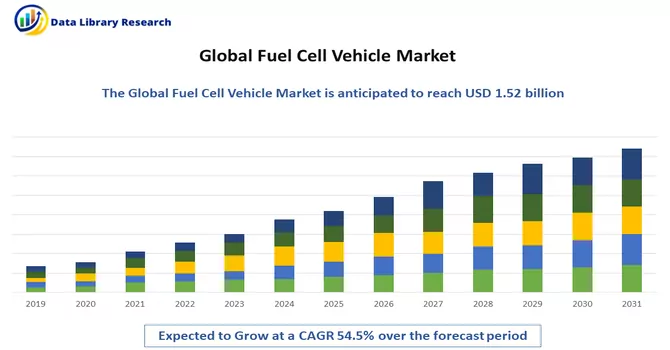

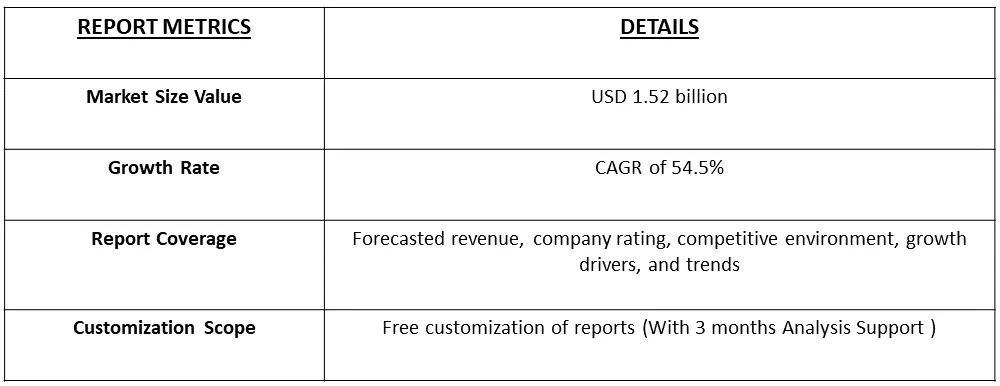

The global fuel cell vehicle market, valued at USD 1.52 billion in 2023, is poised for substantial growth at a remarkable compound annual growth rate (CAGR) of 54.5% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The escalation in population levels has contributed to heightened pollution concerns, prompting a notable shift toward clean fuels and green technology as effective measures to curb carbon emissions. This shift has significantly bolstered the demand for fuel cell vehicles (FCVs) in recent years. The transition from traditional fuel-powered automobiles to eco-friendly vehicles has experienced accelerated momentum, further propelling the demand for FCVs.

A Fuel Cell Vehicle (FCV) is an electric vehicle that utilizes fuel cell technology to generate electricity on board, powering an electric motor for propulsion. Unlike traditional electric vehicles that rely on rechargeable batteries, FCVs generate electricity through a chemical reaction between hydrogen and oxygen, with water and heat being the primary byproducts. The core component of an FCV is the fuel cell stack, where hydrogen and oxygen from the air react to produce electricity and water.

Several factors contribute to the robust growth of the market throughout the forecast period. Stringent environmental regulations, coupled with incentives and subsidies promoting clean fuels, have created a favourable environment for the expansion of the FCV market. The hazardous gas emissions associated with combustion engine vehicles have further fueled the shift towards fuel cell technology. Additionally, a heightened awareness of vehicle emissions has prompted manufacturers to explore and implement alternative powertrains, fostering significant advancements and growth within the market.

The global Fuel Cell Vehicle (FCV) market is witnessing several noteworthy trends that are shaping its trajectory and indicating the direction of future developments. The expansion and development of hydrogen infrastructure, including refueling stations, are becoming a pivotal trend. Increased investments by governments and private entities aim to address the critical challenge of ensuring convenient and widespread access to hydrogen fuel, fostering the adoption of FCVs. The FCV market is diversifying beyond passenger cars, with a growing focus on other vehicle types such as buses, trucks, and commercial fleets. This diversification reflects a broader acknowledgment of the potential applications of fuel cell technology in various transportation sectors.

