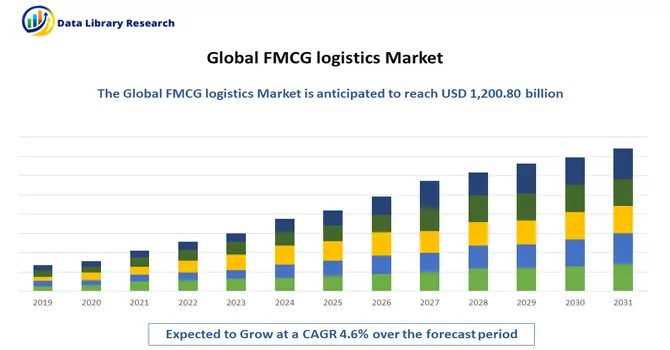

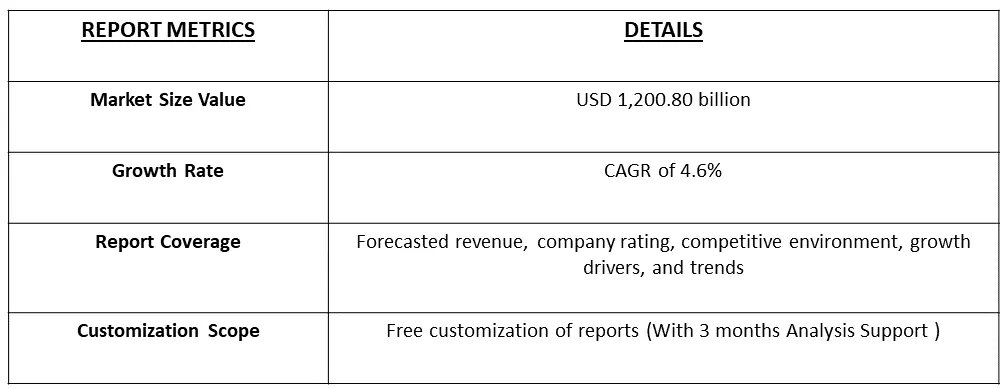

The global FMCG logistics market, valued USD 1,200.80 billion in 2022, reflecting a notable Compound Annual Growth Rate (CAGR) of 4.6% over the forecast period 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

FMCG logistics, which stands for Fast-Moving Consumer Goods logistics, encompasses the strategic planning, execution, and oversight of the streamlined movement and storage of fast-moving consumer goods from their origin to the ultimate point of consumption. This industry plays a pivotal role in ensuring the efficient and cost-effective delivery of products, including food items, beverages, personal care products, and household goods, to consumers in a timely manner. The FMCG sector, characterized by the rapid turnover of goods and consumer-driven preferences, necessitates a responsive logistics infrastructure capable of adapting to fluctuating demand. The essence of FMCG logistics lies in its ability to meet consumer expectations by delivering a diverse range of products promptly.

Moreover, the global nature of markets today, FMCG companies often operate on an international scale, navigating the complexities of cross-border trade. This international dimension requires sophisticated and interconnected logistics networks to facilitate the seamless movement of products across borders. These logistics networks must be not only efficient but also capable of handling the intricacies and challenges associated with international shipping and customs regulations. Thus, the FMCG logistics sector is a linchpin in the supply chain, ensuring that the diverse array of fast-moving consumer goods reaches end consumers with speed, reliability, and cost-effectiveness. The anticipated growth in this market underscores its critical role in supporting the dynamic and ever-evolving landscape of the FMCG industry on a global scale.

The trend of online shopping and the proliferation of e-commerce channels for Fast-Moving Consumer Goods (FMCG) products persist as substantial drivers of industry evolution. Consumers are progressively inclined towards the convenience offered by online platforms for ordering a wide spectrum of household essentials, groceries, and personal care items. This shift reflects a transformative change in consumer behavior, with a notable preference for the accessibility and efficiency provided by digital retail spaces. Moreover, there is a discernible upsurge in consumer awareness regarding health and wellness, prompting an increased demand for products perceived as healthier, natural, and sustainable. This growing consciousness about well-being has reverberated across both the food and non-food segments of the FMCG industry. Consumers are actively seeking products that align with their health goals and resonate with environmentally conscious practices, steering the industry towards a more health-centric and sustainable trajectory. Thus, the combination of the surge in online shopping and the heightened focus on health and wellness has ushered in a transformative era for the FMCG sector. These trends underscore the industry's adaptability to evolving consumer preferences, showcasing the crucial interplay between convenience, health consciousness, and sustainability in shaping the landscape of FMCG consumption.

