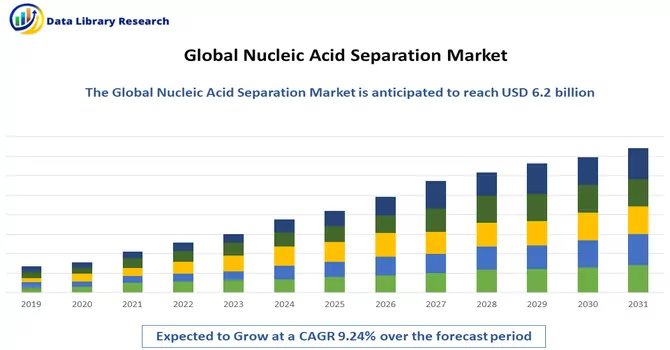

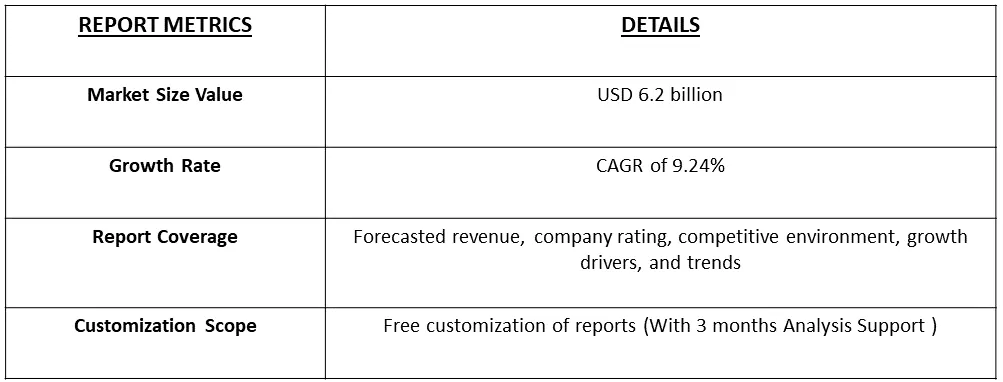

The global nucleic acid isolation and purification market size was estimated at USD 6.2 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.24% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Nucleic acid isolation and purification are pivotal processes in molecular biology, involving the extraction of DNA or RNA from biological samples followed by purification to obtain high-quality nucleic acids. The procedure typically includes sample collection, cell lysis, removal of cellular debris, nucleic acid precipitation, and subsequent purification steps. Various methods such as column-based purification, phenol-chloroform extraction, magnetic bead-based purification, and gel electrophoresis are employed to achieve the desired yield and purity. Challenges include sample quality, balancing yield and purity, considerations for DNA versus RNA isolation, and the increasing adoption of automation. These processes are fundamental for downstream applications in genomics, transcriptomics, and diagnostics, providing researchers with the necessary genetic material for diverse molecular analyses and experiments.

The market's expansion is driven by multiple factors, including the increasing adoption of sequencing platforms for clinical diagnostics, a surge in genomics and enzymology-based research activities, and a notable uptick in investments in research and development (R&D) initiatives. The burgeoning potential of molecular biology, coupled with advancements in precision medicine, is providing further impetus to the growth of the market. Market participants are actively enhancing their manufacturing capabilities to meet the rising demand, exemplified by Agilent Technologies' noteworthy announcement in January 2023. Agilent Technologies disclosed a substantial investment of USD 725 million to bolster the manufacturing capacity of therapeutic nucleic acids. This strategic move not only exemplifies the commitment of industry players to meet market demands but also underscores the pivotal role of manufacturing capacity strengthening in facilitating the overall expansion of the market. As these concerted efforts align with the dynamic landscape of molecular biology and precision medicine, the market is poised to witness sustained growth, offering enhanced solutions for clinical diagnostics and pushing the boundaries of genomics and enzymology research.

Market Segmentation: The Nucleic Acid Isolation and Purification Market is segmented by Technology (Column-based Purification, Magnetic Bead-based Purification, and Reagent-based Purification), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

In the nucleic acid isolation market, several noteworthy trends are shaping the industry landscape. The increasing adoption of sequencing platforms for clinical diagnostics, coupled with a surge in genomics and enzymology-based research, is driving market growth. The rise of precision medicine and the potential of molecular biology are acting as catalysts, further fueling the expansion of the market. Notably, market participants are strategically investing in research and development (R&D) to strengthen manufacturing capacities, exemplified by major players like Agilent Technologies making substantial investments to enhance the production of therapeutic nucleic acids. Additionally, the market is witnessing a trend of strategic acquisitions, such as LGC Biosearch Technologies acquiring PolyDesign, reflecting a consolidation phase aimed at expanding product portfolios and technological capabilities. These trends collectively underscore the dynamic nature of the nucleic acid isolation market, indicating a trajectory marked by technological advancements, strategic investments, and a broader application scope across various research and diagnostic domains.

