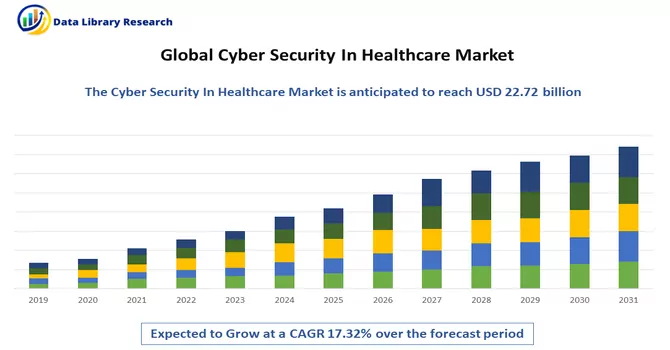

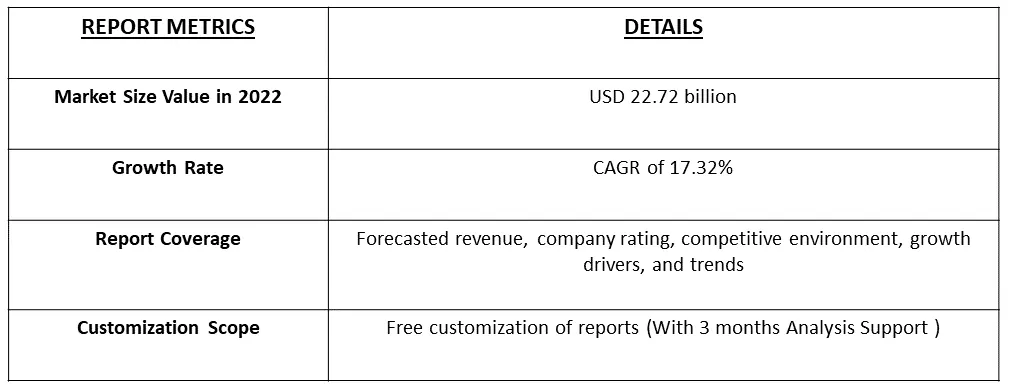

The Healthcare Cyber Security Market size is expected to grow from USD 22.72 billion in 2022, registering a CAGR of 17.32% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Healthcare cybersecurity focuses on preventing attacks by defending systems from unauthorized access, use, and disclosure of patient data. The primary aim is to ensure the availability, confidentiality, and integrity of critical patient data, which, if compromised, could put patient lives at risk.

The principal factor among the drivers of growth in the healthcare cybersecurity market, data breaches might be in the run. An increasing number of healthcare institutions are expected to use these cybersecurity solutions to protect patient data. Due to digital transformation, the healthcare industry is witnessing a shift in the operational process of information security.

The adoption of AI and machine learning for threat detection and prevention is gaining traction, providing proactive defense against cyber threats. The zero-trust security model, where no entity is trusted by default, is becoming more prevalent to protect against insider threats. With the proliferation of IoT devices in healthcare, the focus on securing these devices and networks is increasing. The migration of healthcare data to the cloud is driving the demand for advanced cloud security solutions. Healthcare organizations are increasingly sharing threat intelligence to stay ahead of evolving cyber threats.

Market Segmentation:

The Healthcare Cyber Security Market is segmented

By Type of Threat

Type of Solution

End User :

Geography

The market sizes and forecasts are provided in terms of value in USD billion for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increase in Cyber-attacks

The rise in cyberattacks within the healthcare domain is a growing concern with severe implications. Healthcare organizations need to be proactive in implementing strong cybersecurity measures, raising awareness among staff, and staying up to date with the evolving threat landscape. The consequences of failing to address this issue are far-reaching, affecting both patient well-being and the financial health of healthcare institutions. Vigilance and a commitment to cybersecurity are essential in safeguarding the future of healthcare in an increasingly digital age.

