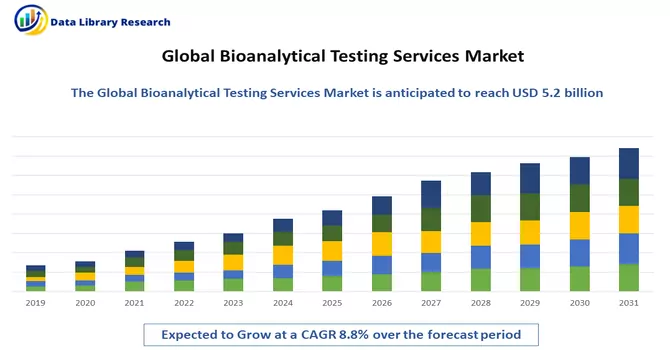

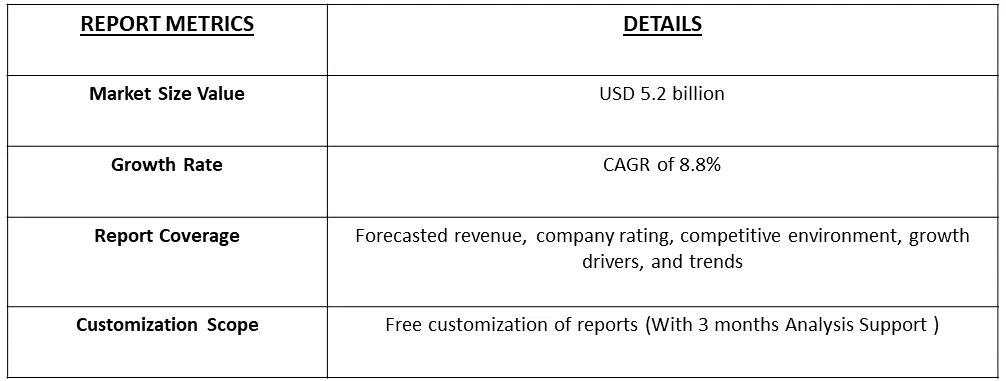

The global bioanalytical testing services market size was estimated at USD 5.2 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.8% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Bioanalytical testing services refer to a set of scientific processes and analytical techniques used to quantify and characterize various biological substances, molecules, or compounds in complex biological samples. These services are crucial for evaluating the pharmacokinetics, pharmacodynamics, and safety of pharmaceutical compounds during drug development. Bioanalytical testing involves the measurement of drugs, metabolites, biomarkers, and other analytes in biological matrices such as blood, plasma, serum, urine, tissues, and other physiological fluids. The goal is to provide accurate and reliable data on the concentration and behaviour of these substances, aiding researchers and pharmaceutical companies in understanding how drugs interact with the body. Bioanalytical testing services play a vital role in supporting preclinical and clinical studies, ensuring compliance with regulatory requirements, and facilitating the development and approval of new drugs and therapies.

The market for bioanalytical testing services is poised for growth in the foreseeable future, driven by several key factors. The continual expansion of drug development and approval processes, reflecting the dynamic nature of the pharmaceutical and biotechnology industries, is a significant catalyst. The increasing complexity of therapeutics, particularly with the development of advanced modalities like gene therapies and biologics, contributes to the heightened demand for specialized bioanalytical testing services. Moreover, a notable trend in the outsourcing of testing services further propels market growth. Pharmaceutical and biotech companies are increasingly relying on external expertise and resources for bioanalytical testing, allowing them to focus on core aspects of drug development and research. This outsourcing trend enhances efficiency, accelerates timelines, and provides access to specialized knowledge and technologies. Thus, the confluence of these factors underscores the critical role of bioanalytical testing services in the evolving landscape of drug development, ensuring the robust evaluation and characterization of novel therapeutics while accommodating the industry's growing intricacies.

