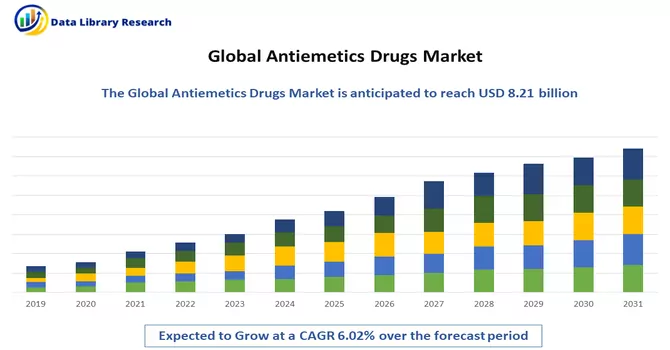

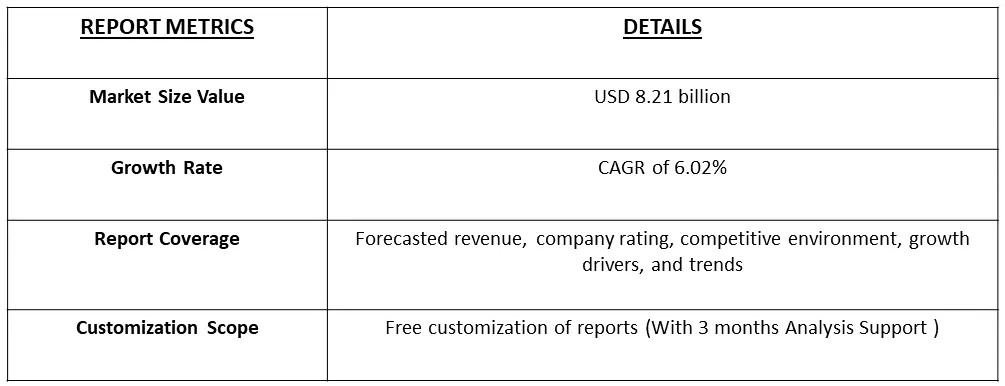

In 2022, the global market for antiemetic drugs reached a valuation of USD 8.21 billion, and it is anticipated to exhibit a robust compound annual growth rate (CAGR) of 6.02% from 2024 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Antiemetic drugs are medications designed to prevent or alleviate nausea and vomiting, commonly referred to as emesis. These drugs target various receptors and pathways in the body to suppress the signals that trigger the vomiting reflex. Antiemetics are used to manage symptoms associated with various conditions, including chemotherapy-induced nausea, postoperative nausea and vomiting, motion sickness, and certain gastrointestinal disorders. The goal of antiemetic therapy is to improve the quality of life for individuals undergoing treatments or experiencing situations that may lead to nausea and vomiting.

These medications play a crucial role in the treatment and prevention of conditions associated with vomiting and nausea. The market's expansion is primarily driven by the increasing occurrences of gastroenteritis and cancer, coupled with a surge in research and development endeavours. Furthermore, the proliferation of generic substitutes hitting the market serves as an additional influential factor contributing to the growing demand for antiemetic drugs.

Market Segmentation: The antiemetic drugs market is segmented by Drug Type (Serotonin-Receptor Antagonists, Glucocorticoids, Anticholinergics, Dopamine Receptor Antagonists, Neurokinin Receptor Antagonists, and Others), Application (Chemotherapy, Gastroenteritis, Post-Operative Surgery, and Others), and Geography (North America, Europe, Asia-Pacific, Middle East, and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The continued investments in research and development by pharmaceutical companies to discover novel antiemetic compounds and improve existing formulations contribute to the expansion of the antiemetic drugs market. This fosters innovation and the introduction of more effective medications. Also, the globalization of pharmaceutical markets allows for broader access to antiemetic drugs across regions. Increased awareness and availability of these drugs in diverse healthcare settings contribute to their market growth on a global scale.

Market Drivers :

Increasing Prevalence of Conditions such as Chemotherapy-Induced Nausea and Vomiting (CINV)

The rising prevalence of conditions such as chemotherapy-induced nausea and vomiting (CINV) has become a significant healthcare concern. CINV is a distressing side effect experienced by individuals undergoing cancer treatment, particularly chemotherapy. Addressing this issue has led to a growing reliance on antiemetic drugs to alleviate and prevent these adverse effects. Also, antiemetic drugs play a pivotal role in managing CINV by preventing or reducing nausea and vomiting. These medications work by targeting specific receptors and pathways involved in the emetic response, helping patients tolerate and complete their cancer treatment regimens with greater comfort.

