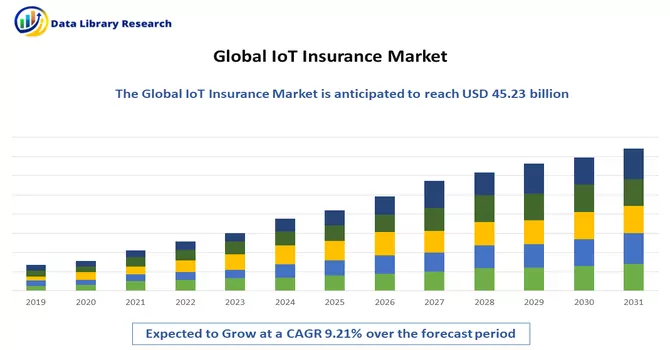

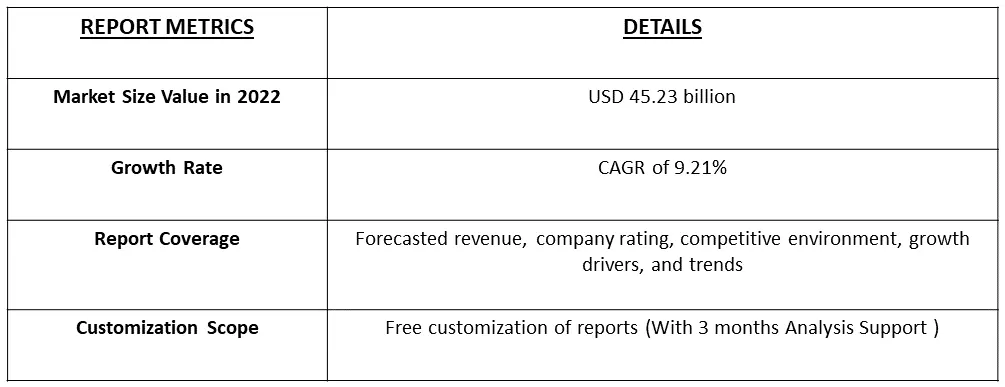

The IoT Insurance Market size is expected to grow from USD 45.23 billion in 2022 registering a CAGR of 9.21% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

IoT insurance, also known as Internet of Things insurance or telematics insurance, is a type of insurance that leverages data collected from IoT (Internet of Things) devices to assess and manage risks, determine insurance premiums, and improve the overall efficiency of the insurance process. IoT insurance relies on the connectivity and data-gathering capabilities of IoT devices to provide more accurate and personalized insurance coverage for policyholders.

The growth of the insurance sector in parallel with innovative insurance models, with the growing usage of IoT to reduce premium and risk-related costs, further expands the studied market growth. Growth in data analytics, Big Data, sensors, and machine learning technologies further expands the studied market's growth. With smart grids envisioned to take over the entire energy industry, IoT utilities are expected to gain traction over the forecast period.

IoT insurance allows for more accurate risk assessment by collecting data on individual behaviour and assets. This trend was leading to the development of highly personalized insurance premiums. For example, safer drivers could enjoy lower auto insurance rates based on their driving habits, and homeowners could receive discounts for implementing IoT-based security systems. Moreover, IoT-enabled devices in industries like manufacturing and logistics were being used to predict maintenance needs for equipment and vehicles. Insurers were beginning to incorporate this data to offer policies that covered equipment breakdowns and disruptions more effectively.

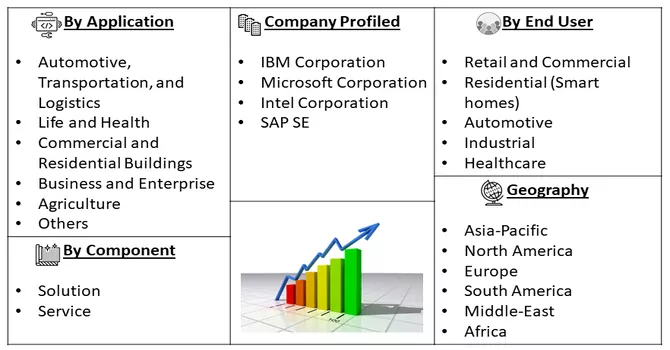

Segmentation:

The IoT Insurance Market is segmented

By End-user Industry :

Geography :

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Growth of Insurance Sector in Parallel with Innovative Insurance Models

The insurance sector's growth in parallel with innovative insurance models is a testament to the industry's adaptability and willingness to embrace technology and changing customer preferences. These innovative models offer more flexibility, customization, and accessibility, ultimately benefiting both insurers and policyholders. As technology continues to evolve, the insurance sector is likely to see even more exciting developments in the coming years. Also, regulatory bodies are adapting to accommodate innovative insurance models, ensuring that they are both compliant and consumer-friendly. These regulatory changes create a conducive environment for insurers to experiment with new models. Thus, the market is expected to witness significant growth over the forecast period.

