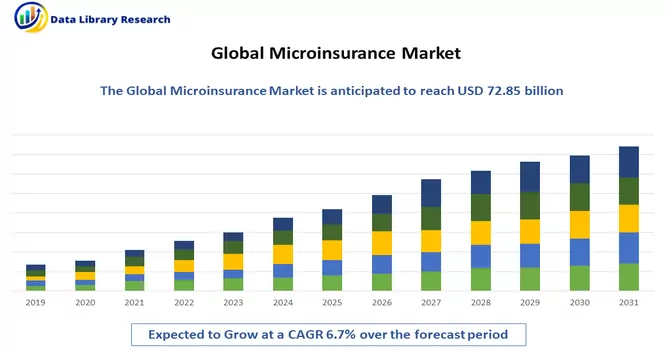

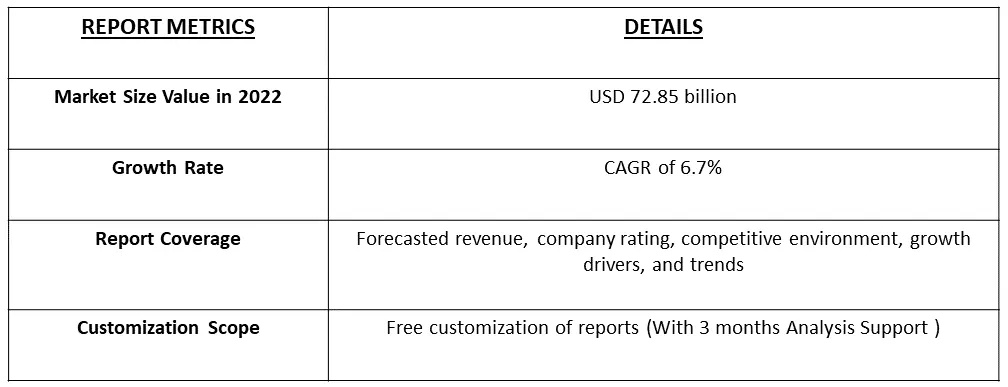

In 2022, the global microinsurance market had a significant value, reaching USD 72.85 billion, and it is projected to exhibit a steady compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. This growth can be primarily attributed to the evolution of novel distribution channels for microinsurance products.

Get Complete Analysis Of The Report - Download Free Sample PDF

Microinsurance is a specialized form of insurance that is designed to provide affordable and accessible insurance coverage to individuals or communities with low incomes or limited financial resources. It typically offers coverage for various risks, such as health, life, property, or crop-related risks, but at a much smaller scale and lower premium cost compared to traditional insurance products.

With the ongoing digital transformation in the insurance industry, insurers are capitalizing on opportunities to partner with other insurance companies, streamlining the marketing and distribution of microinsurance offerings for enhanced convenience and efficiency. Furthermore, the landscape of microinsurance is evolving as digital platforms engage gig workers and remittance platforms serving migrant populations. This ecosystem is increasingly capable of digitally crafting and disseminating insurance solutions tailored to low-income individuals. Concurrently, the burgeoning presence of microinsurance startups, introducing inventive microinsurance plans, is poised to be a driving force behind market expansion.

The adoption of digital technology and mobile platforms has accelerated, allowing microinsurance providers to reach underserved populations more efficiently and offer streamlined services. Mobile apps and online platforms are increasingly used for policy issuance, premium payment, and claims processing. Microinsurance providers are forming partnerships with various organizations, including microfinance institutions, mobile network operators, and retailers, to extend their reach and make insurance more accessible to low-income populations.

Segmentation:

Microinsurance Market Size, Share & Trends Analysis Report

By Model Type :

By Product Type :

By End-use :

By Provider :

By Distribution Channel :

Geography :

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

The Emergence of New, Innovative Channels to Market and Sell Microinsurance

The emergence of new and innovative channels to market and sell microinsurance has been a significant trend in the industry. These channels are designed to make microinsurance more accessible and convenient for underserved populations. Mobile phones are a game-changer for microinsurance distribution. Insurers leverage mobile apps, SMS, and USSD (Unstructured Supplementary Service Data) codes to allow customers to purchase, manage, and claim microinsurance policies directly from their phones. This approach has significantly expanded the reach of microinsurance, especially in regions with high mobile phone penetration.

Increasing Number Of Microinsurance Start-Ups Making Market Foray With Innovative Microinsurance Plans

The increasing number of microinsurance startups with innovative microinsurance plans is a promising development in the financial inclusion landscape. These startups are addressing the specific needs of low-income individuals and communities, making insurance more affordable and accessible, and contributing to greater financial security for underserved populations. Their efforts are not only bridging the insurance gap but also fostering economic resilience and stability among vulnerable communities.