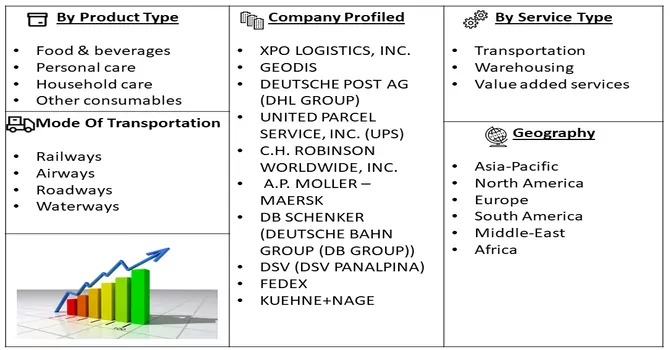

Market Segmentation: The report covers Global FMCG Logistics Companies and the market is segmented by service (transportation, warehousing, distribution, inventory management, and other value-added services), and by geography (Asia-Pacific, North America, Europe, Latin America, Middle East and Africa). The market size and forecasts in value (USD) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Changing Consumer Preferences:

The FMCG market is heavily influenced by shifts in consumer preferences and behaviours.; As consumers become more health-conscious, environmentally aware, and tech-savvy, they demand products that align with these values. FMCG companies need to adapt their product offerings, marketing strategies, and supply chains to cater to evolving consumer trends. For instance, the rising demand for healthier snacks, sustainable packaging, and online shopping reflects the impact of changing consumer preferences on the FMCG market. Moreover, the technolofical developmemts are expected to fuel the growth of the studied market. For instance, In February 2021, Deutsche Post AG (DHL Group) declared to invest about USD 47 million (€40 million) in its Indonesian operations over the next few years. Under this investment plan, DHL unveiled a new 17,000 square meter warehouse located in Cimanggis, which includes specialty features tailored for customers in the fast-moving consumer goods (FMCG) industry. Thus, such developments are expected to witness significant growth over the forecast period.

E-commerce Growth:

The rapid expansion of e-commerce has become a significant driver for the FMCG sector. Consumers increasingly prefer the convenience of online shopping for everyday products such as groceries, personal care items, and household goods. The ease of ordering, home delivery options, and the availability of a wide range of products online have reshaped the way consumers purchase FMCG products. FMCG companies are adjusting their distribution strategies and investing in digital technologies to capitalize on the growth of e-commerce channels, making it a pivotal driver in the industry. In December 2020, A.P. Moller - Maersk opened its warehouse and distribution facility in Abidjan, Ivory Coast. The newly opened 5,000 m2 facility is designed to handle 3,900 pallet positions and meet the endto-end requirements of Maersk’s global customers, including retail, fast moving consumer goods, and technology. Thus, such developments are expected to witness significant growth over the forecast period.

Market Restraints:

Intense Competition and Supply Chain Complexity and Disruptions:

The FMCG sector is highly competitive, with numerous brands vying for consumer attention. Intense competition can lead to pricing wars, reduced profit margins, and increased marketing expenses as companies strive to differentiate themselves. Retailers, both traditional and online, may exert pressure on FMCG manufacturers to keep prices low, impacting profitability. Additionally, the saturation of certain product categories intensifies competition, making it challenging for new entrants to gain market share. FMCG companies often face challenges related to supply chain complexity. Managing the procurement of raw materials, production, distribution, and inventory in an efficient and cost-effective manner is crucial. Disruptions in the supply chain, whether due to natural disasters, geopolitical events, or unexpected demand surges (as seen during the COVID-19 pandemic), can lead to product shortages, increased lead times, and additional costs. Ensuring the resilience and flexibility of the supply chain is a constant challenge for FMCG companies, especially given the perishable nature of many products.

