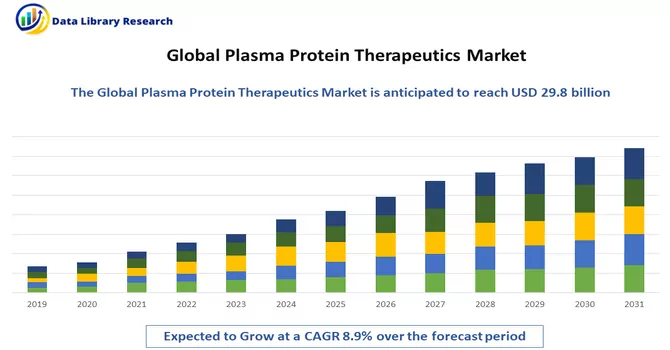

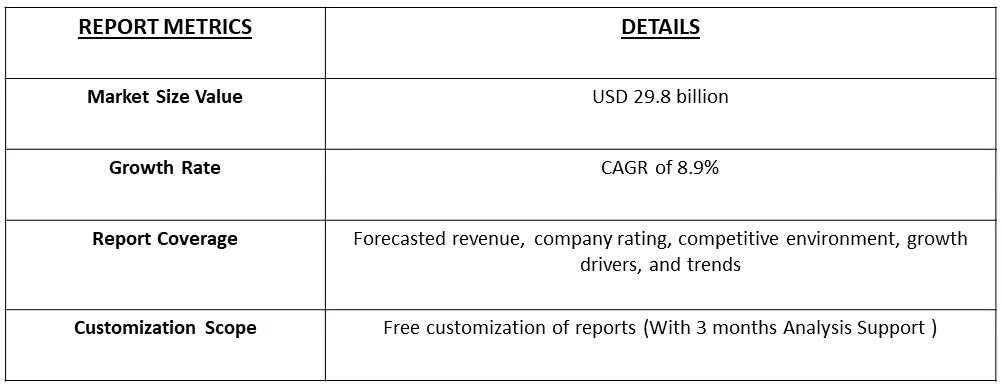

The global plasma protein therapeutics market size was valued at USD 29.8 billion in 2023, and is projected to a CAGR of 8.9% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Plasma protein therapeutics refer to a class of medical treatments derived from human blood plasma, which is the liquid component of blood that remains after cells are removed. These therapeutic products are designed to treat various medical conditions by providing specific proteins that may be deficient or malfunctioning in certain individuals. Plasma protein therapeutics include a range of products such as clotting factors, immunoglobulins, albumin, and other proteins extracted or purified from human plasma. Plasma protein therapeutics include a range of products such as clotting factors, immunoglobulins, albumin, and other proteins extracted or purified from human plasma.

The rising incidence of chronic diseases, including immune deficiencies, bleeding disorders, and autoimmune conditions, is a significant driver for the plasma protein therapeutics market. These conditions often necessitate protein replacement therapies to manage symptoms and improve patients' quality of life. Also, with an ageing global population, there is an increased prevalence of conditions that require plasma protein therapies, such as immunodeficiency disorders and neurologic diseases. The elderly are more susceptible to certain medical conditions that may benefit from the therapeutic effects of plasma-derived proteins. Furthermore, the continued investments in research and development initiatives focused on plasma-derived therapies drive innovation and the introduction of novel products to the market. This ongoing research contributes to expanding the therapeutic applications of plasma proteins.

Market Segmentation: The Global Protein Therapeutics Market is Segmented by Product (Immunoglobulin, Albumin, Plasma Derived Factor VL, and Other Products), Application (Hemophilia, Idiopathic Thrombocytopenic Purpura, Primary Immunodeficiencies, and Other Applications), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The value is provided (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The increasing prevalence of rare diseases, often characterized by deficiencies in plasma proteins, is driving the demand for plasma protein therapeutics globally. As awareness and diagnosis of rare diseases improve, the market is witnessing a surge in the development and adoption of targeted therapies. Moreover, ongoing advancements in plasma fractionation technologies are enhancing the efficiency of extracting specific plasma proteins. Improved separation and purification techniques contribute to the production of high-quality therapeutic proteins, meeting stringent regulatory standards and increasing the safety and efficacy of treatments. Furthermore, the integration of digital technologies, including telemedicine and digital health platforms, is impacting the plasma protein therapeutics market. These technologies enhance patient engagement, streamline healthcare delivery, and facilitate remote monitoring, ultimately improving overall patient care and treatment outcomes. Thus, these market trends are expected to witness significant growth over the forecast period.

