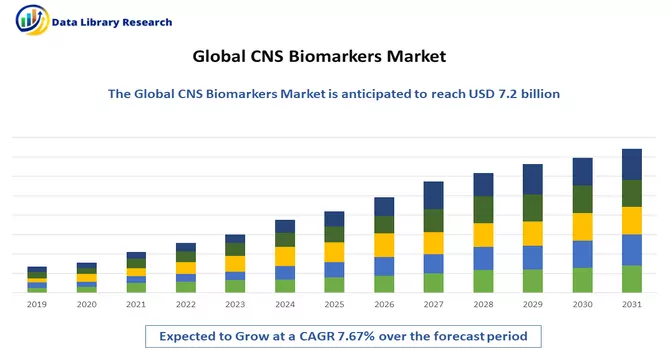

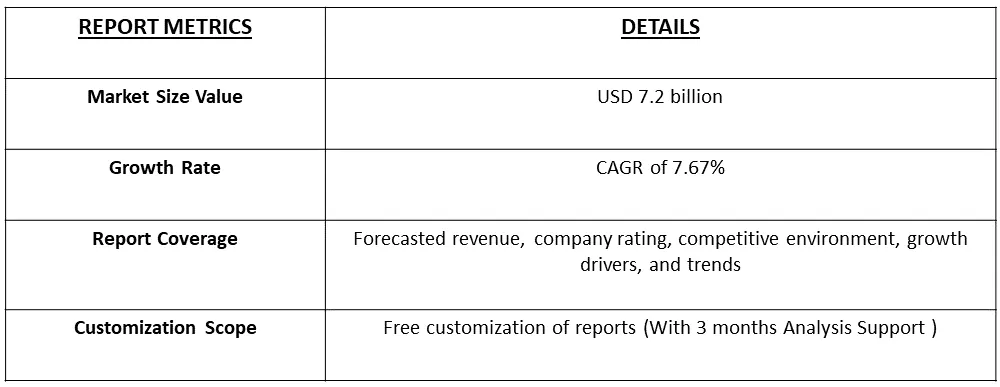

The Global Central Nervous System (CNS) Biomarkers Market, valued at approximately USD 7.2 billion in 2023, is projected to grow at a CAGR of 7.67% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Central Nervous System (CNS) biomarkers are measurable substances or indicators found in the central nervous system, which includes the brain and spinal cord. These biomarkers can be molecular, biochemical, or imaging-based and are used to provide information about the functioning, health, and diseases of the CNS. They are essential for diagnosing neurological disorders, monitoring disease progression, predicting treatment response, and facilitating drug development and clinical trials related to CNS conditions. Biomarkers play a crucial role in early detection, accurate diagnosis, and personalized treatment selection for CNS disorders.

This market involves the identification, measurement, and utilization of specific molecular, biochemical, or imaging markers that provide insights into the functioning, health, and diseases of the CNS, including the brain and spinal cord. These biomarkers are critical for diagnosing neurological disorders, monitoring disease progression, predicting treatment response, and facilitating drug development and clinical trials. The increasing prevalence of neurological disorders like Alzheimer's disease, Parkinson's disease, multiple sclerosis, and traumatic brain injuries is a major driver for the market growth. CNS biomarkers are essential for early detection, accurate diagnosis, and personalized treatment selection for these conditions. Advancements in genomics, proteomics, metabolomics, and neuroimaging techniques have significantly improved the identification, validation, and characterization of novel CNS biomarkers. High-throughput screening platforms, omics-based analyses, and advanced imaging modalities play a crucial role in biomarker discovery and validation processes, offering greater specificity, sensitivity, and predictive value for CNS disorders.

The ongoing advancements in genomics, proteomics, metabolomics, and transcriptomics technologies are continually enhancing the discovery of new Central Nervous System (CNS) biomarkers, boosting their specificity, sensitivity, and predictive accuracy. High-throughput screening platforms and sophisticated bioinformatics tools are streamlining the analysis of vast datasets, aiding in the identification of biomarker patterns linked to neurological disorders. Liquid biopsy methods, like cerebrospinal fluid (CSF) and blood-based biomarker analysis, are offering less invasive options for detecting and tracking CNS biomarkers. These innovations are opening avenues for early disease detection, continuous monitoring of disease progression, and evaluating treatment effectiveness in neurological disorders.

