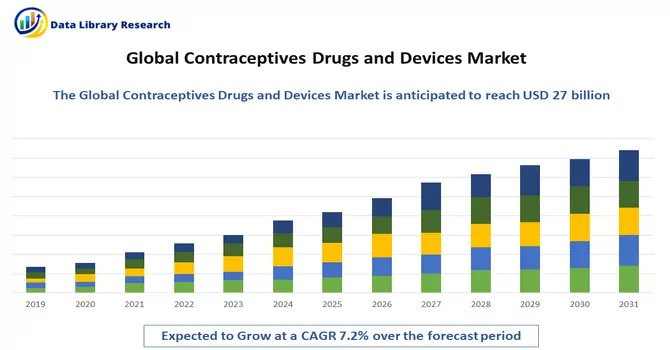

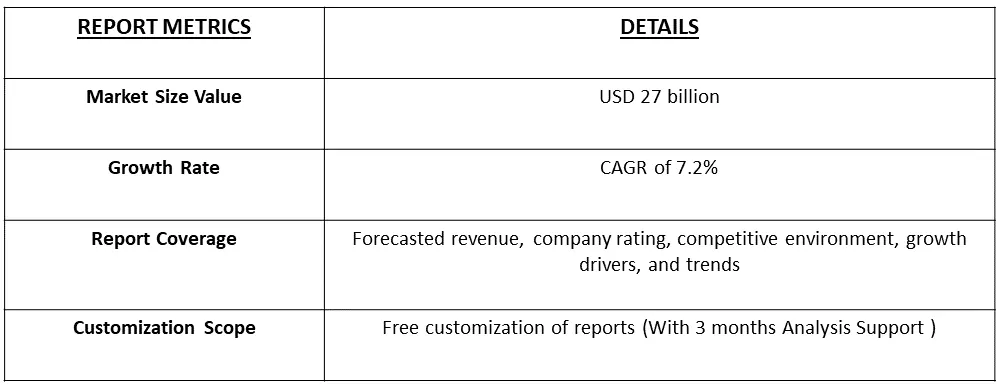

The Contraceptive Drugs and Devices Market was valued at USD 27 billion in 2022 and is expected to grow at a CAGR of 7.2% over the forecast period 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The contraceptive drugs and devices constitute a comprehensive category encompassing pharmaceuticals, medical devices, and products designed to prevent pregnancy, with the overarching objective of providing safe, effective, and diverse options for birth control on a global scale. The market's growth is driven by several factors, including the increasing incidence of sexually transmitted diseases, a rising rate of unintended pregnancies, and government initiatives aimed at addressing reproductive health concerns. The growing prevalence of unwanted pregnancies is a significant global issue, prompting heightened attention and efforts within the contraceptive industry.

This industry offers a broad spectrum of contraceptive methods to address varying preferences and needs. These include hormonal contraceptives such as pills, patches, and injections; barrier methods like condoms and diaphragms; intrauterine devices (IUDs); implants; sterilization procedures; and emergency contraception. Ongoing research and development initiatives play a crucial role in enhancing the efficacy and user-friendliness of contraceptives.

For instance, advancements in drug delivery systems have led to more efficient contraceptive options, and the development of long-acting reversible contraceptives (LARCs) represents a significant breakthrough. These innovations contribute to the continuous evolution of the contraceptive landscape, providing individuals with a wider array of choices and increasing the overall effectiveness of birth control methods. As the industry remains dynamic, the emphasis on research and development is pivotal in addressing emerging challenges and ensuring that contraceptive solutions meet the evolving needs of diverse populations globally.

The popularity of long-acting reversible contraceptives, such as intrauterine devices (IUDs) and implants, is on the rise, driven by their notable effectiveness and convenience, particularly among younger demographics seeking hassle-free birth control options. Ongoing advancements in drug delivery systems further contribute to this trend, with the development of contraceptive patches, rings, and subcutaneous implants aimed at improving the user experience, increasing effectiveness, and enhancing overall convenience. These innovative contraceptive options offer distinct advantages, including prolonged protection against unintended pregnancies and a reduced need for frequent user intervention.

Among these, IUDs and implants stand out as highly effective, reversible methods that provide a longer duration of contraceptive coverage compared to traditional short-term methods. Their popularity is attributed to their reliability and the convenience they offer to individuals seeking a more sustainable and less intrusive approach to birth control. The continuous evolution of drug delivery systems in contraception reflects a commitment to meeting the diverse needs of users. The ongoing research and development in this field contribute to the expansion of contraceptive choices, ensuring that individuals have access to options that align with their preferences and lifestyles. As these advancements progress, the landscape of contraceptive methods becomes more diverse, providing users with a range of effective, user-friendly, and convenient choices for family planning.