Furthermore, the technological development by the key major players is driving the growth of the studied market. For instance, In May 2022, Clearwater acquired CynergisTek, which provides cybersecurity, compliance, and IT services to help highly regulated industries tackle security and privacy issues, for USD 17.7 million. This partnership strengthens CynergisTek's people-centric approach to cybersecurity, privacy, and audit and its essential role in serving the healthcare industry and its clients. Thus, due to the above-mentioned reasons the market is expected to witness significant growth over the forecast period.

Increasing Demand for Cloud Services and Low Penetration of Information Security Systems in the Healthcare Sector

The burgeoning need for cloud services in the healthcare sector, coupled with the limited adoption of information security systems, presents a multifaceted landscape of possibilities and challenges. Achieving the full potential of cloud technology in healthcare, all while upholding the integrity of patient data necessitates a well-thought-out strategy for information security. Healthcare organizations must emphasize strategic priorities such as investment, education, and partnerships with cloud specialists to ensure that the digital revolution in healthcare aligns seamlessly with the most stringent data security standards and, in turn, the highest standards of patient care. Thus, the market is expected to witness significant growth over the forecast period.

Market Restraints:

Lack of Cyber Security Policy Framework in Healthcare Organizations

The absence of a robust cybersecurity policy framework within healthcare organizations poses a substantial challenge in the healthcare cybersecurity market. Healthcare organizations lacking a well-defined cybersecurity policy framework often struggle to implement consistent and effective security measures, leaving them vulnerable to cyber threats. Thus, the growth of the market is expected to slowed down over the forecast period.

The impact of COVID-19 on the healthcare cybersecurity market has been notably favorable. The pandemic has brought with it a surge in cyberattacks targeting various healthcare components, including clinical testing databases, digital health platforms, medical diagnostic systems, and advanced medical devices. This increased threat landscape, marked by the heightened risk of data breaches and a growing frequency of cyberattacks within the healthcare industry, has led to a notable uptick in the adoption of cybersecurity services and solutions.

The latest data published by the United States Government of Cyber Security in April 2021, reported that a staggering 92 ransomware attacks affected more than 600 hospitals, clinics, and other healthcare institutions in the year 2020 in the United States. These incidents underscore the urgency of strengthening cybersecurity measures in the healthcare sector. Furthermore, the rise of COVID-19-related phishing attacks has further underscored the pressing need for robust cybersecurity practices within the healthcare industry. These attacks have further highlighted the critical importance of safeguarding sensitive patient information and maintaining the integrity of healthcare services during these challenging times. In the current scenario, due to the advantages of cyber security, the market is expected to witness significant growth over the forecast period.

Segmental Analysis:

Malware is Expected to Witness Significant Growth Over the Forecast Period

Malware attacks pose a grave and growing threat to the healthcare system, jeopardizing patient data, the continuity of healthcare services, and the reputation of healthcare institutions. To safeguard sensitive information and ensure the integrity of patient care, healthcare organizations must prioritize comprehensive cybersecurity measures, regular staff training, and a proactive approach to identifying and mitigating potential malware threats. Only through a concerted effort can the healthcare sector effectively defend itself against this evolving and complex cybersecurity challenge.

Risk and Compliance Management is Expected to Witness Significant Growth Over the Forecast Period

Risk and compliance management in the healthcare domain is a critical and multifaceted endeavor. It is essential for safeguarding patient data, maintaining operational integrity, and adhering to complex regulatory frameworks. While healthcare organizations face numerous challenges in this regard, the adoption of best practices, ongoing training, and a proactive approach to risk assessment and incident response can help ensure the highest standards of compliance and patient care in this vital sector. Thus, owing to such benefits, the segment is expected to witness significant growth over the forecast period.

