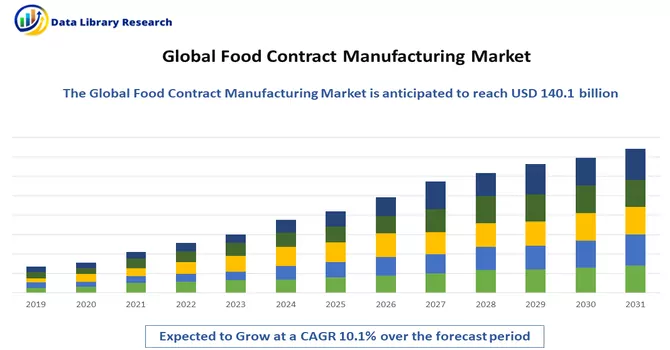

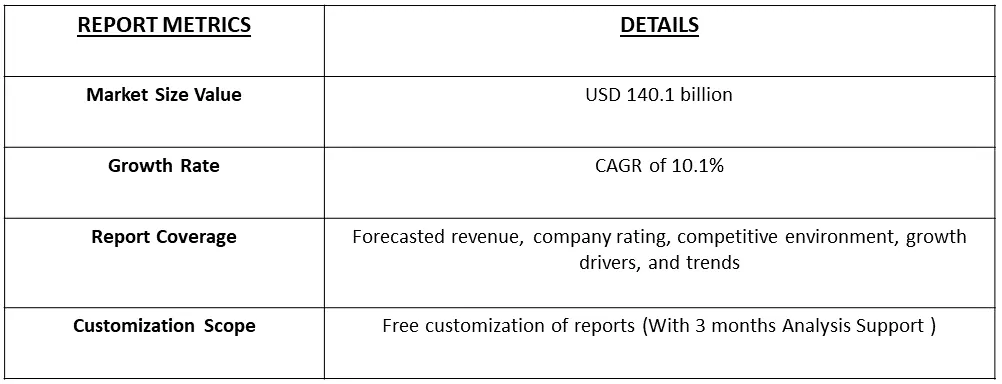

The global food contract manufacturing market size was valued at USD 140.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.1% during the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Food contract manufacturing involves outsourcing the production and manufacturing of food products to a third-party company, known as a contract manufacturer. In this arrangement, a brand or company provides the recipe or concept for a food product, and a specialized manufacturer is hired to handle the production, packaging, and, in some cases, distribution of the product on behalf of the brand owner. The agreement between the two parties outlines the terms, conditions, and responsibilities. This approach allows the brand owner to concentrate on aspects like marketing and sales while leveraging the expertise and facilities of the contract manufacturer. Food contract manufacturing offers benefits such as cost savings, access to specialized equipment, increased production capacity, and flexibility to adapt to market demands, making it a common practice in the food industry for companies seeking to bring products to market without significant investments in manufacturing infrastructure or expertise.

The industry is anticipated to experience positive growth due to a rising demand for outsourcing food manufacturing. Increased spending on research and development in food processing technologies is expected to contribute positively to the market's expansion in the forecast period. The incorporation of artificial intelligence (AI) and the Internet of Things (IoT) for implementing robotics in manufacturing facilities is driving market growth. Additionally, factors like panic buying of comfort food during the pandemic and a surge in private equity investments in contract manufacturing are poised to further enhance the industry's growth prospects.

Several notable market trends are shaping the landscape of the food contract manufacturing industry. Firstly, there is a discernible increase in the demand for outsourcing food production, driven by companies looking to streamline operations, reduce costs, and focus on core competencies. This growing trend is likely to fuel industry growth significantly. Another prominent trend is the rising investment in research and development within the sector, particularly in food processing technologies. This emphasis on innovation is expected to enhance the efficiency and capabilities of contract manufacturing facilities, driving market expansion. The integration of advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT) into manufacturing processes is becoming increasingly prevalent, leading to improved automation and precision. Additionally, the market is witnessing a surge in private equity investments, reflecting confidence in the long-term potential of contract manufacturing in the food industry. Lastly, the impact of external factors, such as the COVID-19 pandemic, has accelerated certain trends, including a spike in demand for comfort foods through panic buying, further bolstering the growth of the food contract manufacturing market.

