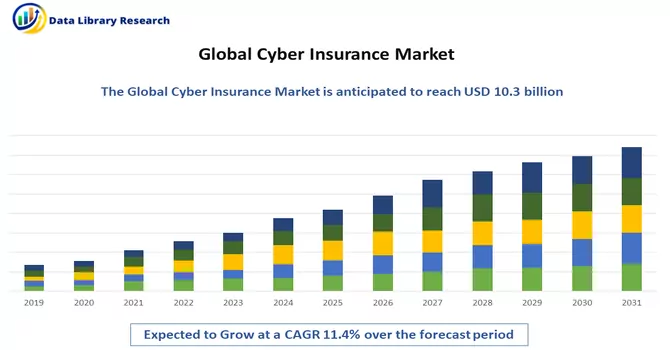

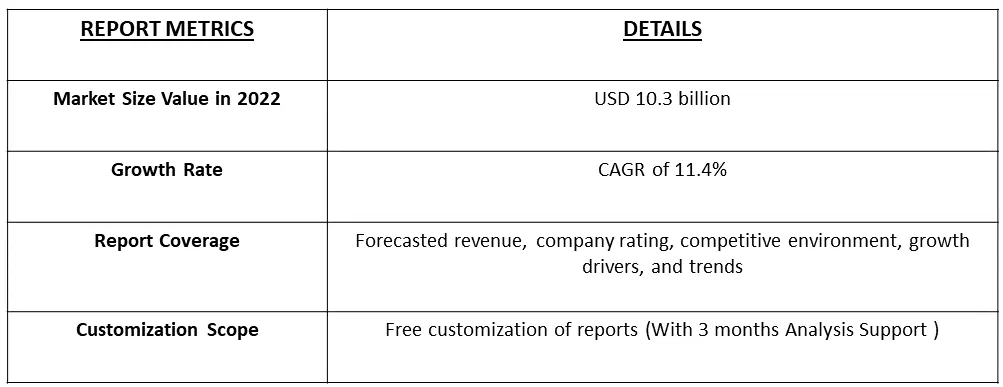

The cybersecurity insurance market size is presently valued at USD 10.3 billion in 2022, registering a CAGR of 11.4% during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Cybersecurity insurance also known as cyber insurance or cyber liability insurance, is a type of insurance coverage designed to protect organizations and individuals from financial losses and liabilities resulting from cybersecurity incidents and data breaches. It provides coverage for legal fees and fines associated with data breaches, as well as regulatory penalties for failing to protect sensitive data adequately.

Coverage for legal fees and fines associated with data breaches, as well as regulatory penalties for failing to protect sensitive data adequately. The rise in ransomware attacks, where cybercriminals encrypt data and demand a ransom for its release, has made cybersecurity insurance a critical tool for dealing with extortion and recovery costs.

Insurers, cybersecurity firms, and industry associations are collaborating to create cyber risk assessment and mitigation standards, which can lead to more effective risk management and insurance offerings. Insurers may require organizations to undergo cybersecurity risk assessments as part of the underwriting process. This proactive approach helps both insurers and insured parties identify vulnerabilities and enhance security measures. These trends reflect the dynamic nature of the cybersecurity insurance market and the need for organizations to stay informed and adaptable in their approach to managing cyber risks. As the threat landscape evolves, so too will the insurance solutions available to protect against the financial and reputational consequences of cyber incidents.

Market Segmentation: The Cybersecurity Insurance Market is Segmented by Insurance Type (Standalone and Tailored), Enterprise Type (SMEs and Large Enterprises), End-Users (Healthcare, BFSI, IT and Telecom, Manufacturing, and Other End-Users), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The report offers market size and forecasts in value (USD Million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers

Increasing Cyberattacks and Data Breeching

The cybersecurity insurance market is subject to evolving trends that reflect the changing landscape of cyber threats and risk management. With the surge in ransomware attacks, organizations are seeking specific coverage for ransom payments and related expenses. Cyber insurance policies are being adapted to address this growing threat. The evolution of data privacy regulations, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), is prompting organizations to secure cyber insurance to ensure compliance and protection in case of regulatory fines. As a result, the market is expected to witness significant growth over the forecast period.

Technological Advancements

Technological advancements have had a profound impact on the cybersecurity insurance market. They have influenced various aspects of the industry, including risk assessment, underwriting, policy development, and claims management. Insurers are increasingly leveraging data analytics and artificial intelligence to assess cybersecurity risks more accurately. By analyzing vast amounts of data, they can identify potential vulnerabilities and determine appropriate coverage and pricing.

Moreover, with the introduction of blockchain, the market is expected to witness significant growth. For instance, Blockchain technology is being explored for securing sensitive data and verifying the authenticity of policyholders' cybersecurity measures. This can reduce fraud and improve the underwriting process. Thus, the market is expected to witness significant growth over the forecast period.

The COVID-19 pandemic has reshaped the cybersecurity insurance market, emphasizing the need for robust protection against the growing threat of cyberattacks in an increasingly digital and remote work environment. The market is evolving to provide more tailored coverage options, with a focus on risk assessment, incident response, and remote work-related risks. As businesses continue to adapt to the challenges presented by the pandemic, cybersecurity insurance will remain a vital component of their risk management strategies.

