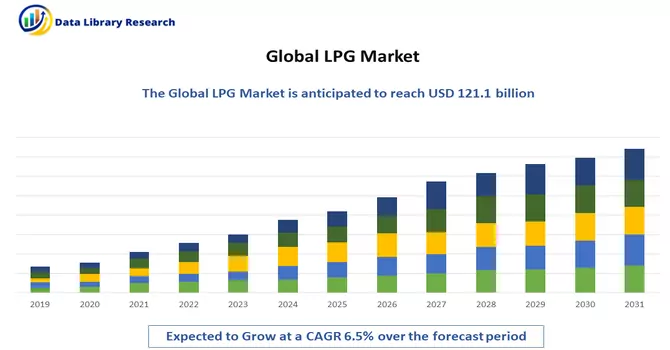

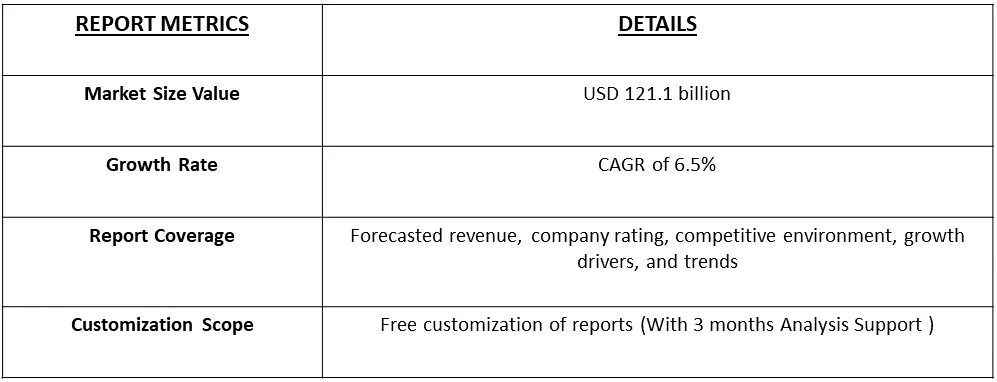

The global liquefied petroleum gas market size was valued at USD 121.1 billion in 2022 and is expected to register a CAGR of 6.5% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

LPG or Liquified Petroleum Gas, is a combustible hydrocarbon gas widely utilized as a fuel source in heating appliances, cooking devices, vehicles, and various industrial applications. This versatile gas is derived as a byproduct of crude oil refining and natural gas processing, primarily composed of propane and butane. Stored under pressure to maintain a liquid state, LPG is recognized for its adaptability and ease of use. One of the distinguishing features of LPG is its reputation as a cleaner-burning fuel when compared to traditional fossil fuels such as coal and oil. The combustion of LPG results in lower emissions of pollutants like sulphur dioxide and particulate matter, making it an appealing choice for environmentally conscious industries and households. This characteristic aligns with the growing global emphasis on reducing the carbon footprint and adopting cleaner energy alternatives.

The composition of LPG, predominantly consisting of propane and butane, enables it to remain in a liquid state under pressure. This liquid form facilitates easy storage, transportation, and distribution, enhancing its practicality as an energy source. Moreover, the liquid state allows for efficient utilization in various applications without the need for complex storage systems. LPG's versatility extends to its broad range of applications, making it a preferred energy source for households and businesses alike. Whether employed for cooking, heating, hot water systems, or as a fuel for vehicles, LPG's compatibility with diverse appliances underscores its flexibility. The convenience and efficiency it offers contribute to its popularity in both residential and commercial settings. Thus, LPG emerges as a valuable energy resource, offering not only practical advantages in storage and transportation but also environmental benefits through its cleaner combustion. Its role spans across different sectors, making it an indispensable component in the global energy landscape.

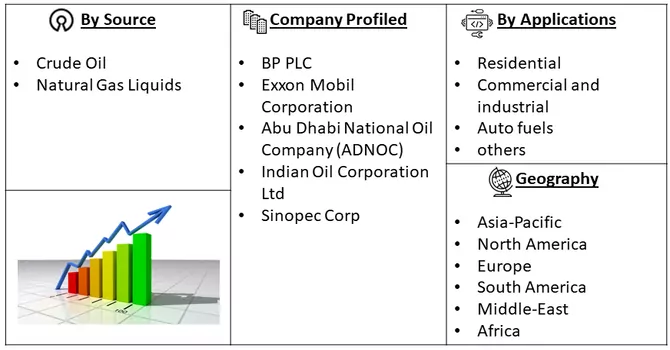

Market Segmentation: The Global LPG Production Market is Segmented by Source of Production (Crude Oil and Natural Gas Liquids), Applications (Residential, Commercial and industrial, Auto fuels, and others), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The report offers the market size and forecasts for the liquefied petroleum gas in revenue (USD billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

