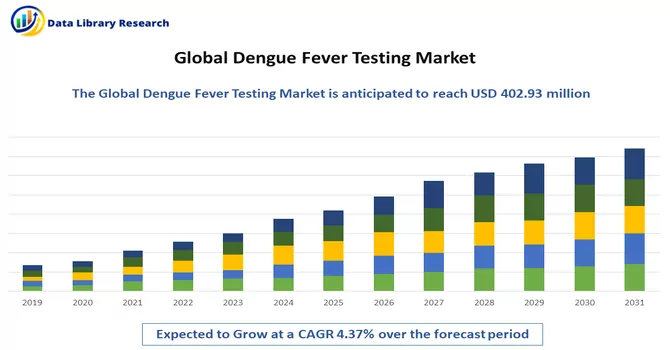

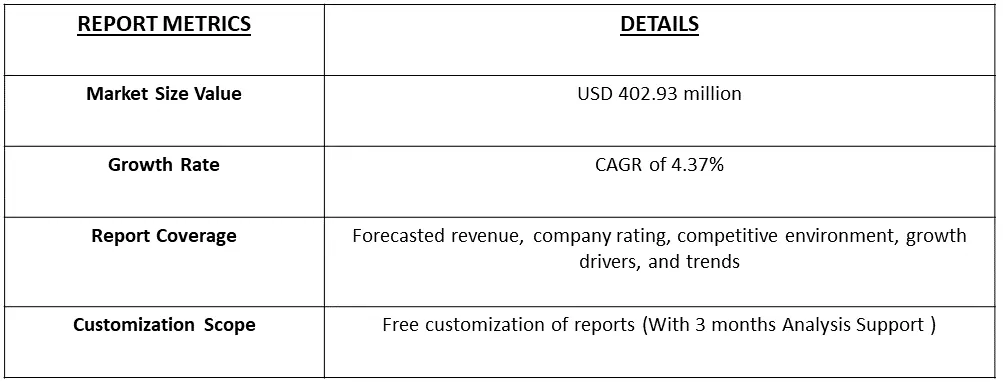

The Dengue Testing Market size is expected to grow from USD 402.93 million in 2022 to USD and is expected to register a CAGR of 4.37% during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The field of dengue testing comprises a diverse range of methods and tools utilized for the diagnosis of dengue fever, a viral infection transmitted by mosquitoes and caused by the dengue virus. The primary objective of dengue testing is to precisely detect the presence of the virus in a patient's bloodstream, facilitating the swift identification of a dengue infection and enabling timely medical intervention and care. Dengue fever is prevalent in tropical and subtropical regions, leading to periodic outbreaks.

The escalating incidence of dengue cases, particularly in areas conducive to mosquito breeding, drives the demand for effective and dependable testing techniques to promptly diagnose the infection. Given the potential for severe complications such as hemorrhagic fever and shock syndrome, dengue poses significant public health challenges. Accurate and timely diagnosis, facilitated by efficient testing, is essential for effective disease management, patient treatment, and the control of outbreaks.

There is a notable trend in the dengue testing landscape towards the creation of rapid diagnostic tests (RDTs). These tests provide rapid results, typically within 15-20 minutes, facilitating swift diagnosis and immediate patient care, particularly in regions with restricted access to laboratory facilities. Technological advancements have played a pivotal role in the development of multiplex testing platforms capable of simultaneously detecting various pathogens. This includes different serotypes of the dengue virus and other related infections such as Zika and chikungunya. These multiplex platforms offer efficient and comprehensive testing solutions.

