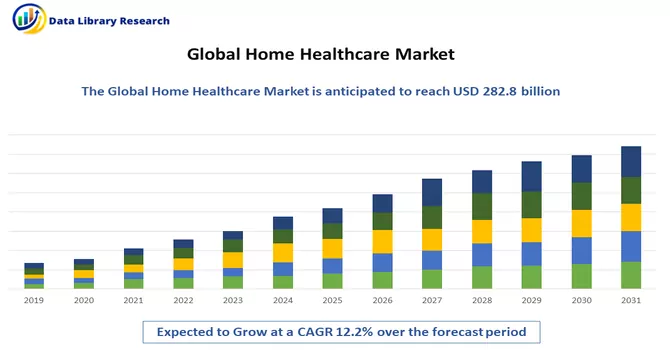

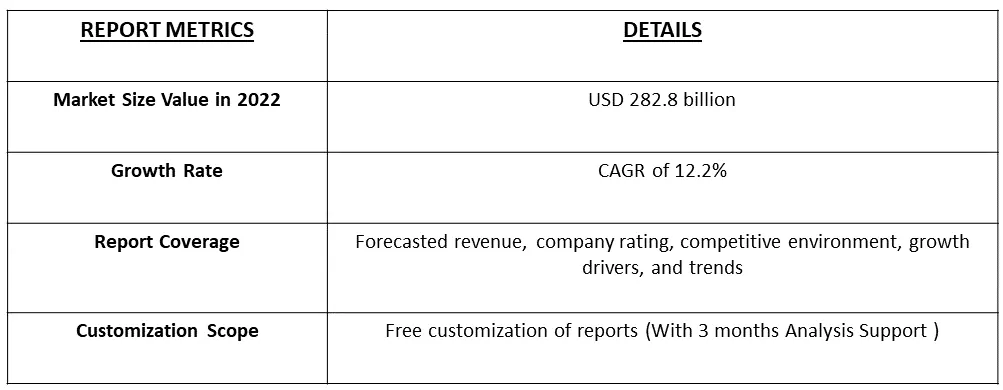

The Home Healthcare Market is currently valued at USD 282.8 billion in the year 2022 and is expected to register a CAGR of 12.2% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Home health care is a wide range of health care services that can be given in your home for an illness or injury. Home health care is usually less expensive, more convenient, and just as effective as care you get in a hospital or skilled nursing facility (SNF).

The market for home healthcare is being driven by the increase in disposable income, the prevalence of surgery, and technological developments in the field. The global population is aging rapidly, owing to reducing birth rates and increasing life expectancy, and it may result in a high prevalence of chronic diseases which will create demand for home healthcare services and software. The geriatric population is expected to have a significant impact on the market studied as people aged above 65 are more prone to chronic diseases is expected to drive the growth of the studied market.

The advancements in the healthcare industry range from e-consultations, telemedicine, and real-time diagnosis to accessing digital therapeutics provided by immersion technology tools. Telehealth including video doctor visits and remote patient monitoring tech extends the reach of physicians, enables a constant relationship between patients and caregivers, and offers providers a continuous stream of real-time health data. All these trends are expected to drive the growth of the studied market.

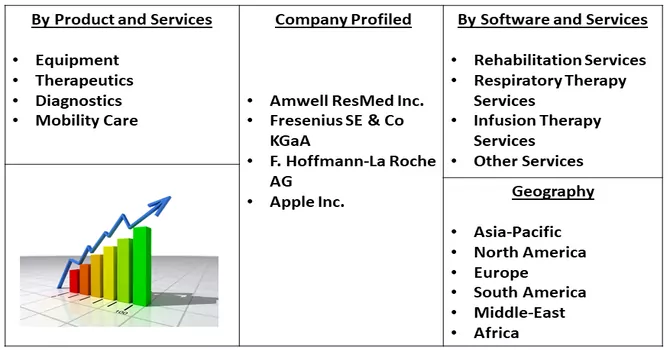

Segmentation:

The Home Healthcare Market is Segmented

By Product and Services :

By Software and Services :

Geography :

The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers.

Rising Disposable Income and High Incidence of Surgical Procedures

As per the recent reports published in 2023, the disposable personal income in some of the developing countries like India has increased to 272995370 INR Million in 2022 from 238573760 INR Million in 2021. The increase in disposable income is leading to an increase in home healthcare products and services. Also, the feasibility of this product is increasing the demand for these products, thereby contributing to the growth of the studied market.

Restraints

Lack of Awareness Among the Developing and Underdeveloped Countries.

The lack of knowledge and to lack of accessible sources may slow down the growth of the studied market over the forecast period. In developing countries people are not aware of the various home-based health setting instruments and the lack of access to these software and services may slow down the growth of the studied market.