Market Drivers:

Increasing Incidence of Autoimmune and Neurological Diseases

The increasing incidence of autoimmune and neurological diseases has become a significant driving force in the utilization of plasma protein therapeutics. Autoimmune diseases, such as rheumatoid arthritis and lupus, as well as neurological conditions like multiple sclerosis and Guillain-Barré syndrome, pose substantial challenges to affected individuals. The global prevalence of autoimmune diseases is witnessing a notable increase, with a growing number of individuals being diagnosed with conditions where the immune system mistakenly attacks the body's own tissues. This surge has led to an elevated demand for therapeutic interventions that modulate immune responses, and plasma protein therapeutics play a crucial role in addressing this need. For instance, an article published by Oxford University in 2023, reported that utilizing an extensive dataset comprising anonymized electronic health records from 22 million individuals in the UK, a comprehensive study investigated 19 prevalent autoimmune diseases. The research aimed to discern trends over time, identify demographic groups most impacted, and explore potential coexistence among different autoimmune conditions. The findings revealed that, collectively, these 19 autoimmune diseases impact approximately 10% of the population, with 13% of women and 7% of men affected. This prevalence surpasses earlier estimates, typically ranging from 3-9%, often derived from smaller sample sizes and encompassing fewer autoimmune conditions. Thus, such a high prevalence of autoimmune disorders is expected to increase the demand for plasma protein therapeutics, thereby driving the studied market growth.

Rise in Research & Development in Plasma Protein

The global Plasma Protein Therapeutics market is witnessing a significant rise in Research and Development (R&D) activities, marking a pivotal trend that shapes the industry's evolution. According to a comprehensive industry report available at, several factors contribute to the surge in R&D initiatives within the plasma protein sector. The broadening scope of therapeutic applications for plasma protein therapeutics has fueled intensified research efforts. Researchers are exploring innovative uses for plasma-derived proteins in treating an array of medical conditions, ranging from autoimmune disorders to neurological diseases. Moreover, the adoption of novel technologies in plasma fractionation and protein purification has spurred interest in developing advanced therapeutic solutions. Innovations in manufacturing processes contribute to the production of high-quality plasma protein products, fostering continuous exploration in R&D. Thus, such factors are expected to boost the studied market growth over the forecast period.

Furthermore, the recent developments are expected to boost the studied market’s growth. For instance, in April 2020, Kedrion Biopharma and Kamada Ltd. unveiled a strategic collaboration geared towards the development, manufacturing, and provision of human plasma-derived COVID-19 polyclonal immunoglobulin (IgG) products, specifically designed for treating individuals affected by COVID-19. Initially concentrated on the distribution of this product in Italy, Israel, and the United States, the collaboration has outlined future plans for extending its reach into additional markets. These collaborative efforts are anticipated to significantly propel advancements in the market's development, particularly in the context of addressing the challenges posed by the ongoing COVID-19 pandemic.

Market Restrains:

Strict Regulations for the Handling of Plasma Protein Products

Stringent regulations governing the handling of plasma protein products have the potential to impede the growth of the plasma protein therapeutics market. Regulatory frameworks play a crucial role in ensuring the safety, efficacy, and quality of therapeutic products derived from plasma. Moreover, compliance with stringent regulatory requirements often involves intricate processes and documentation. Companies operating in the plasma protein therapeutics market must navigate a complex landscape of regulatory standards, which can result in prolonged approval timelines and increased operational costs. Strict regulations can contribute to delays in obtaining marketing authorizations, limiting timely patient access to new and potentially life-saving plasma protein therapeutics. This delay in market access may impact overall market growth and patient outcomes. Thus, such factors are expected to slow down the growth of the studied market over the forecast period.

