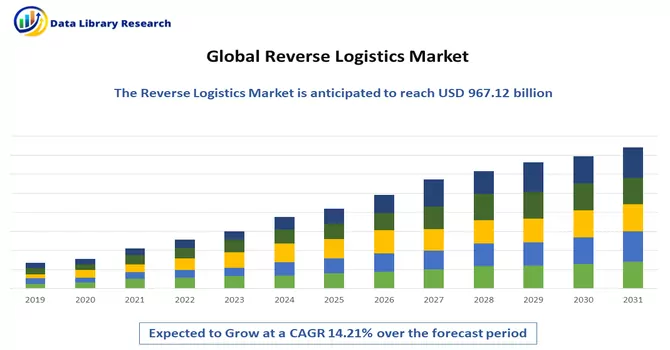

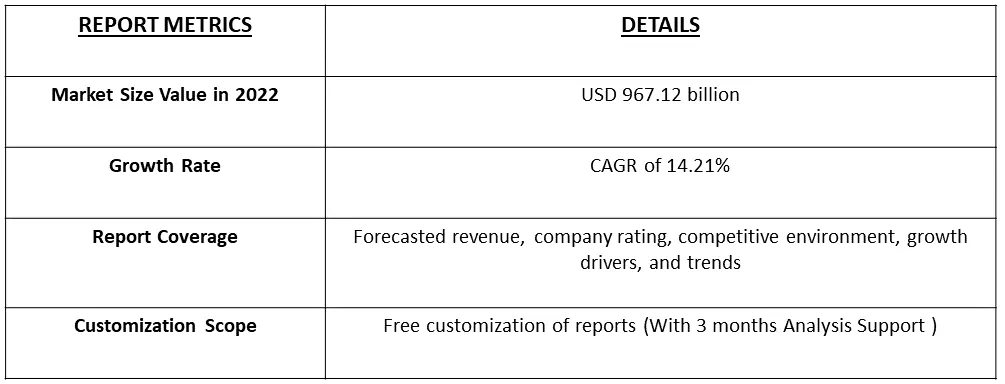

The global reverse logistics market size was evaluated at USD 967.12 billion in 2022 and it is expected to have a CAGR of 14.21% during the forecast period 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Reverse logistics refers to the process of moving goods from their final destination back to the manufacturer or another location for returns, remanufacturing, recycling, or disposal. Unlike traditional logistics, which primarily involves the movement of products from manufacturers to consumers, reverse logistics deals with the product's journey in the opposite direction, away from the consumer or the end user.

The global market is anticipated to be driven by the growing usage of reverse logistics by numerous companies to efficiently handle the return of goods from customers to businesses or makers. In the upcoming years, market development is expected to be fueled by rising environmental awareness as well as increasing knowledge of reverse logistics' advantages.

Technology, such as IoT (Internet of Things), RFID (Radio-Frequency Identification), and blockchain, is being used to improve visibility and traceability in reverse logistics. This helps in tracking returned products and materials throughout the process. Some manufacturers are offering product take-back programs, where customers can return products at the end of their life cycle. These products can then be disassembled, refurbished, or recycled.

Market Segmentation:

The Reverse Logistics Market is Segmented

By End User :

By Software :

Geography :

The market sizes and forecasts are provided in terms of value in USD billion for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Growing Usage of Reverse Logistics by Numerous Companies

The growing usage of reverse logistics by numerous companies underscores its importance in today's business landscape. It is not only a means of managing product returns but also a pathway to a more sustainable, cost-effective, and environmentally responsible supply chain. Collaborative efforts among manufacturers, retailers, and third-party reverse logistics providers are becoming more common. These partnerships can streamline processes, reduce waste, and improve the overall efficiency of reverse logistics operations. For instance, in September 2023, The National Retail Federation today announced its acquisition of the Reverse Logistics Association (RLA), a global trade association for the returns and reverse industry. The announcement was made during the RLA Leadership Summit in Atlanta and is part of NRF's unrivaled commitment to support sustainable practices throughout the retail industry.

Reverse Logistics Market Growth of E-commerce

The growth of e-commerce has elevated the importance of reverse logistics in the retail industry. Managing product returns and optimizing the reverse logistics process has become a critical aspect of e-commerce operations. As the e-commerce sector continues to expand, companies will increasingly invest in advanced reverse logistics solutions to ensure customer satisfaction, reduce operational costs, and demonstrate their commitment to sustainability. Thus, the market is expected to witness significant growth over the forecast period.

Restraints :

Reverse Logistics Market Process Uncertainty in Reverse Logistics

Managing costs related to reverse logistics is complex, as they encompass transportation, storage, labor, recycling, and more. Companies must balance the need to manage costs with providing efficient and sustainable reverse logistics services. Process uncertainty in reverse logistics poses significant challenges for businesses. Addressing these challenges requires a multifaceted approach that combines technology, standardization, improved visibility, and a focus on customer satisfaction.

