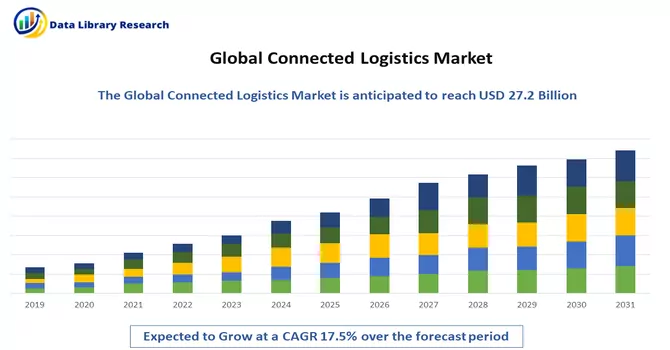

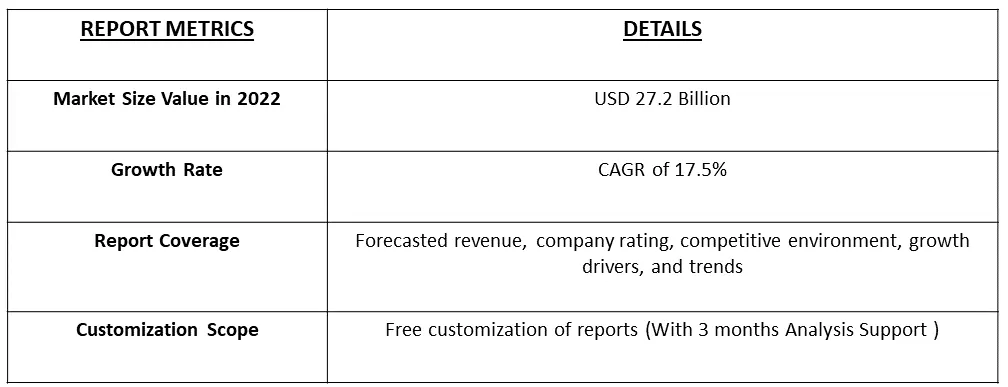

The Global Connected Logistics Market is currently valued at USD 27.2 Billion in the year 2022 and is expected to register a CAGR of 17.5% during the forecast period (2023 - 2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Connected logistics is an interdependent set of communication devices, joints, and Internet of Things (IoT) technologies that change the key logistical processes to become more customer-centric by sharing data, information, and facts with the supply chain partners.

Connected Logistics helps businesses become more customer-centric and efficient by increasing transparency in the business process. The increasing adoption of IoT and sensor-based technologies like RFID in various domains, including the Supply Chain Management (SCM) system, will drive the connected logistics market in the forecast period.

Segmentation:

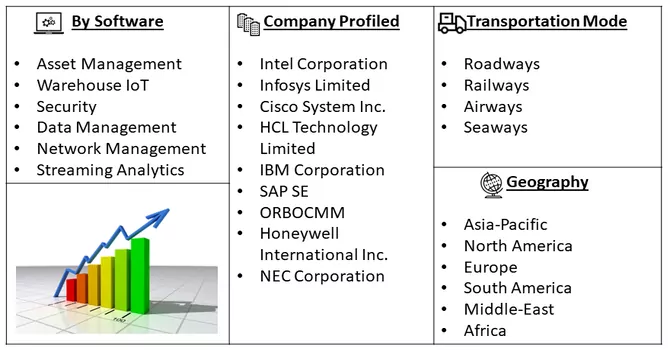

The Connected Logistics Market is segmented

By Software :

Transportation Mode :

End-user Industries

Geography

The report offers the market size and forecasts in value (USD million) for the above-mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

The IoT continues to play a significant role in connected logistics. Sensors and devices were being used to monitor the location, condition, and performance of assets such as vehicles, containers, and goods in transit. Real-time data from these devices allowed for better visibility and control over the supply chain. Moreover, the rollout of 5G networks was expected to improve the connectivity and data transmission capabilities of IoT devices, enabling faster and more reliable data exchange in logistics operations

Drivers

Growing Adoption of Technology-enabled Devices

The growing adoption of technology-enabled devices and connected logistics is leading to greater efficiency, transparency, and innovation in the logistics and supply chain industry. Internet of Things (IoT) technology is being increasingly integrated into logistics operations. Sensors and devices are attached to assets such as vehicles, containers, and packages to collect real-time data on their location, condition, and status. This data is invaluable for tracking and managing goods in transit, improving inventory management, and optimizing routes. Thus, the market is expected to witness significant growth over the forecast period.

Emergence of Autonomous Vehicles

Autonomous trucks, often referred to as self-driving trucks, are being developed and tested by various companies. These vehicles have the potential to revolutionize long-haul transportation by reducing labor costs, improving fuel efficiency, and increasing safety. The integration of Internet of Things (IoT) devices with vehicles, containers, and packages provides real-time data on their location, condition, and performance. This data enhances visibility and helps in monitoring and managing assets and shipments. Thus, the market is expected to witness significant growth over the forecast period.

Restraints

Lack of Logistics Standardization

Without standardized protocols and formats for data exchange, different logistics systems and devices may not be compatible with each other. This can lead to interoperability issues, where data from one system cannot be easily integrated with another. For connected logistics to reach its full potential, it's essential that devices and systems from different manufacturers can seamlessly communicate and share data. Thus, the growth of the market may slow down over the studied period.

The pandemic accelerated the adoption of digital technologies in the logistics industry. Companies recognized the need to increase visibility and control over their supply chains, leading to greater interest in connected logistics solutions. Also, the COVID-19 pandemic served as a catalyst for the adoption of connected logistics solutions. It highlighted the importance of real-time data, visibility, and agility in supply chain management. As a result, the connected logistics market experienced increased interest and investment as companies sought to address the challenges posed by the pandemic and prepare for future disruptions.