There is a growing inclination toward utilizing LPG as a vehicular fuel, commonly referred to as autogas, within the market. This shift is motivated by the collective goal of mitigating transportation emissions and advocating for cleaner alternatives compared to conventional gasoline and diesel vehicles. The endorsement from both governmental bodies and industries alike is actively fostering the adoption of LPG-powered vehicles, thereby expanding the autogas market. LPG is experiencing an upswing in its adoption across residential and commercial sectors, particularly for activities such as cooking, heating, and fulfilling other energy requirements. The momentum behind this surge is attributable to LPG's identity as a versatile and environmentally friendly fuel, positioning it as a substitute for traditional solid fuels and less eco-friendly options in households and businesses. This transition is significantly bolstered by the convenience and operational efficiency offered by LPG appliances, which play a pivotal role in steering this transformative trend. The multifaceted nature of LPG, serving both as an automotive fuel and a cleaner-burning energy source for various applications, highlights its adaptability and attractiveness in the ongoing shift towards more sustainable and eco-conscious practices. As LPG continues to gain traction in diverse sectors, its role in promoting cleaner energy solutions becomes increasingly significant, contributing to a more sustainable and environmentally responsible energy landscape.

Market Drivers:

Cleaner and Environmentally Friendly Alternative

A key catalyst propelling the LPG industry forward is its distinction as a cleaner-burning fuel in contrast to conventional fossil fuels. The combustion of LPG yields significantly lower emissions of pollutants, including sulfur dioxide, particulate matter, and greenhouse gases. Against the backdrop of escalating environmental concerns and stringent regulations, there is a discernible uptick in the demand for cleaner energy sources, with LPG emerging as a favoured option. The imperative to address environmental challenges and adhere to increasingly prominent regulations is steering the heightened adoption of LPG. Governments and industries, in their pursuit of reducing carbon footprints and enhancing air quality, are at the forefront of driving the widespread integration of LPG across diverse sectors. This demand surge is indicative of a broader global commitment to transitioning towards more sustainable and eco-friendly energy alternatives, with LPG playing a pivotal role in this transformative journey. Thus, the market is expected to witness significant growth over the forecast period.

Versatility and Energy Security

The adaptability of LPG, catering to a spectrum of applications including cooking, heating, transportation, and industrial uses, positions it as an invaluable and versatile energy resource. In areas where accessibility to alternative energy sources is constrained, LPG emerges as a dependable and secure choice. The ease of storing and transporting LPG further accentuates its significance as an energy source, rendering it practical and applicable in diverse settings, encompassing both urban and rural environments. This characteristic flexibility makes LPG a pragmatic solution to meet a wide array of energy needs across various sectors.

Market Restraints:

Volatility Of Oil and Gas Prices

The dynamics of the LPG market are intricately tied to the volatility observed in oil and gas prices on the global stage. Swift and unpredictable shifts in energy prices worldwide have a direct bearing on the overall cost of LPG, impacting stakeholders across the production and consumption spectrum. This price volatility introduces a level of uncertainty for businesses and consumers who rely on LPG, presenting challenges in terms of budgeting and planning. Furthermore, the effectiveness of the LPG market is contingent on the adequacy of infrastructure for storage, transportation, and distribution. In some regions, this infrastructure may be limited or insufficient, posing a potential obstacle to the seamless adoption of LPG. This is especially pronounced in rural or remote areas where establishing such infrastructure may be economically challenging. The absence of a robust infrastructure network can impede the widespread accessibility and utilization of LPG, hindering its potential reach and adoption in certain geographic areas. Addressing these challenges becomes pivotal for ensuring the stability and growth of the LPG market, emphasizing the need for strategic planning and investment in infrastructure development.

The COVID-19 pandemic has significantly impacted the Liquefied Petroleum Gas (LPG) market, introducing challenges and disruptions across various segments of the industry. The lockdowns and restrictions imposed to curb the spread of the virus led to changes in energy consumption patterns. While residential demand for LPG increased as more people stayed at home, the industrial and commercial sectors witnessed contractions, affecting overall market demand. The global LPG supply chain faced disruptions due to restrictions on movement, affecting the production, transportation, and distribution of LPG. Delays in the supply chain impacted the availability of LPG in certain regions, leading to localized shortages. Thus, the COVID-19 pandemic brought about a range of challenges for the LPG market, impacting demand, supply chains, pricing, and infrastructure. The industry is now navigating a path toward recovery, with a focus on building resilience and addressing the lessons learned during this unprecedented global crisis.

