) market is witnessing a notable trend with an increased emphasis on workplace safety. As businesses strive to create secure and accident-free environments, the integration of ASRS technology aligns with the overarching goal of enhancing workplace safety. ASRS systems contribute to safety by automating material handling processes, reducing the need for manual labor in potentially hazardous environments. The precision and reliability of ASRS technology minimize the risk of accidents and injuries associated with traditional manual handling methods. With safety becoming a paramount concern for industries, the adoption of ASRS not only enhances operational efficiency but also reflects a commitment to creating safer working environments, positioning it as a critical element in the evolving landscape of workplace safety.

Growth of E-commerce in Developing Countries

The burgeoning growth of e-commerce in developing countries is intricately intertwined with the expansion of the Automated Storage and Retrieval System (ASRS) market. As e-commerce continues to thrive in these regions, the demand for advanced warehousing and logistics solutions, such as ASRS, has witnessed a substantial upswing. The dynamic nature of online retail, characterized by high order volumes and the need for swift order fulfillment, positions ASRS as a vital technology for optimizing storage and retrieval processes. Automated systems play a pivotal role in enhancing the efficiency of e-commerce operations by streamlining inventory management, reducing order processing times, and mitigating errors. As developing countries increasingly embrace the digital marketplace, the adoption of ASRS in e-commerce fulfillment centers becomes a strategic imperative, driving the growth and evolution of the global ASRS market. The symbiotic relationship between the rise of e-commerce and the utilization of ASRS underscores their collective impact on reshaping the logistics landscape in developing economies.

Market Restraints:

Need for Skilled Workforce and Concerns over Replacement of Manual Lab

The global Automated Storage and Retrieval System (ASRS) market faces potential challenges stemming from the need for a skilled workforce and concerns over the replacement of manual labor. While ASRS technology promises increased efficiency and automation in material handling, its successful implementation requires a workforce with specialized skills in system operation, maintenance, and troubleshooting. The demand for such skilled professionals may present a bottleneck, slowing down the pace of market growth. Additionally, apprehensions about job displacement and the potential resistance to fully automated systems replacing manual labor in certain industries may contribute to a cautious adoption of ASRS technology. Striking a balance between technological innovation and workforce considerations will be crucial for navigating these challenges and ensuring the sustainable and widespread adoption of ASRS solutions globally.

The COVID-19 pandemic has significantly impacted the Automated Storage and Retrieval System (AS/RS) market, influencing both demand and supply dynamics. While disruptions in the global supply chain and manufacturing operations initially led to project delays and uncertainties, the increased emphasis on e-commerce and the need for efficient warehouse management has accelerated the adoption of AS/RS solutions. The pandemic has underscored the importance of automated storage systems in maintaining operational continuity, ensuring social distancing norms in warehouse environments, and coping with fluctuating demand patterns. As businesses prioritize resilience and flexibility in their supply chains, the AS/RS market has witnessed a heightened focus on technologies such as robotics, artificial intelligence, and data analytics to enhance system intelligence and adaptability. However, the long-term impact remains contingent on the pace of economic recovery, the evolution of e-commerce trends, and ongoing global efforts to manage and overcome the pandemic.

Segmental Analysis:

Fixed Aisle System Segment is Expected to Witness Significant Growth Over the Forecast Period

The Fixed Aisle System segment is a crucial component within the global Automated Storage and Retrieval System (ASRS) market, representing an advanced warehousing solution that optimizes space and enhances efficiency. This system is characterized by a rigid structure of shelves, racks, or stacks within a confined aisle, where automated storage and retrieval operations take place. The Fixed Aisle System is designed to accommodate high-density storage, utilizing stacker cranes or robotic systems to access and retrieve items with precision. This segment finds widespread application across various industries, including manufacturing, e-commerce, and logistics, where optimizing storage space and streamlining retrieval processes are paramount. The Fixed Aisle System, with its automated and space-efficient features, contributes significantly to the overall growth and sophistication of the global ASRS market, addressing the evolving needs of modern warehouses and distribution centers.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America boasts one of the world's largest retail markets, with a substantial presence of omnichannel vendors driving robust demand for material handling solutions, particularly Automated Storage and Retrieval Systems (ASRS). The e-commerce sector, seeking high throughput operations in fulfillment centers, is a major consumer of ASRS in the region. The United States, a key player in the North American retail landscape, witnesses continuous sales growth in e-commerce, emphasizing the pivotal role of automation in fostering competitiveness between online and omnichannel retailers. With a high number of online shoppers and exceptional internet penetration (89.4%), the region's retail industry thrives on technological advancements. Recognizing the significance of ASRS, retailers are integrating the technology for tangible benefits, including loyalty perks, and creating a seamless consumer experience. Moreover, spurred by the surge in demand during the COVID-19 pandemic, investments in ASRS development have been notable, exemplified by initiatives like Next Generation Manufacturing Canada's USD 5 million investment in projects aiming to enhance ASRS technologies for pandemic mitigation.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market demonstrates a competitive landscape, with key players employing strategies such as product innovation and mergers and acquisitions. The increasing involvement of major manufacturers in the automated storage and retrieval sector is poised to heighten competitive dynamics throughout the forecast period. Influential market incumbents, including Daifuku and Schaefer Systems International Pvt Ltd., exert substantial influence over the overall market trajectory. Furthermore, the widespread adoption of these systems, particularly in warehouse automation, significantly contributes to the competitive stance of major players. As the market continues to evolve, the strategic moves and innovative approaches of key participants are crucial determinants shaping the competitive environment within the automated storage and retrieval sector. Some of the market players are:

Recent Development:

1) In June 2023, Hy-Tek Intralogistics and Hai Robotics joined forces to develop an Automated Storage and Retrieval System (ASRS) for a manufacturing and engineering company in Ohio, specifically designed for a GTP buffer system application. This innovative system incorporates Hai Robotics' autonomous case-handling robots, compact and tall tote retrieval robots capable of navigating a storage grid and reaching heights of 32+ feet for efficient goods storage. Noteworthy features of this solution include three varied heights of the racking, the integration of two different sizes of totes within a single system, and the implementation of double deep tote storage for enhanced storage capacity.

2) In a separate initiative, Wichita State University, in collaboration with Deloitte, launched The Smart Factory@Wichita in September 2020. This initiative includes a comprehensive production line, automated storage facilities, and experimental labs, serving as a hub for advancing technological expertise in manufacturing. The Smart Factory@Wichita aims to foster innovation and collaboration in the realm of automated manufacturing, showcasing a commitment to cutting-edge technologies and industry advancements.

Q1. What was the Automated Storage and Retrieval System Market size in 2023?

As per Data Library Research the global Automated Storage and Retrieval System Market in terms of revenue was estimated to be worth USD 9.1 billion in 2023.

Q2. At what CAGR is the Automated Storage and Retrieval System market projected to grow within the forecast period?

Automated Storage and Retrieval System Market is expected to register a CAGR of 9.1% over the forecast period.

Q3. What are the factors driving the Automated Storage and Retrieval System market?

Key factors that are driving the growth include the Increased Emphasis on Workplace Safety and Growth of E-commerce in Developing Countries.

Q4. Which region has the largest share of the Automated Storage and Retrieval System market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model