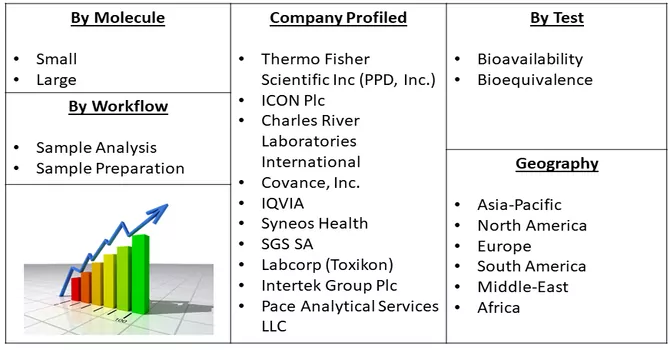

Market Segmentation: The Bioanalytical Testing Services Market is Segmented By Molecule (Small, and Large), Test (Bioavailability, and Bioequivalence), Workflow (Sample Analysis, and Sample Preparation), geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers the market size and forecasts in terms of volume in metric tons and value in USD thousand for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The bioanalytical testing services market is undergoing significant shifts driven by the demand for specialized services in response to the complexities introduced by advanced therapeutic modalities such as gene therapies and biologics. Technological advancements, including high-throughput screening and advanced immunoassays, are enhancing the precision and efficiency of bioanalysis. A steadfast focus on regulatory compliance is evident, with stringent guidelines influencing service providers to uphold rigorous quality control measures. The increasing trend of outsourcing bioanalytical testing services reflects pharmaceutical and biotech companies seeking external expertise to manage costs effectively. The integration of advanced data management solutions addresses the challenge of handling vast amounts of data generated in bioanalysis, facilitating more informed decision-making. The global expansion of testing facilities enables service providers to cater to a broader client base, and the growing emphasis on biomarker testing, particularly in personalized medicine, is evident. Contract research organizations (CROs) play a pivotal role, offering comprehensive services and flexibility to support diverse aspects of bioanalysis in drug development pipelines, underscoring the dynamic and adaptive nature of the market.

Market Drivers:

Increased Necessity of Specific Types of Tests in R&D Activities

The heightened necessity of specific types of tests in Research and Development (R&D) activities has emerged as a prominent driver for the bioanalytical testing services market. In the evolving landscape of pharmaceutical and biotechnology R&D, there is an increasing demand for specialized tests tailored to assess the safety, efficacy, and quality of diverse therapeutic modalities, including biologics, gene therapies, and precision medicines. These specific tests play a crucial role in providing accurate insights into the complex interactions between novel compounds and biological systems, ensuring compliance with stringent regulatory standards. The intricate nature of advanced therapeutics requires sophisticated analytical techniques, and companies engaged in R&D activities are turning to bioanalytical testing services to meet these specialized testing needs. Whether it involves assessing biomarkers, quantifying drug concentrations, or conducting immunogenicity assays, the ability to conduct specific and precise tests is integral to the success of R&D programs. Bioanalytical testing services providers play a pivotal role in supporting R&D endeavours by offering a spectrum of specialized tests, contributing to the comprehensive evaluation of potential drug candidates. The collaborative relationship between R&D entities and bioanalytical testing services firms reflects the industry's commitment to ensuring the safety and efficacy of emerging therapies, ultimately driving advancements in healthcare and meeting the evolving demands of the global pharmaceutical and biotechnology landscape.

Increased Trend of Outsourcing Laboratory Testing Services

The increased trend of outsourcing laboratory testing services has become a prominent feature in various industries, notably in pharmaceuticals, biotechnology, healthcare, and beyond. Companies are increasingly opting to delegate their laboratory testing needs to specialized service providers, known as Contract Research Organizations (CROs) or Contract Testing Organizations (CTOs). This strategic move offers several advantages, including cost efficiency, access to specialized expertise, and the ability to focus on core business activities. Outsourcing laboratory testing services allows organizations to leverage the advanced capabilities and state-of-the-art technologies of CROs, which may have specialized equipment and personnel dedicated to specific types of testing. This is particularly beneficial for industries with stringent regulatory requirements, such as pharmaceuticals and healthcare, where accurate and reliable testing is crucial for product development and compliance. The trend is driven by the increasing complexity of laboratory testing techniques, the need for specialized knowledge, and the desire for flexibility in adapting to changing testing requirements. Additionally, outsourcing provides companies with the ability to manage variable workloads effectively, tapping into external resources when demand fluctuates. As the outsourcing trend continues, it is reshaping the landscape of laboratory testing services, fostering collaborations between organizations and specialized service providers. This strategic approach is expected to persist and evolve, offering businesses a dynamic and flexible solution to meet their diverse laboratory testing needs.

