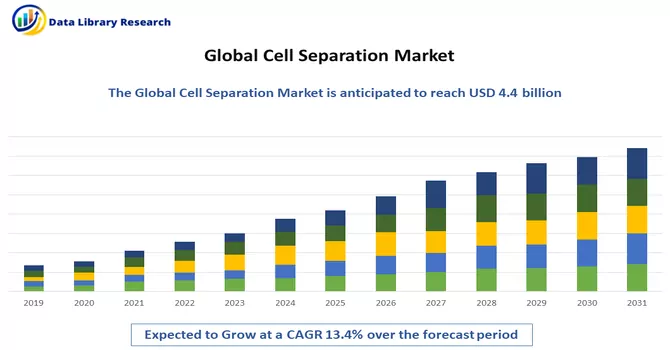

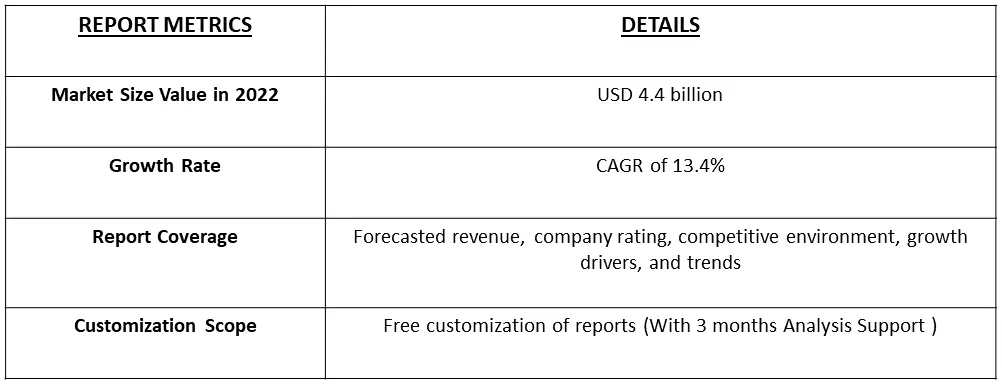

The global cell isolation market has an estimated compound annual growth rate (CAGR) of 13.4%, over the forecast period of 2023-2030 and a revenue size in the region of USD 4.4 billion in 2022.

Get Complete Analysis Of The Report - Download Free Sample PDF

Cell isolation encompasses the process of segregating target cells from intricate biological samples, employing diverse techniques like centrifugation, fluorescence-activated cell sorting (FACS), magnetic-activated cell sorting (MACS), and density gradient centrifugation. The selection of a specific method is contingent upon the distinctive characteristics of the cells slated for isolation. The persistent advancements in life sciences and molecular biology fuel the demand for innovative cell isolation techniques. Researchers leverage isolated cells to delve into cellular functions, mechanisms, and signaling pathways. The biotechnology and biopharmaceutical sectors have a substantial dependence on cell isolation, utilizing it across various applications such as drug discovery, vaccine development, and the production of biologics. The escalating investments in these industries play a pivotal role in propelling the expansion of the cell isolation market.

Continuous advancements in cell isolation technologies, including microfluidics, automation, and cutting-edge sorting techniques, are elevating the effectiveness, accuracy, and scalability of cell isolation procedures. Additionally, the growing emphasis on single-cell analysis is fostering a heightened demand for technologies that facilitate the isolation and examination of individual cells. This trend is especially pertinent in domains such as genomics and transcriptomics.