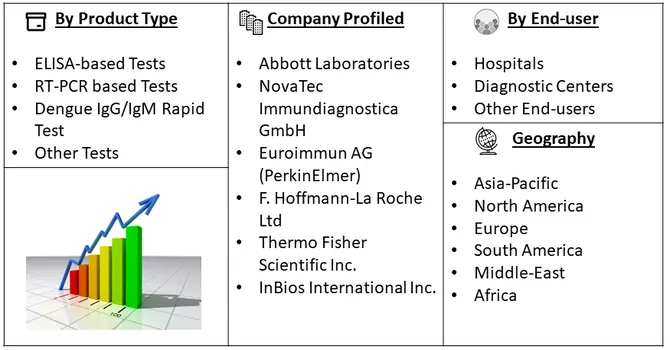

Market Segmentation: The Global Dengue Testing Market is Segmented by Product Type (ELISA-based Tests, RT-PCR based Tests, Dengue IgG/IgM Rapid Test, and Other Tests), by End-user (Hospitals, Diagnostic Centers, and Other End-users), and by Geography (Asia-Pacific and Americas). The report offers the value (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Dengue Burden and Outbreaks

The increasing global prevalence of dengue fever, coupled with recurring outbreaks in diverse regions, stands as a significant catalyst for the dengue testing sector. As the frequency of dengue cases continues to escalate, especially in tropical and subtropical areas, there is a growing need for precise and efficient diagnostic tests. This surge in demand propels the advancement and acceptance of testing methodologies that facilitate early detection and effective management of dengue cases, contributing to disease control and prevention initiatives.

Over the past several years, the overall incidence of dengue and the occurrence of explosive outbreaks have witnessed a substantial increase. For instance, statistics from the European CDC indicate 1,371,248 reported dengue cases and 849 deaths worldwide this year. Brazil reported the majority of cases (1,114,758), followed by Peru (45,816), Vietnam (25,694), Indonesia (22,331), and Colombia (21,576). According to data from the WHO and PAHO, as of June 1st this year, America reported 1,238,528 dengue cases, with 544,125 confirmed cases and 426 deaths. The escalating burden of dengue cases globally is expected to drive increased demand for dengue testing, consequently propelling the market's growth in the forecast period.

Technological Advancements and Innovation

Continuous advancements in diagnostic technologies, coupled with innovations in testing methods, propel the progression of dengue testing. There is a persistent effort to enhance the sensitivity, specificity, and rapidity of diagnostic tests. Notable innovations encompass the creation of rapid point-of-care tests, multiplex testing platforms capable of concurrently identifying multiple pathogens, and the refinement of molecular diagnostic techniques. These technological strides act as a driving factor in the growth of the dengue testing market, prompting investments in research and development to produce more effective and accessible testing solutions. For instance, in August 2023, Mylab Discovery Solutions has introduced two rapid point-of-care tests for the detection of dengue infections — rapid gold test and high-accuracy dry luminescence assay test. Thus, such developments are expected to fuel the growth of the studied market over the forecast period.

Market Restraints:

The process of dengue testing frequently entails intricate procedures to distinguish between dengue and other closely related viral infections. Achieving specificity in tests, particularly in areas where multiple viruses coexist, such as Zika or chikungunya, can present challenges in ensuring accurate diagnoses, potentially resulting in the misinterpretation of results. Certain diagnostic tests for dengue may demonstrate variable accuracy rates, particularly across various stages of the infection. Factors such as fluctuations in viral load, variations in serotypes, or cross-reactivity with antibodies from prior infections can contribute to instances of false negatives or false positives.

The healthcare systems in numerous regions endemic to dengue experienced substantial strain during the COVID-19 pandemic. Resources, including healthcare personnel, laboratory facilities, and funding, were redirected to address the surge in COVID-19 cases. This reallocation of resources impacted the capacity for dengue testing and surveillance. The initial symptoms of both COVID-19 and dengue fever, such as fever, headache, and body aches, share similarities. This similarity in symptoms presented challenges in distinguishing between the two diseases, resulting in an increased demand for testing to accurately diagnose patients.

Segmentation Analysis:

ELISA-based Tests Segment is Expected to Witness Significant Growth Over the Forecast Period

Enzyme-linked immunosorbent Assay (ELISA) based tests are crucial tools in the dengue testing industry. ELISA tests detect the presence of dengue virus-specific antibodies (IgM and IgG) or viral antigens in a patient's blood serum or plasma. These tests play a significant role in diagnosing dengue fever and assessing the stage of the infection. Furthermore, an article published by NCBI in 2021, reported that ELISA had high sensitivity and specificity (>90%), but the false-negative and false-positive rates makes the test suboptimal for prevaccination screening. Individuals who are falsely identified as seropositive by dengue IgG ELISA and then vaccinated might be at risk of developing severe disease during a subsequent exposure to wild-type dengue virus. Those with a monotypic profile would benefit the most from vaccination, but the sensitivity of the IgG ELISA was much lower in this group than in those with a multitypic profile. Thus, owing to such benefits the usage for ELISA Testing for dengu fever detection may increase over the forecast period.