As projected by the American Cancer Society for the year 2023, approximately 1,958,310 new cancer cases and 609,820 cancer-related deaths are expected in the United States. Additionally, a study published by the National Center for Biotechnology Information (NCBI) in January 2019 revealed a high prevalence of rotavirus gastroenteritis in India. Consequently, the prevalence of these diseases, known to cause vomiting and nausea, is foreseen to be a driving force behind the growth of the market in the coming years. Thus, a high number of cancer cases may propel the demand for antiemetic drugs, which is expected to drive the growth of the studied market over the forecast period.

Growing Number of Surgical Procedures, Including Both Inpatient and Outpatient Surgeries

According to a September 2020 published article titled "Estimation of the National Surgical Needs in India by Enumerating the Surgical Procedures in an Urban Community Under Universal Health Coverage," approximately 5,000 surgeries are deemed necessary to address the surgical burden of diseases for every 100,000 individuals in low- and middle-income countries (LMICs). Additionally, the same source indicates varying reported surgery rates, ranging from 295 per 100,000 population in LMICs to 23,000 in high-income countries (HIC). Furthermore, based on data from the Organization for Economic Cooperation and Development (OECD), Turkey reported 393,901 cataract surgical procedures in 2020. In the same year, Italy recorded 84,647 hip replacement procedures and approximately 114,601 cesarean section procedures. This surge in the number of surgical procedures is expected to drive the demand for antiemetic drugs, which is expected to drive the growth of the studied market over the forecast period.

Market Restraints:

Regulatory Approval Challenges

Regulatory agencies demand comprehensive evidence of a drug's efficacy and safety. For antiemetic drugs, demonstrating effectiveness in preventing or alleviating nausea and vomiting, particularly in specific patient populations, requires robust clinical trial data. Ensuring the safety profile of these drugs is equally critical, involving thorough investigations into potential side effects and adverse reactions. Moreover, regulatory agencies emphasize consistency in study design across different phases of clinical trials. Maintaining uniformity in methodologies and endpoints helps establish a clear and reliable data set. Deviations or inconsistencies may lead to questions about the robustness of the findings, potentially impacting regulatory approval. Thus, all these processes require a longer time, which may hinder the growth of the studied market over the forecast period.

The COVID-19 pandemic has significantly influenced the pharmaceutical industry, including the market for antiemetic drugs. The strain on healthcare systems and resources during the pandemic led to disruptions in routine healthcare services, including the management of conditions requiring antiemetic drugs. Non-urgent medical visits were deferred, impacting the diagnosis and treatment of nausea and vomiting associated with various medical interventions. Also, an article published by NCBI in July 2022, reported that clinical trials for new antiemetic drugs or expanded indications faced disruptions due to the pandemic. Site closures, delays in patient recruitment, and challenges in data collection affected the progress of trials, potentially extending the time to bring new drugs to market. Thus, such instances impacted the market growth during the initial phase. However, with decreasing COVID-19 cases, the resumption of clinical trials of various drug molecules began and thus the market witnessed significant growth over the forecast period.

Segmental Analysis

The Serotonin Receptor Antagonists Segment is Expected to Witness Growth Over the Forecast Period

Serotonin-receptor antagonists play a pivotal role in the field of antiemetic drug therapy, offering effective solutions for managing nausea and vomiting associated with various conditions. Serotonin-receptor antagonists primarily target serotonin, a neurotransmitter involved in triggering the vomiting reflex. These drugs selectively block serotonin receptors, particularly those in the gastrointestinal tract and the central nervous system, inhibiting the emetic signals and reducing the likelihood of nausea and vomiting.

A March 2020 research study titled "Antiemetics in Children with Acute Gastroenteritis," published in the Official Journal of the American Academy of Pediatrics, highlights the exceptional efficacy of Ondansetron as an antiemetic drug. Conducted by the Department of Pediatrics and encompassing twenty-four studies with 3,482 children, the research underscores Ondansetron's significant impact on halting vomiting. The comprehensive analysis revealed that Ondansetron stands out by exerting the most substantial effect on stopping vomiting among the studied interventions. Notably, it emerged as the sole intervention capable of reducing the necessity for intravenous rehydration and the frequency of vomiting episodes. This compelling evidence underscores the advantages offered by Ondansetron, positioning serotonin receptor antagonists as a pivotal choice for the target population. As a result, the utility and preference for serotonin receptor antagonists, particularly Ondansetron, are anticipated to witness a surge, thereby propelling growth within this segment. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period,