Restraints:

Complex Regulatory Framework for Maintaining Laboratories

The complex regulatory framework for maintaining laboratories is a critical aspect that organizations in various industries must navigate diligently. Laboratories, especially those in sectors like pharmaceuticals, healthcare, and biotechnology, operate within a stringent regulatory environment to ensure the accuracy, reliability, and safety of laboratory testing processes and results. Regulatory bodies, such as the Food and Drug Administration (FDA) in the United States and the European Medicines Agency (EMA) in Europe, set forth comprehensive guidelines and standards that laboratories must adhere to. Thus, these complaex regulatory framework may slow down the growth of the studied market over the studied period.

Bioanalytical technologies have played a pivotal role in addressing the challenges posed by the COVID-19 pandemic and are poised to remain integral in combating subsequent waves and future infectious disease outbreaks. Companies like SGS are at the forefront, providing a comprehensive range of bioanalytical services catering to both small molecules and biologics. Their offerings encompass advanced techniques such as mass spectrometry, immunoassays, and cell-based assays. In a strategic move in November 2020, SGS, a global leader in inspection, verification, testing, and certification, made significant investments in its Biosafety Center of Excellence located in Glasgow. This investment was geared towards enhancing the center's capacity, reinforcing its commitment to supporting scientists and manufacturers in the development of effective vaccines, cell and gene therapies, and other biological medicines. The continued evolution and strengthening of bioanalytical technologies position them as invaluable tools in the ongoing battle against pandemics and emerging infectious diseases.

Segment Analysis:

Small Segment is Expected to Witness Significant Growth Over the Forecast Period

Small molecules play a crucial role in drug development, and bioanalytical testing serves as a cornerstone in assessing their pharmacokinetics, efficacy, and safety. Bioanalytical testing of small molecules involves the quantification and characterization of these compounds within biological matrices, such as blood, plasma, or urine. This process aids in understanding how the body absorbs, distributes, metabolizes, and excretes small molecules, providing critical data for regulatory submissions and clinical decision-making. Advanced bioanalytical techniques, including mass spectrometry and liquid chromatography, are commonly employed to analyze small molecules with high sensitivity and precision. These methods allow researchers to detect and quantify small molecules at low concentrations, crucial for evaluating their pharmacological effects. The bioanalytical testing of small molecules is an integral part of various stages in drug development, from preclinical studies to clinical trials and post-market surveillance. Rigorous bioanalytical validation ensures the reliability and reproducibility of results, meeting regulatory requirements and industry standards. Thus, bioanalytical testing of small molecules is an indispensable component of pharmaceutical research, providing crucial insights into the behaviour of these compounds within biological systems. The precision and accuracy of these tests contribute significantly to the development of safe and effective pharmaceutical products.

Bioavailability Segment is Expected to Witness Significant Growth Over the Forecast Period

Bioavailability, a critical parameter in pharmacology, refers to the proportion of an administered drug that enters the bloodstream and is available for systemic circulation. Bioanalytical testing plays a pivotal role in assessing the bioavailability of drugs, providing essential data to understand how effectively a drug is absorbed and utilized by the body. Accurate and reliable bioanalytical testing is crucial for determining key pharmacokinetic parameters, including peak plasma concentration (Cmax), time to reach peak concentration (Tmax), area under the plasma concentration-time curve (AUC), and elimination half-life (t½). Understanding these parameters is essential for optimizing drug formulations, and dosage regimens, and ensuring therapeutic efficacy. Thus, the synergy between bioavailability and bioanalytical testing is integral to drug development, guiding researchers in formulating drugs with optimal absorption and bioavailability profiles. This information is vital for achieving desired therapeutic outcomes and ensuring the safety and effectiveness of pharmaceutical products.

