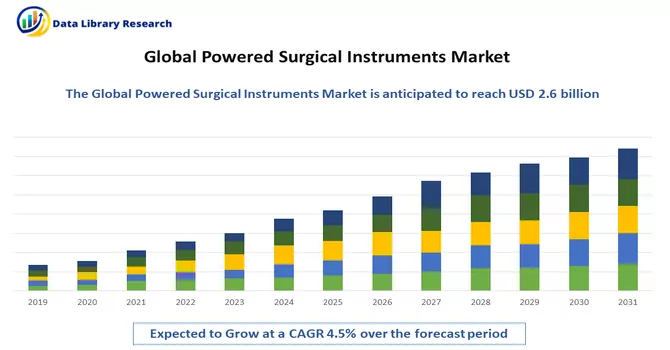

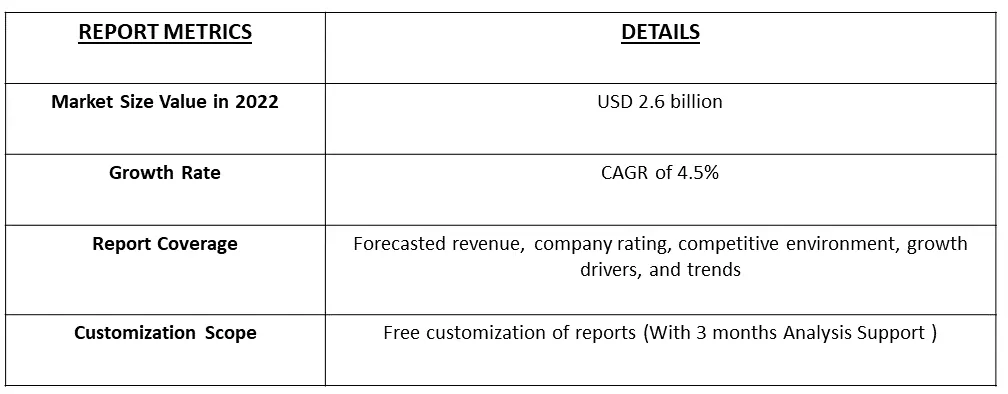

The Powered Surgical Instrument Market is currently valued at USD 2.6 billion in the year 2022 and is expected to register a CAGR of 4.5% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

An increasing number of surgical procedures coupled with technological advancements, such as the introduction of robot-assisted surgical procedures, are expected to drive the growth of the powered surgical instrument market. In addition, the growth in the geriatric population worldwide and the growing prevalence of lifestyle diseases also fuel the powered surgical instruments market.

Powered surgical instruments are specially designed tools or devices that assist in the performance of various surgeries, including orthopedic surgery, ENT surgery, neurosurgery, and oral and maxillofacial surgery, among others.

The adoption of minimally invasive surgical techniques continues to grow. Surgical instruments designed for MIS, such as laparoscopic and robotic instruments, are in high demand. These procedures offer benefits like smaller incisions, reduced scarring, and quicker recovery times. Robotic surgery systems, like the da Vinci Surgical System, are becoming more prevalent. These systems offer enhanced precision and dexterity to surgeons, making complex procedures more manageable. The market for robotic surgical instruments is expanding as more healthcare facilities invest in this technology.

Segmentation:

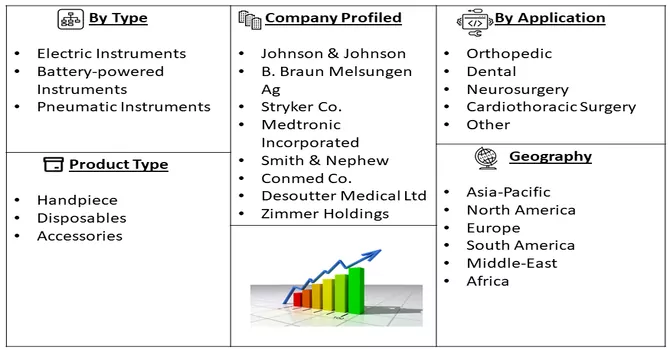

The Powered Surgical Instrument Market is segmented by Type of Power Source (Electric Instruments, Battery-powered Instruments, and Pneumatic Instruments), Product Type (Handpiece, Disposables, and Accessories), Application (Orthopedic, Dental, Neurosurgery, Cardiothoracic Surgery, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