Chemotherapy Segment is Expected to Witness Growth Over the Forecast Period

Chemotherapy, a cornerstone in cancer treatment, often brings about unwelcome side effects, with nausea and vomiting being among the most challenging for patients. Effectively managing these symptoms is crucial to enhancing the overall quality of life for individuals undergoing chemotherapy. Antiemetic drugs play a pivotal role in mitigating the impact of chemotherapy-induced nausea and vomiting, providing relief and supporting patients throughout their treatment journey. Educating patients about the potential for CINV, the importance of adhering to prescribed antiemetic regimens, and proactive communication with healthcare providers contribute to better outcomes. Patient support programs address the emotional and psychological aspects of managing CINV during cancer treatment. Thus, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Growth Over the Forecast Period

North America is poised to assert its dominance in the antiemetic drugs market, driven by a confluence of factors. The region's leading position can be attributed to the ready availability of these medications, economic stability among the population, heightened consumer awareness about healthcare, key drug launches, a rising prevalence of cancers and gastroenteritis, a concentration of market players, and the strong presence of manufacturers in the United States. For instance, in the United States, the growth of the antiemetic drugs market is fueled by factors such as the ease of access to healthcare, economic prosperity, and a well-informed consumer base. Notably, key drug launches and an upsurge in the incidence of cancers and gastroenteritis contribute significantly to the market's expansion. The presence of a multitude of market players and manufacturers, particularly in the United States, further propels the growth trajectory.

The statistics from the National Cancer Institute emphasize the substantial impact of cancer in the region, with an estimated 1,806,590 new cases and 606,520 deaths reported in 2020. Additionally, acute gastroenteritis (AGE) poses a significant healthcare burden, with approximately 179 million cases reported annually in the United States, according to the Centers for Disease Control and Prevention. Further supporting the market's growth, reports from the American Academy of Pediatrics in 2020 reveal that 2-23% of children with acute gastroenteritis in the United States and other regions receive treatment with antiemetics. This underscores the increasing demand for antiemetic drugs within the region. A noteworthy development in September 2020 was the launch of generic Fosaprepitant, an antiemetic drug used to prevent chemotherapy-induced nausea and vomiting, by Sandoz, a division of Novartis. This strategic move not only enhanced hospital offerings but also expanded the injectables portfolio, contributing to the overall growth of the antiemetics market in the United States. Thus, with these compelling factors, the North American region is poised to experience substantial growth in the antiemetic drugs market in the coming years.

Get Complete Analysis Of The Report - Download Free Sample PDF

Prominent market participants are actively engaged in a variety of strategic initiatives aimed at preserving and enhancing their foothold in the industry. These strategic measures not only serve to maintain their market presence but also play a crucial role in fortifying and expanding their business avenues. By strategically navigating the competitive landscape, these key players position themselves to capitalize on market opportunities, address challenges, and reinforce their overall market standing. Key Antiemetics Drugs Companies:

Recent Developments:

1) In January 2023, Glenmark Pharmaceuticals Ltd introduced AKYNZEO I.V., an innovative intravenous injection formulation in the Indian market. This medication serves as an effective solution for preventing chemotherapy-induced vomiting and nausea.

2) In October 2023, Astellas Pharma Inc. showcased research findings at the European Society for Medical Oncology (ESMO) Congress 2023. The presentation included an abstract highlighting the impact of antiemetics on gastric injury and emesis frequency in ferrets. Such informative presentations by key industry players are anticipated to enhance awareness about antiemetic drugs, potentially fostering market growth in the forecast period.

Q1. What was the Antiemetics Drugs Market size in 2022?

As per Data Library Research the global market for antiemetic drugs reached a valuation of USD 8.21 billion in 2022.

Q2. At what CAGR is the Antiemetics Drugs market projected to grow within the forecast period?

Antiemetics Drugs market it is anticipated to exhibit a robust compound annual growth rate (CAGR) of 6.02% over the forecast period.

Q3. What Impact did COVID-19 have on the Antiemetics Drugs Market?

The COVID-19 pandemic has significantly influenced the pharmaceutical industry, including the market for antiemetic drugs. For detailed insight request a sample here.

Q4. Which are the major companies in the Antiemetics Drugs market?

Pfizer Inc., Cipla Inc., Merck KGaA and Eagle Pharmaceuticals, Inc. are some of the major companies in the Antiemetics Drugs market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model