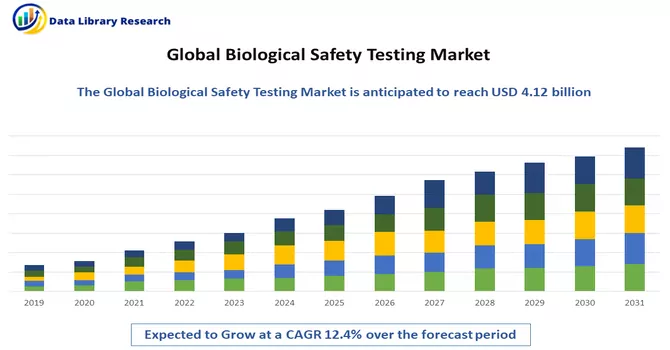

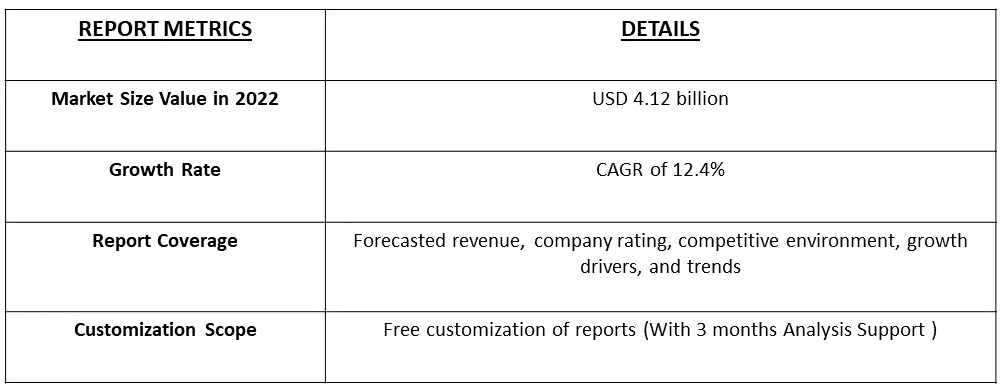

The biological safety testing market is currently valued at 4.12 billion in 2022 and is expected to witness a CAGR of 12.4% during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Biological safety testing refers to a set of procedures and evaluations conducted to assess the safety of biological products, such as pharmaceuticals, vaccines, medical devices, or genetically modified organisms (GMOs). The primary objective of these tests is to determine whether the biological product poses any potential risks to human health or the environment.

Ensuring the safety of biological products is paramount to protect the health and safety of individuals who may be exposed to these products. Rigorous testing helps identify and mitigate potential risks, such as toxicity or allergenic reactions. Testing is a critical component of quality assurance to maintain consistency and reliability in the production of biological products. Quality control measures, including safety testing, help uphold the product's quality and performance standards.

The adoption of cutting-edge analytical technologies, such as next-generation sequencing, mass spectrometry, and advanced imaging techniques, is improving the sensitivity and accuracy of safety testing. These tools allow for a more comprehensive analysis of biological products and their potential risks. Traditional 2D cell culture models are being supplemented or replaced by 3D and organ-on-a-chip models that better mimic human physiology. These models offer more physiologically relevant testing platforms and reduce the need for animal testing.

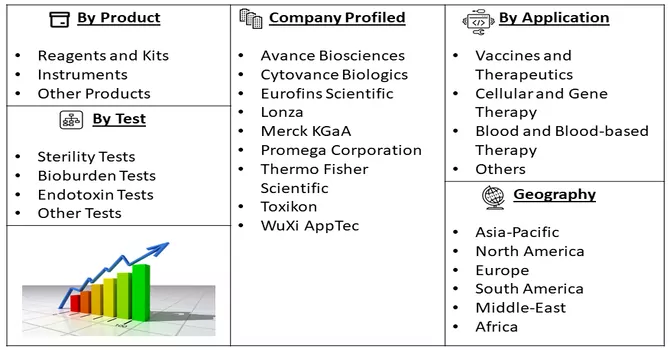

Market Segmentation: The Biological Safety Testing Market is segmented by Product (Reagents and Kits, Instruments and Other Products), by Application (Vaccines and Therapeutics, Cellular and Gene Therapy, Blood and Blood-based Therapy and Other Applications), by Test (Sterility Tests, Bioburden Tests, Endotoxin Tests, Other Tests), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growth in the Pharmaceutical and Biotechnology Industries, along with Increasing Investments