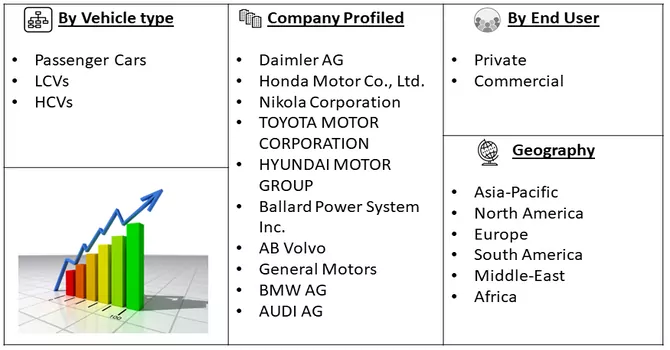

Market Segmentation: The Fuel Cell Vehicle Market is Segmented by Vehicle type (Passenger Cars, LCVs, HCVs), and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Environmental Concerns and Emission Reduction

The growing environmental awareness and increasing concerns about air quality and climate change have become driving forces behind the demand for clean and sustainable transportation solutions. As the detrimental impacts of traditional internal combustion engine vehicles on the environment become more apparent, there is a heightened emphasis on finding alternatives that can significantly reduce greenhouse gas emissions and combat air pollution. Fuel Cell Vehicles (FCVs) have emerged as a compelling option in response to these environmental challenges. Unlike conventional vehicles powered by gasoline or diesel, FCVs operate on hydrogen fuel cells, which generate electricity through a chemical reaction between hydrogen and oxygen. This electrochemical process produces energy to power the vehicle's electric motor, and the only byproduct is water vapor. This emission profile makes FCVs an environmentally friendly choice, as they release no harmful pollutants or greenhouse gases directly into the atmosphere during operation. The reduction of greenhouse gas emissions is a crucial aspect of mitigating climate change, and the carbon footprint of FCVs is notably lower compared to traditional combustion engine vehicles. By utilizing hydrogen as a clean energy carrier and producing electricity with minimal environmental impact, FCVs contribute to the overall goal of creating a more sustainable and eco-friendly transportation system. Thus, such factors are expected to drive the growth of the studied market.

Hydrogen Infrastructure Development

The expansion of hydrogen infrastructure plays a pivotal role in driving the adoption of Fuel Cell Vehicles (FCVs), addressing a critical barrier and facilitating their widespread acceptance. The establishment of hydrogen refueling stations is a key component of this infrastructure development, and it contributes significantly to fostering consumer confidence in the viability and practicality of FCVs. Hydrogen refueling stations mitigate "range anxiety," a common concern among consumers considering FCVs. The availability of a well-distributed network of refueling stations ensures that FCV drivers have convenient access to hydrogen, alleviating concerns about running out of fuel during their journeys. Thus, the critical role of hydrogen infrastructure expansion lies in its ability to remove barriers to FCV adoption. It transforms FCVs from niche vehicles with limited refueling options into a mainstream and practical choice for consumers, businesses, and governments committed to sustainable and zero-emission transportation. As investments in hydrogen infrastructure continue, the positive feedback loop between infrastructure development and FCV adoption is likely to accelerate, fostering a more sustainable and widespread transition to hydrogen-powered mobility.

Market Restraints :

Regulatory Challenges and Standards and Lack of Consumer Awareness

The absence of standardized regulations and industry standards for hydrogen fuel cell technology may impede the growth of FCVs. Regulatory uncertainties, differing standards, and a lack of harmonization across regions can create challenges for manufacturers and investors. Limited awareness and understanding among consumers about the benefits and operational aspects of FCVs act as a restraint. Lack of education and promotion may result in hesitancy to adopt FCVs, particularly when compared to more established and familiar vehicle technologies.

