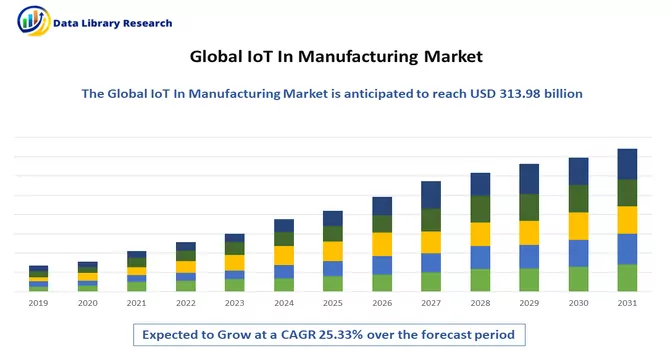

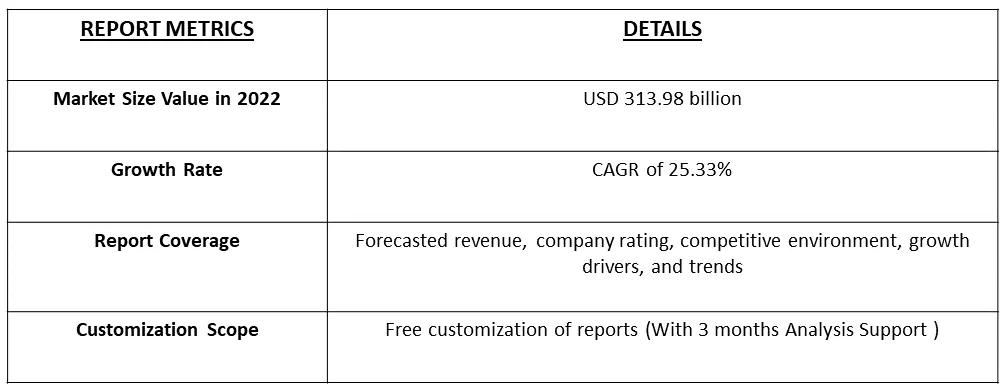

The Internet-of-Things (IoT) Market in Manufacturing is expected to grow from USD 313.98 billion in 2022, registering a CAGR of 25.33% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

IoT manufacturing is a transformative approach to industrial processes, offering increased automation, efficiency, and adaptability. It leverages the power of IoT technology to address the complex challenges of modern manufacturing while capitalizing on the opportunities for improved competitiveness and sustainability.

With the increasing demand in the last two decades for traceability and transparency, companies have started making the processes involved in the production of their products transparent. Data collection and analysis through IoT devices make the whole process seamless for manufacturers.

IoT devices and sensors are increasingly integrated with edge computing solutions. This allows data to be processed closer to the source, reducing latency and ensuring real-time decision-making. Edge computing is particularly beneficial for time-sensitive applications in manufacturing. The rollout of 5G networks has provided high-speed, low-latency connectivity, which is crucial for IoT manufacturing applications. 5G enables faster data transmission, enhanced device-to-device communication, and greater network reliability.

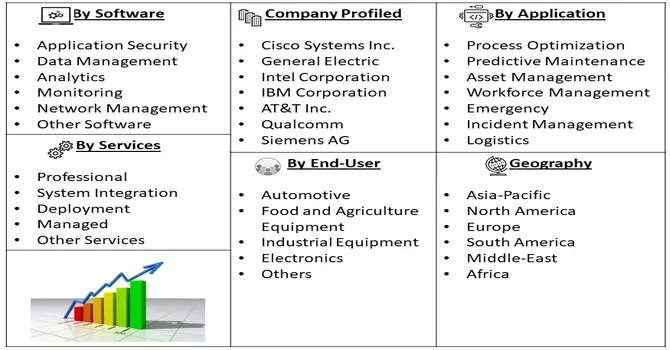

Segmentation:

The internet of things (IoT) market in manufacturing is segmented

By Software :

Connectivity :

Services :

Application :

End-user Vertical :

Geography :

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Rapid Growth and Technological Advancements in Data Analytics

The rapid growth and technological advancements in data analytics and IoT manufacturing have positioned the industry for significant advancements in the years to come. These innovations are not only enhancing efficiency and quality but also driving manufacturers towards greater sustainability, customization, and competitiveness in a fast-evolving global market. As technology continues to advance, the future of IoT manufacturing is likely to be even more data-driven and dynamic.