Hospitals Segment is Expected to Witness Significant growth Over the Forecast Period

Hospitals, especially those with well-equipped laboratories, conduct various diagnostic tests for dengue, including ELISA-based assays, PCR (Polymerase Chain Reaction) tests, NS1 antigen tests, and serological tests to detect dengue-specific antibodies. These tests aid in confirming dengue infections, determining the stage of the disease, and differentiating between dengue and other febrile illnesses. Hospitals provide comprehensive care to individuals affected by dengue fever. Patients with confirmed or suspected dengue infections receive medical attention, symptom management, and supportive care, including fluid replacement therapy and monitoring for severe manifestations like dengue hemorrhagic fever or dengue shock syndrome.

Asia-Pacific Segment is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is anticipated to witness the most rapid growth in the dengue testing market in the coming years. This growth is attributed to the increasing prevalence of dengue infections in the region. For example, data from the ECDC indicates reported cases in Indonesia, Sri Lanka, Timor-Leste, and Vietnam. In India, according to NCVBDC, dengue cases surged from 44,585 to 193,245 in the base year, emphasizing the need for extensive testing. Malaysia, part of the Western Pacific region, reported 17,497 dengue cases according to WHO data, showing a 57.6% increase compared to the same period in the base year. The rising number of dengue cases is expected to drive the demand for dengue testing in the region. Notably, a study revealed a correlation between COVID-19 and dengue virus infection, emphasizing the public health challenge in detecting COVID-19 in dengue-endemic countries. Additionally, a Singaporean study highlighted the efficacy of rapid diagnostic kits, with Standard Q demonstrating the highest sensitivity and specificity in detecting dengue virus infection. The increasing need for such diagnostic kits is likely to contribute to market growth. Outbreaks across Asia-Pacific prompted companies to develop dengue diagnostic test kits. For instance, Achiko initiated the development of a dengue fever diagnostic test utilizing its DNA aptamer technology platform. Government initiatives to raise dengue awareness further contribute to market growth. For instance, Sri Lanka's National Dengue Control Unit organized a mosquito control program to curb the spread of dengue. Considering these factors, the dengue testing market is poised for substantial growth in the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The landscape of the dengue testing market reflects consolidation, marked by the substantial contributions of several key companies that play pivotal roles in driving market growth. These companies, through their extensive involvement and impact, shape the dynamics and trajectory of the dengue testing market. The market is characterized by the dominance of major players who hold significant market share. These key companies exert influence over market trends, innovations, and the overall direction in which the dengue testing sector is heading. Major players in the dengue testing market are actively involved in strategic initiatives that contribute to the market's expansion. These initiatives may include research and development efforts, technological advancements, collaborations, partnerships, and mergers and acquisitions.

Some of the major players in the market are:

Recent Developments:

1) In May 2022, Mylab Discovery Solutions launched a combined RT-PCR test kit for detecting Sars-CoV-2 and monsoon diseases. The test kit can differentiate between malaria, Chikungunya, dengue, Zika, Leptospirosis and Salmonellosis bacterial species, and Leishmaniasis parasites.

2) In May 2022, Anitoa System launched a portable RT-PCR molecular test capable of detecting dengue virus infections

Q1. What was the Dengue Fever Testing Market size in 2022?

As per Data Library Research the Dengue Testing Market size is expected to grow USD 402.93 million in 2022.

Q2. At what CAGR is the Dengue Fever Testing market projected to grow within the forecast period?

Dengue Fever Testing Market is expected to register a CAGR of 4.37% during the forecast period.

Q3. What are the factors driving the Dengue Fever Testing Market?

Key factors that are driving the growth include the Dengue Burden and Outbreaks and Technological Advancements and Innovation.

Q4. Which Region is expected to hold the highest Market share?

Asia-Pacific region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model