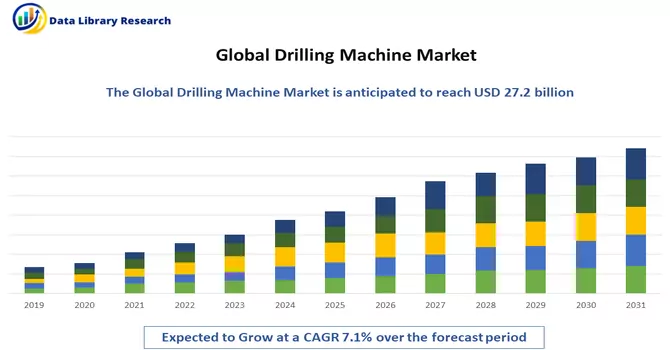

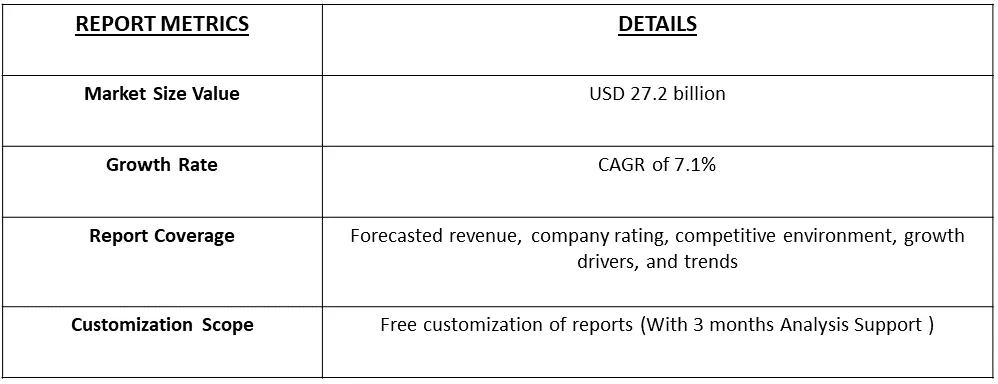

The size of the Drilling Machines market is USD 27.2 billion in the year 2023 and is anticipated to register a CAGR of over 7.1% during the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

A drilling machine is a versatile power tool or machine tool utilized for creating holes in materials such as wood, metal, or plastic. It consists of key components, including a base for stability, a vertical column supporting the drilling head, and a drilling head that can be moved vertically along the column. The drill spindle, which holds and rotates the drill bit, is housed in the drilling head. The machine also features an adjustable table to support the workpiece, a motor that drives the drill spindle (electric, pneumatic, or hydraulic), and a drill chuck for holding and changing drill bits conveniently. Drilling machines find widespread applications in construction, manufacturing, woodworking, metalworking, and maintenance, playing a crucial role in tasks like creating holes for fasteners and openings for pipes and cables, as well as other precision drilling operations.

The growth of the drilling machine industry is propelled by several key factors. Technological advancements and innovations in drilling machine design and capabilities have significantly enhanced efficiency and precision in various industries, driving the demand for more advanced equipment. The expanding construction and infrastructure sectors, both globally and regionally, contribute to the increased need for drilling machines in tasks such as foundation drilling and tunneling. Additionally, the growth of the manufacturing sector, particularly in sectors like aerospace and automotive, fuels the demand for drilling machines for precision machining and hole creation in metal components. The rise in exploration and extraction activities in the oil and gas industry also boosts the demand for specialized drilling equipment. Furthermore, the ongoing developments in renewable energy sources, such as wind and solar, involve extensive drilling operations for foundation installation and support structures. Overall, the increasing demand across diverse industries, coupled with technological progress, positions drilling machines as crucial tools driving growth in the broader industrial landscape.