The plasma protein therapeutics market experienced a notable impact from the COVID-19 pandemic in its initial stages, primarily influenced by various factors that disrupted the industry landscape. Reduced plasma donations, closures of laboratories and testing centers, and restrictions on the import and export of medicines were among the challenges faced. However, as restrictions have gradually lifted, the sector has shown resilient recovery, paving the way for renewed growth. The recovery in the plasma protein therapeutics market is attributed to several factors. First and foremost, the resumption of regular activities and the reopening of crucial facilities, including laboratories and testing centres, have contributed to the market's revival. This has allowed for a more seamless flow of essential processes such as plasma collection and testing. Moreover, the easing of restrictions on medicine import and export has facilitated smoother global trade in plasma protein therapeutics. This is particularly significant for maintaining the supply chain and ensuring a steady availability of these critical therapeutic products on a broader scale. Thus, the initial impact of the COVID-19 pandemic presented challenges for the plasma protein therapeutics market, the sector has demonstrated resilience and adaptability. The recovery is evident through the gradual restoration of key operational aspects, the easing of trade restrictions, and a renewed focus on research and development. These factors collectively contribute to the positive outlook for the plasma protein therapeutics market, positioning it for sustained growth in the foreseeable future.

Segmental Analysis:

The Immunoglobulin Segment is Expected to Witness Significant Growth Over the Forecast Period

Immunoglobulin (Ig), a crucial component of the immune system, plays a pivotal role in the field of plasma protein therapeutics. Immunoglobulins, also known as antibodies, are proteins produced by plasma cells in response to the presence of foreign substances, such as bacteria, viruses, or toxins. They serve as the body's defense mechanism, recognizing and neutralizing these invaders. Immunoglobulins derived from human plasma are harnessed for therapeutic purposes. These plasma-derived immunoglobulins, known as therapeutic immunoglobulins or intravenous immunoglobulins (IVIG), are used to treat various medical conditions. IVIG is prepared from pooled plasma donations and contains a diverse range of antibodies. Furthermore, the ongoing research and development efforts are focused on enhancing the therapeutic potential of immunoglobulins. This includes exploring new indications, optimizing manufacturing processes, and investigating the use of specific antibodies for targeted therapies. Also, regulatory approval from government bodies is expected to boost the studied market growth over the forecast period. For instance, in March 2018, approval from the Food and Drug Administration (FDA) was granted to CSL for Hizentra, marking a significant milestone as the inaugural subcutaneous immunoglobulin therapy for the treatment of Chronic Inflammatory Demyelinating Polyneuropathy (CIDP). Anticipated factors contributing to market growth include distinctive product profiles, a rising count of plasma donor centers, and ample fractionation capacity. These combined elements are poised to provide robust support to the expansion of the market. Thus, owing to such factors the segment is expected to witness significant growth over the forecast period.

The Haemophilia Segment is Expected to Witness Significant Growth over the Forecast Period

Haemophilia, a hereditary bleeding disorder characterized by the deficiency or absence of specific blood clotting factors, has been a focal point in the realm of plasma protein therapeutics. Plasma-derived and recombinant clotting factor concentrates play a critical role in the treatment and management of haemophilia. The primary approach to treating haemophilia involves clotting factor replacement therapy. Individuals with haemophilia lack sufficient levels of clotting factors, specifically Factor VIII for Haemophilia A or Factor IX for Haemophilia B. Plasma protein therapeutics provide concentrated forms of these factors to restore the blood clotting process. Moreover, plasma-derived clotting factor concentrates have been a longstanding therapeutic option for haemophilia. These concentrates are derived from human plasma, which undergoes a meticulous fractionation process to extract and concentrate the deficient clotting factor. This allows for the administration of concentrated clotting factors to patients with haemophilia. Thus, plasma protein therapeutics play a pivotal role in addressing the therapeutic needs of individuals with haemophilia. Through the provision of clotting factor concentrates, advancements in recombinant technology, and ongoing research into innovative treatment approaches, plasma protein therapeutics continue to contribute significantly to improving the quality of life for those affected by haemophilia.