The number of surgical procedures is increasing across various countries, which is driving the market growth. For example, in April 2022, the Victorian government in Australia announced an investment of USD 1.5 billion to address its growing elective surgery waitlist. This investment is part of a catch-up scheme that aims to increase surgical capacity by a quarter. The COVID Catch-Up Plan is designed to raise capacity to 125% in 2023, with an additional 40,000 surgeries planned for the following year. With such high investments in surgeries, the market is expected to witness significant growth over the forecast period. Moreover, according to the Organization for Economic Co-operation and Development (OECD) data updated in August 2022, the number of surgeries performed in some European countries such as Portugal, Denmark, Ireland, and Norway in 2021 includes 94.87, 49.33, 32.84, 21.5 (in thousand). Such a huge number of surgeries in developed European countries will lead to increased adoption of powered surgical instruments, which is expected to propel the market growth.

Powered Surgical Instruments Market Technological Innovations

The launch of new innovative products is expected to fuel the studied market growth over the forecast period. For instance, in September 2021, Panther Healthcare launched the Smart Powered Stapler platform that offers intelligent and automatic control over tissue compression, transection, and resection for gastrointestinal (including bariatric), thoracic, colorectal, oncology, gynecologic, and other open and laparoscopic surgical procedures. The device has been released in Europe, the Middle East, Africa, Asia, and Latin America. Thus, such developments are expected to fuel the market growth over the forecast period.

Restraints:

Reimbursement rates for surgical procedures and associated instruments can vary widely by region and payer. This variability can create financial uncertainty for healthcare providers and impact their instrument procurement decisions. Moreover, Innovative or specialized surgical instruments may not have specific reimbursement codes. Healthcare providers may face difficulties obtaining reimbursement for these instruments, which can hinder their adoption. Thus, these factors may slow down the growth of the studied market.

The COVID-19 pandemic had a multifaceted impact on the surgical instrument market, disrupting supply chains and delaying elective surgeries while emphasizing the importance of infection control and technology adoption. countries postponed elective surgeries to prioritize COVID-19 patients and conserve healthcare resources. This led to a temporary decline in the demand for surgical instruments for non-urgent procedures, affecting market growth. For instance, an article published by NCBI in July 2022, reported a 23.5% reduction in surgeries in Australia, thereby impacting the growth of the studied market. In the current scenario, it is estimated that due to the reduction of COVID-19 cases and the resumption of various services, the market is expected to witness significant growth over the forecast period.

Segmental Analysis:

Pneumatic Instruments is Expected to Witness Significant Growth Over the Forecast Period

Pneumatic surgical instruments are specialized medical devices powered by compressed air or gas to perform various surgical procedures with precision and control. These instruments are widely used in various surgical disciplines due to their reliability, speed, and versatility. Pneumatic surgical instruments find applications in various surgical specialties, including orthopedics, neurosurgery, ENT (ear, nose, and throat) surgery, plastic surgery, and general surgery. Thus, the segment is expected to witness significant growth over the forecast period.

Stapler's Segment is Expected to Witness Significant Growth Over the Forecast Period

Surgical staplers play a crucial role in modern surgery by providing efficient and reliable means of tissue closure. They are versatile instruments used in a variety of surgical specialties and are continually evolving to meet the demands of minimally invasive and robotic-assisted surgery, making them indispensable tools for surgeons worldwide. Continuous innovations in surgical stapler design aim to enhance precision, reduce tissue damage, and improve safety. These include ergonomically designed handles, wireless technology for remote monitoring, and real-time feedback systems.

Moreover, the launch of new products is expected to drive the growth of the studied segment. For instance, in June 2022, Ethicon part of Johnson & Johnson MedTech launched the ECHELON 3000 Stapler, a digitally enabled device that provides surgeons with simple, one-handed powered articulation to help address the unique needs of their patients. Designed with a 39% greater jaw aperture and a 27% greater articulation span, ECHELON 3000 gives surgeons better access and control over each transection, even in tight spaces and on challenging tissue. These features combined with software that provides real-time haptic and audible device feedback enable surgeons to make critical adjustments during procedures.

