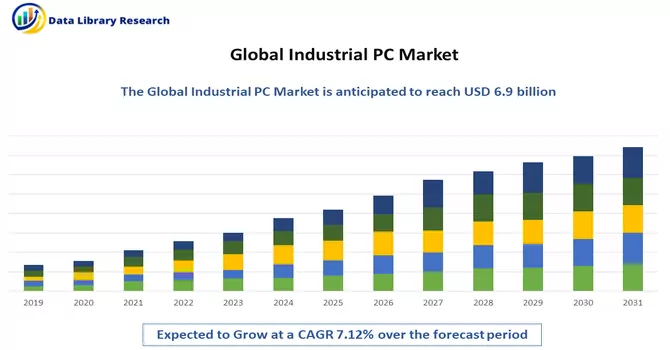

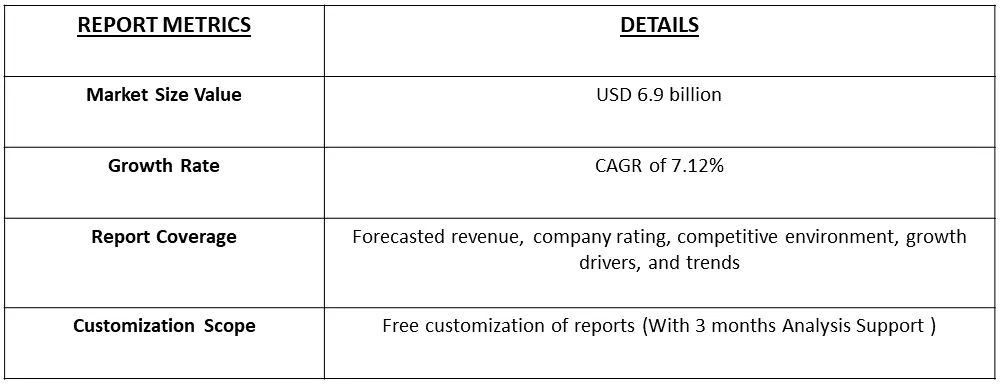

The industrial personal computer (PC) market is currently valued at USD 6.9 billion in 2023, registering a CAGR of 7.12% during the forecast period of 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Industrial PC (IPC) market encompasses ruggedized computer systems tailored for industrial environments, featuring robust designs to withstand harsh conditions such as extreme temperatures, humidity, and vibration. These PCs provide high performance, expandability, and customization, often supporting specialized interfaces and peripherals for diverse industrial applications. With an emphasis on reliability, redundancy, and compatibility with industrial protocols, they are crucial in tasks like process control, automation, and data acquisition across various industries, where prolonged product life cycles and system stability are paramount.

The Industrial PC (IPC) market is poised for significant growth driven by several key factors. Firstly, the increasing adoption of automation and Industry 4.0 initiatives across various sectors fuels the demand for robust computing solutions in industrial settings. As industries embrace smart manufacturing and IoT integration, there is a rising need for high-performance IPCs capable of handling complex tasks such as data analytics, machine learning, and real-time monitoring. Additionally, the expansion of sectors like manufacturing, energy, and transportation, coupled with the demand for efficient and reliable industrial processes, contributes to the market growth. The growing emphasis on predictive maintenance, quality control, and the integration of artificial intelligence in industrial applications further propels the demand for advanced IPCs. Furthermore, the rising trend of digital transformation in industries worldwide, including the adoption of edge computing for faster data processing, is likely to stimulate the IPC market as these systems play a crucial role in supporting these technological advancements.

The Industrial PC (IPC) market is witnessing several notable trends indicative of the industry's evolution. Firstly, there is a growing emphasis on edge computing within industrial settings, driving the demand for powerful and ruggedized IPCs capable of processing data closer to the source. Additionally, as industries increasingly adopt digital transformation and Industry 4.0 initiatives, there is a trend toward the integration of artificial intelligence, machine learning, and advanced analytics into IPC solutions, enhancing real-time decision-making and operational efficiency. The market is also experiencing a shift towards modular and scalable IPC designs, allowing for flexibility and customization to meet specific industry needs. Cybersecurity concerns are driving the incorporation of robust security features in IPCs to protect critical industrial systems from potential threats. Moreover, the rising significance of Internet of Things (IoT) in industrial applications is influencing IPC development, with a focus on seamless connectivity and interoperability. These trends collectively underscore the dynamic nature of the Industrial PC market, reflecting the industry's adaptation to technological advancements and the changing demands of modern industrial processes.