Further, the recent innovations are expected to drive the growth of the studied market. For instance, in June 2022, Elemental Machines, a leading LabOps Intelligence technology platform, and MasterControl, a developer of a next-generation manufacturing execution system (MES), announced a strategic partnership utilizing two cutting-edge technologies to assist bio manufacturers in automating manual data collection, enhancing data integrity, guaranteeing compliance, and accelerating production for advanced biologics like cell and gene therapies.

Improved Supply Chain Management and Logistics at Lower Operational Costs

IoT manufacturing has transformed supply chain management and logistics by providing real-time visibility, data-driven insights, and greater control over operations. These improvements lead to reduced operational costs, enhanced efficiency, and a more sustainable approach to logistics. As IoT technology continues to evolve, the integration of IoT in manufacturing will likely lead to even more advanced, cost-effective, and eco-friendly supply chain and logistics operations.

Restraints:

Lack of Standardized Interfaces and Limited Integration and Scalability

IoT devices come from various manufacturers, and they often use different communication protocols and data formats. This lack of standardization makes it challenging to ensure that devices from different sources can seamlessly communicate and work together. Interoperability problems can result in inefficiencies and increased complexity. Thus, the growth of the market may slow down the growth of the studied market. The pandemic accelerated digital transformation efforts in manufacturing. IoT will be a central element in these efforts, fostering greater automation, efficiency, and agility. Thus, the market is expected to witness significant growth over the forecast period.

The COVID-19 pandemic has had a mixed impact on IoT manufacturing. While it highlighted the value of IoT technology in addressing operational challenges during a crisis, it also exposed vulnerabilities and supply chain dependencies. As the industry evolves, IoT manufacturing will continue to adapt to the changing business landscape, emphasizing resilience, efficiency, and remote operational capabilities.

Segmental Analysis:

The Data Management and Analytics Segment is Expected to Witness Significant Growth Over the Forecast Period

Data management and analytics are essential in IoT manufacturing, enabling manufacturers to convert the wealth of data generated by IoT devices into actionable insights. This data-driven approach enhances operational efficiency, quality control, and decision-making, ultimately leading to improved competitiveness, sustainability, and innovation within the manufacturing industry.

Satellite Network Segment is Expected to Witness Significant Growth Over the Forecast Period

Satellite networks have become integral to IoT manufacturing, enabling connectivity and data transmission in locations and situations where traditional networks fall short. The combination of IoT technologies with satellite networks enhances the capabilities of manufacturers by providing global reach, real-time data insights, and the ability to monitor and control manufacturing processes in diverse and challenging environments. This synergy empowers the industry to operate efficiently and sustainably while expanding its scope and reach.

System Integration and Deployment Segment is Expected to Witness Significant Growth Over the Forecast Period

System integration and deployment are vital steps in the successful implementation of IoT manufacturing. When executed effectively, they result in a manufacturing environment that leverages IoT technology to improve efficiency, reduce costs, enhance product quality, and enable data-driven decision-making. The careful integration of hardware, software, and data systems ensures that IoT manufacturing initiatives meet their objectives and drive the industry toward greater innovation and competitiveness.

Thus, the segment is expected to witness significant growth over the forecast period.

Logistics and Supply Chain Management Segment is Expected to Witness Significant Growth Over the Forecast Period

IoT manufacturing has significantly improved logistics and supply chain management by providing comprehensive, real-time data and insights. This has led to increased efficiency, reduced costs, improved customer service, and a more agile and responsive supply chain. As IoT technology continues to evolve and mature, its integration with logistics and supply chain management will play an increasingly pivotal role in the manufacturing industry's quest for enhanced competitiveness and sustainability. Moreover, IoT devices can ensure compliance with regulatory standards and quality control measures by monitoring environmental conditions, tracking product authenticity, and maintaining records for compliance purposes. Thus, the segment is expected to witness significant growth over the forecast period.