Hospitals by End-Users Segment is Expected to Witness Significant Growth Over the Forecast Period Hospitals face escalating cybersecurity challenges due to their intricate tech systems, mobile device reliance, and the sensitive patient data they handle. The vulnerabilities associated with IoT devices in healthcare settings underscore the pressing need for comprehensive cybersecurity solutions. To ensure the safety of patient information and the integrity of healthcare operations, hospitals are implementing access control solutions and strengthening cybersecurity measures to protect against malicious cyberattacks, as evidenced by the Monongalia Health System breach.

The 2022 State of Healthcare IoT Device Security report by Cynerio found that over 50% of Internet of Things (IoT) devices in hospitals had critical cybersecurity vulnerabilities. Similarly, a security report revealed that one-third of bedside IoT healthcare devices posed significant cybersecurity risks, with around 79% of hospital IoT devices used at least monthly, limiting the window for vulnerability patching. Thus, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The North American region stands as a frontrunner in the Healthcare Cybersecurity market, and this article delves into the factors behind its preeminent position. It is driven by the presence of established industry giants and emerging startups, an advanced medical infrastructure, substantial investment in healthcare IT, the proliferation of cloud-based solutions, the escalating sophistication and frequency of cyberattacks, and the emergence of transformative digital technologies.

North America boasts a thriving ecosystem, with a blend of industry leaders and innovative startups, creating a fertile ground for healthcare cybersecurity growth. Furthermore, technological developments are expected to slow down the growth of the studied market. For instance, in November 2021, Fortinet, a global pioneer in comprehensive, integrated, and automated cybersecurity solutions, unveiled the industry's most comprehensive solution for securing and connecting work-from-anywhere environments. Fortinet delivers Protection, services, and threat intelligence by combining its broad range of zero trust, endpoint, and network security products into the Fortinet Security Fabric. Thus, the region is expected to witness significant growth over the forecast period. Moreover, in the United States, stringent regulations, including HIPAA, have propelled the penetration rates of cybersecurity solutions within the healthcare sector, ensuring the privacy and security of digital patient records.

Thus, due to the above-mentioned reasons the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The healthcare cybersecurity market exhibits a moderate level of competitiveness and is characterized by the presence of several prominent players. At present, a handful of key players hold substantial market share. Companies operating within this sector are making substantial investments in research and development efforts. They are also actively pursuing various strategic approaches, including collaboration, joint ventures, and mergers and acquisitions, as a means to maintain their competitiveness. Furthermore, a significant number of organizations within the healthcare cybersecurity industry prioritize enhancing their existing product portfolios with the aim of attracting and retaining customers. This strategic focus on product portfolio improvement underscores the commitment of these companies to meeting the evolving needs of their clientele. Some of the major players working in this market segment are:

Recent Developments:

1. In July 2022, Clearwater, a prominent vendor specializing in cyber risk management and HIPAA compliance solutions, successfully concluded its acquisition of Tech Lock. This strategic move has empowered Clearwater to expand its service offerings by introducing a 24/7 Managed Detection and Response (MDR) solution. Notably, this MDR solution incorporates a proprietary Security Orchestration and Response (SOAR) engine, designed to proactively monitor and respond to cyber threats.

2. In July 2022 demonstrated Clearwater's proactive expansion of its cybersecurity services and Google Cloud's strategic partnership and initiative to enhance the healthcare sector's cybersecurity posture. These endeavors signify a collective commitment to addressing the evolving and complex challenges facing the healthcare industry's digital security landscape. 3.

Q1. What was the Cyber Security In Healthcare Market size in 2022?

As per Data Library Research the Healthcare Cyber Security Market size was USD 22.72 billion in 2022.

Q2. At what CAGR is the market projected to grow within the forecast period?

Healthcare Cyber Security Market is registering a CAGR of 17.32% during the forecast period.

Q3. What segments are covered in the Healthcare Cyber Security Market Report?

By Type of Threat, By Type of solution, End User and Geography these are the segments covered in the Healthcare Cyber Security Market Report

Q4. Which region has the largest share of the Healthcare Cyber Security Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model