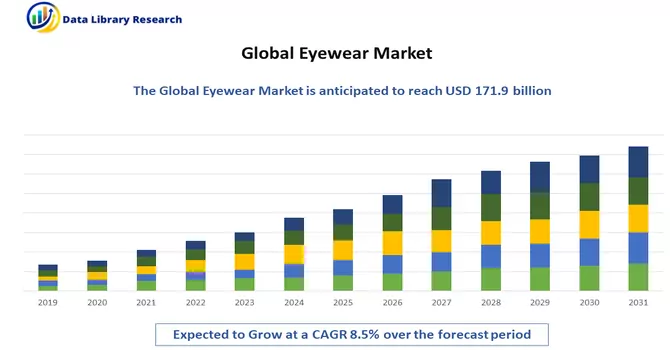

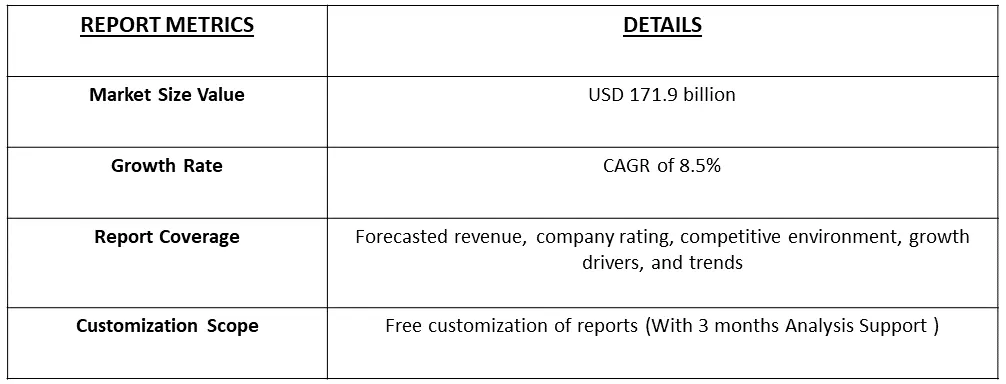

As of 2022, the global eyewear market has attained a substantial valuation of USD 171.9 billion, and projections indicate a robust compound annual growth rate (CAGR) of 8.5% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Eyewear Industry encompasses the design, manufacturing, and distribution of various types of eyewear products, including eyeglasses, sunglasses, contact lenses, and related accessories. It plays a crucial role in providing corrective vision solutions, protecting eyes from harmful UV rays, and serving as fashion accessories. The industry caters to a diverse consumer base with varying needs, ranging from vision correction to style preferences and eye protection. Increasing awareness of the importance of eye health and regular eye check-ups is a significant driving factor for the eyewear industry.

Consumers are becoming more proactive in addressing vision issues, leading to higher demand for prescription eyeglasses and contact lenses. The rising prevalence of vision disorders, such as myopia, hyperopia, and astigmatism, is a driving force for the eyewear industry. As the global population ages and spends more time in front of digital screens, the need for corrective eyewear has increased, contributing to the industry's growth.

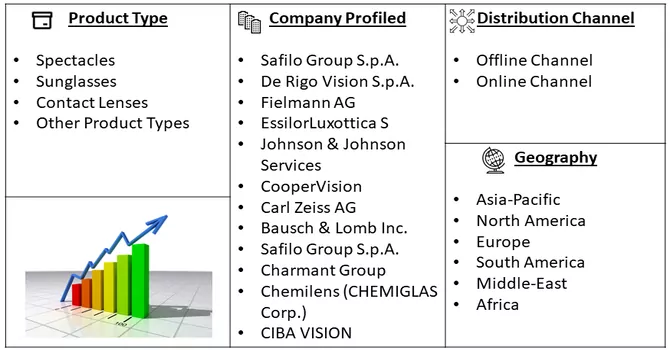

Market segmentation: The Global Eyewear Market is Segmented by Product Type (Spectacles, Sunglasses, Contact Lenses, and Other Product Types); by Distribution Channel (Offline Channel and Online Channel); and by Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The report offers market size and values in (USD million) during the forecasted years for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The integration of technology into eyewear, such as smart glasses and augmented reality (AR) applications, is gaining momentum. Smart eyewear offers features like fitness tracking, augmented reality experiences, and connectivity with smartphones, catering to tech-savvy consumers. With increased screen time from digital device usage, there's a rising demand for eyewear with blue light filtering lenses. These lenses aim to reduce eye strain and discomfort caused by prolonged exposure to digital screens, aligning with the growing awareness of digital eye strain. Thus, these market trends are expected to boost the studied market growth over the studied period.