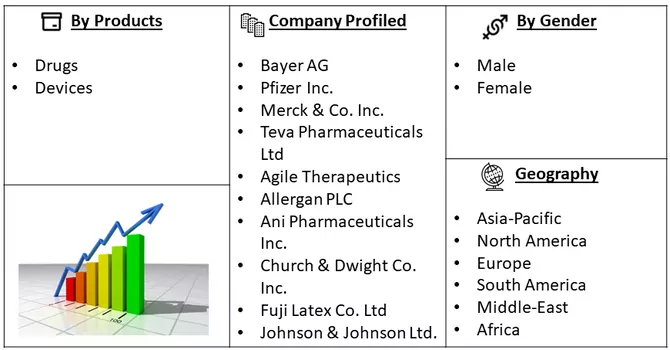

Market Segmentation: The Contraceptive Drugs and Devices Market is segmented by Products (Drugs and Devices), Gender (Male and Female) and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Technological Advancements and Innovation

The ongoing technological advancements play a pivotal role in driving the market forward. Developments in drug delivery systems, such as long-acting reversible contraceptives (LARCs) like implants and intrauterine devices (IUDs), have increased efficacy and convenience for users. Additionally, innovations in non-hormonal methods, such as fertility tracking devices or barrier methods, cater to diverse consumer preferences and needs. Continuous research into new formulations, delivery mechanisms, and materials contributes to the development of safer, more effective, and user-friendly contraceptive options. For instance, as per the Bill & Melinda Gates Foundation data published in 2022, the foundation is aiming to offer USD 280 million per year from 2021 to 2030 for developing new and improved contraceptive technologies, support family planning programs that reflect the preferences of local communities and enable women and girls to be in control of their contraceptive care. Thus, such developments are expected to contribute to the studied market’s growth.

Healthcare Access and Policy Changes

The accessibility of contraceptives plays a pivotal role in driving market dynamics, especially in regions with limited healthcare resources. Government initiatives, policies advocating family planning, and the expansion of healthcare coverage or subsidies for contraceptives have a substantial impact on the growth of the contraceptive market. Enhanced accessibility, facilitated by public health programs or broadened insurance coverage, encourages a greater adoption of contraceptive methods, thereby fostering market expansion. Regulatory shifts that facilitate over-the-counter availability or reduce barriers to obtaining contraceptives further contribute to market growth by amplifying consumer access and choice.

Moreover, the right to privacy, a fundamental tenet guaranteed by the United States Constitution, encompasses the freedom to acquire and utilize contraceptives. For instance, the United States Agency for International Development (USAID) actively promotes and supports voluntary family planning and reproductive health initiatives across approximately 40 countries worldwide. Additionally, the establishment of the National Chlamydia Screening Program (NCSP) in the United Kingdom in March 2022 underscores the role of government initiatives in promoting contraceptive use to mitigate unnecessary births and abortions. The NCSP focuses on reducing the risk of untreated chlamydia infection by prioritizing screening for women and girls, emphasizing timely testing, treatment, and re-testing after treatment.

Thus, these government initiatives are expected to play a crucial role in promoting the use of contraceptive methods, aligning with broader reproductive health goals and contributing to the growth of the studied segment.

Market Restraints:

Regulatory Hurdles and Compliance Challenges and Social and Cultural Factors

The rigorous regulations and intricate approval processes governing new contraceptives pose a significant hurdle to innovation and market entry. Complying with safety standards and securing regulatory approvals from diverse health authorities can be a time-consuming and costly endeavor, presenting a formidable barrier, particularly for smaller companies or new entrants seeking to bring novel contraceptive solutions to market. The societal attitudes, cultural norms, and religious beliefs further contribute to complexities in the adoption of certain contraceptive methods. These factors may generate resistance or reluctance among individuals or communities, affecting the acceptance and uptake of specific contraceptives. The influence of cultural and religious considerations on family planning choices can vary widely across regions and communities, leading to disparities in market penetration. In navigating these challenges, the contraceptive industry must not only prioritize meeting regulatory requirements but also engage in comprehensive market assessments that consider the diverse sociocultural landscapes. Addressing these intricate dynamics is crucial for ensuring the successful introduction and acceptance of new contraceptives, fostering inclusivity, and meeting the unique needs of different populations.

The growth of the analyzed market was significantly impacted during the initial phase of the pandemic due to government-imposed restrictions. As reported in an article published in Contraceptives and Reproductive Medicine in March 2022, there was a notable decrease in the use of long-acting contraceptives, with implants experiencing a 76% decline, intrauterine systems seeing a 79% decrease, and intrauterine devices registering a 76% reduction. Additionally, data from the United Nations Population Fund in March 2021 revealed that women faced challenges in accessing contraception, resulting in nearly double the rate of unexpected births—from 1.3% pre-lockdown to 2.1% post-lockdown. The repercussions of the COVID-19 pandemic had a significant impact on the contraceptive drugs and devices market. However, with the easing of lockdown restrictions, the industry has been showing signs of recovery. Notably, in October 2022, TTK Healthcare Ltd in India reported a more than twofold increase in quarterly profit, driven by heightened sales of medical devices and contraceptives. The revenue from its protective devices division, including the Skore condom brand, surged by over 33% following the introduction of new products. Furthermore, the company secured a contract to supply contraceptive devices to an international organization until July 2023. Instances like these are anticipated to contribute to the market's growth over the forecast period.

