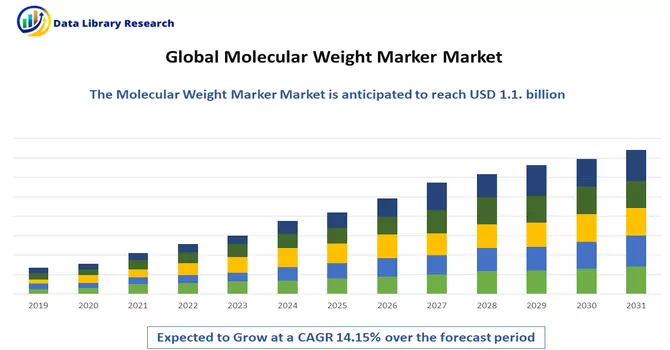

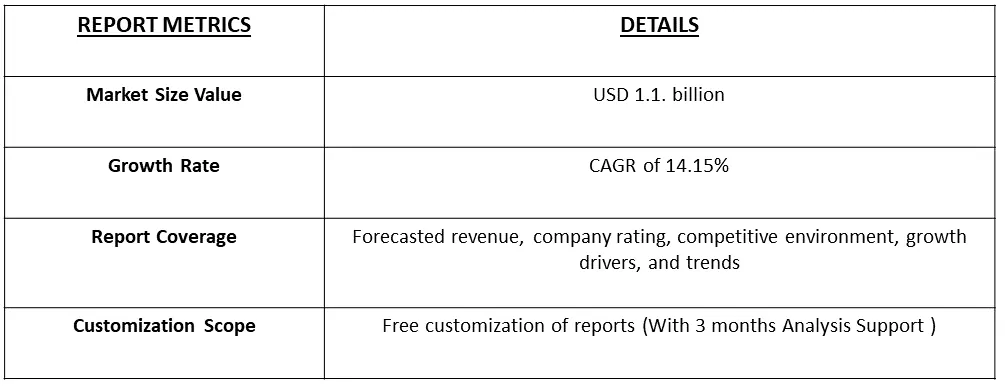

The Molecular Weight Marker Market size is expected to grow from USD 1.1. billion in 2023 billion by 2030, at a CAGR of 14.15% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Molecular weight markers consist of a set of standard molecules with known molecular weights that are run alongside the sample of interest on the gel. By comparing the migration distance of the sample bands to the migration distances of the standard bands, researchers can estimate the size or molecular weight of the sample molecules. These markers typically come in discrete bands, each representing a different known molecular weight. The range and distribution of molecular weights in a marker can vary, and the choice of marker depends on the size range of the molecules being analyzed. Molecular weight markers are essential tools for accurate size determination in gel electrophoresis experiments.

The increasing prevalence of genetic and protein-related disorders worldwide underscores the importance of molecular weight markers in diagnostic applications, contributing to their demand in clinical laboratories and healthcare settings. The rapid expansion of point-of-care testing applications, driven by the need for quick and accurate diagnostic results, necessitates the use of molecular weight markers in portable and efficient diagnostic platforms.

The expanding scope of academic and industrial research, encompassing fields like genomics, proteomics, and molecular biology, propels the demand for reliable tools like molecular weight markers, which are fundamental for validating experimental results. Moreover, the ongoing advancements in gel electrophoresis techniques, such as the development of high-resolution systems and novel gel matrices, contribute to the demand for molecular weight markers that can complement and maximize the capabilities of these technologies.

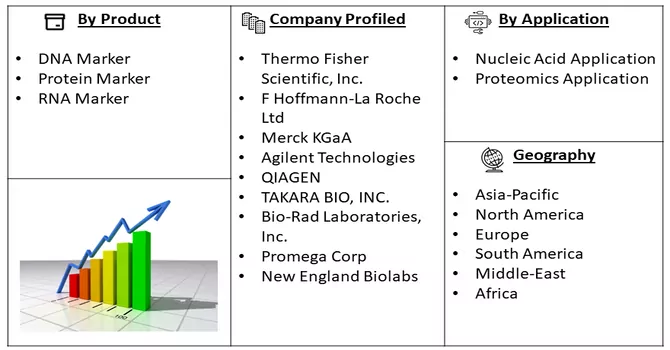

Market Segmentation: The Molecular Weight Marker Market is Segmented by Product (DNA Marker, Protein Marker, and RNA Marker), Application (Nucleic Acid Application (PCR, Northern Blotting, Southern Blotting, Molecular Cloning, and Other Nucleic Acid Applications), and Proteomics Application (Western Blotting, Gel Extraction, and Other Proteomics Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing Investment on R&D