Growing Usage of IoT to Reduce the Premium and Risk-related Costs

IoT devices foster better communication between insurers and policyholders. Insurers can offer safety tips, reminders, and personalized recommendations based on IoT data, enhancing customer engagement and trust. The growing usage of IoT in insurance is reshaping the industry by making it more data-driven, customer-centric, and cost-efficient. As insurers leverage IoT data to improve risk assessment and encourage risk mitigation, policyholders benefit from lower premiums and reduced risk-related costs while enjoying the advantages of a safer and more connected world. Thus, the market is expected to witness significant growth over the forecast period.

Restraints

High Risk for Privacy from the Collected Data

The high risk for privacy concerns stemming from the collection and use of personal data is a significant factor that has been slowing down the growth of the IoT (Internet of Things) insurance market. Stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, place strict requirements on how personal data is collected, processed, and stored. Insurers need to comply with these regulations, which can add complexity and costs to IoT data management. Thus, the growth of the market may slow down over the forecast period.

The COVID-19 pandemic accelerated the adoption and importance of IoT technology in the insurance industry. It highlighted the value of real-time data and remote monitoring for risk assessment, customer engagement, and the delivery of contactless services. As a result, the IoT insurance market witnessed both challenges and opportunities, with a focus on health and wellness, risk mitigation, and digital transformation. In the current scenario, the IoT technology played a crucial role, the pandemic also posed challenges. Supply chain disruptions and logistical issues affected the deployment of IoT devices, leading to delays in implementing IoT-based insurance programs. Thus, the market is expected to witness significant growth over the forecast period.

Segmental Analysis:

Retail and Commercial is Expected to Hold Significant Share

Digital disruptions are expected to impact commercial insurers, as the industry has been preparing to witness some significant transformation. IoT technology is expected to be at the core of various new initiatives. Insurance firms are trying to utilize IoT data to assess customers, reduce premiums, and provide real-time warnings. Commercial property insurers are expected to witness multiple opportunities to redraw their relationships with their clients. Technological advancements, such as IoT and cloud, are significantly creating vast amounts of data that can be used to deliver value to commercial customers, primarily enabling closer partnerships and new sources of revenue.

Due mainly to the rapid rise of the global e-commerce market over the past few years, the retail sector has also seen enormous growth. As a result, retailers use IoT solutions to boost the customer experience and operational efficiency to gain a competitive edge. As a result, the need from customers for an improved shopping experience, the growing acceptance of smart payment solutions, and the declining cost of IoT-based sensors and connectivity are some of the key drivers influencing the adoption of IoT technology in the researched segment. IoT has been significantly contributing to process automation and improving the operational effectiveness of retail establishments. It offers energy efficiency, security and surveillance, inventory and supply chain optimization, and labor management. Additionally, IoT is developing its capabilities in the area of cold chain monitoring for perishable food and pharmaceutical products

North America is Expected to Witness Significant Growth Over the Forecast Period

North America stands out as a significant hub for the IoT insurance market, driven by the increasing awareness and rapid adoption of IoT technologies across the region. Notably, several prominent companies like Liberty Mutual, Progressive, and State Farm are capitalizing on these IoT advancements to bolster the efficiency of their risk assessment processes.

John Hancock, a major player in the U.S. insurance industry, was among the pioneers in harnessing the potential of wearable devices. Through a strategic partnership with Vitality, they distributed complimentary Fitbit devices to their customers and monitored their well-being, effectively reducing the likelihood of these customers making insurance claims.

Furthermore, the United States serves as the headquarters for several key players who offer their IoT solutions to various insurance companies in the region. In addition, it is anticipated that factors such as the early adoption of the Internet of Things (IoT) and a robust regional workforce will further propel the growth of the IoT insurance market in North America. Several crucial factors underpin the adoption of IoT insurance solutions in the region, including the expansion of the insurance sector, the development of innovative insurance models, and the increasing utilization of IoT technology to reduce premiums and mitigate risk-related costs.

Get Complete Analysis Of The Report - Download Free Sample PDF

The IoT insurance market is highly competitive, due to the market's large and small businesses' existence, which allows them to compete on both domestic and global marketplaces. Due to the presence of so many technology behemoths, the market seems to be fragmented. Some of the major market players working in this domain are:

Recent Development:

1. November 2022 - IBM Corporation has announced a partnership with Ablera and Bulgaria to enhance ABACUS, a solution for insurance companies for pricing and rating processes powered by artificial intelligence, which brings next-level speed and accuracy to these processes, minimizing the error-prone, cumbersome manual efforts and allowing a more comprehensive range of users to work with the sophistication of applied mathematics.

2. August 2022 - Telit, a global leader in the Internet of Things (IoT), has announced the acquisition of group assets from Mobilogix; acquisition adds comprehensive device engineering expertise and resources that focus on optimizing specifications for handoff to electronic manufacturing services, original device manufacturing, and the attainment of regulatory approvals and carrier certifications

Q1. What is the current IoT Insurance Market size?

The IoT Insurance Market size is expected to grow from USD 45.23 billion.

Q2. At what CAGR is the market projected to grow within the forecast period?

IoT Insurance Market size registering a CAGR of 9.21% during the forecast period.

Q3. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Q4. Which are the major companies in the IoT Insurance Market?

IBM Corporation, Microsoft Corporation and Intel Corporation are some of the major companies in the IoT Insurance Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model