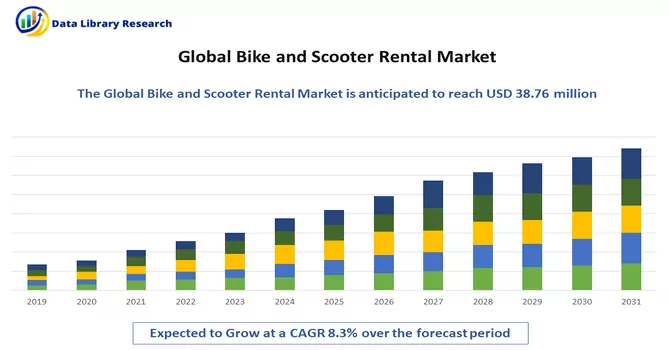

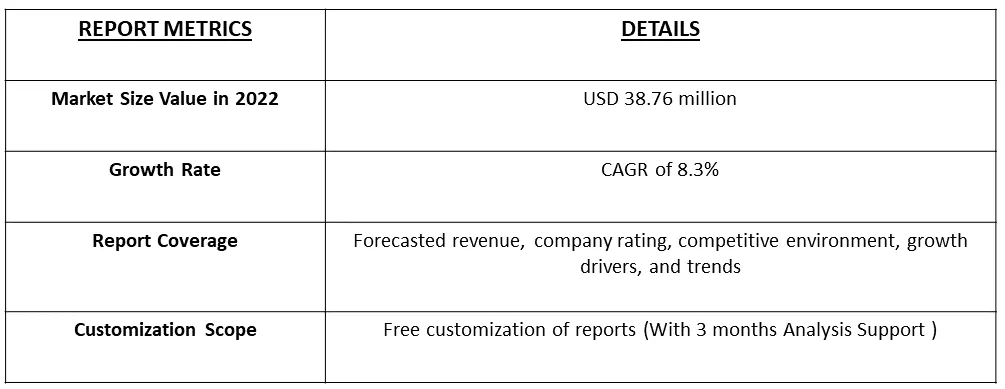

The two-wheeler rental market was valued at USD 38.76 million in 2022 registering a CAGR of more than 8.3% during the forecast period (2023 – 2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Two-wheeler rental provides an easy and convenient way to own a motorcycle without paying any maintenance costs for it. Two-wheeler rental companies offer motorcycles/scooters as per the requirement of the customer based on the hourly, daily, weekly, and monthly renting duration, along with additional facilities like panniers, helmets, riding gears, and many more.

The Bike and Scooter Rental market has witnessed significant growth over the past decade, driven by changing consumer preferences, urbanization, and the increasing need for convenient and eco-friendly transportation options.

The shift towards electric scooters and bikes is a prominent trend in the market. Electric vehicles offer enhanced convenience and are perceived as a greener option. The inclusion of e-bikes and e-scooters in micro-mobility services has gained popularity, offering users flexibility and a wider range of transportation choices. Many rental companies are partnering with public transportation providers, ride-sharing companies, and local businesses to expand their reach and improve customer convenience. Moreover, companies are increasingly focusing on sustainability by adopting greener practices, including the use of renewable energy for charging and implementing recycling programs.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Rapid Urbanization and Cost Efficiency in Developing Countries

Rapid urbanization in developing countries has led to a surge in demand for cost-effective transportation options. Bike and motorcycle rentals have emerged as a popular choice for commuters, tourists, and students alike. These rentals offer a convenient and affordable way to navigate through congested urban areas, especially during peak hours. For instance, a report published by Economic Times in February 2022, reported that urbanization in developing countries is expected to increase by 2.5% annually, with the majority of this growth occurring in Asia and Africa. This trend has led to an increase in traffic congestion, air pollution, and road accidents. In response, many cities have implemented bike-sharing programs and encouraged the use of motorcycles as an alternative mode of transportation. Also, bike-sharing programs have been successful in many cities across the world, including Beijing, Paris, and New York City. These programs allow users to rent bikes for short periods of time at low costs. They are often equipped with GPS tracking systems and mobile apps that make it easy for users to locate and rent bikes.

Motorcycle rentals are also gaining popularity in many developing countries. In India, for example, motorcycle rentals have become a popular choice for tourists who want to explore the country’s scenic landscapes. These rentals offer a cost-effective way to travel long distances without having to worry about public transportation schedules or expensive taxi fares.