As the global population grows and ages, the demand for healthcare services and treatments has increased. This demographic shift has created a significant market for pharmaceuticals and biotechnology products, as they play a critical role in addressing various health conditions and improving the quality of life. Governments, private investors, and philanthropic organizations have recognized the potential of the pharmaceutical and biotechnology sectors to drive innovation and economic growth. To encourage research and development, they provide incentives such as tax breaks, grants, and research funding, leading to increased investments in the industry. Thus, the market is expected to witness significant growth over the forecast period.

Rising Production of New Biologics due to High Disease Burden

Chronic diseases like cancer, autoimmune disorders, and metabolic diseases are on the rise. These conditions often require innovative and targeted treatments, and biologics are at the forefront of addressing them. The rapid progress in biotechnology, including genetic engineering and genomics, has unlocked new possibilities for creating highly specific and effective biologics. This has expanded the potential for biologics to address a wider range of diseases. For instance, in 2021, biologics accounted for second of the top-eight drugs in terms of revenue. Humira (adalimumab), which was developed by AbbVie for the treatment of rheumatoid arthritis, psoriasis, Crohn’s, and other autoimmune diseases, led to USD 20.7 billion sales, as per the Top 15 Best-selling Drugs of 2021 report. Humira was also the fastest-growing biological drug. Thus, such instances are expected to drive the growth of the studied market.

Restraints :

Time Consuming Approval Process

Drug discovery typically begins with preclinical research. This stage involves identifying potential drug candidates and conducting extensive laboratory tests and animal studies to assess safety and efficacy. Preclinical research can take several years to complete as researchers refine their understanding of the compound's properties. Thus, the time-consuming approval process for drug discovery is a multifaceted challenge that requires a delicate balance between scientific rigor, patient safety, and the need for timely access to innovative treatments. Pharmaceutical companies, researchers, and regulatory agencies continue to work together to streamline and expedite the drug development process without compromising safety and efficacy standards. Thus, such instances are expected to slow down the growth of the studied market over the forecast period.

The urgent need for COVID-19 vaccines accelerated the development and production of vaccines. This led to a heightened demand for biological safety testing services and products, as regulatory agencies required rigorous safety assessments before granting emergency use authorizations. Virology testing, which is crucial for the evaluation of vaccines and antiviral drugs, gained prominence during the pandemic. Laboratories and testing facilities had to expand their virology capabilities, resulting in higher demand for related testing equipment and expertise. Governments and private organizations allocated substantial funding for COVID-19-related research, including the development of treatments, diagnostics, and vaccines. This funding directly supported the biological safety testing market through increased demand for testing services. Thus, the pandemic are likely to shape the future of biological safety testing and influence preparedness for similar public health crises, emphasizing the importance of agility, remote capabilities, and global collaboration in the industry.

Segmental Analysis:

Reagents and Kits Segment is Expected to Witness Significant Growth Over the Forecast Period

Reagents and kits play a crucial role in biological safety testing, supporting the accurate and reliable assessment of the safety and efficacy of pharmaceuticals, biologics, vaccines, and other biological products. Reagents and kits are used in toxicity testing to assess the adverse effects of biological products on living organisms. Cell viability assays, enzyme activity assays, and apoptosis detection kits are examples of tools that employ reagents to evaluate the toxicity of compounds. Moreover, for vaccines and biologics, assessing immunogenicity is critical. Reagents and kits are employed to measure the immune response triggered by the product. ELISA (Enzyme-Linked Immunosorbent Assay) kits, for instance, are commonly used to detect specific antibodies or antigens. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Vaccines and Therapeutics Segment is Expected to Witness Significant Growth Over the Forecast Period

