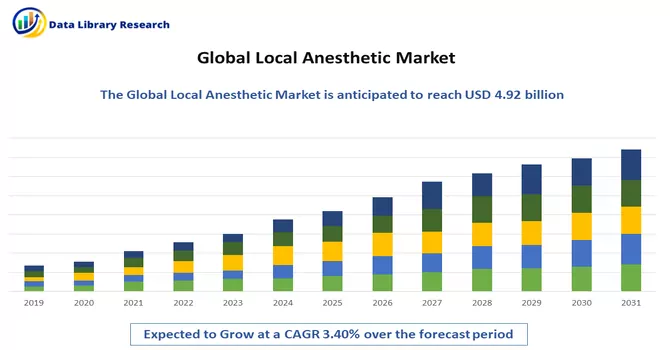

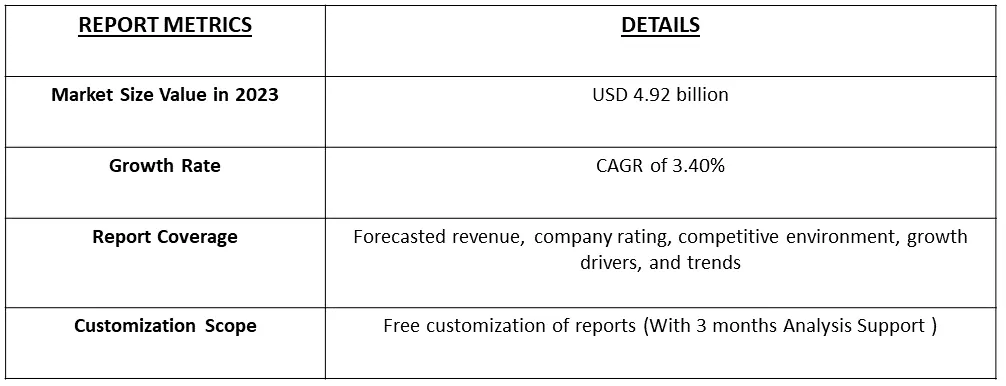

The Global Local Anesthesia Drugs Market size is expected to grow from USD 4.92 billion in 2023 registering a CAGR of 3.40% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Local anesthetics are a class of medications used to induce a reversible loss of sensation and pain in a specific area of the body while the patient remains conscious. They work by blocking nerve signals in the vicinity of the application, preventing the transmission of pain sensations to the brain.

Regional anesthesia techniques, including epidurals and peripheral nerve blocks, are gaining traction for providing targeted pain relief. They are being increasingly used in surgeries and chronic pain management, reducing the need for general anesthesia. Pharmaceutical companies are focusing on developing new and improved drug formulations for local anesthesia. These formulations aim to enhance drug efficacy, duration of action, and patient comfort during and after procedures.

Segmentation:

The Local Anesthesia Drugs Market is Segmented

By Drug Type :

Mode of Administration :

Geography

The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

The local anesthesia drugs market is experiencing substantial growth driven by several key factors. One of the primary drivers is the increasing prevalence of surgical procedures, underpinned by factors such as medical advancements and shifting healthcare trends. Notably, the market has seen a significant rise in the number of surgeries conducted, contributing significantly to its expansion. For instance, data from the American Society of Plastic Surgeons' Plastic Surgery Statistics Report for 2020 revealed that a total of 2,314,720 cosmetic procedures were performed, including 211,067 liposuction procedures in the United States alone. Since local anesthesia plays a pivotal role in many of these procedures, the growing demand for surgical interventions directly fuels the need for anesthesia drugs.

Moreover, the market is benefiting from the introduction and approval of novel local anesthesia drugs, offering fresh revenue streams for industry players. A noteworthy example of this is PainPass, which, in February 2021, launched an innovative product line featuring Cannabidiol (CBD)/lidocaine combinations designed to address chronic pain and provide external muscle numbing. These developments underscore the evolving landscape of local anesthesia drugs, further augmenting market growth.

Restraints:

Stringent regulatory requirements for drug approval and administration protocols pose challenges for market players. Compliance with complex regulations can delay product launches and increase development costs. Moreover, inadequate reimbursement policies for local anesthesia procedures in some regions may discourage healthcare providers from offering these services, affecting market accessibility. Thus, these factors may slow down the growth of the studied market.

The demand for local anesthesia in the treatment of COVID-19 patients has surged due to its numerous advantages and minimal risk of viral transmission. Moreover, a noteworthy article published in October 2020, titled "Topical Lignocaine Anesthesia for Oropharyngeal Sampling for COVID-19," highlighted the substantial benefits of applying topical oropharyngeal lignocaine when collecting samples from the throat for COVID-19 testing. This innovative approach significantly increased patient comfort during the sampling process while not interfering with the accurate detection of SARS-CoV-2 in the upper airway.