Market Drivers:

Increasing Awareness of Eye Health

Growing awareness of the importance of eye health is a significant driver in the eyewear industry. Consumers are becoming more proactive in addressing vision issues and understanding the role of regular eye check-ups. This awareness translates into a higher demand for prescription eyeglasses, contact lenses, and other vision correction solutions, driving the overall growth of the eyewear market. Also, an article published by Modern Optometry in June 2022, reported that Approximately 2.2 billion people experience vision impairment or blindness, and 80% of these individuals experience preventable blindness. The main cause of vision impairment is uncorrected refractive error, followed by cataracts. Other causes include glaucoma, diabetic retinopathy (DR), retinal detachment, and age-related macular degeneration. Thus, high number of eye disorder, may demand for eyewear devices, that may contribute to the studied market growth over the studied period.

Fashion and Style Trends and Product Launches& Approvals

Fashion and style trends exert a considerable influence on the eyewear industry. Eyeglasses and sunglasses are not just functional but also serve as fashion accessories. Changing trends in frame designs, colors, and shapes drive consumer preferences and stimulate continual demand for stylish eyewear. The industry's ability to align with and capitalize on fashion trends contributes significantly to its growth. Moreover, the launch of new products in the studied market segment, may propel the growth of the studied market over the forecast period. For instance, in 2022, the FDA approved the EVO Visian ICL (Implantable Collamer Lens) for treating nearsightedness in patients with moderate to severe myopia with or without astigmatism. Unlike LASIK surgery, which reshapes the cornea, inserting the permanent implantable contact lens does not change the shape of the cornea.

Market Restraint:

High Cost of Designer and Specialty Eyewear and Impact of Economic Downturns

The eyewear industry faces a challenge in the form of the high cost associated with designer and specialty eyewear. Luxury brands and specialized eyewear often come with premium price tags, limiting the affordability for a segment of consumers and potentially restraining market growth. Also, the economic downturns and uncertainties can impact consumer spending on non-essential items, including eyewear. During periods of economic recession, consumers may prioritize essential expenses over discretionary purchases, leading to a decline in overall eyewear sales. Thus, the factors may slow down the growth of the studied market over the studied period.

The eyewear industry experienced disruptions in its global supply chain due to factory closures, lockdowns, and restrictions on international trade during the pandemic. Delays in the production and distribution of eyewear products affected inventory levels and the availability of certain eyewear brands. Mandatory closures of retail stores and reduced foot traffic in shopping areas during lockdowns significantly impacted the brick-and-mortar sales of eyewear. Consumers were less likely to visit physical stores for eyewear purchases, leading to a decline in in-store sales for eyeglasses and sunglasses. In the current scenario, due resumption of services and regularization and supply chain, the services has resumed to the normal level, which may drive the growth of the studied market over the studied period.

Segmental Analysis:

Spectacles Segment is Expected to Witness Significant growth Over the Studied Period

Spectacles, commonly known as eyeglasses or glasses, are optical devices that consist of lenses mounted in a frame and are worn to correct vision issues or protect the eyes. In the eye care industry, spectacles have been a fundamental and widely used solution for vision correction. Spectacles are primarily used to correct refractive errors such as myopia (nearsightedness), hyperopia (farsightedness), astigmatism, and presbyopia. The lenses in the spectacles are customized to address the specific vision needs of an individual. Also, the the new product launches are expected to boost the studied segment’s growth. For instance, in November 2023, Avant-garde fashion pioneers Viktor&Rolf mark three decades of their unique beauty with the introduction of an eyewear collection launched at Specsavers. The company’s "Flowerbomb" and numerous haute couture collections, the glasses feature a distinctive metal rose embellishment on the temples. These are crafted from bio acetate, the design pays homage to the tradition that deems items dipped in silver as cherished forever. Thus, such factors are expected to drive the studied segment’s growth.