North America Region Segment is Expected to Witness Significant Growth over the Forecast Period

Throughout the forecast period, North America is poised for growth in the overall plasma protein therapeutics market. This trajectory is underpinned by the increasing prevalence and incidence of autoimmune and neurological diseases, coupled with a surge in research and development activities in the field of plasma protein. The well-established healthcare infrastructure in the region, with a focus on R&D by market players, recent product launches, and the escalating burden of autoimmune disorders, stands as a key driver of market expansion in the United States.

Notably, collaborations among key industry players and the introduction of new, advanced products are anticipated to further propel market growth. An illustrative example is the March 2022 partnership between Sanofi and IGM Bioscience, aiming to jointly develop and commercialize six immunoglobulin M (IgM) antibody agonists targeting oncology and immunology. Similarly, in May 2020, Bio Products Laboratory (BPL), a company specializing in the production of plasma-derived protein therapies, announced the U.S. launch of ALBUMINEX 5% solution and ALBUMINEX 25% solution for injection. These strategic initiatives underscore the dynamic landscape of collaboration and innovation, contributing significantly to the upward trajectory of the plasma protein therapeutics market in North America. Thus, such developments are expected to boost the studied market’s growth in the region over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Key players in the Plasma Protein Therapeutics Market are channelling substantial resources into research and development endeavours. This proactive approach enables them to explore new therapeutic avenues, enhance existing products, and pioneer cutting-edge solutions. The emphasis on R&D is geared towards staying abreast of scientific advancements and addressing unmet medical needs effectively. Also, some players in the Plasma Protein Therapeutics Market are opting for strategic mergers and acquisitions to achieve market expansion. By acquiring complementary businesses or integrating with existing entities, companies aim to consolidate their market presence, leverage synergies, and access new customer bases. This strategic growth approach enhances their overall competitiveness. Some prominent players in the global plasma protein therapeutics market include:

Key Developments:

1) In October 2023; BioAegis Therapeutics secured a $20 million contract from BARDA in the United States for the development of plasma gelsolin as a potential treatment for acute respiratory distress syndrome (ARDS). This funding, awarded by BARDA's DRIVe division, emphasizes the government's commitment to supporting innovative research and development by early-stage companies. The contract builds upon a 2021 agreement between BioAegis and BARDA, highlighting sustained collaboration in advancing therapies, with a specific focus on addressing the critical challenges posed by acute respiratory distress syndrome in the context of respiratory illnesses.

2) In May 2023, Biotest AG obtained marketing authorizations to introduce Cytotect, a CMV-hyper immunoglobulin, in five new markets. These markets encompass the Czech Republic, Slovakia, Lithuania, Ireland, and Romania, expanding the total number of countries where Cytotect is available to 28. This regulatory approval signifies a significant milestone for Biotest AG, enhancing its market presence and reinforcing its commitment to making Cytotect accessible to a broader international audience.

Q1. What was the Plasma Protein Therapeutics Market size in 2023?

As per Data Library Research the global plasma protein therapeutics market size was valued at USD 29.8 billion in 2023.

Q2. At what CAGR is the Plasma Protein Therapeutics market projected to grow within the forecast period?

Plasma Protein Therapeutics Market is projected to a CAGR of 8.9% over the forecast period.

Q3. What segments are covered in the Plasma Protein Therapeutics Market Report?

By Product, By Application and Geography these segments are covered in the Plasma Protein Therapeutics Market Report.

Q4. What are the Growth Drivers of the Plasma Protein Therapeutics Market?

Increasing Incidence of Autoimmune and Neurological Diseases and Rise in Research & Development in Plasma Protein are the Growth Drivers of the Plasma Protein Therapeutics Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model