Restraints:

Microinsurance Market Lack of Financial Literacy

One of the primary challenges is that many individuals, particularly those with limited financial literacy, may not fully grasp the importance and benefits of insurance. They might not realize how insurance can protect them and their families from financial hardships in the event of unexpected events, such as illness, accidents, or natural disasters. Moreover, microinsurance products can vary in terms of coverage, terms, and conditions. Understanding the terms and conditions, exclusions, and limitations of policies can be challenging for those with limited financial literacy. This can lead to misunderstandings, dissatisfaction, and even mistrust of insurance products. Thus, the growth of the market may slow down over the forecast period.

The global market experienced a somewhat positive influence from the COVID-19 pandemic. This health crisis heightened awareness regarding the significance of health and life insurance, resulting in an upswing in the request for microinsurance offerings. People have grown more conscious of the need for insurance coverage to safeguard themselves and their loved ones from unexpected circumstances, including illness and loss of life. Moreover, the pandemic compelled microinsurance providers to adapt and innovate in response to shifting customer demands. These providers have introduced novel products and services tailored to the pandemic's unique challenges, including insurance products specifically designed to address COVID-19-related risks. They have also expanded their distribution channels, emphasizing online platforms and mobile-based solutions to enhance accessibility and convenience for policyholders.

Segmental Analysis:

Life Insurance Segment is Expected to Witness Significant Growth Over the Forecast Period

Life insurance is a crucial financial tool that can provide peace of mind and financial security to individuals and their loved ones. The choice of the right type and amount of life insurance depends on individual circumstances, financial goals, and needs. Life insurance can be used to pay off outstanding debts, such as a mortgage, personal loans, or credit card balances so that surviving family members do not inherit these financial obligations. Thus, the segment is expected to witness significant growth over the forecast period.

Financial Institutions Segment is Expected to Witness Significant Growth Over the Forecast Period

Financial institutions, including microfinance institutions, banks, and credit unions, are integral to the successful implementation and growth of microinsurance. Their extensive outreach and established relationships with underserved communities make them valuable partners in making insurance accessible and affordable for those who need it most. Financial institutions have access to valuable data on their clients' financial behavior and risk profiles. Microinsurance providers can use this data to refine their products and better serve the needs of low-income populations. Thus, the segment is expected to witness significant growth over the forecast period.

Business Segment is Expected to Witness Significant Growth Over the Forecast Period

Businesses can play a pivotal role in the microinsurance ecosystem. They can both distribute microinsurance products to their employees and clients and leverage microinsurance to mitigate risks and foster economic growth. These partnerships between businesses and microinsurance providers can contribute to financial inclusion, social development, and the overall well-being of underserved populations. Thus, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia Pacific region emerged as the dominant force in the microinsurance market, contributing predominance due to the substantial underserved population, a low level of insurance coverage, a regulatory environment that fosters microinsurance, and a culture of technological innovation. One significant driver in the Asia Pacific region is the strong support from governments for microinsurance initiatives. Many countries in this region have implemented policies and measures aimed at promoting the growth of microinsurance. For instance, some nations, like the Philippines and Indonesia, have taken steps to alleviate regulatory burdens on microinsurance providers. This includes exemptions from specific regulatory requirements, such as capitalization and solvency rules. For instance, in the Philippines, the Microinsurance Act of 2013 has established a streamlined regulatory framework specifically designed to facilitate the development and operation of microinsurance, making it easier for providers to offer accessible and affordable insurance solutions to underserved populations. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Prominent companies are investing in strategic initiatives, such as product launches, partnerships, and mergers and acquisitions, to stay ahead of the competition and offer innovative solutions to their customers. Some of the prominent players in the global microinsurance market include:

Recent Developments:

1. In January 2023, The Insurance Business Law in Vietnam took effect and it has allowed mutual organizations to offer microinsurance products with less stringent financial, personal, and professional requirements than those imposed by conventional insurance companies.

2. In October 2021, MicroEnsure, a Micro Insurance Company (MIC) subsidiary, formed a strategic partnership with Chamasure, an insurance platform based in Nairobi, that aims to provide insurance solutions for underserved communities. As a result of this partnership, MicroEnsure was able to offer digital insurance services to people in underserved communities throughout Kenya, providing comprehensive support for enrollment and claims settlement processes.

Q1. At what CAGR is the market projected to grow within the forecast period?

Microinsurance Market is expected to reach at a CAGR of 6.7% during the forecast period.

Q2. What segments are covered in the Microinsurance Market Report?

By Model Type, By Product Type, By End User, By Provider, By Distribution Channel and Geography are the segments covered in the Microinsurance Market Report.

Q3. Which region has the largest share of the Microinsurance Market? What are the largest region's market size and growth rate?

Asia Pacific region has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Q4. Which are the major companies in the Microinsurance Market?

The Hollard Insurance Company, Afpgen.com.ph, American, International Group, Inc. and Bharti AXA Life Insurance Company Ltd. are some of the major companies in the Microinsurance Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model