Biological safety testing plays a pivotal role in the development and evaluation of vaccines and therapeutics, ensuring their safety and efficacy before they are approved for use in humans. Vaccines and therapeutics are distinct categories of biological products, and both rely on rigorous testing to meet regulatory requirements and ensure public health. Before moving to clinical trials, vaccines undergo extensive preclinical safety assessments. Animal studies are conducted to evaluate the vaccine's safety profile, including its potential for adverse effects, toxicity, and immunogenicity. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Endotoxin Tests Segment is Expected to Witness Significant Growth Over the Forecast Period

Endotoxin tests are a crucial component of biological safety testing, particularly in the pharmaceutical and biotechnology industries. Endotoxins, also known as lipopolysaccharides (LPS), are cell wall components of Gram-negative bacteria. They are potent pyrogens, meaning they can induce fever and inflammatory responses in the human body. Endotoxin testing is employed to detect and quantify the presence of endotoxins in pharmaceuticals, medical devices, and other biological products to ensure safety and compliance with regulatory standards. Endotoxin tests are often part of sterility testing protocols. Sterility testing ensures that a product is free from viable microorganisms, while endotoxin tests verify the absence of bacterial endotoxins. Both tests are essential to prevent contamination and maintain the safety of pharmaceuticals and medical devices.

Moreover, medical devices that come into contact with the bloodstream, such as catheters or implants, must undergo endotoxin testing to ensure patient safety. The presence of endotoxins on such devices can lead to serious complications, including sepsis. Thus, owing to such advantages the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America continues to dominate the biological safety testing market, and this trend is expected to persist in the forecast period. The United States, in particular, is poised to be a major contributor to the region's market growth. The outbreak of COVID-19 has, surprisingly, had a positive impact on market growth due to increased research and development (R&D) activities related to the virus. The remarkable growth of the biological safety testing market in North America can be directly attributed to the thriving biotechnology and pharmaceutical industries in the region. These industries are experiencing substantial growth, driven by factors such as innovative technologies and favorable government initiatives.

Furthermore, the growing necessity for the validation of drug and device manufacturing processes is set to drive market demand. In 2021, the United States Food & Drug Administration (FDA) reported approximately 4,814 drug manufacturing sites in the United States. Additionally, North America boasts an advanced healthcare infrastructure and a significant uptick in R&D investment, further boosting the market's revenue size. According to data from the Pharmaceutical Research and Manufacturers of America (PhRMA), the pharmaceutical industry in the United States spent approximately USD 83 billion on R&D. Consequently, this substantial investment is expected to drive market growth throughout the forecast period. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The biological safety testing market is highly competitive and consists of a few major players. Some of the companies working in domain are:

Recent Development:

1) In April 2021, Lonza expanded its product ''PyroTec PRO Automated Robotic Solution'' for endotoxin testing. It is compatible with the company's product PYROGENT-5000 Turbidimetric LAL (Limulus Amebocyte Lysate) Assay, Kinetic-QCL Chromogenic LAL Assay, and the PyroGene rFC Assay.

2) In December 2020, Redberry introduced a new product ''Red One Automated Bioburden Detection'' that enables instantaneous bioburden detection of microorganisms and has been designed for water and pharmaceutical testing.

Q1. What is the current Biological Safety Testing Market size?

The biological safety testing market is currently valued at 4.12 billion.

Q2. What is the Growth Rate of the Biological Safety Testing Market?

Biological Safety Testing Market is expected to witness a CAGR of 12.4% during the forecast period.

Q3. Which region has the largest share of the Biological Safety Testing Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Q4. What segments are covered in the Biological Safety Testing Market Report?

By Product, By Application, By Test and Geography are the segments covered in the Biological Safety Testing Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model