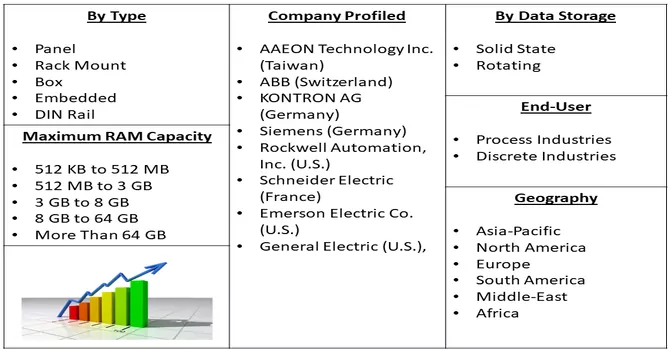

Market Segmentation: The Global Industrial Personal Computer (PC) Market is Segmented By Type (Panel, Rack Mount, Box, Embedded and DIN Rail), Data Storage Medium (Solid State and Rotating), Maximum RAM Capacity (512 KB to 512 MB, 512 MB to 3 GB, 3 GB to 8 GB, 8 GB to 64 GB, and More Than 64 GB), End-User Industry (Process Industries and Discrete Industries) and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for butadiene in terms of USD for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Rising Industry 4.0 Adoption

The increasing adoption of Industry 4.0 practices, emphasizing automation, data exchange, and smart manufacturing, is a significant driver for the Industrial PC market. As industries strive for enhanced efficiency and connectivity in their operations, the demand for robust computing solutions, capable of supporting advanced manufacturing processes and real-time data analytics, continues to rise.

Rising Need for Edge Computing

The growing significance of edge computing, where data is processed closer to the source rather than relying solely on centralized data centers, is driving the demand for Industrial PCs. Edge computing enables faster decision-making and reduced latency in industrial applications, making IPCs crucial for supporting tasks like machine control, monitoring, and automation in decentralized environments.

Market Restraints:

High Initial Costs

One of the key restraints for the Industrial PC market is the high initial costs associated with ruggedized and specialized computing solutions. Industrial PCs designed to withstand harsh environmental conditions and meet industry-specific requirements often involve substantial upfront investments. This cost factor can be a limiting factor for small and medium-sized enterprises (SMEs) or industries with budget constraints, hindering widespread adoption of advanced Industrial PC technologies.

The Industrial PC (IPC) market underwent significant impacts due to the COVID-19 pandemic. Initially, disruptions in the global supply chain resulted in production delays and distribution challenges for IPC components. However, the crisis accelerated the adoption of remote monitoring and control solutions, boosting demand for ruggedized IPCs. Industries prioritized automation to enhance resilience, driving the need for reliable IPCs. Sectors like healthcare and logistics saw increased demand for IPCs to support critical operations. While the pandemic led to short-term challenges, it also acted as a catalyst for the rapid digitization of industries, shaping a future where IPCs play a crucial role in advancing smart manufacturing and automation solutions.

Segmental Analysis:

Embedded Segment is Expected to Witness Significant Growth Over the Forecast Period

The Embedded Type Industrial PC market is witnessing a significant growth driven by the increasing demand for compact and specialized computing solutions in industrial settings. These PCs are integrated into machinery and equipment, offering tailored solutions for diverse applications such as automation, control systems, and data acquisition. The market is characterized by a competitive landscape where companies strive to provide robust, reliable, and efficient embedded industrial PCs. Factors such as the rise of Industry 4.0, the need for real-time processing capabilities, and the integration of advanced technologies contribute to the expanding market potential. Embedded Type Industrial PCs cater to the specific requirements of industries such as manufacturing, energy, and transportation, offering compact yet powerful computing solutions to enhance operational efficiency in challenging environments.

Solid States Segment is Expected to Witness Significant Growth Over the Forecast Period

The Solid State Data Storage market is experiencing substantial growth driven by advancements in technology and the increasing demand for high-performance storage solutions. Solid State Drives (SSDs) have gained prominence in various industries, including the Industrial PC (IPC) market, due to their faster data access speeds, lower power consumption, and enhanced reliability compared to traditional Hard Disk Drives (HDDs). In the Industrial PC market, the integration of SSDs enhances the overall performance and durability of ruggedized computing solutions tailored for industrial environments. These SSDs contribute to quicker data processing in applications such as automation, control systems, and data acquisition, crucial for industries like manufacturing and energy. The synergy between the Solid State Data Storage market and the Industrial PC market reflects a broader trend toward more efficient and reliable computing solutions in industrial settings, supporting the growing needs of Industry 4.0 and smart manufacturing initiatives.

8 GB to 64 GB Segment is Expected to Witness Significant Growth Over the Forecast Period

The 8 GB to 64 GB segment plays a pivotal role in the Industrial PC (IPC) market, where robust computing capabilities are essential for demanding industrial applications. As industrial processes become more complex and data-intensive, the need for higher memory capacities becomes increasingly critical. Industrial PCs within the 8 GB to 64 GB RAM range cater to a spectrum of applications such as automation, control systems, and data acquisition, ensuring seamless operation and processing of large datasets in real time. These memory configurations enable industrial computers to handle sophisticated tasks and run resource-intensive applications, contributing to enhanced efficiency and performance in industrial environments. The scalability provided by the 8 GB to 64 GB segment aligns with the evolving requirements of the IPC market, supporting the integration of advanced technologies and accommodating the demands of Industry 4.0 initiatives across manufacturing, energy, and other industrial sectors.