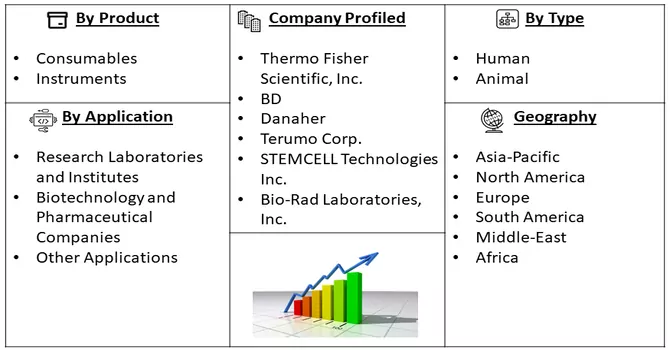

Market Segmentation: The Cell Isolation Market is Segmented by Product (Consumables (Reagents and Kits, Beads, and Disposables) and Instruments (Centrifuges, Flow Cytometers, Filtration Systems, Magnetic-activated Cell Separator Systems, and Other Instruments)), Type (Human and Animal), Application (Research Laboratories and Institutes, Biotechnology and Pharmaceutical Companies, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value in USD million for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing Biopharmaceutical Research and Development

The biopharmaceutical sector extensively depends on cell isolation techniques for diverse objectives, including drug discovery, development, and manufacturing. The isolation of distinct cell types empowers researchers to investigate their behaviors, responses to medications, and potential therapeutic uses. With the escalating demand for novel and targeted biopharmaceuticals, the significance of efficient cell isolation methods is progressively pivotal. This aspect serves as a prominent catalyst in propelling the cell isolation market, prompting companies to invest in advanced technologies that bolster biopharmaceutical research. As an illustration, in March 2020, the U.S. President enacted an emergency spending bill allocating USD 3 billion for the research and development of vaccines, medical treatments, and test kits. This substantial allocation has notably surged the demand for cell separation tools in research applications. Cell separation or isolation techniques play a crucial role in the development and production of biologics, including monoclonal antibodies and recombinant proteins. Over the past few decades, these products have witnessed significant traction. The robust expansion of specialty drugs and personalized medicine has further fueled the demand for biologics.

Advancements in Stem Cell Research and Regenerative Medicine

The realm of regenerative medicine, particularly in the context of stem cell research, emerges as a pivotal force propelling the cell isolation market. The isolation and characterization of distinct types of stem cells play a fundamental role in the development of therapeutic interventions, spanning areas like tissue engineering, regenerative therapies, and personalized medicine. As our comprehension of stem cell biology deepens and their potential applications broaden, there is a mounting demand for precise and effective cell isolation techniques. The capacity to isolate and manipulate stem cells is indispensable for advancing research and translating discoveries into clinical applications, positioning it as a crucial driving factor in the cell isolation market. For instance, in October 2023, The Alliance for Regenerative Medicine (ARM), the leading international advocacy organization championing the benefits of engineered cell therapies and genetic medicines, today announced new analysis showing that durable cell and gene therapies have clinical success rates between two and three times higher than other types of treatments. NEWDIGS of Tufts Medical Center conducted the research – supported by ARM — by using its proprietary data set of durable cell and gene therapy clinical trials. NEWDIGS will present the research today at ARM’s annual Cell & Gene Meeting on the Mesa in Carlsbad, CA.

Market Restraints. :

A significant hurdle in the cell isolation market is the elevated cost associated with advanced cell isolation technologies and equipment. State-of-the-art methods, including fluorescence-activated cell sorting (FACS) or microfluidic systems, often demand substantial investments in both equipment and consumables. This financial barrier can prove to be especially challenging for smaller research laboratories or institutions operating within constrained budgets. The high cost serves as an impediment, potentially limiting the widespread adoption and accessibility of advanced cell isolation technologies, thereby impacting overall market growth.

The pandemic induced disruptions in worldwide supply chains, influencing the accessibility of materials and components essential for cell isolation technologies. These disruptions may have resulted in manufacturing and distribution delays, subsequently affecting the overall market. The global health crisis triggered a realignment in research priorities and funding towards projects related to COVID-19. Numerous research laboratories and institutions temporarily redirected their resources and focus to address immediate public health concerns, potentially influencing non-COVID-related research endeavors, including studies in the field of cell isolation. Thus, COVID-19 increased the growth of the studied market over the forecast period.

