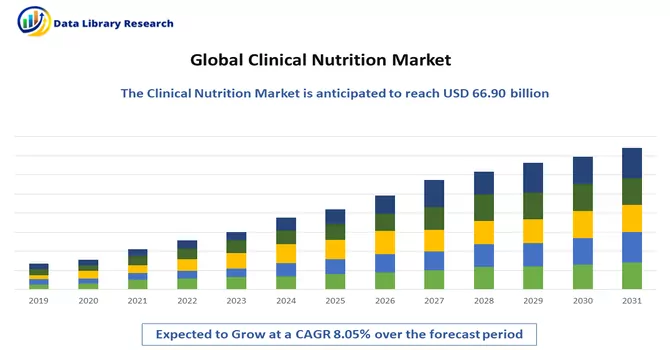

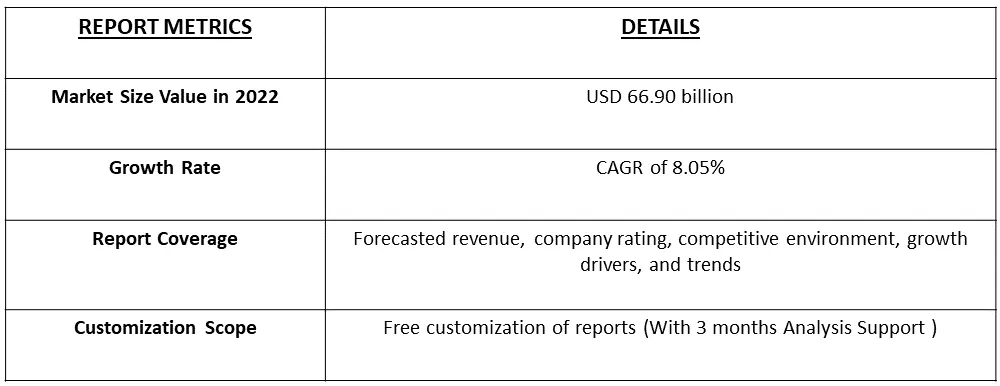

The Clinical Nutrition Market size is expected to grow from USD 66.90 billion in 2023, registering a CAGR of 8.05% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Clinical nutrition is a specialized field of nutrition that focuses on the application of nutrition principles to the prevention and treatment of various medical conditions and diseases. It involves assessing the nutritional needs of individuals and developing tailored dietary and nutritional plans to promote health and manage specific health issues. Clinical nutrition professionals, such as registered dietitians or clinical nutritionists, work closely with patients, healthcare providers, and other allied health professionals to ensure that individuals receive the appropriate nutrients and dietary guidance to support their overall well-being and address medical concerns.

Several factors are driving the growth of the clinical nutrition market. This growth is attributed to the growing incidence of metabolic disorders, substantial healthcare expenditure, and the expansion of the middle class in emerging economies. In the last ten years, there has been a notable rise in the occurrence of metabolic disorders.

There is a growing focus on personalized nutrition plans to meet individual health needs. Advances in genetics and diagnostics are allowing for more tailored nutritional interventions, addressing specific health conditions and genetic predispositions. Moreover, with the aging population in many countries, there's a rising demand for clinical nutrition products tailored to the unique dietary requirements of the elderly. This includes products for muscle preservation, bone health, and cognitive function.

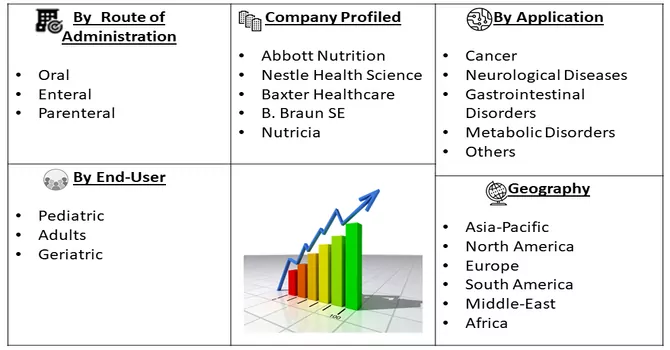

Market Segmentation: The Global Medical Nutrition Market is Segmented by Route of Administration (Oral Enteral, and Parenteral), Application (Nutritional Support in Malnutrition, Nutritional Support Metabolic Disorders, Nutritional Support in Gastrointestinal Diseases, Nutritional Support in Neurological Diseases, Nutritional Support in Cancer, and Nutritional Support in Other Diseases), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The value is provided (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers :

Increasing Prevalence of Metabolic Disorders

The increasing prevalence of metabolic disorders is a global health concern, but clinical nutrition offers a powerful tool to manage and prevent these conditions. Through personalized dietary plans, lifestyle guidance, and ongoing support, clinical nutritionists can help individuals regain control over their metabolic health and improve their overall quality of life.

An article from the Gaucher's Institute, last updated in November 2021, highlighted that Gaucher disease affects both males and females equally, with a global prevalence ranging from 0.70 to 1.75 cases per 100,000 individuals. Additionally, the article noted that the standardized birth incidence of Gaucher disease varies within the general population, ranging from 0.39 to 5.80 cases per 100,000 individuals. This considerable disease burden underscores the demand for clinical nutrition products, which in turn stimulates market growth.

High Spending on Healthcare and Growing Geriatric Population

As per the latest data published by OECD databases in 2021, total health expenditure in the U.S. exceeded 4 trillion USD. Expenditure as a percentage of GDP is projected to increase to approximately 20% by the year 2031. Furthermore, the introduction of new products is a significant catalyst for market expansion. As an example, in August 2021, Esperer Nutrition unveiled a selection of consumer nutraceuticals targeting areas like bone and joint health, immunity, urinary tract health, sleep apnea, and pre-diabetic care. These product launches are anticipated to boost the acceptance of clinical nutrition, ultimately contributing to the market's growth throughout the forecast period.

Market Restraints :

Imprecise Perception About Clinical Nutrition and Reduction in Birth Rates

The imprecise perception of clinical nutrition can have far-reaching consequences, including suboptimal health outcomes and potentially influencing birth rates. When individuals do not have a clear understanding of clinical nutrition, they may make dietary choices based on popular trends or fads rather than evidence-based recommendations. This can lead to suboptimal health outcomes. Thus, the growth of the market is expected to slow down over the forecast period.

The clinical nutrition market was notably impacted by the COVID-19 pandemic, and various research studies shed light on these effects. For instance, in May 2021, a research study published in the National Library of Medicine revealed that the prevalence of malnutrition among COVID-19 hospitalized patients was as high as 42%. This high prevalence underscores the insufficient nutritional support provided during the pandemic. Furthermore, initiatives aimed at issuing new guidelines are anticipated to fuel market growth in the coming years.

For instance, in January 2021, the European Society for Clinical Nutrition and Metabolism released guidelines related to the nutritional management of COVID-19-infected patients in the ICU. Clinical nutrition played a pivotal role in both infection prevention and the treatment of malnutrition associated with COVID-19. In a similar vein, in February 2021, Tata & Lyle launched the Tata & Lyle Nutrition Centre, a new digital platform offering convenient access to authoritative scientific information on ingredients that can aid food manufacturers in addressing public health challenges. As a result of these factors, the clinical nutrition market is poised to experience a positive impact during the forecast period of the study.

