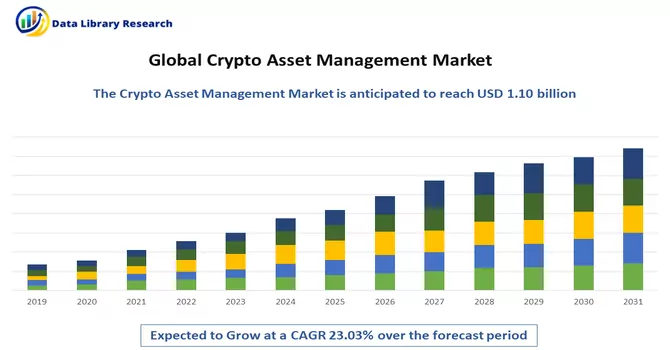

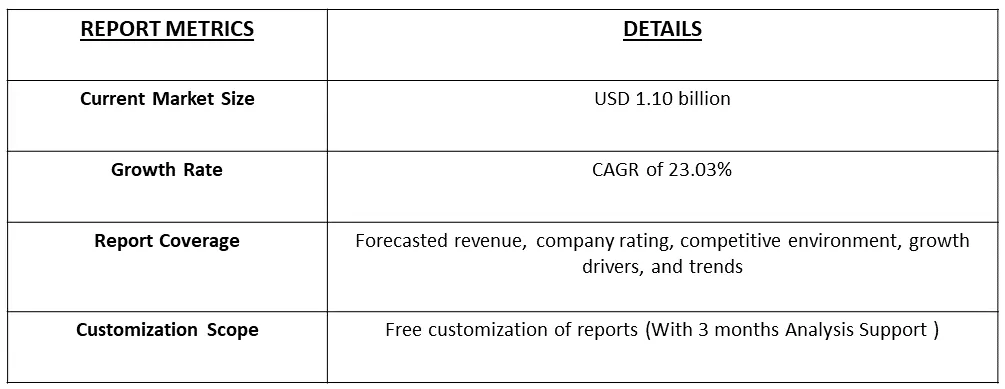

The Crypto Asset Management Market size is currently valued at USD 1.10 billion in 2022, registering a CAGR of 23.03% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Crypto asset management refers to the practice of managing and overseeing cryptocurrency and digital asset investments. It includes managing a diverse range of cryptocurrencies to spread risk and potentially maximize returns. Diversification can involve various digital assets, such as Bitcoin, Ethereum, and altcoins.

The increasing acceptance and adoption of cryptocurrencies like Bitcoin and Ethereum have expanded the market for crypto asset management. More individuals and institutional investors are seeking professional services to manage their digital assets. The availability of advanced data analytics tools and services in the crypto space has made it easier to track and analyze the performance of digital assets. Crypto asset managers use these tools to make informed investment decisions.

Crypto asset management services are expanding globally as interest in cryptocurrencies spreads beyond traditional financial centers. This trend includes the establishment of crypto asset management firms in various regions. The use of artificial intelligence and advanced data analytics tools for investment decision-making and risk assessment is becoming more common among crypto asset managers. These technologies can provide valuable insights into market trends.

Market Segmentation: The Crypto Portfolio Management Market is Segmented by Type (Solutions (Custody Solutions, Tokenization Solutions, Transfer and remittance Solutions, Trading Solutions), Services), Deployment Mode (Cloud, On-Premise), End-user Industry (BFSI, Retail and e-commerce, Media and entertainment), and Geography (North America, Europe, Asia Pacific, Rest of the World). The market sizes and forecasts are provided in terms of value (USD billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing Adoption of Blockchain Technology Across End-user Industries

The crypto asset management market is intertwined with the expanding adoption of blockchain technology across numerous end-user industries. As blockchain technology continues to revolutionize traditional practices, crypto asset managers play a pivotal role in facilitating the investment and management of digital assets. The synergy between these two spheres creates opportunities for investors to access diverse digital assets while enjoying the benefits of blockchain's transparency, security, and automation. Blockchain is being leveraged to improve healthcare data management. Patient records can be securely stored, shared, and accessed with permission, reducing data breaches and ensuring the privacy and integrity of sensitive information. Thus, the market is expected to witness significant growth over the forecast period.

Increasing Focus on the Security of Cryptocurrency Assets

Cryptocurrency assets, including Bitcoin, Ethereum, and various altcoins, have gained substantial popularity as investment vehicles and stores of value. However, as the crypto market has grown, so too have concerns about the security of these assets. The need to protect cryptocurrency holdings has given rise to a heightened focus on security within the crypto asset management market. Cybercriminals have become increasingly sophisticated, employing advanced techniques to breach exchanges, wallets, and online platforms. The crypto ecosystem faces persistent threats from hacking and fraud. Thus, the market is expected to witness significant growth over the forecast period.