Market Drivers:

Rapid Technological Advancements

Rapid technological advancements have significantly transformed the landscape of nucleic acid separation, ushering in innovative methodologies and tools that enhance efficiency, accuracy, and scalability in various applications. Techniques for nucleic acid separation, such as gel electrophoresis, chromatography, and magnetic bead-based methods, have witnessed notable improvements driven by cutting-edge technologies. Advanced gel electrophoresis systems now integrate features like automated imaging and real-time monitoring, enabling precise separation and analysis of nucleic acids. Chromatographic methods benefit from advancements in column materials and instrumentation, enhancing resolution and speed in nucleic acid purification. Magnetic bead-based separation technologies, leveraging nanotechnology, offer high-throughput capabilities and increased sensitivity in isolating nucleic acids from complex samples. Furthermore, microfluidics and lab-on-a-chip technologies have emerged as game-changers in nucleic acid separation, allowing for miniaturized and parallelized processes with reduced sample and reagent volumes. The integration of microfluidic devices with automated systems has streamlined nucleic acid separation workflows, enabling faster and more cost-effective analyses. The advent of next-generation sequencing (NGS) and advancements in molecular biology techniques have propelled nucleic acid separation technologies into new frontiers. Techniques like size exclusion chromatography, capillary electrophoresis, and isothermal amplification methods contribute to the rapid and efficient separation of nucleic acids, crucial for applications in genomics, diagnostics, and therapeutic research.In conclusion, the synergy between rapid technological advancements and nucleic acid separation is driving continuous innovation, offering researchers and scientists powerful tools to unravel the complexities of genetic material. These advancements not only improve the speed and accuracy of nucleic acid separation but also contribute to the evolution of various scientific fields, shaping the future of genomic research, diagnostics, and personalized medicine.

Wide-range Applications of Nucleic Acid Testing in Diagnostics

Nucleic acid testing (NAT) has become integral to diagnostics, showcasing a diverse range of applications that have revolutionized the field of molecular medicine. In diagnostics, NAT plays a pivotal role in identifying and characterizing genetic material, offering unparalleled sensitivity and specificity. The detection of pathogens, including viruses and bacteria, through nucleic acid amplification techniques like PCR (polymerase chain reaction) has transformed infectious disease diagnostics, enabling rapid and accurate identification. In the context of genetic disorders, NAT allows for the detection of mutations and variations in DNA or RNA, aiding in the early diagnosis and personalized treatment strategies. Moreover, nucleic acid isolation, a fundamental step in NAT, holds wide-ranging applications. It is crucial for obtaining high-quality genetic material from various sample types, such as blood, tissues, or bodily fluids. This isolated nucleic acid serves as the foundation for downstream applications like sequencing, genotyping, and gene expression analysis. In cancer diagnostics, nucleic acid isolation facilitates the identification of specific genetic markers, guiding prognosis and treatment decisions. The versatility of nucleic acid isolation extends to fields beyond diagnostics, encompassing applications in genomics, forensics, and biotechnology. In genomics research, it enables large-scale DNA and RNA extraction for genome sequencing and functional genomics studies. In forensics, the isolation of nucleic acids from crime scene samples contributes to DNA profiling and identification. Biotechnological processes, such as recombinant DNA technology and gene cloning, heavily rely on efficient nucleic acid isolation to manipulate and engineer genetic material. In essence, the wide-ranging applications of nucleic acid testing in diagnostics, coupled with the crucial role of nucleic acid isolation in facilitating these applications, showcase the transformative impact of molecular techniques on healthcare, research, and various industries. As technological advancements continue to enhance the sensitivity and specificity of NAT, the field is poised for further breakthroughs, offering new insights into disease mechanisms, personalized therapies, and innovative biotechnological applications.

Market Restraints:

Lack of Skilled Professionals

The nucleic acid purification field faces a notable challenge due to a scarcity of skilled professionals proficient in the intricate techniques of isolating genetic material. With increasing demand in healthcare, research, and biotechnology, the shortage poses potential setbacks in ensuring the accuracy and reliability of nucleic acid purification processes. The multi-step procedures involved demand a nuanced understanding of molecular biology and advanced laboratory skills. Inadequate expertise can result in suboptimal outcomes, impacting downstream applications like PCR and sequencing. Addressing this challenge requires comprehensive training programs and collaborative efforts between academia and industry to bridge the gap, fostering a skilled workforce capable of navigating evolving purification technologies. By investing in education and professional development, the nucleic acid purification field can overcome the lack of skilled professionals, ensuring the robustness of processes crucial for advancements in genomics, diagnostics, and diverse applications relying on high-quality genetic material.

