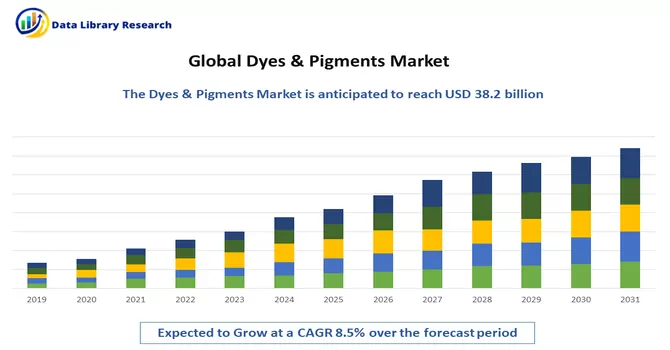

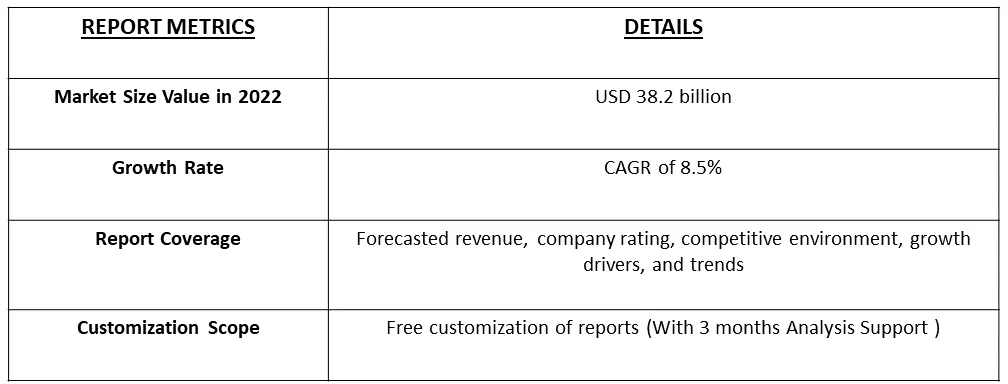

The Global Dyes & Pigments Market size was estimated at USD 38.2 billion in 2022 and is expected to register a CAGR of 8.5% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Pigments refer to finely ground, colored, or black-and-white powders that are used to impart color to various materials. These materials include paints, coatings, plastics, inks, cosmetics, textiles, and a wide range of other products. Pigments are different from dyes in that they are insoluble in the medium in which they are used.

Pigments are widely used in industries such as paints and coatings, plastics, textiles, printing inks, and cosmetics. The expansion of these industries, driven by population growth and economic development, increases the demand for pigments. Moreover, the automotive industry uses pigments for vehicle coatings and interior components. As the global automotive market expands, the demand for pigments used in automobile manufacturing also grows.

The pigment market is a dynamic and ever-evolving sector that serves a wide range of industries, from paints and coatings to plastics, textiles, and cosmetics. In recent years, several trends have shaped the pigment market, reflecting changing consumer preferences, environmental concerns, and technological advancements. There is a growing demand for high-performance and specialty pigments that offer enhanced properties, including UV resistance, durability, and heat stability. These pigments find applications in industries like automotive coatings, aerospace, and electronics, where performance is critical.

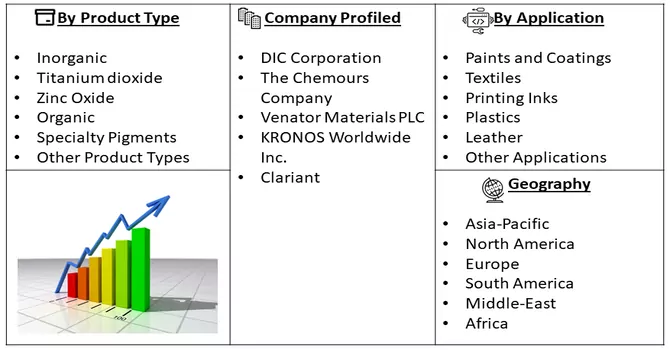

Segmentation:

The Report Covers Global Pigment is segmented

By Product Type :

Application :

Geography :

The report offers market size and forecasts for pigments in revenue (USD million) for the abovementioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Growing Urbanization and Infrastructure Development and Rising Disposable Income

The growing urbanization and infrastructure development, coupled with rising disposable income, collectively drive the global pigment market by increasing the demand for colored materials and products. Pigments are essential in providing the vibrant and diverse colors seen in modern urban environments and in products that cater to the preferences of consumers with greater purchasing power. For instance, an article published by Urbanization journal, in June 2022, reported that as disposable income levels rise, consumers are more likely to invest in consumer electronics such as smartphones, tablets, and laptops. Pigments play a critical role in coloring the casings and components of these devices. The article also quoted that the process of urbanization often involves the construction of new residential and commercial buildings, leading to a heightened demand for architectural and decorative paints. Pigments are essential components in these paints, contributing to the vibrant and diverse color schemes that adorn urban landscapes. As a result, the market is expected to witness significant growth over the forecast period.

Growing Consumer Electronics and Technology

The consumer electronics industry drives innovation in pigment technology. Pigment manufacturers develop new formulations and technologies to meet the stringent performance and durability requirements of electronic applications. The global pigment market is significantly influenced by the growth of the consumer electronics and technology sector. The rapid evolution of technology and the increasing demand for electronic devices have profound effects on the demand for pigments in various applications. As a result, the market is expected to witness significant growth over the forecast period.

Restraints :

Environmental Regulation and Health and Safety Concerns

Stringent environmental regulations and guidelines regarding the use of pigments, especially those containing heavy metals, volatile organic compounds (VOCs), and hazardous chemicals, can limit the types of pigments that can be used in various applications. Compliance with these regulations may require costly adjustments and investments. The use of certain pigments, particularly in the cosmetics and food industry, can raise health and safety concerns. Allergies, skin sensitivities, and other health issues associated with pigments can affect their use and market acceptance. Thus, these factors are expected to slow down the factors of the studied market.

The COVID-19 pandemic, which emerged in late 2019, has had profound and far-reaching effects on the global economy, including the pigment market. The pigment market relies on a complex global supply chain. During the pandemic, lockdowns, restrictions, and disruptions in transportation and logistics led to delays in the shipment of raw materials and finished pigments. This affected production schedules and product availability. The global economic downturn caused by the pandemic affected consumer spending and business investments. Companies that manufacture products using pigments faced challenges in terms of reduced orders and revenue. In the current scenario, due to advantages of global pigment in various other sections the market is expected to witness significant growth over the forecast period. Segmental Analysis

Titanium Oxide Segment is Expected to Witness Significant Growth Over the Forecast Period

Titanium dioxide (TiO2) is a critical component in the global pigment market, playing a central role in the production of white pigments and a variety of colored pigments. Its versatility, durability, and optical properties make it one of the most widely used pigments in numerous industries, including paints and coatings, plastics, cosmetics, and more. Titanium dioxide is the primary pigment used to create white colors in a wide range of applications. This includes architectural paints, coatings, plastics, paper, textiles, and cosmetics. Its exceptional opacity and brightness make it the pigment of choice for achieving vibrant whites. In addition to providing color, titanium dioxide offers effective UV protection. It is used in sunscreens, cosmetics, and outdoor coatings to shield against harmful UV radiation, preventing damage to both products and human skin. As a result, the segment is expected to witness significant growth over the forecast period.

Paints and Coatings Segment is Expected to Witness Significant Growth Over the Forecast Period

The use of pigments is a fundamental aspect of the paints and coatings industry, where they play a pivotal role in enhancing the visual appeal, protective properties, and overall functionality of these products. Pigments are responsible for providing color, opacity, and other critical attributes that make paints and coatings indispensable in various applications. Pigments are primarily known for their role in imparting color to paints and coatings. They allow manufacturers to produce an extensive palette of colors that meet the diverse preferences of consumers and the specific requirements of various applications. The aesthetics of paints and coatings are greatly enhanced by pigments, making them visually appealing and functional. As a result, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period.