Market Segmentation: The Food Contract Manufacturing Market is Segmented by Service (Manufacturing, Packaging, Custom Formulation And R&D), and Geography (North America, Europe, Asia-Pacific, South America and Middle-East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Leveraging innovations such as automation, AI, and IoT to enhance manufacturing processes and ensure product quality

The Food Contract Manufacturing market is experiencing a transformative shift by leveraging cutting-edge innovations such as automation, Artificial Intelligence (AI), and the Internet of Things (IoT) to elevate manufacturing processes and uphold product quality standards. Automation plays a pivotal role in streamlining production workflows, reducing manual errors, and improving overall operational efficiency. AI is being deployed for data analysis, predictive maintenance, and quality control, enabling manufacturers to make data-driven decisions and optimize production outcomes. IoT technologies facilitate real-time monitoring of equipment, supply chains, and production environments, enhancing traceability and ensuring compliance with quality standards. The integration of these technologies not only accelerates production but also contributes to sustainable practices by minimizing waste and resource consumption.

The use of Food Contract Manufacturing further amplifies the impact of these innovations. Companies that specialize in contract manufacturing can leverage these advanced technologies without the need for individual brands to invest heavily in their implementation. Contract manufacturers equipped with automated systems, AI-driven processes, and IoT-enabled monitoring can offer clients a competitive edge in terms of efficiency, cost-effectiveness, and product quality. This collaborative approach allows food brands to focus on product development, marketing, and market expansion while relying on the specialized capabilities of contract manufacturers to ensure a seamless and technologically advanced production process. Overall, the symbiotic relationship between the adoption of innovations and the utilization of Food Contract Manufacturing is propelling the industry toward greater efficiency and competitiveness in the dynamic landscape of the food manufacturing sector.

Increasing complexity of food production, along with the need for specialized expertise

The Contract Food Manufacturing market is witnessing significant growth propelled by the increasing complexity of food production and the growing demand for specialized expertise in the industry. As the intricacies of food production processes continue to evolve, companies are finding it challenging to manage every aspect of manufacturing in-house. The intricacy is driven by factors such as diverse consumer preferences, stringent quality standards, and the incorporation of advanced technologies in food processing. To navigate this complexity and maintain a competitive edge, many food companies are turning to Contract Food Manufacturing. Contract Food Manufacturing provides a strategic solution by allowing companies to outsource specific aspects of their production process to specialized manufacturers. These contract manufacturers bring a wealth of expertise and advanced capabilities to the table, addressing the intricate requirements of modern food production. Whether it's the production of specialized ingredients, adherence to regulatory standards, or the incorporation of innovative technologies, contract manufacturers play a crucial role in meeting these challenges.

The trend towards outsourcing in the food industry is not only driven by the complexity of production but also by the desire for operational efficiency and cost-effectiveness. Contract Food Manufacturing enables companies to focus on their core competencies, such as product development, marketing, and brand building, while leveraging the specialized skills of contract manufacturers to ensure the efficient and high-quality production of their food products. As the food industry continues to evolve, the Contract Food Manufacturing market is expected to play a pivotal role in helping companies navigate the complexities of modern food production.

Market Restraints:

Potential loss of confidentiality and intellectual property

The Contract Food Manufacturing market encounters a notable challenge concerning the potential loss of confidentiality and intellectual property, which has the potential to impede its growth. As companies engage in outsourcing their food production to contract manufacturers, they often share proprietary recipes, unique formulations, and specialized production processes. This exchange of sensitive information raises concerns about the protection of intellectual property, as it exposes companies to the risk of unauthorized use or disclosure of their closely guarded recipes and trade secrets. This potential loss of confidentiality poses a significant deterrent for some businesses contemplating entering into contract manufacturing agreements. The fear of intellectual property compromise may slow down the pace at which companies are willing to leverage the services of contract manufacturers. Protecting proprietary information becomes paramount, especially in an industry where the distinctiveness of recipes and manufacturing processes contributes significantly to a brand's competitive edge.

The COVID-19 pandemic has exerted a multifaceted impact on the Food Contract Manufacturing market. Initially, the industry experienced disruptions in supply chains, labor shortages, and logistical challenges, leading to temporary closures and delays in production. The increased focus on hygiene and safety protocols further influenced manufacturing practices. On the demand side, shifts in consumer behavior, such as a surge in demand for shelf-stable and comfort foods during lockdowns, prompted adjustments in production priorities. The pandemic accelerated trends such as e-commerce adoption and heightened the importance of resilient and flexible supply chains. While certain segments faced challenges, the crisis also underscored the value of contract manufacturing in providing agility and scalability to food brands. As the industry adapts to the new normal, the Food Contract Manufacturing market is poised for recovery and potential growth, driven by evolving consumer preferences and the need for resilient and adaptive production solutions.