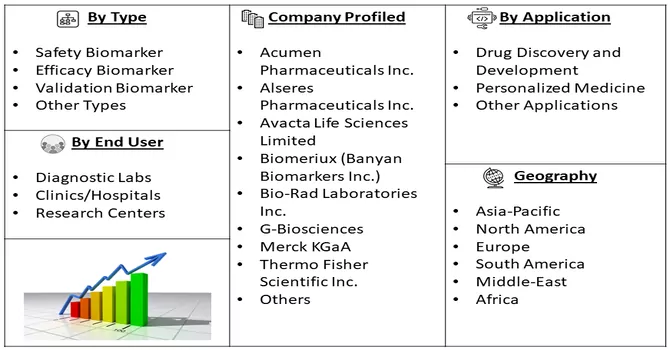

Market Segmentation: The Global Central Nervous System Biomarkers Market is Segmented by Type of CNS Biomarkers (Safety Biomarker, Efficacy Biomarker, Validation Biomarker, and Other Types of CNS Biomarkers), Application (Drug Discovery and Development, Personalized Medicine, and Other Applications), End User (Diagnostic Labs, Clinics/Hospitals, and Research Centers), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market values are provided in terms of (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Advancements in Omics Technologies

The recent advancements in genomics, proteomics, metabolomics, and transcriptomics have significantly contributed to the discovery of novel biomarkers for the central nervous system (CNS). These technologies have enabled researchers to identify biomarkers with greater specificity, sensitivity, and predictive value, enhancing our understanding of neurological disorders. High-throughput screening platforms and advanced bioinformatics tools play a crucial role in analyzing large datasets generated by these technologies. These tools help researchers identify biomarker signatures associated with different neurological disorders. By studying these biomarker patterns, researchers can gain insights into disease mechanisms, progression, and potential treatment targets. One notable example of the application of biomarkers in CNS research is the collaboration between Eisai Co. Ltd and Biogen Inc. In November 2021, they presented their use of plasma-based biomarkers in the Phase 3 AHEAD 3-45 study of lecanemab (BAN2401), an investigational antibody for Alzheimer's disease. This approach highlights the importance of biomarkers in monitoring treatment response and disease progression in neurodegenerative disorders. Thus, the continued advancements in biomarker discovery and analysis technologies offer promising opportunities for early disease detection, personalized treatment strategies, and improved outcomes for patients with neurological disorders.

Emergence of Liquid Biopsy Approaches

Liquid biopsy methods, including the analysis of cerebrospinal fluid (CSF) and blood-based biomarkers, present less invasive ways to detect and monitor central nervous system (CNS) biomarkers. These techniques offer significant advantages for early disease detection, continuous tracking of disease progression, and evaluating treatment efficacy in neurological disorders. By analyzing CSF and blood-based biomarkers, researchers and clinicians can gather valuable information about CNS health and disease status. CSF, which surrounds the brain and spinal cord, can provide direct insights into CNS conditions. Blood-based biomarkers, on the other hand, offer a less invasive alternative, as they can be collected more easily and frequently. The ability to detect and monitor CNS biomarkers through liquid biopsies has transformative potential for neurological disorders. It enables clinicians to intervene earlier in disease progression, potentially improving patient outcomes. Additionally, these methods allow for longitudinal monitoring, providing valuable data on disease progression and treatment response over time. Thus, liquid biopsy techniques represent a promising avenue for advancing the field of CNS biomarker research. They offer minimally invasive, yet powerful, tools for early detection, monitoring, and treatment evaluation in neurological disorders.

Market Restraints:

Complexity of CNS Disorders and Limited Understanding of Disease Mechanisms

Central nervous system (CNS) disorders present a complex and diverse range of conditions, making it difficult to find dependable biomarkers that truly reflect the disease's nature, progression, and response to treatment. The intricate nature of these disorders complicates the process of discovering, validating, and applying biomarkers in clinical settings. Despite significant progress in neuroscience, there is still a considerable gap in our knowledge of the underlying mechanisms of CNS disorders. This limited understanding of disease processes and molecular pathways poses challenges in pinpointing precise biomarkers and utilizing them effectively in clinical practice.