The COVID-19 pandemic put enormous strain on already overburdened and understaffed hospitals and healthcare systems around the world. Home health hub technology made it possible for patients to stay safe in their own homes during the pandemic while putting less strain on hospitals, emergency rooms, and front-line healthcare workers, which had a positive effect on the market. According to the study titled "COVID-19's Impact on Home Health Services, Caregivers and Patients: Lessons from the French Experience" published in the Lancet Regional Health in August 2021, Home-based care has been in high demand ever since the COVID-19 pandemic began to relieve hospital overcrowding and enable patients with chronic illnesses or non-severe Covid-19 to receive treatment and monitoring at home. Thus, COVID-19 had a favorable effect on the home health hub market. With social distancing as the new norm and hospital visits not only highly risky but also expensive; telemedicine solutions have become a convenient alternative. This has generated greater demand for home healthcare solutions. In 2020, Baptist Health and BAYADA Announced the Home Health Care Partnership to provide home healthcare services in Northeast Florida.

Segmental Analysis:

The Diagnostic Equipment Segment is Expected to Hold the Largest Market Share in the Home Healthcare Market And Expected to do Same in the Forecast Period.

With the number of COVID-19 infections rising and the healthcare infrastructure and resources limited, home healthcare could help to address a portion of the present healthcare requirement. For instance, in April 2020, CVS Health entered a partnership with UCLA Health to enhance its existing capacity and capabilities to treat more patients in home-based settings, in turn, easing the burden of the COVID-19 crisis on hospitals.

The diagnostic segment is expected to account for the most significant revenue over the forecast period due to a rise in the prevalence of chronic disorders, such as infectious diseases, diabetes, arthritis, cardiopulmonary, and cardiovascular conditions, which require continuous monitoring for efficient treatment. The rise in technological advancements in recent years led to the launch of new products for self-monitoring, like multi-parameter diagnostic monitors, home pregnancy, and fertility kits. According to a survey conducted by the World Health Organization for the time period from 24 January 2022 to 06 February 2022, approximately 12,368 people tested positive for influenza viruses. Out of these, 8,423 (68.1%) people were infected with influenza A, and 3,945 (31.9%) people as influenza B. Furthermore, 171 (6.4%) were influenza A(H1N1), and 2,483 (93.6%) were influenza A (H3N2).

Infusion Therapy Services is Expected to Witness Significant Growth Over the Forecast Period.

Home infusion therapy involves the intravenous or subcutaneous administration of drugs or biologicals to an individual at home. The components needed to perform home infusion include the drug, equipment, and supplies. The launch of the new products is expected to drive the growth of the studied market. For instance, In June 2021, Aducanumab (Aduhelm) received accelerated approval as a treatment for Alzheimer’s disease from the United States Food and Drug Administration (FDA). This is the first FDA-approved infusion therapy to address the underlying biology of Alzheimer’s disease. Thus, due to the above-mentioned reasons the segment is expected to witness significant growth over the forecast period.

North America Dominates the Market and is Expected to Witness High Growth Over the Forecast Period.

Factors such as the high adoption of sophisticated technology, the prevalence of chronic and lifestyle diseases, rising healthcare spending, physician shortages, and increasing demand for better healthcare services are all contributing to North America's big share of the worldwide market. According to the Globocan 2020 report, an estimated 2,281,658 new cancer cases were diagnosed in the United States in 2020, with nearly 612,390 deaths. In 2020, The most common cancers were breast (253,465), lung (227,875), prostate (209,512), and colon (101,809) in the United States.

With travel restrictions and the risk of contagion on stepping outside, there has been a significant escalation in the demand for at-home health screening and monitoring devices. In June 2020, Datametrex AI Limited secured non-exclusive rights to sell RapiGEN Inc. COVID-19 home test kit in Canada. These test kits are Food and Drug Administration registered, suitable for point-of-care testing, no extra equipment is needed, and are easy to use with results in 5-10 minutes. Also, in 2020, EverlyWell, Nurx launched at-home COVID-19 test kits in the United States.

Get Complete Analysis Of The Report - Download Free Sample PDF

Competitive Landscape:

The home healthcare market is moderately competitive and consists of several major players. Some of the companies are expanding their market position by adopting various strategies, such as mergers and acquisitions, and research collaborations with other companies to launch innovative products and consolidate their market positions across the world. Some of the companies currently dominating the market are:

Key Players :

Recent Development:

1) In March 2022, Axxess, launched a fully independent palliative care software solution. Axxess Palliative Care is the latest innovation in Axxess' complete suite of solutions developed for organizations that provide care in the home.

2) In February 2022, CVS Pharmacy launched six home healthcare products as an extension of the company's CVS Health product line. The new products include convertible shower chairs, easy-fold travel walkers, and canes with comfortable grips.

Q1. What is the current Home Healthcare Market size?

The Home Healthcare Market is currently valued at USD 282.8 billion.

Q2. What is the Growth Rate of the Home Healthcare Market?

Home Healthcare Market is expected to register a CAGR of 12.2% over the forecast period

Q3. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Q4. Which is the leading Component Segment in the Home Healthcare Market?

The Diagnostic Equipment is the leading Component Segment in the Home Healthcare Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model