Segmental Analysis:

Crude Oil and Natural Gas Liquids Segment is Expected to Witness Significant Growth Over the Forecast Period

Crude oil serves as a fundamental raw material in the production of LPG. Through the refining process, crude oil undergoes fractional distillation, a method that segregates its various components based on their respective boiling points. LPG, alongside other derivatives like gasoline and diesel, represents one of the fractions obtained from this intricate process of refining crude oil. Natural Gas Liquids (NGLs) constitute components of natural gas that exist in a liquid state under standard temperature and pressure conditions. This group of hydrocarbons includes ethane, propane, butane, and pentane. Of particular significance, propane and butane emerge as pivotal constituents of LPG. NGLs are frequently separated from natural gas during the processing stage and can also be extracted from specific types of crude oil. The extraction and utilization of these components underscore the intricate and interconnected processes involved in harnessing LPG from both crude oil refining and natural gas processing. Thus, the segment is expected to witness significant growth over the forecast period.

The Commercial & Industrial Segment is Expected to Witness Significant Growth Over the Forecast Period

The Commercial and industrial Liquefied Petroleum Gas (LPG) market represents a dynamic sector where LPG is utilized as a versatile and efficient energy source across various commercial and industrial applications. LPG, a blend of propane and butane, is favoured for its clean-burning characteristics and flexibility in meeting diverse energy needs. The global shift towards cleaner energy sources has spurred increased adoption of LPG in commercial and industrial sectors seeking to reduce their carbon footprint. Thus, owing to the high application of LPG in this segment, the segment is expected to witness significant growth over the forecast period.

North America Region Segment is Expected to Witness Significant Growth Over the Forecast Period

The North America liquefied Petroleum Gas (LPG) market is a significant segment within the broader energy landscape of the region. LPG, consisting mainly of propane and butane, is utilized across various sectors for its versatility and environmentally friendly attributes. The development and adoption of renewable LPG, produced from sustainable sources, may gain traction in response to growing sustainability concerns.

The North America LPG market reflects a balance between traditional usage in residential settings and evolving applications in the commercial, industrial, and transportation sectors. As the region continues to prioritize environmental sustainability and energy diversification, the LPG market is poised to play a strategic role in fulfilling these objectives. Ongoing developments in regulations, technology, and market dynamics will likely shape the trajectory of the North America LPG market in the years to come.

Get Complete Analysis Of The Report - Download Free Sample PDF

The liquefied petroleum gas (LPG) market exhibits a state of moderate fragmentation, characterized by the presence of multiple players operating within the industry. This fragmentation is reflective of a diverse array of companies and stakeholders participating in various facets of the LPG supply chain, from production and distribution to storage and retail. The moderate fragmentation implies that there is no singular dominant entity or a small number of major players that monopolize the entire LPG market. Instead, a multitude of companies, both global and regional, contribute to the overall dynamics of the market. This diversity in market participants fosters healthy competition and can lead to a variety of products, services, and pricing strategies being offered to consumers. The key players in the LPG market include:

Recent Development:

1) In October 2022, Maire Tecnimont S.p.A. disclosed that Tecnimont S.p.A., its primary subsidiary, secured an Engineering, Procurement, and Construction (EPC) contract from SONATRACH's Direction Centrale Engineering & Project Management. This contract involves the establishment of an LPG extraction facility within the existing Rhourde El Baguel oil and gas treatment complex in northeastern Algeria, with a total contract value estimated at approximately USD 380 million.

2) In February 2022, Indian Oil Corp. (IOC) unveiled its intentions to build three new plants in Northeast India, aiming to augment its LPG bottling capacity by nearly 53% to reach 8 crore cylinders annually by 2030. This strategic expansion is in response to the escalating demand for LPG in the region. The anticipated total investment in this plant expansion initiative is projected to fall within the range of USD 43-46 million.

Q1. What was the LPG Market size in 2022?

As per Data Library Research the global LPG market size was valued at USD 121.1 billion in 2022.

Q2. What is the Growth Rate of the LPG market ?

LPG market is expected to register a CAGR of 6.5% over the forecast period.

Q3. Which region has the largest share of the LPG market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Q4. Who are the key players in LPG Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model