In conclusion, bike and motorcycle rentals are emerging as a popular choice for commuters and tourists in developing countries. They offer a cost-effective and convenient way to navigate through congested urban areas while reducing traffic congestion and air pollution.

Bike and Scooter Rental Market Technological Developments

The integration of GPS, mobile apps, and IoT technology has revolutionized the way people rent bikes and scooters. With the help of these technologies, users can easily locate and rent bikes and scooters, enhancing the overall user experience. GPS technology helps users locate the nearest bike or scooter rental station, while mobile apps allow them to reserve a bike or scooter in advance. IoT technology enables users to track their rented bikes or scooters in real time, ensuring that they are always aware of their location and status. This integration has made it possible for bike and scooter rental companies to offer more flexible rental options, such as hourly rentals, daily rentals, and long-term rentals. It has also made it easier for users to pay for their rentals using mobile payment options. Thus, the integration of GPS, mobile apps, and IoT technology has made renting bikes and scooters more convenient and accessible than ever before, thereby contributing to the studied market’s growth.

Restraints:

Safety Concerns and Regulatory Challenges

The lack of proper infrastructure, traffic accidents, and concerns over personal safety have raised questions about the safety of bike and scooter rentals, discouraging some potential users. Many cities and regions have struggled to implement effective regulations for bike and scooter rentals, leading to issues related to parking, user behavior, and liability.

The COVID-19 pandemic had a mixed impact on the Bike and Scooter Rental market. While usage decreased during lockdowns due to reduced commuting and safety concerns, the industry rebounded as lockdowns eased. In the post-pandemic era, consumers are increasingly turning to bike and scooter rentals as a safe and socially distanced mode of transportation.

Segmental Analysis:

Short-Term Rentals Capturing Significant Demand Over the Forecast Period

Cities across the nation are grappling with a crisis of traffic congestion and pollution brought about by rapid urbanization, which is placing immense strain on public transportation systems. The two-wheeler rental market is emerging as a viable solution to this challenge while simultaneously giving a significant boost to local tourism. This is particularly appealing to the younger generation, who prefer to explore their surroundings on two wheels due to its affordability and convenience.

Several startups, including VOGO and Bounce, have introduced QR-based dockless rental scooters. This innovative system enables users to unlock and utilize scooters through smartphone applications. Meanwhile, local players in the traditional motorcycle rental sector are catering to daily commuters by offering monthly and weekly rental services.

Moreover, developing countries like India are also gradually witnessing the introduction of electric scooters. Startups like Zipp and eBikeGo have initiated electric scooter rental services in select cities. It is anticipated that the adoption of electric scooters in the rental market will increase significantly during the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is a hotbed of activity in the Bike and Scooter Rental market, driven by urbanization, youthful demographics, and the need for sustainable transportation options. A significant proportion of the population in Asia-Pacific consists of young individuals who are tech-savvy and open to adopting new mobility solutions. This demographic is a key driver for the growth of bike and scooter rentals. For instance, an article published by NCBI in July 2023, reported that India reported the fastest number of growing youth, accounting for 23%. Thus, such instances show the growing youth are more inclined towards scooty and bike rental services, thereby contributing to the studied market growth.

Moreover, Asia-Pacific is a popular tourist destination, and bike and scooter rentals provide tourists with a convenient and cost-effective way to explore cities and tourist spots. This has contributed to the growth of the market.

Get Complete Analysis Of The Report - Download Free Sample PDF

The two-wheeler rental market is moderately competitive due to the presence of a few companies working globally and regionally. The leading players operating in the bike rental market are:

Recent Developments:

In February 2022, Yamaha Motors subsidiary company Moto Business Service India (MBSI) invested in bike rental company Royal Brothers. This acquisition is based on a revenue-sharing basis. MBSI also has further plans to partner with other emerging players in the market.

Q1. What is the current Bike and Scooter Rental Market size?

The Bike and Scooter Rental Market was valued at USD 38.76 million.

Q2. What is the Growth Rate of the Bike and Scooter Rental Market?

Bike and Scooter Rental Market is registering a CAGR of more than 8.3% during the forecast period.

Q3. Which region has the largest share of the Bike and Scooter Rental Market? What are the largest region's market size and growth rate?

Asia-Pacific region has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Q4. Which are the major companies in the Bike and Scooter Rental Market?

Bird Rides, Inc., Bolt Technology, Bounce and Cityscoot are some of the major companies in the Bike and Scooter Rental Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model