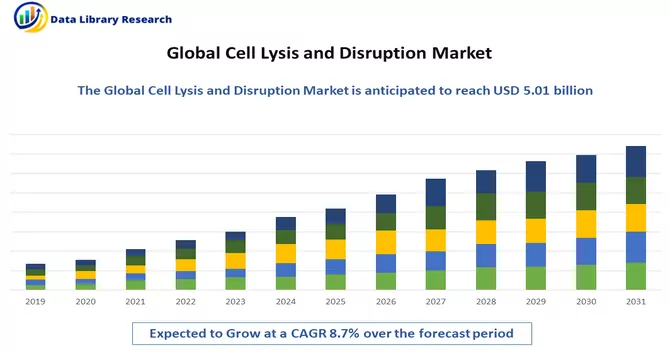

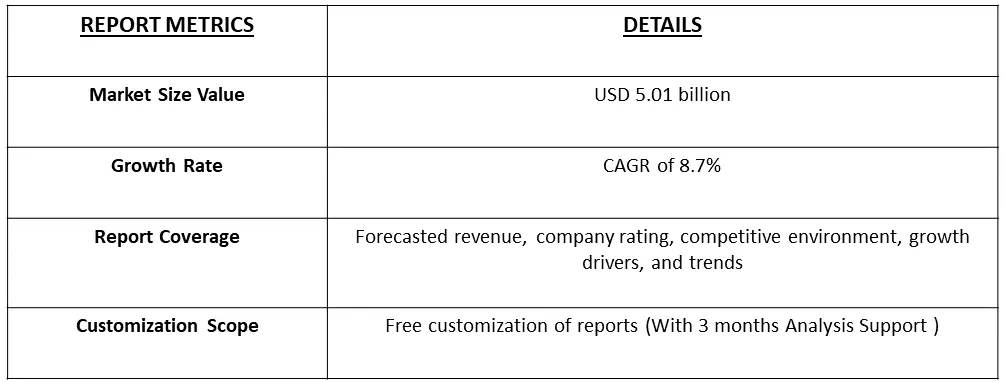

The global market for cell lysis and disruption reached a valuation of USD 5.01 billion, with anticipated growth at a robust compound annual growth rate (CAGR) of 8.7% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The cell lysis market encompasses products and techniques used to break open cell membranes to release cellular contents. This process is crucial in various scientific fields, including molecular biology, biotechnology, and pharmaceuticals, allowing access to cellular components such as DNA, RNA, proteins, and organelles.

The substantial expansion can be attributed to the widespread adoption of gene expression protocols within the biotechnology sector. This surge is further fueled by the biopharmaceutical industry's continuous growth, where the retrieval and purification of biopharmaceuticals rely significantly on cell lysis and disruption techniques. Additionally, the integration of biotechnological processes across pharmaceuticals, agriculture, and bio-services industries is poised to propel market advancement, given the crucial role of cell lysis in various bioprocessing applications. The ongoing advancements in biotechnology and life sciences drive the need for efficient cell lysis techniques to extract biomolecules for research, drug development, and diagnostics. As pharmaceutical and biotech companies intensify efforts to develop new drugs and therapies, efficient cell lysis techniques are essential for isolating target molecules and understanding cellular mechanisms.

There's a growing focus on developing cell lysis methods that are both gentle on the cellular components and efficient in yielding high-quality biomolecules. Techniques like sonication, enzymatic lysis, and microfluidic-based lysis are gaining traction due to their ability to maintain the integrity of sensitive molecules. Furthermore, the integration of microfluidic technologies for cell lysis has gained attention. These miniaturized devices offer precise control and manipulation of cells and fluids, allowing for efficient lysis and analysis on a smaller scale. They are particularly beneficial for point-of-care diagnostics and research applications.

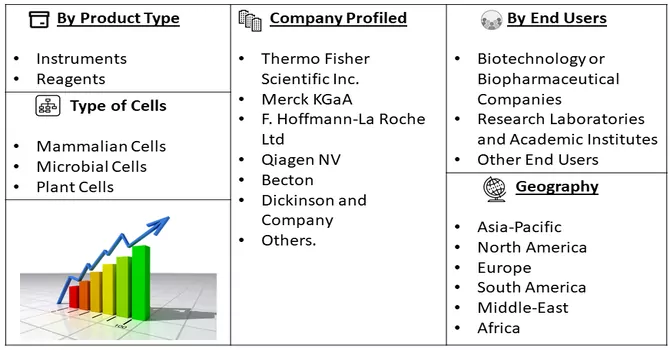

Market Segmentation: The Cell Lysis Market is Segmented by Product (Instruments and Reagents), Type of Cells (Mammalian Cells, Microbial Cells, and Plant Cells), End User (Biotechnology or Biopharmaceutical Companies, Research Laboratories and Academic Institutes, and Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers market size and forecast values in USD million for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increased Demand in Biopharmaceutical Production:

As the pharmaceutical industry continues to shift towards biopharmaceuticals, there's a substantial demand for efficient cell lysis techniques. Biopharmaceuticals like monoclonal antibodies, recombinant proteins, and vaccines are produced using living cells, necessitating the extraction of these substances from the cells. Improved cell lysis methods are crucial in this process, as they enable the efficient release and purification of target biomolecules, supporting the growing demand for biopharmaceuticals. Moreover, the development in this market segment is expected to drive the growth of the studied market. For instance, in January 2021, Thermo Fisher Scientific, Inc. announced the acquisition of Henogen S.A., the viral vector manufacturing business of Novasep. This expanded the company's capabilities for gene and cell therapies & vaccines and enhanced its cell lysis and disruption business as part of the manufacturing workflow. Thus, such developments are expected to drive the growth of the studied market.