Segmental Analysis:

Consumables segment is Expected to Witness Significant Growth Over the Forecast Period

In the realm of cell isolation, reagents encompass chemical substances or compounds utilized in the isolation process to attain specific outcomes, such as segregating target cells from a heterogeneous mixture. These reagents serve diverse purposes in cell isolation, including cell labeling, staining, and separation. Common examples of reagents include fluorescent dyes, antibodies, and other labeling agents, which are instrumental in tagging specific cell types, thereby enabling their identification and isolation. Cell isolation kits, comprising pre-packaged sets of reagents, protocols, and occasionally equipment, are intricately designed to streamline and simplify the cell isolation process. These kits present a standardized and user-friendly approach, ensuring the attainment of reliable results. Geared towards offering convenience and consistency in cell isolation procedures, these kits typically encompass all essential components, such as antibodies, buffers, and instructions. This design minimizes the necessity for researchers to individually source reagents and fine-tune protocols, proving particularly advantageous for laboratories aiming for efficiency and reproducibility in their results. Magnetic or fluorescent beads play a pivotal role in various cell isolation techniques, particularly in methods like magnetic-activated cell sorting (MACS). Coated with specific antibodies or ligands, these beads bind to target cells, facilitating their physical separation. For instance, magnetic beads can be utilized to label cells, after which a magnetic field is applied to selectively separate the labeled cells from the remainder of the sample. This method finds widespread use in the positive or negative selection of specific cell populations. Thus, the segment is expected to witness significant growth over the forecast period.

Research Laboratories and Institutes Segment is Expected to Witness Significant Growth Over the Forecast Period

Research laboratories and institutes play a crucial role in advancing cell separation techniques, contributing significantly to scientific progress and technological innovation. Research laboratories are hubs of innovation, where scientists and researchers explore novel ideas and techniques in cell separation. They engage in the development of new technologies, methodologies, and reagents to enhance the efficiency, specificity, and scalability of cell separation processes. Institutes are at the forefront of technological advancements in cell separation. They contribute to the refinement and development of cutting-edge technologies, such as microfluidics, automation, and advanced sorting techniques, improving the precision and capabilities of cell isolation methods. Thus, the segment is expected to witness significant growth over the forecast period.

North America is Expected to Witness Significant Growth Over the Forecast Period

North America, specifically the United States and Canada, stands as one of the primary markets for cell isolation products and technologies, experiencing consistent growth propelled by several key factors. The region has witnessed a steady rise driven by heightened research and development activities, a robust healthcare infrastructure, and the significant presence of key market players. The region is a hub for numerous biotechnology and pharmaceutical companies that play a pivotal role in leveraging cell isolation technologies. These companies heavily depend on cell isolation for various purposes, including drug discovery, development, and the manufacturing of biologics. The substantial number of major players in the region contributes significantly to the overall growth and innovation observed in the cell isolation market. Furthermore, the recent development in the region is expected to drive the growth of the studied market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

Some of the key companies in the global cell separation market are:

Recent Development:

1. In October 2022, Thermo Fisher Scientific launched a closed and automated cell isolation and bead removal solution to help evolve cell therapy manufacturing. The new technology improves cell purity and isolation efficiency and increases the recovery of target cells for scalable cell therapy manufacturing.

2. In January 2022, Sony Corporation launched CGX10, an advanced cell isolation system that sorts cells at high speed and high purity in a closed system.

Q1. What was the Cell Separation Market size in 2022?

Cell Separation Market revenue size in the region of USD 4.4 billion in 2022.

Q2. At what CAGR is the Cell Separation Market projected to grow within the forecast period?

Cell Separation Market is estimated compound annual growth rate (CAGR) of 13.4% over the forecast period.

Q3. What are the factors driving the Cell Separation Market?

Key factors that are driving the growth include the Increasing Biopharmaceutical Research and Development and Advancements in Stem Cell Research and Regenerative Medicine.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model