Sample Analysis Segment is Expected to Witness Significant Growth Over the Forecast Period

Sample analysis in the realm of bioanalytical testing is a critical process that involves the examination and quantification of various substances within biological samples. These substances can include drugs, metabolites, biomarkers, or other analytes present in bodily fluids like blood, plasma, urine, or tissues. The primary goal of sample analysis is to generate accurate and reliable data about the concentration and behaviour of these substances within a biological system. Bioanalytical testing techniques, such as chromatography and mass spectrometry, are commonly employed for sample analysis due to their high sensitivity and specificity. Liquid chromatography coupled with tandem mass spectrometry (LC-MS/MS) is particularly popular for its ability to separate and quantify complex mixtures of compounds in biological samples with exceptional precision. Thus, the insights gained from sample analysis through bioanalytical testing are pivotal in pharmacokinetic studies, drug development, and clinical research. Understanding how substances interact within the biological matrix provides essential information for optimizing drug formulations, determining dosage regimens, and assessing the safety and efficacy of pharmaceutical products. In essence, sample analysis is the cornerstone of bioanalytical testing, providing the foundation for informed decision-making in the fields of healthcare and pharmaceutical development.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

North America is a thriving hub for bioanalytical testing services, serving as a cornerstone for the pharmaceutical, biotechnology, and healthcare industries. The region boasts a robust market characterized by leading Contract Research Organizations (CROs) and cutting-edge laboratories equipped with advanced technologies. The demand for bioanalytical testing services in North America is driven by a prolific pharmaceutical pipeline, a focus on precision medicine, and adherence to stringent regulatory standards set by the U.S. Food and Drug Administration (FDA). Major biotech and pharmaceutical hubs, including Boston, San Francisco, and the Research Triangle, fuel the need for diverse bioanalytical services, ranging from pharmacokinetic studies to biomarker analysis. North America's commitment to innovation and personalized medicine aligns seamlessly with the capabilities of bioanalytical testing services, fostering collaborations and driving advancements in drug development. The region's prominence in research and development positions it at the forefront of the global bioanalytical testing landscape, contributing significantly to the delivery of safe and effective healthcare solutions.

Additionally, as highlighted by the International Diabetes Federation, the prevalence of diabetes in North America reached approximately 48 million adults in 2020, and this upward trajectory is anticipated to persist, leading to an increased demand for bioanalytical services to support the development of novel therapeutics for managing diabetes. Consequently, the growing need for bioanalytical services, coupled with a substantial number of ongoing clinical trials and significant investments from major pharmaceutical companies, stands out as pivotal factors propelling the market's expansion in the region. A recent noteworthy development contributing to the market's growth is the acquisition announcement by Pace Analytical Services in April 2023, as it acquired Alpha Analytical, thereby expanding its laboratory services across the Northeastern U.S. with an extensive network of over 39 locations.

Get Complete Analysis Of The Report - Download Free Sample PDF

The bioanalytical testing services market exhibits a moderate level of competitiveness, with numerous key players vying for market share. Within this landscape, some companies are actively strengthening their market position by diversifying their service offerings, introducing novel methods for assay validation, and expanding their laboratory solutions. This dynamic competition is characterized by a continual drive for innovation and differentiation among market participants. While some firms focus on the development and introduction of advanced testing methodologies, others emphasize comprehensive laboratory solutions to meet the evolving needs of the pharmaceutical and biotechnology industries. This competitive environment fosters a climate of continuous improvement and strategic initiatives aimed at solidifying market presence and meeting the diverse demands of clients in the bioanalytical testing services sector. Key Bioanalytical Testing Services Companies:

Recent Development:

1) In September 2023, Cerba HealthCare finalized the acquisition of CIRION BioPharma Research, a Canadian contract research laboratory. This strategic move aims to bolster Cerba HealthCare's bioanalytical capabilities, providing a significant enhancement for the efficient execution of intricate clinical trials.

2) In November 2023, Resolian successfully completed the acquisition of Denali Medpharma, a well-established bioanalytical Contract Research Organization (CRO) located in China. This acquisition marks Resolian's expansion of bioanalysis laboratory operations, now encompassing facilities in the United States, the United Kingdom, Australia, and China. The acquisition positions Resolian as a key player in the global bioanalytical testing services market.

Q1. What was the Bioanalytical Testing Services Market size in 2023?

As per Data Library Research the global bioanalytical testing services market size was estimated at USD 5.2 billion in 2023.

Q2. What is the Growth Rate of the Bioanalytical Testing Services Market?

Bioanalytical Testing Services Market is anticipated to grow at a compound annual growth rate (CAGR) of 8.8% Over the forecast period.

Q3. Which region has the largest share of the Bioanalytical Testing Services market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Q4. What segments are covered in the Bioanalytical Testing Services market Report?

By Molecule, Test, Workflow, Geography these segments are covered in the Bioanalytical Testing Services market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model