The COVID-19 pandemic has had a significant impact on research laboratories and academic institutions, leading to temporary closures or reduced operations. This has disrupted the process of discovering and validating novel biomarkers for central nervous system (CNS) disorders, slowing down progress in understanding these conditions. Many research projects were delayed or suspended, affecting the pace of biomarker research and studies on neurological disorders. The pandemic also caused a shift in research priorities, with many researchers focusing on understanding the neurological effects of COVID-19 and their underlying mechanisms. This shift diverted resources and attention away from other neurological disorders, as efforts were redirected towards studying CNS biomarkers associated with COVID-19-related neurological complications such as encephalopathy, stroke, and neuroinflammation.

Segmentation Analysis

Safety Biomarker Segment is Expected to Witness Significant Growth Over the Forecast Period

Biomarkers that indicate neurotoxicity play a crucial role in evaluating the safety of drugs and therapies designed to treat central nervous system (CNS) disorders. These biomarkers can include various indicators of neuronal damage, synaptic dysfunction, and neuroinflammation. Examples of such biomarkers include neurofilament light chain (NfL), glial fibrillary acidic protein (GFAP), and certain cytokines. Neurotoxicity biomarkers provide valuable insights into the potential adverse effects of drugs or therapies on the CNS. By monitoring these biomarkers, researchers and clinicians can assess the impact of treatments on neuronal health and function. This information is essential for ensuring the safety and efficacy of CNS-targeted therapies and for guiding treatment decisions in clinical practice.

Efficacy Biomarker Segment is Expected to Witness Significant Growth Over the Forecast Period

Biomarkers linked to the pathology, progression, and response to treatment are vital for evaluating the effectiveness of therapies in central nervous system (CNS) disorders. These biomarkers can encompass various indicators of neuronal function, inflammation, neurodegeneration, or neurotransmitter activity, tailored to the specific mechanisms of each disease. These biomarkers provide valuable insights into the underlying processes of CNS disorders and how they respond to treatment. By monitoring these biomarkers, clinicians and researchers can assess the impact of therapies on disease progression and tailor treatments to individual patients. Overall, biomarkers play a critical role in advancing our understanding and management of CNS disorders.

Drug Discovery and Development Segment is Expected to Witness Significant Growth Over the Forecast Period

Once researchers identify and validate molecular targets, they use various screening methods, such as high-throughput screening (HTS), virtual screening, and structure-based drug design, to find candidate compounds with therapeutic potential. Central nervous system (CNS) biomarkers play a crucial role in this process by helping prioritize hit compounds based on their ability to affect disease-related pathways and biological activities.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is a hub for leading research institutions, academic centers, and medical universities that are at the forefront of central nervous system (CNS) biomarker research. Renowned institutions such as Harvard University, Johns Hopkins University, Stanford University, and the University of California system are known for their pioneering work in neuroscience, biomarker discovery, and translational medicine. These institutions drive innovation in CNS biomarker research through their cutting-edge research initiatives and collaborations. Their work contributes significantly to advancing our understanding of CNS disorders and developing novel diagnostic and therapeutic approaches. Their contributions have a global impact, shaping the future of CNS biomarker research and its application in clinical practice. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Some of the key market players working in this segment are:

Recent Developments:

1) Eisai Co. Ltd and Biogen Inc. disclosed in November 2021 their plans to present findings on the potential use of plasma-based biomarkers in the Phase 3 AHEAD 3-45 study of lecanemab (BAN2401), an experimental anti-amyloid beta (Aβ) protofibril antibody for Alzheimer's disease. This study aims to explore the utility of plasma-based biomarkers in predicting treatment response and disease progression.

2) In October 2021, Diadem released clinical data demonstrating that its AlzoSure biomarker test can forecast the progression of Alzheimer's disease years before symptoms manifest. This breakthrough could revolutionize early diagnosis and intervention strategies for Alzheimer's, potentially enabling more effective treatments and improved patient outcomes.

Q1. What was the CNS Biomarkers Market size in 2023?

As per Data Library Research the Central Nervous System (CNS) Biomarkers Market, valued at approximately USD 7.2 billion in 2023.

Q2. At what CAGR is the CNS Biomarkers market projected to grow within the forecast period?

CNS Biomarkers market is projected to grow at a CAGR of 7.67% over the forecast period.

Q3. What are the factors driving the CNS Biomarkers market?

Key factors that are driving the growth include the Advancements in Omics Technologies and Emergence of Liquid Biopsy Approaches.

Q4. Who are the key players in CNS Biomarkers market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model