The COVID-19 pandemic had a notable impact on the reverse logistics market, with both challenges and opportunities arising as a result of the disruptions and changes brought about by the global health crisis. The pandemic disrupted global supply chains, leading to delays in production, shipping, and distribution. This caused shortages of products in some regions and surpluses in others. Reverse logistics played a crucial role in managing excess inventory and redistributing products to areas with higher demand. In the current scenario, technology plays a crucial role in helping businesses navigate these challenges and optimize their reverse logistics operations in response to the evolving market demands and thus the market is expected to witness significant growth over the forecast period.

Segmental Analysis

Commercial Returns Segment is Expected to Witness Significant growth over the Forecast Period

Commercial returns and reverse logistics are integral to modern supply chain management. Efficiently managing the return and aftermarket process is crucial for reducing costs, maintaining customer satisfaction, and promoting sustainability. By understanding the reasons behind returns, implementing the right technology, and adapting to changing consumer preferences, businesses can turn commercial returns into strategic opportunities rather than cost centers. Moreover, technology, such as barcoding, RFID (Radio-Frequency Identification), and data analytics, plays a critical role in commercial returns and reverse logistics. These tools help track returned products, assess their condition, and make informed decisions about their disposition. Thus the segment is expected to witness significant growth over the forecast period.

E-commerce Segment is Expected to Witness Significant growth over the Forecast Period

E-commerce businesses often experience a higher rate of product returns compared to traditional retail stores. This is primarily because consumers shopping online do not have the opportunity to physically inspect products before purchase, leading to more frequent returns. Reverse logistics is crucial for efficiently handling these returns, ensuring customer satisfaction and managing the associated costs. E-commerce companies recognize the importance of providing a convenient and hassle-free return process. Meeting customer expectations is critical for maintaining trust and loyalty. E-commerce businesses invest in robust reverse logistics processes to ensure returns are processed efficiently and refunds or replacements are provided promptly. Thus, owing to such benefits the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant growth over the Forecast Period

North America's mature and competitive market, driven by the rise of e-commerce, environmental concerns, technology adoption, and a focus on customer satisfaction, has made reverse logistics a crucial aspect of supply chain management in the region. Companies in North America continue to refine their reverse logistics processes to meet the evolving demands of consumers and regulatory requirements while striving for sustainability and efficiency.

Also, North America has a highly developed retail industry, both in terms of traditional brick-and-mortar stores and e-commerce. Retailers in the region have recognized the significance of effective reverse logistics for managing product returns and minimizing costs while maintaining customer satisfaction.

Furthermore, the recent developments are expected to drive the studied market growth. For instance, in October 2023, Blue Yonder, a prominent provider of supply chain solutions, announced the signing of an agreement to acquire Doddle, a leading technology company specializing in first and last-mile services. Co-founded by Tim Robinson and Sir Lloyd Dorfman, Doddle's expertise covers final mile delivery, returns management, and reverse logistics solutions. This strategic acquisition will enable Blue Yonder to further enrich its comprehensive suite of supply chain management and commerce solutions. With Doddle's capabilities, Blue Yonder can offer retailers and logistics service providers, including carriers, an enhanced customer experience that is both streamlined and transformative. This expansion not only benefits their customers but also provides opportunities for sustainable growth as they seek to fortify their operations and foster more resilient supply chains. Thus, such developments in the region are expected to boost the studied market growth in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Reverse Logistics Market is highly competitive due to the presence of many major players working globally and regionally. Some of the major players working in this market segment are:

Recent Developments:

1) In March 2023, Optoro introduced Gap Inc. as its latest partner to transform exchanges and returns for Old Navy, Gap, Banana Republic, and Athleta. Optoro’s returns experience features an intuitive online returns portal for initiating returns quickly and easily, instant exchanges, fraud-protected customer keep, box-free, label-free drop-off locations, and more.

2) In March 2022, ReverseLogix and DHL Supply Chain, a division of the Deutsche Post DHL Group, announced a deal.

Q1. At what CAGR is the Reverse Logistics market projected to grow within the forecast period?

Reverse Logistics market is expected to have a CAGR of 14.21% during the forecast period

Q2. What is the Reverse Logistics market size in 2022?

As per Data Library Research Reverse Logistics market valued at USD 967.12 billion in the year 2022.

Q3. Which region has the largest share of the Reverse Logistics market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Q4. What segments are covered in the Reverse Logistics market Report?

By Software, By End User & Geography ae the segments covered in the Reverse Logistics market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model