Segmental Analysis:

The Standalone Segment is Expected to Witness Significant Growth Over the Forecast Period

Standalone cybersecurity insurance policies are designed specifically to address the unique and dynamic risks associated with cyber threats, data breaches, and digital vulnerabilities. They are separate from traditional commercial insurance policies, such as general liability or property insurance, which may offer limited or no coverage for cyber incidents. Standalone policies offer more comprehensive coverage tailored to the ever-changing landscape of cyber threats. They typically cover a range of cyber-related risks, including data breaches, ransomware attacks, business interruption, legal and regulatory expenses, and third-party liabilities. Thus, owing to such benefits, the segment is expected to witness significant growth over the forecast period.

First Party Segment is Expected to Witness Significant Growth Over the Forecast Period

First-party coverage is a critical component of the cybersecurity insurance market. It provides protection to policyholders for the direct financial losses and expenses they incur as a result of a cyber incident. In the context of cybersecurity insurance, first-party coverage addresses the impact of a breach, cyberattack, or data loss on the insured organization itself. Thus, first-party coverage plays a pivotal role in the cybersecurity insurance market by providing essential protection against the financial impact of cyber incidents. In an age of increasing cyber threats, organizations must carefully evaluate their cybersecurity needs and work with insurers to customize policies that address their unique risks and vulnerabilities. This proactive approach ensures financial security and the ability to recover quickly in the event of a cyber incident.

Large Enterprises segment is Expected to Witness Significant Growth Over the Forecast Period

Large enterprises, with their extensive digital footprints and significant financial stakes, play a pivotal role in shaping the cybersecurity insurance market. The adoption of cybersecurity insurance among large organizations has grown steadily, reflecting the evolving landscape of cyber threats and the need for comprehensive protection. Large enterprises often operate in multiple regions and are subject to various data protection and privacy regulations. These regulations may require substantial investments in cybersecurity measures and the acquisition of cybersecurity insurance to comply with legal requirements. Thus, owing to such advantages the segment is expected to witness significant growth over the forecast period.

IT Segment is Expected to Witness Significant Growth Over the Forecast Period

The Information Technology (IT) industry is intrinsically linked to the cybersecurity insurance market, both as a consumer and provider of cybersecurity insurance. This industry, which encompasses a wide range of businesses from software developers to managed service providers, has a unique position in shaping the landscape of cybersecurity insurance. IT companies, like any other businesses, are consumers of cybersecurity insurance. Given the sensitive data they handle, their reliance on technology, and their exposure to cyber risks, IT firms are prime candidates for cybersecurity insurance. They often require tailored policies to address their specific needs, which can differ significantly from traditional businesses. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North American businesses, ranging from large enterprises to small and medium-sized enterprises (SMEs), face significant cyber risk exposure. With vast amounts of sensitive data and extensive digital operations, they are prime targets for cyberattacks and data breaches. Both the United States and Canada have enacted data protection regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) and the Personal Information Protection and Electronic Documents Act (PIPEDA). These laws place legal obligations on organizations to protect sensitive data and report data breaches, reinforcing the need for cybersecurity insurance.

Furthermore, the recent developments in the region are expected to boost the studied market’s growth. For instance, in February 2023, Tenable, the Exposure Management company, reported that it had added a Cyber Insurance Report within its Tenable Vulnerability Management solution, which summarizes exposure information relevant to cyber insurance providers in an effort to streamline the policy underwriting process for both insurers and customers. The Tenable Cyber Insurance Report will enable insurers, for the first time, to measure preventive security programs by sharing vulnerability data that resides within the firewall.

Thus, North America's strong presence in the cybersecurity insurance market is driven by its advanced economies, high cyber risk exposure, and regulatory landscape. As organizations in the region continue to adapt to the challenges presented by cyber threats, cybersecurity insurance will remain a critical component of their risk management strategies.

Get Complete Analysis Of The Report - Download Free Sample PDF

The cybersecurity insurance market is highly competitive due to the presence of many companies working globally and regionally in this market segment. Some of the market players working in this market segment are:

Recent Development:

1) In September 2023: Moody’s RMS launched Moody’s RMS Cyber Industry Steering Group to develop industry initiatives that respond to the growth of the global cyber insurance market. With cyber underwriting offering huge growth potential, the group has been formed to tackle the current constraints to growth in the cyber insurance market

2) In September 2023: Tech Mahindra, a leading provider of digital transformation, consulting, and business re-engineering services and solutions, reported that it has entered a strategic partnership with Surance.io, an innovative personal cyber insurance platform. The strategic partnership will provide international multilingual tech support and enhance cybersecurity solutions to reinforce secure digital transformation in the insurance sector.

Q1. What is the Growth Rate Cyber Insurance Market?

Cyber Insurance Market is registering a CAGR of 11.4% during the forecast period.

Q2. What are the factors on which the Cyber Insurance Market research is based on?

By Insurance Type, By Enterprise Type, End-User and Geography are the factors on which the Cyber Insurance Market research is based.

Q3. How big is the Cyber Insurance Market?

The cybersecurity insurance market size is presently valued at USD 10.3 billion in 2022, registering a CAGR of 11.4% during the forecast period.

Q4. What are the factors driving the Cyber Insurance Market?

Key factors that are driving the growth include the Increasing Cyberattacks and Data Breeching and Technological Advancements.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model