Segmental Analysis:

Custom Formulation Segment is Expected to Witness Significant Growth Over the Forecast Period

Custom formulation plays a pivotal role in the dynamic landscape of Contract Food Manufacturing, offering brands a tailored approach to product development. This process involves collaborating with contract manufacturers to create unique recipes, formulations, and product specifications that align with a brand's distinct identity and meet consumer preferences. The synergy between custom formulation and contract manufacturing empowers food companies to outsource production while maintaining control over the creation of innovative and exclusive products. This collaborative model not only caters to niche markets and evolving consumer trends but also enhances the overall competitiveness of brands by providing flexibility and agility in bringing customized food products to market efficiently. As consumer preferences continue to diversify, the integration of custom formulation within the framework of Contract Food Manufacturing emerges as a strategic tool for brands seeking differentiation and responsiveness in the ever-evolving food industry.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America, the Contract Food Manufacturing market is experiencing significant growth and evolution, driven by several key factors. The region's robust and dynamic food industry is witnessing a heightened demand for outsourcing manufacturing processes, as companies aim to enhance efficiency, flexibility, and market responsiveness. Contract Food Manufacturing in North America has become a strategic solution for brands seeking to navigate the complexities of food production while focusing on core competencies like branding and marketing. The market is characterized by a diverse range of products, including snacks, beverages, frozen foods, and more, reflecting the region's diverse consumer preferences. The region's Contract Food Manufacturing market is also influenced by the increasing adoption of advanced technologies, such as automation and digitalization, to optimize production processes and ensure product quality. Moreover, the emphasis on food safety, quality standards, and adherence to regulatory requirements aligns with the rigorous standards set by North American consumers. Additionally, the COVID-19 pandemic has further underscored the importance of resilient and adaptable supply chains, prompting companies to reevaluate their manufacturing strategies and consider the benefits of contract manufacturing. As consumer trends continue to evolve, Contract Food Manufacturing in North America is poised for sustained growth, providing brands with the flexibility to introduce innovative products, respond to changing market demands, and navigate the competitive landscape effectively. The region's strategic position as a hub for food innovation and its consumer-driven market make it a focal point for the expansion and diversification of the Contract Food Manufacturing sector.

Get Complete Analysis Of The Report - Download Free Sample PDF

There is a notable trend of accelerated consolidation within the value chain among major manufacturers in the food industry. Simultaneously, companies are diversifying their offerings by providing supplementary value-added services, including packaging, research and development (R&D) expertise, and storage solutions, which is driving substantial growth within the sector. The innovative strategies implemented by food contract manufacturers have given rise to collaborative co-development opportunities. Notably, food companies are embracing a revamped supply chain strategy, emphasizing the pivotal role of manufacturing to gain a competitive edge. This strategic shift is instrumental in mitigating cross-border risks and optimizing sales channels, as manufacturers strategically position themselves to play a central role in the evolving dynamics of the food industry. The industry's landscape is evolving as these trends reshape traditional approaches, fostering a more integrated and competitive environment across the entire food manufacturing value chain. Some prominent players in the global food contract manufacturing market include:

Recent Development:

1) In July 2023, Annapurna Swadisht formalized a manufacturing contract with Gopal Food Products, establishing a partnership to utilize Gopal's production facility. This state-of-the-art facility boasts a substantial production capacity, enabling the manufacturing of 1000 metric tons (MT) of biscuits, 150 MT of snacks, and 60 MT of namkeen each month. The strategic collaboration positions the production unit to effectively serve the markets in North West and Central India, showcasing Annapurna Swadisht's commitment to meeting the diverse demands of the regional consumer base.

2) In June 2023, as Thrive Foods announced the impending acquisition of Groneweg Group, also recognized as Freeze-Dry Foods. Groneweg Group specializes in the supply and manufacturing of air-dried and freeze ingredients, making it a valuable addition to Thrive Foods' portfolio. The acquisition, set to conclude in 2023, is anticipated to enhance Thrive Foods' market presence and capabilities in the realm of dried freeze products. This strategic move underscores the industry's dynamics, with companies seeking strategic acquisitions to strengthen their position and broaden their offerings in response to evolving market trends and consumer preferences.

Q1. What was the Food Contract Manufacturing Market size in 2023?

As per Data Library Research the global food contract manufacturing market size was valued at USD 140.1 billion in 2023.

Q2. What is the Growth Rate of the Food Contract Manufacturing Market?

Food Contract Manufacturing Market is expected to grow at a compound annual growth rate (CAGR) of 10.1% during the forecast period.

Q3. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Q4. Who are the key players in Food Contract Manufacturing Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model