Lockdowns, social distancing measures, and concerns about health and safety led to shifts in consumer behavior. There was a surge in demand for essential products such as groceries, hygiene items, and household cleaners. Consumers prioritized essential goods over non-essential items, impacting the sales patterns and product preferences within the FMCG sector. The pandemic disrupted global supply chains due to factory closures, transportation restrictions, and labor shortages. This led to challenges in procuring raw materials, manufacturing products, and distributing goods. FMCG companies faced delays and shortages, impacting their ability to meet demand and maintain consistent inventory levels.

Segmental Analysis:

Transportation Segment is Expected to Witness Significant Growth Over the Forecast Period.

FMCG companies often operate extensive distribution networks to reach a wide range of retailers and consumers. Transportation plays a vital role in connecting production facilities with various distribution centers, warehouses, and retail outlets. FMCG products may be transported using various modes, including road, rail, sea, and air transport, depending on factors such as distance, urgency, and cost considerations. Road transport is commonly used for short distances and last-mile delivery, while sea and air transport are preferred for international shipments

North America is Expected to Witness Significant Growth Over the Forecast Period.

The North American Fast-Moving Consumer Goods (FMCG) market stands as a significant and diverse arena encompassing a wide array of products, ranging from food and beverages to personal care items and household goods. Historically, this market has demonstrated consistent growth, propelled by consumer preferences for convenience, innovation, and product quality. A discernible shift in consumer preferences is underway in North America, with an increasing inclination towards healthier and more sustainable products. This evolving trend is marked by a rising demand for natural and organic options, with consumers displaying heightened awareness and consideration of factors such as product ingredients, sourcing practices, and ethical standards. The FMCG landscape in North America is adapting to meet these changing consumer expectations, with companies emphasizing transparency and sustainability in their offerings. In a strategic move reflective of the region's dynamic logistics landscape, DB SCHENKER inaugurated a warehousing hub in Badli, Gurgaon, in September 2020. This facility is strategically positioned to enhance supply chain management within the National Capital Region (NCR) and North India. Offering a comprehensive suite of logistics and chain solutions, this hub caters to a diverse range of sectors, including automotive, pharma, retail & consumer, industrial, electronics, and aerospace. The establishment of this hub underscores the industry's commitment to efficient and effective supply chain operations, aligning with the evolving needs of the North American FMCG market.

Get Complete Analysis Of The Report - Download Free Sample PDF

The FMCG logistics market is fairly fragmented with the presence of large players and small and medium-sized local players with quite a few players who occupy the market share. DHL Group, C.H. Robinson, Kuehne + Nagel, Ceva Logistics, DB Schenker, DSV, and XPO Logistics are among Global’s top competitors. Most of the global logistics players have a retail and consumer goods logistics division to meet the market needs and demand. Additionally, local players are increasingly enhancing their capabilities in terms of inventory handling, service offerings, products handled, and technology. One of the market players working in this segment are:

Recent Development:

1) August 2023: Reliance Retail expanded its store count by 3,300 reaching a total of 18,040 stores with a combined area of 65.6 million square feet.

2) July 2023: India's Swiggy is set to acquire LYNK Logistics, a retail distribution company in the fast-moving consumer goods (FMCG) space, marking the food-delivery company's entry into the retail business-to-business (B2B) segment. The acquisition of LYNK will help Swiggy strengthen its food and grocery delivery network via an extensive retail distribution system.

Q1. What was the FMCG (Fast-Moving Consumer Goods) logistics Market size in 2022?

As per Data Library Research the global FMCG logistics market, valued USD 1,200.80 billion in 2022.

Q2. At what CAGR is the FMCG (Fast-Moving Consumer Goods) logistics market projected to grow within the forecast period?

FMCG (Fast-Moving Consumer Goods) logistics market is registering a notable Compound Annual Growth Rate (CAGR) of 4.6% over the forecast period.

Q3. What are the factors driving the FMCG (Fast-Moving Consumer Goods) logistics market?

Key factors that are driving the growth include the Changing Consumer Preferences and E-commerce Growth.

Q4. Which region has the largest share of the FMCG (Fast-Moving Consumer Goods) logistics market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model