The market experienced a substantial impact from the COVID-19 pandemic, primarily attributable to the heightened demand for testing and drug research related to the disease. The necessity for nucleic acid and purification procedures surged during the pandemic, driven by extensive research efforts aimed at comprehending the intricacies of the SARS-CoV-2 virus and COVID-19 infection dynamics. Notably, a November 2021 NCBI article highlighted the utilization of a direct capture method for the purification and detection of viral nucleic acid, facilitating epidemiological surveillance of SARS-CoV-2. The market growth was further propelled by the integral role played by nucleic acid and purification in diagnostic assays, molecular testing for COVID-19, and vaccine development. As the post-pandemic period unfolded, the continued research activities intensified, particularly in response to the emergence of mutant strains of COVID-19, further contributing to the market's growth prospects anticipated throughout the forecast period.

Segmental analysis:

Column-based Purification Segment is Expected to Witness Significant Growth Over the Forecast Period

Column-based purification stands as a pivotal method in nucleic acid separation, providing an efficient and selective approach for isolating DNA or RNA from complex biological samples. In this technique, nucleic acids selectively bind to a solid-phase matrix within a column, allowing impurities to be washed away before the purified nucleic acids are eluted for downstream applications. This process is characterized by its simplicity, scalability, and applicability to various sample types, making it a widely adopted method in genomics, diagnostics, and molecular biology research. The commercial availability of pre-packaged kits further enhances the convenience and consistency of column-based purification, contributing significantly to the efficiency and reliability of nucleic acid isolation workflows. Despite its effectiveness, the choice of the appropriate column and kit is crucial for optimal results, highlighting the importance of tailored selection based on specific nucleic acid types and intended applications. Overall, column-based purification remains a foundational technique, playing a central role in advancing genomic research and molecular diagnostics.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

Anticipated growth in the nucleic acid isolation and purification market is expected in North America, propelled by several factors. The region is witnessing an upswing in research and development within the genomic field, necessitating robust nucleic acid isolation and purification procedures. Increased demand for sequencing platforms in clinical diagnostics and amplified funding for molecular biology research further contribute to this growth trajectory. Notable instances, such as UCLA Health securing a USD 4.8 million grant from the National Institutes of Health in June 2021 for the enhancement of genetic risk estimates and polygenic risk scores, underscore the region's commitment to advancing genomics. Additionally, Beckman Coulter Life Sciences' introduction of the EMnetik System in September 2021, designed to semi-automate PCR cleanup workflows using magnetic bead-based technology, exemplifies the ongoing innovations driving market dynamics. The prevalence of genetic disorders, exemplified by Hemophilia A affecting 1 in 5,000 male births in the United States, is further fueling demand for nucleic acid isolation and purification for diagnostics and treatment development. With a confluence of research initiatives, product launches, and addressing genetic disorder challenges, North America is poised for substantial growth in the nucleic acid isolation and purification market throughout the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Prominent entities in the nucleic acid isolation and purification market, these leading companies collectively wield significant market influence, shaping industry trends and holding the largest market share. A comprehensive analysis of their financials, strategic maps, and product portfolios is conducted to intricately map the intricate supply network within the industry. By delving into the financial performances, strategic maneuvers, and product offerings of these key players, a comprehensive understanding of the dynamics influencing the nucleic acid isolation and purification sector is achieved. This scrutiny not only delineates the market leadership of these companies but also provides insights into the interconnected supply chain, elucidating the strategic landscape that dictates the trajectory of the industry.

Recent Development:

1) In December 2023, Thermo Fisher Scientific Inc. introduced the Thermo Scientific KingFisher Apex Dx, an automated nucleic acid purification instrument, along with the Applied Biosystems MagMAX Dx Pathogen/Viral NA Isolation Kit. This innovative system is designed for the isolation and purification of bacterial and viral pathogens from diverse biological samples. The launch reflects Thermo Fisher Scientific's commitment to advancing nucleic acid purification technologies, providing researchers with efficient tools for extracting genetic material from complex samples in various applications, including diagnostics and research.

2) In November 2023, LGC Biosearch Technologies completed the acquisition of PolyDesign, a leading manufacturer specializing in solid support embedded frits for DNA/RNA oligonucleotide synthesis and purification. This strategic move enhances LGC's Nucleic Acid Chemistry product catalog, integrating PolyDesign's proprietary frit technology. This acquisition positions LGC Biosearch Technologies to offer comprehensive solutions in the field of nucleic acid synthesis and purification, strengthening their market presence and expanding their capabilities in serving the evolving needs of the genomics and molecular biology research communities.

Q1. What was the Nucleic Acid Separation Market size in 2023?

As per Data Library Research the global nucleic acid isolation and purification market size was estimated at USD 6.2 billion in 2023.

Q2. At what CAGR is the Nucleic Acid Separation market projected to grow within the forecast period?

Nucleic Acid Separation Market is anticipated to grow at a compound annual growth rate (CAGR) of 9.24% over the forecast period.

Q3. What are the factors driving the Nucleic Acid Separation market?

Rapid Technological Advancements and Wide-range Applications of Nucleic Acid Testing in Diagnostics are the factors driving the Nucleic Acid Separation market.

Q4. Who are the key players in Nucleic Acid Separation market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model