Segmental Analysis:

Surface Anesthetic Segment is Expected to Witness Significant Growth Over the Forecast Period.

Surface anesthetics, also known as topical anesthetics, are invaluable tools in the fields of medicine, dentistry, and aesthetics. These agents are specifically designed to provide temporary numbing or anesthesia to the surface of the skin or mucous membranes, offering patients a pain-free experience during various medical procedures.

Moreover, surface anesthetics are commonly used in dentistry to alleviate pain and discomfort associated with procedures like dental cleanings, fillings, and extractions. They ensure that patients can undergo these necessary treatments with minimal discomfort. In dermatological procedures, surface anesthetics are employed to numb the skin's surface before minor surgeries, laser treatments, or cosmetic procedures like dermal fillers or botox injections. Thus, due to the above-mentioned reasons the market is expected to witness significant growth over the forecast period.

Bupivacaine Expected to Register Significant Growth over the Forecast Period

In terms of drug type, bupivacaine is poised to experience substantial growth in the foreseeable future. Bupivacaine is a prescription medication renowned for its use as a local anesthetic, effectively blocking nerve impulses responsible for transmitting pain signals to the brain. This injectable form of anesthesia finds widespread application in local and regional anesthesia for a diverse range of medical procedures, including surgical interventions, diagnostic examinations, therapeutic treatments, and obstetrical procedures. Consequently, the escalating global prevalence of surgeries is anticipated to drive an increased demand for bupivacaine in the coming years.

Moreover, the market witnesses active participation from various key players who are actively implementing strategic initiatives, thus making noteworthy contributions to market expansion. As an illustrative example, in March 2021, Pacira BioSciences Inc. received approval from the US Food and Drug Administration (FDA) for a supplemental new drug application (sNDA) concerning the expanded utilization of its product, Exparel (Bupivacaine Liposome Injectable Suspension), specifically in pediatric patients. This regulatory approval underscores the growing importance of bupivacaine in medical settings and its potential for expanded applications. Consequently, the increasing number of surgeries and ongoing product developments are set to stimulate demand for bupivacaine, ultimately driving substantial growth within this drug segment over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In North America, the United States dominates the local anesthesia market, primarily due to several key factors driving its growth. The region's significant market share can be attributed to the increasing number of surgical procedures, a growing aging population with chronic health conditions, the expanding use of local anesthetics for post-operative pain management, and continuous advancements in anesthesia administration techniques.

For instance, data from the American Society of Plastic Surgeons (ASPS) reveals that in 2020, a substantial number of cosmetic procedures were performed across various age groups. Approximately 768,000 total cosmetic procedures were carried out in individuals aged 10-29 years, while 6.1 million total cosmetic procedures were performed among those in the age group of 40-54 years. These statistics underscore the steady rise in surgical procedures within the region, consequently increasing the demand for anesthesia drugs.

Furthermore, numerous market players have been actively involved in implementing strategic initiatives that contribute to the market's growth trajectory. As an illustration, in December 2021, Hikma Pharmaceuticals PLC (Hikma) launched Bupivacaine HCl Injection USP through its U.S. affiliate, Hikma Pharmaceuticals USA Inc. The company introduced this product in varying concentrations of 0.25%, 0.5%, and 0.75%, available in 10 milliliter and 30 milliliter doses. These significant developments, combined with the rising number of surgical procedures utilizing anesthesia drugs, are poised to further enhance and bolster market growth throughout the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The local anesthesia drugs market is competitive with several global players operating in the market. Companies are focusing on major collaborations, mergers, and acquisitions in order to enhance their market share. The major market players are:

Key Players :

Recent Development:

1. In January 2022, Laboratoires Théa SAS (Théa), Europe’s leading independent pharmaceutical company specializing in the research, development, and commercialization of eye-care products, entered an agreement to purchase seven branded ophthalmic products from Akorn Operating Company LLC. The strategic move will enable Théa to add Akorn-branded products to its portfolio, including Akten (lidocaine HCl ophthalmic gel), a local anesthetic indicated for ocular surface anesthesia during ophthalmologic procedures.

2. In March 2021, Luye Pharma Group received approval for clinical trials by the Centre for Drug Evaluation of China’s National Medical Products Administration for its LY09606, the first Ropivacaine multivesicular liposome formulation local anesthetic to be used as a postoperative analgesic.

Q1. How big is the Local Anesthetic Market?

The Global Local Anesthesia Drugs Market size is expected to grow from USD 4.92 billion in 2023 registering a CAGR of 3.40% during the forecast period.

Q2. What is the CAGR Local Anesthetic Market?

Local Anesthetic Market is registering a CAGR of 3.40% during the forecast period.

Q3. What segments are covered in the Local Anesthetic Market Report?

By Drug Type, Mode of Administration & Geography are the segments covered in the Local Anesthetic Market Report.

Q4. Which region has the largest share of the Local Anesthetic Market? What are the largest region's market size and growth rate?

North America region has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model