With a surge in R&D funding, researchers can explore and implement cutting-edge technologies, such as advanced gel electrophoresis systems and imaging techniques. This leads to the development of more sophisticated molecular weight markers with improved precision and sensitivity. The increased R&D investment allows for the exploration of novel formulations and materials for molecular weight markers. This includes the incorporation of fluorescent dyes, quantum dots, or other labeling technologies that enhance detection capabilities and accuracy in sizing biomolecules. For instance, Merck KGaA completed the acquisition of Sigma-Aldrich Co. LLC. for USD 17 billion to strengthen its life science business. Similarly, In June 2021, Bio-Rad Laboratories, Inc. partnered with Seegene, Inc., for the commercialization and development of infectious disease molecular diagnostic products. This agreement will enable Bio-Rad Laboratories to provide required diagnostic testing products to U.S. markets. Thus, such developments are fueling the growth of the studied market.

Growing Focus on Proteomics and Genomics Technologies Research

The rise in quantitative proteomics research, aimed at understanding the abundance and changes in protein expression, necessitates accurate sizing of proteins. Molecular weight markers play a crucial role in gel electrophoresis and Western blotting techniques, providing reference points for the determination of protein sizes in complex biological samples. As genomic sequencing technologies continue to evolve, the need for precise molecular weight markers becomes paramount. These markers are essential in agarose gel electrophoresis during DNA fragment analysis, aiding researchers in assessing the size distribution of DNA fragments and verifying the success of sequencing reactions. For instance, in May 2022, Agilent Technologies, Inc. collaborated with APC Ltd., combining their technologies and working towards a real-time process monitoring solution, enabling workflow that supports automated process analysis with the use of liquid chromatography for consumers. Thus, such factors are fueling the growth of the studied market.

Market Restraints :

Lack of Skilled Healthcare Professionals and Strict Government Regulations

The growth of the molecular weight marker market can face challenges due to various factors, including the shortage of skilled healthcare professionals and stringent government regulations. These challenges have the potential to impede market expansion and influence the dynamics of the industry. Molecular weight markers are integral to techniques like gel electrophoresis, which may require specialized knowledge and skills to ensure accurate and reliable results. The shortage of skilled healthcare professionals proficient in these techniques may hinder the effective utilization of molecular weight markers in research and diagnostic settings. The scarcity of skilled professionals can limit the speed of research and development activities aimed at creating advanced molecular weight markers. Moreover, the delays in R&D may hinder the introduction of markers with enhanced features, reducing the market's ability to meet the evolving demands of researchers. Thus, such factors are expected to slow down the growth of the studied market over the forecast period.

Amid the pandemic, there was a notable surge in research and development endeavors within the pharmaceutical and biotechnology sectors, resulting in an increased reliance on molecular weight markers. Globally, researchers extensively utilized genomic technologies to gain deeper insights into the biology and evolutionary patterns of SARS-CoV-2, consequently fostering a heightened demand for molecular weight markers. Despite facing initial disruptions caused by the pandemic, the market is anticipated to exhibit stable growth throughout the forecast period, driven by the expanding applications of molecular weight markers in various research domains.

Segmental Analysis:

RNA Market segment is Expected to Witness Significant growth over the Forecast Period

RNA molecular weight markers, synthetic chains with defined lengths, are essential tools in molecular biology research for accurately determining the size of RNA species. These markers are created through in vitro transcription of linearized plasmids using RNA polymerases, resulting in distinct markers used in various applications.

Typically stored in a buffer like EDTA, RNA molecular weight markers remain viable for up to two years when stored at -80 °C. To enhance visibility during gel electrophoresis, these markers are often stained, with ethidium bromide being a commonly used dye. They serve as crucial size standards in techniques like northern blotting and RNA gel electrophoresis.