Orthopedic Segment is Expected to witness Significant Growth Over the Forecast Period

Orthopedic surgical instruments are specialized tools used in orthopedic surgery, a medical specialty focused on the treatment of musculoskeletal conditions, injuries, and disorders. These instruments are designed to aid orthopedic surgeons in procedures related to bones, joints, muscles, tendons, and ligaments. Furthermore, the launch of new products is expected to drive the growth of the studied market. For instance, May 2023, Stryker launched its Ortho Q Guidance system, enabling advanced surgical planning and guidance for hip and knee procedures, easily controlled by the surgeon from the sterile field. The system combines new optical tracking options via a redesigned, state-of-the-art camera with sophisticated algorithms of the newly launched Ortho Guidance software to deliver additional surgical planning and guidance capabilities. When used with Ortho Q, the Ortho Guidance software for Express Knee, Precision Knee, and Versatile Hip serves as a planning and intraoperative guidance system that enhances procedural speed and efficiency through a smart, streamlined workflow. Thus, such developments are expected to fuel the market growth over the forecast period.

North American Region is Expected to Witness Significant Growth Over the Forecast Period

The North American region is expected to hold a significant share of the powered surgical instrument market, which is mainly attributed to the well-established medical device industries and the presence of key companies providing powered surgical instruments. The United States is believed to dominate the market in the region due to the increasing number of surgical procedures across the country. For instance, as per the American Academy of Orthopedic Surgeons (AAOS) Annual Report 2021, around 2.24 million primary and revision hip and knee arthroplasty procedures were performed in the last eight years. Primary knee (54.5%) and primary hip (38.6%) procedures made up most of the orthopedic surgeries in the country during the period. In addition, as per the American Joint Replacement Registry (AJRR) 2021, there were around 105,743 hip arthroplasty procedures for femoral neck fractures in the United States. Therefore, the rising number of orthopedic surgical procedures is anticipated to support the market’s growth in the United States.

Moreover, the data updated by Cedars-Sinai in January 2022 showed that coronary artery bypass graft surgery (CABG), also known as coronary artery bypass or bypass surgery, is the most common heart surgery, and more than 300,000 people have successful bypass surgery in the United States each year. New product launches by the key companies from the region are expected to boost the market growth. For instance, in March 2021, Ethicon announced the global launch of the ECHELON+ Stapler with GST Reloads, a new powered surgical stapler designed to increase staple line security and reduce complications through more uniform tissue compression and better staple formation.

Therefore, owing to the increasing disease burden and the new product launches, the powered surgical instrument market is believed to grow significantly in North America.

Get Complete Analysis Of The Report - Download Free Sample PDF

Market players in the medical device industry concentrate on continuous product development and provide a diverse range of products at competitive prices, particularly in developing nations. These companies are emphasizing the expansion of their product portfolios by implementing inorganic growth strategies like acquisitions, mergers, and partnerships. Some of the prominent players in this sector include:

Key Players :

Recent Developments:

1. September 2022: Teleflex Incorporated announced that it completed the previously announced acquisition of Standard Bariatrics, Inc., which has commercialized an innovative powered stapling technology for bariatric surgery.

2. June 2022: Ethicon, part of Johnson & Johnson MedTech, launched the ECHELON 3000 Stapler, a digitally enabled device that provides surgeons with simple, one-handed powered articulation to help address the unique needs of their patients.

Q1. What is the current Powered Surgical Instruments Market size?

The Powered Surgical Instrument Market is currently valued at USD 2.6 billion.

Q2. What is the Growth Rate of the Powered Surgical Instruments Market?

Powered Surgical Instruments Market is expected to register a CAGR of 4.5% over the forecast period.

Q3. Which region has the largest share of the Powered Surgical Instruments Market? What are the largest region's market size and growth rate??

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Q4. What segments are covered in the Powered Surgical Instrument MarketReport?

By Type, By Product Type, By Application & Geography segments are covered in the Powered Surgical Instrument Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model