The Asia-Pacific region has emerged as a dominant force in the market, primarily attributed to the escalating demand for construction activities in countries like China and India. In China, there has been a notable increase in government expenditure directed towards the construction of affordable housing facilities to address the surging housing demand. This strategic investment aims to cater to the needs of the growing population. Furthermore, China is committed to substantial investments, with a staggering USD 1.43 trillion earmarked for significant construction projects in the coming five years, spanning until 2025. The National Development and Reform Commission (NDRC) has detailed ambitious plans, with Shanghai alone slated to receive a substantial USD 38.7 billion in investments over the next three years. Similarly, Guangzhou has entered into agreements for 16 new infrastructure projects, backed by a considerable investment of USD 8.09 billion. China's demographic landscape is expected to be a continued driver for growth in residential construction. As household incomes rise and rural populations migrate to urban areas, the demand for residential construction remains robust.

In India, an emerging economy, the construction sector is a thriving industry and a critical driver of economic growth. The Indian government has placed substantial emphasis on infrastructure development, recognizing its pivotal role in advancing the nation's economy. Initiatives have been launched to ensure the timely and efficient creation of world-class infrastructure. India's government is proactively promoting several residential projects in the coming years. The 'Housing for All' initiative, for instance, aims to construct over 20 million affordable homes for urban underprivileged populations by 2022, significantly stimulating residential construction activities. The smart cities mission is yet another ambitious government project, targeting the establishment of more than 100 smart cities across the country to expedite urbanization.

In the 2021-22 budget, a substantial allocation of USD 778.4 million (INR 6,450 crore) was made for the smart cities mission, representing a significant increase from the USD 410.3 million (INR 3,400 crore) in the 2020-21 revised estimates. Furthermore, in March 2021, the Indian Parliament passed legislation to establish the National Bank for Financing Infrastructure and Development (NaBFID), a substantial USD 2.5 billion development finance institution. The primary objective of this institution is to fund infrastructure projects across India, providing a considerable boost to the construction and infrastructure sectors. Consequently, the flurry of construction activities coupled with proactive government measures in the Asia-Pacific region is poised to drive the construction industry. This, in turn, is expected to fuel the demand for paints and coatings, leading to an increased requirement for pigments.

Get Complete Analysis Of The Report - Download Free Sample PDF

The pigment market is consolidated with the top five players accounting for significant market share. The major companies include:

Recent Developments

1) August 2022: Chemours started mining its newest sand mine in Florida, allowing the business to increase TiO2 output, which is used in white pigment. The new sand mine will be located in Putnam County, Florida, and will supply the company with a consistent source of high-quality sand for its titanium dioxide (TiO2) manufacturing. The new mine will produce up to 1.5 million tons of sand annually.

2) October 2021: KRONOS introduced 9900 Digital White pigment, a newly developed aqueous pigment concentrate designed to fulfill the demands of the digital printing industry. KRONOS Digital White is specially designed for exceptional storage stability and anti-settlement features in white water-based inkjet inks, offering superior opacity and the highest whiteness in prints.

Q1. What was the Dyes & Pigments Market size in 2022?

The Global Dyes & Pigments Market size was estimated at USD 38.2 billion in 2022.

Q2. At what CAGR is the Dyes & Pigments Market projected to grow within the forecast period?

Dyes & Pigments Market is expected to register a CAGR of 8.5% over the forecast period.

Q3. What are the factors driving the Dyes & Pigments Market?

Key factors that are driving the growth include the Growing Urbanization and Infrastructure Development and Rising Disposable Income and Growing Consumer Electronics and Technology.

Q4. Which Region is expected to hold the highest Market share?

Asia-pacific region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model