Discrete Industries Segment is Expected to Witness Significant Growth Over the Forecast Period

The Discrete Industries, which include sectors like manufacturing and automotive, significantly drive the Industrial PC (IPC) market as they increasingly adopt advanced technologies for automation and process optimization. Industrial PCs play a crucial role in Discrete Industries by serving as the backbone of control systems, production monitoring, and data analytics. These computing solutions are tailored to withstand the challenging environments of manufacturing floors, providing reliability and real-time processing capabilities. In Discrete Industries, Industrial PCs contribute to the implementation of smart manufacturing practices, supporting tasks such as robotics, quality control, and supply chain management. The demand for ruggedized and high-performance IPCs continues to rise as Discrete Industries embrace digital transformation and Industry 4.0 initiatives to enhance productivity and efficiency. The synergy between Discrete Industries and the Industrial PC market underscores the integral role these computing solutions play in advancing modern manufacturing processes and ensuring a competitive edge in the rapidly evolving industrial landscape.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

North America stands as a significant hub for the Industrial PC (IPC) market, showcasing a robust and dynamic landscape driven by technological advancements and the increasing adoption of automation across various industries. The region's industrial sector, spanning manufacturing, energy, aerospace, and more, has been a key catalyst for the growth of the Industrial PC market. As industries in North America continue to invest in smart manufacturing practices and Industry 4.0 initiatives, the demand for ruggedized and high-performance computing solutions has surged. Industrial PCs find extensive applications in North America, supporting critical functions such as process control, monitoring, and data acquisition. The presence of advanced manufacturing facilities and a focus on optimizing production processes contribute to the elevated demand for sophisticated IPCs tailored to withstand challenging industrial environments. Additionally, the integration of Industrial PCs in sectors like automotive manufacturing, electronics, and pharmaceuticals reflects the region's commitment to technological innovation and efficiency enhancement. Moreover, North America is a hub for technological innovation, with numerous companies in the United States and Canada actively contributing to the development of cutting-edge Industrial PC solutions. The competitive landscape is characterized by a mix of established players and emerging technology firms, fostering a climate of innovation and product diversification. Thus, North America's Industrial PC market not only responds to the immediate needs of its industrial sectors but also acts as a driving force behind the global evolution of industrial computing solutions, shaping the future of smart manufacturing and automation.

Get Complete Analysis Of The Report - Download Free Sample PDF

The competitive landscape of the industrial personal computer (PC) market is characterized by a comprehensive analysis of key competitors, encompassing various crucial aspects. This includes a thorough examination of each company's profile, encompassing an overview of their operations, financial status, revenue generation, market potential, and investment in research and development. Insights into new market initiatives, global presence, production sites and facilities, as well as production capacities, offer a comprehensive understanding of each competitor's strategic positioning. The analysis delves into the identification of company strengths and weaknesses, shedding light on their competitive advantages and areas for improvement. Details about product launches, emphasizing product width and breadth, along with the dominance in specific applications, provide a nuanced understanding of the market strategies employed by each player. It's important to note that the provided data points focus specifically on the companies' endeavours and positioning within the industrial personal computer (PC) market, contributing to a comprehensive evaluation of their competitive standing in this dynamic industry. Some of the major players operating in the industrial personal computer (PC) market are:

Recent Development:

1) In 2021, Mobile Demand launched the xTablet T1190, the latest addition to its rugged tablet lineup, offering a versatile all-in-one computing solution for enhanced work performance. The xTablet T1190 is designed to adapt to the evolving retail environment with optional add-ons such as a barcode scanner and multi-payment systems. This rugged tablet caters to mobile workers seeking durable and adaptable computing solutions.

2) In May 2021, Panasonic introduced the TOUGHBOOK S1 rugged tablet, specifically crafted for the mobile workforce. Featuring a 7-inch screen, this Android tablet is designed to seamlessly integrate into various applications. Running on Android 10 OS, it boasts 4GB of RAM, a Qualcomm SDM660 Octa-Core CPU, and 64GB of storage. The TOUGHBOOK S1 is MIL-STD-810H certified, with an IP65/67 dust and water resistance rating, and has been drop-tested up to 150cm onto concrete, ensuring robust durability in challenging work environments.

Q1. What was the Industrial PC Market size in 2023?

As per Data Library Research the industrial personal computer (PC) market is currently valued at USD 6.9 billion in 2023

Q2. At what CAGR is the Industrial PC market projected to grow within the forecast period?

Industrial PC Market is registering a CAGR of 7.12% during the forecast period.

Q3. What are the factors driving the Industrial PC Market?

Key factors that are driving the growth include the Rising Industry 4.0 Adoption and Rising Need for Edge Computing.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model