Segmental Analysis ;

Oral Route of Administration Segment is Expected to Witness Significant Growth Over the Forecast Period

Among the various routes available for clinical nutrition administration, oral and enteral routes are the most commonly utilized, with the parenteral route following closely behind. This preference primarily stems from the additional processing costs associated with parenteral routes. Until circumstances necessitate alternative administration routes, physicians typically opt for the oral route due to its relative simplicity and cost-effectiveness compared to the other two methods. Enteral therapy involves specialized liquid feedings comprising essential nutrients such as proteins, carbohydrates, fats, vitamins, and minerals required for sustaining life. These nutrition support products are tailored to meet individual needs, addressing a range of disease states and conditions. Notably, many of the disease conditions that call for oral clinical nutrition administration are chronic or non-acute. For instance, a 2021 paper published in the Journal of Nephrology highlights the case of end-stage renal disease (ESRD) patients, who have limited options—either waiting for a kidney transplant (which isn't always feasible due to donor availability and wait times) or undergoing regular hemodialysis. Specialized clinical nutrition administered orally or enterally is prescribed for these patients to ease the strain on their kidneys, helping regulate the production of waste products like creatinine, uric acid, and bilirubin. In addition to these factors, initiatives by key market players play a pivotal role in driving market growth. As an illustration, in April 2021, NutiFood entered into a partnership with BASF to manufacture Human Milk Oligosaccharides (HMO) products. This collaboration marked NutiFood as the first Vietnamese dairy company to collaborate with a European corporation to introduce HMO products into its line of nutrition offerings, which can be orally consumed.

Therefore, these factors mentioned above are expected to contribute to the growth of this segment during the forecast period.

Nutritional Support in Malnutrition

Malnutrition can take different forms, including undernutrition, overnutrition (obesity), and micronutrient deficiencies. Each type requires a tailored approach to nutritional support. Malnutrition may result from insufficient food intake, poor diet quality, underlying medical conditions, or a combination of these factors. Clinical nutrition is indispensable in the management of malnutrition. Through personalized assessment and tailored nutrition plans, clinical nutritionists help individuals overcome malnutrition's adverse effects on health. As a result, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America significantly contributes to the growth of the clinical nutrition market compared to other regions. However, the emergence of COVID-19 has led to shortages of clinical nutrition products in this area. According to data from the American Society for Parenteral and Enteral Nutrition (ASPEN) as of January 2021, several parenteral products, such as adult and pediatric multi-vitamin infusions, amino acids, potassium acetate injection, USP, sodium acetate injection, USP, and sodium chloride, are currently facing a shortage, with approximately 23.4% of injections affected.

Several key factors contribute to the growth of the clinical nutrition market, one of which is the increasing prevalence of metabolic disorders. For example, according to a press release by the Government of Canada published in August 2021, diabetes is a prominent chronic disease affecting Canadians. It was reported that over 3 million Canadians, equivalent to 8.8% of the population, had been diagnosed with diabetes, and 6.1% of Canadian adults were considered to be at high risk of developing diabetes as of August 2021. These chronic conditions necessitate long-term clinical nutritional support, underscoring the potential for diseases like diabetes to fuel market growth over the forecast period. These instances indicate a growing demand for clinical nutrition products, thereby propelling market growth.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market players are continuously engaged in expanding their presence through various inorganic growth strategies, such as acquisition, merger, and strategic collaboration, to gain significant market share and strengthen their product portfolios. Some of the key players in the market include:

Recent Developments

1. October 2022: Hologram Sciences, and Maeil Health Nutrition entered into a strategic partnership to deliver personalized nutrition solutions to the Korean market.

2. April 2022: Glanbia Nutritionals launched TechVantage a functionally optimized nutrient technology platform, which will provide customers with nutrient solutions.

Q1. How big is the Clinical Nutrition Market?

The Clinical Nutrition Market size is expected to grow from USD 66.90 billion in 2023, registering a CAGR of 8.05% during the forecast period.

Q2. At what CAGR is the market projected to grow within the forecast period?

Clinical Nutrition Market is registering a CAGR of 8.05% during the forecast period

Q3. What are the factors on which the Clinical Nutrition Market research is based on?

By Route of Administration, By Application and Geography are the factors on which the Clinical Nutrition Market research is based.

Q4. What are the factors driving the Clinical Nutrition Market?

Key factors that are driving the growth include the Increasing Prevalence of Metabolic Disorders and High Spending on Healthcare and Growing Geriatric Population.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model