The COVID-19 pandemic has had a notable impact on various sectors, including the Fuel Cell Vehicles (FCVs) market. The automotive industry, in particular, faced disruptions in production, supply chains, and consumer demand. The pandemic led to disruptions in global supply chains, affecting the production of critical components for FCVs. Delays in the supply of hydrogen fuel cell stacks, batteries, and other essential parts impacted the manufacturing timelines of fuel cell vehicles. The overall economic impact of the pandemic influenced investment decisions and consumer spending patterns. Uncertainties in the global economy may have affected funding for research, development, and infrastructure projects related to fuel cell vehicles. Thus, the COVID-19 pandemic introduced both challenges and opportunities for the fuel cell vehicles market. The industry's resilience, coupled with evolving consumer and government priorities, will play a crucial role in shaping the post-pandemic trajectory of the fuel cell vehicles sector.

Segmental Analysis :

Passenger Cars Segment is Expected to Witness Significant Growth in Fuel Cell Vehicles (FCVs) Market

The Passenger Cars and Fuel Cell Vehicles (FCVs) market represents a dynamic segment within the automotive industry, showcasing the intersection of sustainable transportation and cutting-edge technology. This market segment is characterized by the development, production, and adoption of passenger cars powered by fuel-cell technology. The market witnessed the emergence of passenger cars equipped with fuel cell technology, utilizing hydrogen fuel cells to generate electricity for propulsion. These vehicles offer an alternative to traditional internal combustion engine cars and battery electric vehicles (BEVs), providing zero-emission mobility. Moreover, the ongoing advancements in fuel cell technology drive innovation within the Passenger Cars and FCVs market. Improvements in fuel cell stacks, efficiency, and durability contribute to enhanced performance, longer driving ranges, and increased appeal to consumers. Thus, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific is Expected to Witness Significant Growth in Fuel Cell Vehicles (FCVs) Market

The Asia Pacific region emerged as the dominant force in the fuel cell vehicle market, capturing the largest share of revenue at 66.3%. The substantial increase in car sales, particularly in countries like South Korea and Japan, stands out as the primary catalyst propelling the growth of the passenger cars market within this region.

Moreover, Japan's government initiatives advocating for the use of fuel cell vehicles and providing consumer support through subsidies have been instrumental in fostering market expansion. Notably, in November 2021, China's Development and Reform Commission issued a directive aiming to manufacture 5,000 hydrogen fuel cell automobiles by 2025. These vehicles are intended for applications in port transportation, buses, and intercity logistics. The remarkable progress in clean energy initiatives within the automotive sector, exemplified by such developments, is poised to be a significant driving force for the continued growth of the fuel cell vehicle market throughout the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Companies are making significant investments in research and development (R&D) for fuel cell vehicles. To expand their businesses, many firms are anticipated to adopt growth strategies such as engaging in mergers and acquisitions, forming partnerships, and fostering collaborations.Key Fuel Cell Vehicle Companies:

Recent Development

1) In May 2022, Renault unveiled a prototype of an SUV powered by a hydrogen fuel cell. The prototype, named Scenic Vision, was designed to incorporate a 16kW fuel cell, aiming to extend the vehicle's driving range to an impressive 800 kilometers without the need for recharging. Featuring a lightweight battery and other outstanding features, Renault aimed to achieve a remarkable 75% reduction in carbon footprint compared to conventional electric vehicle models.

2) In August 2022, Toyota disclosed a collaboration on a joint venture for hydrogen fuel-cell trucks alongside Isuzu and Hino Motors. Specifically engineered for widespread adoption, these trucks aim to tackle the challenges prevalent in the transportation industry, playing a pivotal role in realizing a carbon-neutral society.

Q1. What was the Fuel Cell Vehicle Market size in 2023?

As per Data Library Research the global fuel cell vehicle market, valued at USD 1.52 billion in 2023.

Q2. At what CAGR is the Fuel Cell Vehicle market projected to grow within the forecast period?

Fuel Cell Vehicle market is expected to grow at a compound annual growth rate (CAGR) of 54.5% over the forecast period.

Q3. What are the factors driving the Fuel Cell Vehicle market?

Key factors that are driving the growth include the Environmental Concerns and Emission Reduction and Hydrogen Infrastructure Development.

Q4. Which region has the largest share of the Fuel Cell Vehicle market? What are the largest region's market size and growth rate?

Asia Pacific has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model