Segmentation Analysis

Drugs and Devices Segment is Expected to Witness Significant growth over the Forecast Period

These contain hormones (estrogen and progestin or progestin-only) to prevent ovulation and alter cervical mucus, inhibiting sperm from reaching the egg.A transdermal patch releasing hormones (similar to birth control pills) through the skin to prevent pregnancy. T-shaped devices inserted into the uterus. Hormonal IUDs release progestin, while copper IUDs use copper to prevent fertilization. Small rods inserted under the skin of the upper arm that release hormones to prevent ovulation.

These include birth control pills, patches, injections, and hormonal intrauterine devices (IUDs). Hormonal contraceptives typically contain synthetic hormones, such as estrogen and progestin, which regulate the menstrual cycle, inhibit ovulation, and create a hostile environment for sperm. Moreover, a widely used form of contraception, condoms act as physical barriers, preventing sperm from reaching the egg. They are available for both male and female use. Diaphragms and Cervical Caps are devices are inserted into the vagina to cover the cervix, blocking sperm from entering the uterus. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant growth Over the Forecast Period

North America presents a diverse range of contraceptive options, encompassing birth control pills, patches, injections, intrauterine devices (IUDs), implants, condoms, diaphragms, and various other barrier methods. This market caters to a variety of preferences, offering hormonal and non-hormonal, long-term and short-term contraceptive choices. Recognized as a hub for healthcare technological innovation, North America showcases advancements in drug delivery systems, particularly in long-acting reversible contraceptives (LARCs) like hormonal implants and IUDs. The region also witnesses a growing interest in digital health solutions for contraception, including fertility tracking apps and wearable devices.

Moreover, the rising prevalence of sexually transmitted diseases (STDs) in the region contributes to market growth. A report from the CDC in April 2022 highlighted the continued public health concern of STDs in the United States. Chlamydia trachomatis infection, the most prevalent sexually transmitted infection in 2020, and a significant number of reported gonorrhea infections underscore the need for effective contraception. This is expected to drive demand for male condoms, which offer protection against various pathogens, further propelling market growth.

Several organizations are actively involved in strategic initiatives to enhance contraceptive care in the country. For instance, the Bill & Melinda Gates Foundation is committed to allocating USD 280 million annually from 2021 to 2030 for developing improved contraceptive technologies and supporting family planning programs that align with the preferences of local communities.

Furthermore, the increasing approval and launch of contraceptive products in the region are anticipated to boost market growth. In June 2021, Mayne Pharma Group Limited and Mithra Pharmaceuticals introduced Estelle (Nextstellis) in the United States, featuring a novel estrogen mechanism of action. Additionally, in March 2021, Health Canada approved Nextstellis, a combined oral contraceptive product based on the unique native estrogen estetrol (E4).

Thus, North America's dynamic contraceptive market, characterized by technological innovation, digital solutions, and strategic initiatives, is poised for growth as it addresses evolving healthcare needs and responds to public health challenges such as STDs.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Contraceptive Drugs and Devices Market is fragmented and consists of several major players. Over the forecast period, most domestic and international players focus on the emerging market, and these countries are growing rapidly in the contraceptive drugs and devices market. Some of the companies which are currently dominating the market are:

Recent Developments:

1) In July 2022, HRA Pharma, a pharmaceutical company headquartered in Paris, revealed its intention to pursue FDA approval for an over-the-counter birth control pill. This particular pill, commonly referred to as a mini pill due to its exclusive progestin content without estrogen, could potentially become the inaugural oral contraceptive accessible without a prescription in the United States if granted approval.

2) In February 2022, Mithra and Searchlight Pharma jointly introduced Myring, Mithra's vaginal contraceptive ring, in Canada, branding it as Haloette.

Q1. What was the Contraceptives Drugs and Devices Market size in 2022?

As per Data Library Research the Contraceptive Drugs and Devices Market was valued at USD 27 billion in 2022.

Q2. At what CAGR is the Contraceptives Drugs and Devices Market projected to grow within the forecast period?

Contraceptives Drugs and Devices Market is expected to grow at a CAGR of 7.2% over the forecast period.

Q3. What are the Growth Drivers of the Contraceptives Drugs and Devices Market?

Technological Advancements and Innovation and Healthcare Access and Policy Changes are the Growth Drivers of the Contraceptives Drugs and Devices Market.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model