Market Restraints :

Lack of a Centralized Regulatory Framework and Lack of Technical Knowledge and Awareness of the Technology

The crypto asset management market has shown tremendous potential for growth and innovation, but it faces significant challenges stemming from the absence of a centralized regulatory framework and a general lack of technical knowledge and awareness among potential investors. One of the most significant hindrances to the crypto asset management market is the lack of a comprehensive and unified regulatory framework that applies to cryptocurrencies and related services. The absence of clear guidelines can deter institutional and retail investors who seek a stable and regulated environment for their investments. This uncertainty can lead to a reluctance to participate in the crypto market. Thus, the growth of the market is expected to witness significant growth over the forecast period.

The COVID-19 pandemic has been a global disruptor, affecting economies and financial markets worldwide. The crypto asset management market, being an integral part of the broader cryptocurrency ecosystem, has also experienced significant impacts and changes due to the pandemic. COVID-19 accelerated the entry of institutional investors into the crypto space. As institutions sought to diversify their portfolios and explore non-correlated assets, they began to consider cryptocurrencies. This shift in perception led to growing demand for crypto asset management services that catered to institutional needs. Thus, the COVID-19 pandemic has had a multifaceted impact on the crypto asset management market. It accelerated the adoption of cryptocurrencies, increased institutional involvement, prompted regulatory changes, and highlighted the importance of security and risk management.

Segmental Analysis:

The transfer and remittance Solutions Segment is Expected to Witness Significant Growth Over the Forecast Period

The integration of transfer and remittance solutions with the crypto asset management market reflects the dynamic and evolving nature of the financial landscape. As cryptocurrencies continue to disrupt traditional financial services, they offer new opportunities for investors and asset managers. The cost-efficiency, speed, and accessibility of crypto-based remittances align with the objectives of the crypto asset management market, where diversification, optimization, and innovation are key drivers. As both fields continue to adapt and innovate, they are likely to find increasing synergy in serving the evolving needs of a global client base. Thus, the segment is expected to witness significant growth over the forecast period.

Cloud Segment is Expected to Witness Significant Growth Over the Forecast Period

Cloud service providers prioritize data security and offer robust encryption, access control, and compliance features. These are vital components of crypto asset management, where the security of digital assets is paramount. Additionally, cloud providers offer reliable disaster recovery solutions, safeguarding against data loss or system failures. The adoption of cloud computing technology is revolutionizing the crypto asset management market. It offers numerous advantages, including enhanced accessibility, scalability, security, and collaboration. With the flexibility to harness advanced analytics and machine learning, integrate with blockchain technology, and ensure regulatory compliance, the cloud is becoming an indispensable tool for crypto asset managers.

The Retail & E-commerce Segment is Expected to Witness Significant Growth Over the Forecast Period

As retail and e-commerce segments innovate and adopt blockchain technology and digital currencies, this stimulates the growth of the crypto asset management market. Both sectors benefit from the technological advancements and financial solutions that emerge from this collaboration. The synergy between the retail and e-commerce segment and the crypto asset management market reflects the ongoing evolution of financial technology and consumer behavior. Thus, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America, primarily driven by the United States and Canada, is poised to lead the global crypto asset management market. The region's widespread adoption of cryptocurrencies, prominent role in crypto trading, early technological adoption, presence of key market players, and commitment to innovation create an environment conducive to the rapid growth of the asset management sector. The United States, in particular, is expected to be a catalyst for this expansion, thanks to its diverse adoption of digital assets across various industries and a commitment to providing advanced solutions to meet evolving client demands.

Additionally, a growing number of businesses in the United States are incorporating cryptocurrencies and digital assets into their operations, investments, and transactions. This trend opens significant opportunities for asset management market vendors, who are likely to witness substantial growth in the near future.

The country's diverse adoption of cryptocurrencies across various sectors is expected to boost asset management platforms in the coming years. A noteworthy example is the introduction of BNY Mellon's Digital Asset Custody Platform in October 2022, enabling select clients to transfer and hold Bitcoin and Ether. This reflects the industry's commitment to meeting client demands for a reliable traditional and digital asset servicing provider. Thus, due to the above-mentioned reasons the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The competitive landscape of the Crypto Asset Management Market is anticipated to shift toward fragmentation as cryptocurrency adoption continues to rise globally. Furthermore, the market is poised to benefit from the emergence of numerous small and medium-sized global players. Established market participants are actively introducing new products and innovations to enhance their market footprint. Some of the market players working in this market segment are:

Recent Development

1) October 2022: Crypto-focused asset-management company BlockTower launched a venture capital arm with a new USD 150 million fund to back decentralized finance (DeFi) and blockchain-infrastructure projects.

2) June 2022: Global asset manager firm AllianceBernstein Holdings (AB) announced to work with Allfunds Blockchain to adapt its services to the blockchain ecosystem. Allfunds Blockchain, an arm of fund distribution platform Allfunds (ALLFG), focuses on integrating blockchain technology with funds to provide efficiency and an additional layer of safety.

Q1. What is the current Crypto Asset Management Market size?

The Crypto Asset Management Market size is currently valued at USD 1.10 billion.

Q2. What is the Growth Rate of the Crypto Asset Management Market ?

Crypto Asset Management Market is registering a CAGR of 23.03% during the forecast period.

Q3. Which Region is expected to hold the highest Market share?

North America Region is expected to hold the highest Market share.

Q4. Who are the key players in Crypto Asset Management Market?

Some key players operating in the market include:

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model