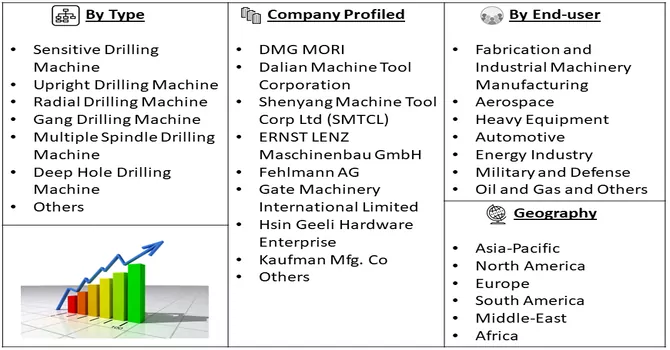

Market Segmentation: The Drilling Machines Market is segmented by Type (Sensitive Drilling Machine, Upright Drilling Machine, Radial Drilling Machine, Gang Drilling Machine, Multiple Spindle Drilling Machine, Deep Hole Drilling Machine and Others), by End-user (Fabrication and Industrial Machinery Manufacturing, Aerospace, Heavy Equipment, Automotive, Energy Industry, Military and Defense, Oil and Gas and Others) and by Geography(North America, Latin America, Asia-Pacific, Middle East, and Africa, and Europe). The report offers market size and forecast values (USD billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The drilling machine market is witnessing several notable trends that shape its trajectory. One significant trend is the increasing adoption of automated and computer numerical control (CNC) drilling machines, driven by the quest for enhanced precision and efficiency in drilling operations. Integration of IoT (Internet of Things) technology and data analytics in drilling equipment is another noteworthy trend, providing real-time monitoring and predictive maintenance capabilities. Sustainability concerns and a growing focus on eco-friendly practices have led to the development of energy-efficient and environmentally friendly drilling machines. The market is also experiencing a surge in demand for portable and compact drilling solutions, catering to the needs of smaller workshops and industries with limited space. Furthermore, there is a rising inclination towards multi-functionality in drilling machines, with manufacturers incorporating features that allow for a broader range of applications. As industries increasingly prioritize safety, drilling machines equipped with advanced safety features and ergonomic designs are gaining traction. Overall, these trends underscore a dynamic and evolving drilling machine market that aligns with the demands for efficiency, sustainability, and technological innovation across various industrial sectors.

Market Drivers:

Growing Infrastructure and Construction Activities

The considerable expansion observed in the global infrastructure and construction sectors serves as a pivotal driving force for the drilling machine market. The imperative requirement to establish robust foundations, intricate tunnels, and other essential structures propels a substantial demand for drilling machines. These machines play a vital role in facilitating the construction processes by enabling the creation of precise and strategically positioned holes necessary for foundational work and tunnelling activities. As the infrastructure landscape continues to evolve and witness growth worldwide, the demand for drilling machines is further accentuated, reflecting their indispensable role in supporting the development of critical structures essential for various construction projects.

Rise in Manufacturing Activities

The expanding trajectory of the manufacturing industry, particularly in sectors such as aerospace and automotive, is a key catalyst driving the heightened demand for drilling machines. This surge in demand is attributed to the industry's need for precision machining and the creation of meticulously crafted holes in diverse materials. In the aerospace sector, where precision is paramount, drilling machines play a crucial role in the production of aircraft components, ensuring the accuracy and quality of intricate structures. Similarly, in the automotive sector, drilling machines are instrumental in fabricating components that demand precise hole placement, contributing to the overall efficiency and performance of vehicles. As these manufacturing sectors continue to grow and advance, the reliance on drilling machines for intricate and high-precision machining processes becomes increasingly pivotal, underscoring their indispensable role in meeting the exacting standards of modern manufacturing.

Market Restraints:

High Initial Investment and Cyclical Nature of Industries

The drilling machine market faces potential challenges that could impede its growth, including the barriers presented by high initial investment requirements and the cyclical nature of industries it serves. The acquisition of drilling machines often involves a substantial upfront investment, particularly for advanced and technologically sophisticated models. This financial hurdle can pose a significant challenge for smaller businesses and industries operating on tighter budgets, potentially limiting their ability to adopt or upgrade drilling equipment. Additionally, the cyclical nature of industries such as mining, oil and gas, and construction can have a direct impact on the demand for drilling machines. Economic downturns or fluctuations in these sectors can lead to reduced investments in new drilling equipment as companies may prioritize cost-cutting measures during challenging economic periods. These factors highlight the need for strategic planning and financial considerations within the drilling machine market, as stakeholders navigate the delicate balance between innovation and cost-effective solutions in the face of economic uncertainties.

The COVID-19 pandemic has profoundly impacted the drilling machine market, causing disruptions across the industry. The initial outbreak resulted in economic slowdowns, supply chain disruptions, and manufacturing restrictions, leading to delays and cancellations in construction and infrastructure projects, major drivers for the drilling machine market. The oil and gas sector, another significant contributor, faced challenges due to plummeting oil prices and reduced global demand, impacting exploration and production activities and subsequently affecting the demand for drilling machines. Travel restrictions and supply chain disruptions further hindered the availability of critical components, leading to delays in maintenance and repair services. Despite these challenges, the pandemic prompted a heightened interest in technology adoption, with the industry exploring remote monitoring, automation, and digital solutions to ensure operational continuity. As economies recover and vaccination efforts progress, the drilling machine market is expected to rebound, driven by pent-up demand, resumption of infrastructure projects, and a renewed focus on technological advancements for operational resilience in the post-pandemic era. The long-term impact will hinge on the pace of global economic recovery and the effectiveness of adaptive strategies implemented by industry stakeholders.