Electronics and Communication Equipment Segment is Expected to Witness Significant Growth Over the Forecast Period

Electronics and communication equipment are the backbone of IoT manufacturing, as they enable the collection, transmission, and processing of data critical for improving operational efficiency, enhancing product quality, and reducing costs. As technology continues to evolve, the synergy between these sectors will drive the advancement of IoT in manufacturing, offering new opportunities for innovation and growth. IoT manufacturing often relies on wireless technologies to connect devices, making the production process more flexible and agile. Manufacturers in the electronics and communication industry continue to innovate with wireless solutions, including 5G, which enables high-speed, low-latency data transmission for IoT applications. Thus, the segment is expected to witness significant growth over the forecast period.

North America is Expected to Witness Significant Growth Over the Forecast Period

The North American region is a dominant force in the IoT (Internet of Things) manufacturing market. This prominence can be attributed to its strong economies, such as the United States and Canada, which make substantial investments in research and development activities related to IoT, thereby driving the innovation of new technologies. With their early embrace of trending technologies like mobility, big data, and IoT, manufacturers in this region are actively seeking to integrate IoT solutions into their operations.

Connected devices and the seamless flow of data are already finding practical applications in the manufacturing sector. As a result, we can anticipate faster deliveries due to reduced infrastructure costs. To maintain their competitiveness, manufacturers are harnessing the power of IoT and analytics to optimize and enhance their business operations. In the United States, approximately 35% of manufacturers are actively collecting and utilizing data generated by smart sensors to improve their manufacturing processes. According to a study, around 34% of manufacturers believe that embracing IoT is crucial for manufacturers in the United States. For manufacturers, IoT has evolved into an ecosystem where software, cloud computing, and analytics tools are combined to transform raw data from various sources into meaningful predictions, which are then presented through user-friendly interfaces. By 2025, it is expected that the number of connected devices in the automation sector will increase by 50%. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Internet-of-Things (IoT) market in manufacturing is cohesive and coherent. The market after Industry 4.0 has started to be more attractive, as companies are opting for IoT as enablers in their manufacturing units. Moreover, the market is inclined toward fragmentation. Some of the key players in the market are:

Recent Development:

1. August 2022: Intel Corporation and Check Point Software Technologies have started a new partnership. As a result of the cooperation, Intel's new platform for the Internet of Things (IoT) device developers, Intel Pathfinder for RISC-V, would now include Check Point's Quantum IoT Protect. IoT device manufacturers could implement cutting-edge security at the beginning of the product life cycle by enabling the Check Point software within the platform.

2. February 2022: To assist its service provider clients in providing a more straightforward method to manage LPWAN/4G/5G IoT connectivity for novel and developing use cases, Cisco announced improvements to its Internet of Things (IoT) portfolio. The new offer makes it practical and financially advantageous for service providers to develop new revenue streams and seize new mass IoT market opportunities. It also decreases connectivity management complexity and costs without compromising quality.

Q1. How big is the IoT in Manufacturing Market?

The IoT in Manufacturing Market in Manufacturing is expected to grow from USD 313.98 billion in 2022, registering a CAGR of 25.33% during the forecast period.

Q2. Which region has the largest share of the IoT in Manufacturing? What are the largest region's market size and growth rate?

North American region has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Q3. What are the factors on which the IoT in Manufacturing Market research is based on?

By Software, By Connectivity, Services, Application, End User and Geography are the factors on which the IoT in Manufacturing research is based.

Q4. Which are the major companies in the IoT in Manufacturing Market?

Cisco Systems Inc., General Electric, Intel Corporation and IBM Corporation are some of the major companies in the IoT in Manufacturing Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model