Segmental Analysis

Software Segment is Expected to Witness Significant Growth Over the Forecast Period

The software for the connected logistics market encompasses a wide range of solutions and platforms that enable real-time tracking, monitoring, optimization, and management of various aspects of the supply chain and transportation. These software solutions play a crucial role in improving efficiency, visibility, and decision-making within the logistics industry. For instance, TMS software helps optimize the planning and execution of transportation operations. It includes features for route optimization, carrier selection, load optimization, and real-time tracking of shipments. Thus, such development of software is expected to fuel the growth of the segment, thereby fueling the growth of the studied market.

The Railway Segment is Expected to Witness Significant growth over the Forecast Period

The connected logistics in railways leverage technology and data to optimize rail transportation, enhance safety, and improve the overall efficiency of the supply chain. It plays a vital role in modernizing and advancing the railway industry to meet the demands of a rapidly changing logistics landscape. Moreover, connected logistics in railways often involve the use of telematics and onboard sensors to monitor the condition and location of rail assets such as locomotives, railcars, and freight containers in real time. These sensors provide data on factors like temperature, humidity, speed, and track conditions, enabling proactive maintenance and better asset utilization. Thus, the segment is expected to witness significant growth over the forecast period.

Commercial Vehicle Segment is Expected to Witness Significant growth over the Forecast Period

Commercial vehicles play a critical role in connected logistics, as they are essential for the transportation of goods and materials within the supply chain. Connected logistics solutions for commercial vehicles involve the integration of various technologies, software, and data-driven systems to optimize operations, enhance safety, and improve efficiency. Telematics systems are installed in commercial vehicles to collect and transmit data on vehicle location, speed, fuel consumption, engine performance, and more. Fleet management software then processes this data to optimize routes, improve fuel efficiency, and schedule maintenance.

Moreover, connected logistics systems use vehicle data to predict maintenance needs. By analyzing factors like engine performance and mileage, maintenance schedules can be optimized to reduce downtime and prevent breakdowns. Thus, the segment is expected to grow significantly growth over the forecast period.

Retail & E-commerce Segment is Expected to Witness Significant growth over the Forecast Period

The retail and e-commerce industry has undergone significant transformations in recent years, with connected logistics playing a crucial role in shaping its future. The rise of e-commerce has revolutionized the retail industry. E-commerce allows consumers to shop online, making it convenient and accessible. This trend has accelerated, especially during the COVID-19 pandemic when online shopping became a necessity for many. Moreover, retailers use data and artificial intelligence to personalize the shopping experience. Recommendations based on past purchases and user behavior have become common, enhancing customer satisfaction and increasing sales. Thus, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth over the Forecast Period

The Asia Pacific region is poised for substantial revenue growth in the coming years, particularly in developing economies such as India and China. Factors driving this growth include advancements in technology, the proliferation of sensors, and increased automation.

For example, China stands as the world's largest E-Commerce market, accounting for over 50% of global E-Commerce transactions. According to Dezan Shira & Associates, the number of digital buyers in China exceeded 634 million in 2020. Furthermore, China's E-Commerce market is projected to surpass the combined markets of the U.S., U.K., Japan, Germany, and France. The recent expansion of China's E-commerce industry can be attributed to improvements in internet infrastructure and the establishment of global logistics networks.

In a similar vein, Singapore has embarked on a transformation journey within the logistics sector to bolster its position in the Asia Pacific logistics industry. The Singaporean government has initiated this transformation as part of its $4.5 billion Industry Transformation Programme. The primary objective of this program is to enhance the efficiency of logistics operations, foster innovation leadership, cultivate a skilled local logistics workforce, and make Singapore an attractive destination for foreign investment.

This initiative is referred to as the Logistics Industry Transformation Map (ITM) and aligns with similar strategies employed in Singapore's food and beverage and precision engineering sectors.

Get Complete Analysis Of The Report - Download Free Sample PDF

The competitive landscape of the global connected logistics market is moderately fragmented due to the presence of many existing and emerging players in the market. The technological developments in the logistics industry are expected to fuel the rise in investments and product innovations. The competitors are proactively addressing the challenges by crafting strategies that can have the best overall effect on the market’s progress. The opportunities for growth in the market have ample scope for development in the forecast period. Some of the companies working in this domain are:

Intel Corporation

Recent Development:

1. May 2020 - E2open Parent Holdings, Inc., a leading network-based provider of a 100% cloud-based, mission-critical, end-to-end supply chain management platform, announced to acquisition of BluJay Solutions, a leading cloud-based logistics execution platform for approximately USD 1.7 billion.

2. June 2021 - Holisol Logistics, which provides end-to-end (E2E) supply chain management solutions, has raised USD 3 million in debt financing from Northern Arc Capital. Holisol provides E2E solutions due to customer demands for supply chain logistics. The proceeds shall be used for the company’s growth and to increase demand

Q1. What is the current Connected Logistics Market size?

The Global Connected Logistics Market is currently valued at USD 27.2 Billion.

Q2. What is the Growth Rate of the Connected Logistics Market?

Connected Logistics Market is expected to register a CAGR of 17.5% during the forecast period

Q3. Which region has the largest share of the Connected Logistics Market? What are the largest region's market size and growth rate??

Asia Pacific region has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Q4. What are the factors on which the Connected Logistics Market research is based on?

By Software, By Transportation & Geography are the factors on which the Connected Logistics Market research is based.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model