Segmental Analysis:

Sensitive Drilling Machine Segment is Expected to Witness Significant Growth Over the Forecast Period

The drilling machine market encompasses a diverse range of machines catering to various applications, including sensitive drilling machines designed for precision and accuracy in tasks such as electronics and aerospace manufacturing. These machines, characterized by their lightweight and compact design, offer operators precise control with features like variable speed settings and sensitive feed mechanisms. The market, overall, is influenced by factors such as the expansion of global infrastructure, technological advancements, and the demand for drilling equipment in sectors like manufacturing. However, challenges like high initial investment costs and the cyclical nature of certain industries can impact market growth. The COVID-19 pandemic has introduced disruptions, influencing project timelines and affecting demand. Despite challenges, collaborative efforts among key players, innovation, and a commitment to excellence are evident, reflecting a competitive and dynamic market environment. As industries recover and technological advancements continue, the drilling machine market is poised for growth, with sensitive drilling machines expected to play a pivotal role in meeting the increasing demand for precision in diverse applications.

Heavy Equipment Segment is Expected to Witness Significant Growth Over the Forecast Period

The use of heavy equipment and drilling machines is integral across various industries, serving critical roles in construction, mining, oil and gas exploration, and manufacturing. Heavy equipment, including excavators, bulldozers, and loaders, facilitates large-scale earthmoving, material handling, and construction tasks, enhancing efficiency and productivity in infrastructure projects. Meanwhile, drilling machines play a crucial role in creating holes and tunnels necessary for construction foundations, mining operations, and oil and gas exploration. These machines, ranging from versatile handheld drills to specialized industrial units, are essential for tasks such as precision machining in manufacturing and foundational work in construction. The versatility and power of heavy equipment and drilling machines contribute significantly to the progress and development of diverse industries, showcasing their indispensable role in shaping the modern landscape and supporting essential operations across the globe.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

In the Asia Pacific region, the use of drilling machines is integral to the rapid development and expansion observed across diverse industries. The robust growth of the construction sector, driven by infrastructure projects in countries like China and India, has significantly contributed to the increased demand for drilling machines. These machines play a pivotal role in foundational work, tunnelling, and creating precise holes required for large-scale construction endeavours. Additionally, the region's burgeoning manufacturing sector, particularly in automotive and electronics, relies heavily on drilling machines for precision machining and hole creation in various materials. In sectors such as mining and oil exploration, the utilization of drilling equipment is crucial for resource extraction. The Asia Pacific's dynamic economic landscape, marked by urbanization and industrialization, underscores the indispensable role of drilling machines in supporting and advancing key sectors, contributing substantially to the region's overall growth and modernization.

Get Complete Analysis Of The Report - Download Free Sample PDF

The report encompasses major global players actively engaged in the drilling machine market. The market exhibits a highly fragmented nature, characterized by the presence of large companies that wield substantial market share. Collaboration and innovation are prevalent among several key players, who collaborate to generate fresh ideas, expand their business operations, achieve industry recognition through awards, and undertake various initiatives to enhance their products. This collaborative and innovative approach underscores their commitment to staying competitive in the dynamic market environment. These players leverage synergies, research and development efforts, and strategic partnerships to foster growth, ensuring a continuous evolution of their products and services to meet the evolving demands of the market. This concerted effort among key players highlights the competitive dynamics and the ongoing commitment to excellence within the drilling machine market.

The following are the market players for the studied market:

Recent Development:

1) In December 2022, Komatsu Limited, a prominent Japanese manufacturing company, disclosed its agreement to acquire GHH Group GmbH (GHH), a German-based manufacturer specializing in underground mining, tunnelling, and special civil engineering equipment, with its headquarters in Gelsenkirchen. This strategic acquisition is seen as a significant opportunity for Komatsu to broaden its portfolio in the field of underground mining equipment. The collaboration with GHH is expected to expedite new product development, leveraging synergies with Komatsu's existing team and product offerings.

2) In November 2022, Nidec Corporation, another Japanese manufacturing and distribution giant, successfully acquired PAMA, an Italian company renowned for its machine tools. The deal, valued at approximately 15 billion yen (USD 108 million), as reported by Nikkei Asia, includes PAMA's nine affiliate companies. PAMA, with production bases in Italy and China, achieved sales exceeding USD 124 million (118.3 million euros) in 2021. This strategic move enhances Nidec's global presence and technological capabilities, positioning the company for further growth in the competitive manufacturing landscape.

Q1. What was the Drilling Machine Market size in 2023?

As per Data Library Research the size of the Drilling Machines market is USD 27.2 billion in the year 2023.

Q2. What is the Growth Rate of the Drilling Machine Market?

Drilling Machine Market is anticipated to register a CAGR of over 7.1% during the forecast period.

Q3. What are the factors driving the Drilling Machine Market?

Key factors that are driving the growth include the Growing Infrastructure and Construction Activities and Rise in Manufacturing Activities.

Q4. Which region has the largest share of the Drilling Machine Market? What are the largest region's market size and growth rate?

Asia-Pacific has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model