A study highlighted in an August 2022 article from SpringerLink focused on in vitro and in vivo mapping of RNA structure. The study utilized denaturing acrylamide gel electrophoresis of p-labeled cDNAs and corresponding sequencing RNA ladders, underscoring the pivotal role of RNA markers in advancing research methodologies. Beyond academic research, major pharmaceutical and biotechnology companies are increasing their investments in research and development activities, with a notable emphasis on RNA markers. Globally, initiatives such as the New South Wales Government's allocation of USD 119 million over a decade for RNA R&D projects, announced in December 2022, reflect the recognition of RNA's crucial role in advancing genomics research.

Thus, in conclusion, the surge in R&D investments, particularly in genomics research, coupled with the expanding applications of RNA markers, positions the RNA marker segment for significant growth. This trend is expected to be further fueled by ongoing genomic research, with a specific focus on cancer genomics, as scientists continue to unravel the complexities of RNA in various biological processes.

Molecular Cloning Segment is Expected to Witness Significant Growth Over the Forecast Period

The relation between molecular cloning and molecular weight markers is evident in numerous aspects of molecular biology research. During molecular cloning experiments, researchers frequently utilize molecular weight markers to assess the success of DNA fragment isolation, the efficiency of ligation reactions, and the accuracy of subsequent DNA amplification. Gel electrophoresis with molecular weight markers aids in confirming the presence and size of the cloned DNA fragments. Additionally, molecular weight markers are employed in the verification of plasmid integrity and the assessment of DNA migration patterns. Thus, molecular cloning and molecular weight markers are interconnected components of molecular biology, with molecular cloning being a core technique for manipulating DNA sequences, and molecular weight markers serving as essential tools for accurate size determination during experimental analyses. The combined use of these methodologies enhances the precision and reliability of genetic and protein research, contributing to advancements in various fields, including medicine, biotechnology, and basic biological sciences,

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The North American molecular weight markers market is significantly shaped by the substantial presence of numerous major pharmaceutical and biotechnology companies in the United States. Additionally, the region grapples with a growing burden of diverse infectious and chronic diseases, further intensified by escalating investments in research and development (R&D).

Illustratively, the Canadian Cancer Society's November 2022 estimate projected that 233,900 individuals would be diagnosed with cancer in 2022, attributing this upswing to the aging and expanding population in Canada. Consequently, the increasing incidence of chronic diseases is poised to propel heightened R&D activities, acting as a catalyst for the expansion of the molecular weight markers market in the North American region throughout the forecast period. In a notable development in September 2022, the Centers for Disease Control and Prevention (CDC) allocated USD 90 million to the Pathogen Genomics Centers of Excellence (PGCoE) network. This strategic investment aims to stimulate innovation and bolster technical capabilities in pathogen genomics, molecular epidemiology, and bioinformatics. The overarching goal is to fortify the prevention, control, and response to microbial threats of public health significance. Anticipated impacts include a surge in the utilization of molecular weight markers during the forecast period of the study.

In summary, the amalgamation of heightened investment in R&D and the increasing prevalence of chronic and infectious diseases is anticipated to be a driving force behind the growth of the molecular weight markers segment in the North American market.

Get Complete Analysis Of The Report - Download Free Sample PDF

Some prominent players in the industry include:

Recent Development:

1) In November 2022, Creative Enzymes unveiled a cutting-edge series of DNA markers and ladders known for their exceptional efficiency and cost-effectiveness, swiftly capturing the attention and favor of the research community.

2 ) In August 2022, Bio-Rad Laboratories, Inc., a renowned producer of molecular weight markers, successfully acquired all outstanding shares of Curiosity Diagnostics, Sp. Z. o. o. from Scope Fluidics, S.A. This strategic acquisition was strategically orchestrated to enhance Bio-Rad's standing in the molecular diagnostics sector, broadening its product portfolio and reinforcing its position in the market.

Q1. What was the Molecular Weight Marker Market size in 2023?

As per Data Library Research the Molecular Weight Marker Market size is USD 1.1. billion in 2023.

Q2. At what CAGR is the Molecular Weight Marker Market projected to grow within the forecast period?

Molecular Weight Marker Market is expected to reach at a CAGR of 14.15% during the forecast period.

Q3. What are the factors driving the Molecular Weight Marker Market?

Key factors that are driving the growth include the Increasing Investment on R&D and Growing Focus on Proteomics and Genomics Technologies Research.

Q4. Who are the key players in Molecular Weight Marker Market?

Some key players operating in the Molecular Weight Marker Market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model