Advancements in Life Sciences Research:

The continual progress in life sciences research, particularly in fields like genomics, proteomics, and molecular biology, fuels the demand for innovative cell lysis techniques. Researchers require reliable methods to extract DNA, RNA, proteins, and other cellular components for various studies, including understanding disease mechanisms, developing new therapies, and conducting diagnostic tests. As research technologies evolve and become more sophisticated, there's an increased need for cell lysis techniques that can provide high-quality, intact biomolecules for analysis. This driver is further amplified by the growth in personalized medicine and precision therapies, where detailed molecular analysis of patient samples is crucial. Thus, advancements in life sciences research act as a strong driver for the development and adoption of improved cell lysis methodologies to meet the demands of diverse research applications. Thus, the above-mentioned factors are expected to drive the growth of the studied market. Thus, advancements in life sciences research act as a strong driver for the studied market.

Market Restraints:

High Cost of Advanced Cell Lysis Technologies

The implementation of cutting-edge cell lysis technologies often comes with a high initial cost. This can be a barrier, particularly for smaller research laboratories or companies with budget constraints, hindering widespread adoption. Moreover, certain cell lysis methods have the potential to cause damage to sensitive biomolecules, such as proteins and nucleic acids. This limitation can impact the quality of extracted biological materials and subsequent analyses. Thus, this may slow down the growth of the studied market.

The urgency to understand the SARS-CoV-2 virus and develop vaccines and treatments led to a surge in demand for research tools, including cell lysis kits and techniques. Scientists required efficient methods to extract viral RNA, proteins, and other components for studying the virus's structure, replication mechanisms, and potential drug targets. Diagnostic Development: Rapid diagnostic test development also relied on efficient cell lysis methods to extract viral RNA for PCR-based tests and antigen detection. This fueled the demand for cell lysis products optimized for quick and reliable extraction of viral genetic material from patient samples. The pandemic disrupted global supply chains, causing shortages of certain laboratory supplies, including reagents and consumables used in cell lysis kits. This affected the availability of these products, impacting research and diagnostic efforts. Many research institutions and biotech companies redirected their focus and resources toward COVID-19-related research. While this led to increased demand for specific cell lysis tools tailored for coronavirus studies, it also meant reduced attention and investment in non-COVID-related research, impacting the broader cell lysis market.

Segmental Analysis:

Instruments and Reagents Segment is Expected to Witness Significant Growth of the Market Over the Forecast Period

Utilize beads (glass, ceramic, or metal) to physically disrupt cells by agitating them in a closed system. Offer versatility in processing various sample sizes and types. Use high-frequency sound waves to disrupt cell membranes. Effective for small volumes and delicate samples due to their non-contact nature. Disrupt cell membranes by solubilizing lipids and proteins. Include Triton X-100, SDS, and other non-ionic or ionic detergents. Contain various components (salts, chaotropic agents, protease inhibitors) to facilitate cell disruption and preserve extracted biomolecules. Customizable based on downstream applications

Biotechnology or Biopharmaceutical Companies Segment is Expected to Witness Significant Growth of the Market Over the Forecast Period

Offers a range of kits and reagents for cell lysis and nucleic acid extraction, including the QIAamp and DNeasy kits for DNA extraction and RNeasy kits for RNA isolation. Provides various instruments, reagents, and kits for cell lysis, such as ultrasonic homogenizers, bead mill homogenizers, and the MagMAX line of nucleic acid extraction kits.

North America Region is Expected to Witness Significant Growth of the Market Over the Forecast Period

The region is a hub for biopharmaceutical companies engaged in the development of novel therapeutics, vaccines, and biologics. These endeavors require efficient cell lysis methods for extracting biomolecules, contributing significantly to the demand for cell lysis products. North America boasts cutting-edge research facilities, academic institutions, and biotech hubs. These institutions continually demand high-quality instruments, reagents, and kits for cell lysis to support various studies in genomics, proteomics, drug discovery, and molecular biology.

Further, the recent development in the region is expected to drive the growth of the studied market over the forecast period. For instance, in March 2023, Seagen, through its advisor S&C, announced its imminent acquisition by Pfizer for USD 43 billion. The transaction, estimated to double Pfizer's portfolio of early-stage cancer therapies, is the largest merger and acquisition deal disclosed until March 2023.

In another instance, in January 2021, Thermo Fisher Scientific, Inc. announced the acquisition of Henogen S.A., the viral vector manufacturing business of Novasep. This expanded the company's capabilities for gene and cell therapies & vaccines and enhanced its cell lysis and disruption business as part of the manufacturing workflow. Thus, the above-mentioned factors are expected to drive the growth of the studied market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market studied is moderately competitive and consists of local and international companies. Some players include

Recent Developments:

1. In September 2022, SCIENION and Cellenion launched the proteoCHIP LF 48 for label-free single cell proteomics sample preparation on the cellenONE platform.

2. In March 2022, Sanofi and IGM Biosciences, Inc. announced signing an exclusive worldwide collaboration agreement to create, develop, manufacture, and commercialize IgM antibody agonists against three oncology targets and three immunology/inflammation targets.

Q1. What was the Cell Lysis and Disruption Market size in 2022?

As per Data Library Research the global market for cell lysis and disruption reached a valuation of USD 5.01 billion

Q2. What is the Growth Rate of the Cell Lysis and Disruption Market ?

Cell Lysis and Disruption Market is ecpected to grow at a compound annual growth rate (CAGR) of 8.7% over the forecast period.

Q3. What are the factors driving the Cell Lysis and Disruption Market?

Key factors that are driving the growth include the Increased Demand in Biopharmaceutical Production and Advancements in Life Sciences Research.

Q4. Which region has the largest share of the Cell Lysis and Disruption Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model