Off-Line Distribution Channel is Expected to Witness High Growth Over the Studied Period

Offline distribution plays a crucial role in the eyewear industry, providing consumers with a tangible and personalized experience when selecting and purchasing eyewear products. This traditional distribution channel encompasses physical retail stores, optical shops, and eye care professionals' practices. Moreover, One of the significant advantages of offline distribution is the opportunity for personalized consultation with eye care professionals. Optometrists and trained staff in brick-and-mortar stores can assess customers' vision needs, provide accurate prescriptions, and guide them in selecting eyewear that suits their individual requirements. Thus, such factors are expected to drive the studied segment’s growth over the studied period.

Asia-Pacific Region is Expected to Witness Significant growth Over the Studied Period

The Asia-Pacific region is home to a large and diverse population. The aging demographic in many countries, coupled with increasing life expectancy, contributes to a higher prevalence of age-related eye conditions such as presbyopia, cataracts, and glaucoma. This demographic trend propels the demand for eye care services and products. For instance, an article published by NCBI in June 2022, reported that 22% of India’s rural population is suffering from one or other eye disease. Thus, such instances, report that here is important need for eyewear products in the region.

Moreover, the expansion of eyewear retain chain are expected to increase the surplus of eyewear products, that is expected to drive the studied market’s growth. For instance, in January 2022, Lenskart, a prominent eyewear retail chain in India, inaugurated 73 new stores spanning across 19 states and unveiled ambitious plans to add an additional 400 stores to its portfolio. Although the eyewear segment experienced a temporary dip in revenue share amid the pandemic-induced lockdowns across various countries, the subsequent easing of restrictions and a notable inclination among consumers towards physical stores are expected to propel the segment's growth in the foreseeable future.

Thus, the Asia-Pacific region's eye care market is marked by a combination of demographic trends, lifestyle changes, technological advancements, and proactive efforts by governments and industry players to address the diverse eye health needs of the population. The market is poised for further growth, driven by a combination of increased awareness, expanding accessibility, and evolving consumer preferences.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market is fragmented. However, key players such as Safilo Group and Essilor International are witnessing a gain in their revenue share across developing economies. The most adopted strategies by key market players are product innovation and development, followed by partnerships and joint ventures, and expansion. Impact of Economic Downturns Moreover, companies are investing significantly in technology-based innovative solutions through new ventures, partnerships, or acquisitions. The top players in the global eyewear market include

Recent Development:

1) January 2022: EssilorLuxottica SA introduced a new anti-reflective coating, Crizal Sapphire HR new Crizal High Resistance technology, and claimed that the product provided up to 70% more scratch resistance and up to a 20% improvement in thermal resistance.

2) December 2021: Saflio Group announced the debut of Imprint 3D technology, developed and launched through its propriety brand Smith. Smith created this patent-pending Imprint 3D Technology to address the vast range of face shapes and features while eliminating the one-size fits all approach to sports gear. The initial launch debuts with a first-to-market custom-crafted 3D printed snow goggle that delivers increased comfort, elimination of light leaks due to improper fit, removal of pressure points or hot spots, and an expanded field of view.

3) September 2021: Luxottica Group's Ray-ban announced the launch of its latest range of smart glasses, which includes features to aid customers in shooting images and videos, sharing their trips, listening to music, or making phone calls with Ray-Ban Stories. The smart glasses were initially available for sale online and at a few select retail locations in the United States, Australia, Canada, Ireland, Italy, and the United Kingdom, with prices starting at USD 299 and 20 style combinations.

Q1. What was the Eyewear Market size in 2022?

As per Data Library Research the global eyewear market has attained a substantial valuation of USD 171.9 billion in 2022.

Q2. What is the Growth Rate of the Eyewear Market?

Eyewear Market is expected to reach compound annual growth rate (CAGR) of 8.5% over the forecast period.

Q3. What are the factors on which the Eyewear Market research is based on?

By Product Type, By Distribution Channel, End-User and Geography are the factors on which the Eyewear Market research is based.

Q4. Which region has the largest share of the Eyewear Market? What are the largest region's market size and growth rate?

Asia-pacific has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model